Company Summary

| Chibagin Securities Review Summary | |

| Founded | 1883 |

| Registered Country/Region | Japan |

| Regulation | FSA |

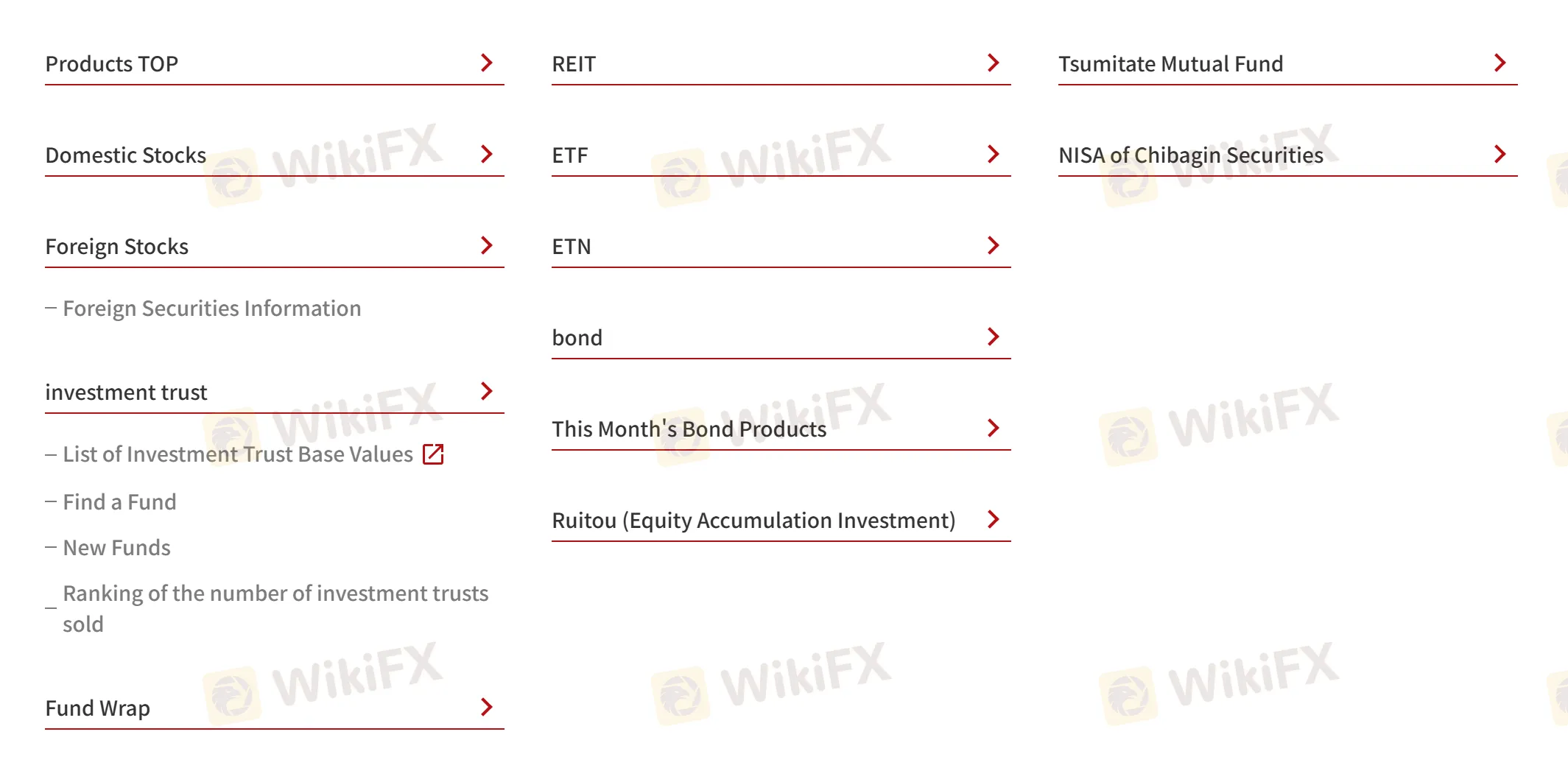

| Trading Products | Domestic Stocks, Foreign Stocks, investment trust, Fund Wrap, REIT, ETF, ETN, bond, Ruitou (Equity Accumulation Investment), Tsumitate Mutual Fund, and NISA of Chibagin Securities |

| Demo Account | ❌ |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Reception hours: Weekdays 8:00 ~ 17:00 |

| Contact form | |

| Phone: 0120-154-702 | |

| Address: 〒260-0013, 2-5-1 Chuo, Chuo-ku, Chiba-shi | |

Chibagin Securities is a financial firm founded in 1883 and registered in Japan. Regulated by the Financial Services Agency (FSA) with a Retail Forex License, Chibagin Securities offers diverse trading products: Domestic Stocks, Foreign Stocks, investment trusts, Fund Wraps, REITs, ETFs, ETNs, bonds, Ruitou (Equity Accumulation Investment), Tsumitate Mutual Funds.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Limited info on accounts |

| A wide range of trading products | No demo accounts |

| Lack of info on trading platforms |

Is Chibagin Securities Legit?

Yes, Chibagin Securities is currently regulated by FSA, holding a Retail Forex License.

| Regulated Country | Regulated Authority | Regulated Entity | Current Status | License Type | License Number |

| Financial Services Agency (FSA) | ちばぎん証券株式会社 | Regulated | Retail Forex License | 関東財務局長(金商)第114号 |

What Can I Trade on Chibagin Securities?

On Chibagin Securities, you can trade with Domestic Stocks, Foreign Stocks, investment trust, Fund Wrap, REIT, ETF, ETN, bond, Ruitou (Equity Accumulation Investment), Tsumitate Mutual Fund, and NISA of Chibagin Securities.

Fees

Chibagin Securities provides a list of fees for face-to-face transactions, you can refer to it on their website. https://www.chibagin-sec.co.jp/service/commission/