Overview

Freedom Securities Trading Inc. operates out of Belize and was founded in 2014. However, potential clients should exercise caution as the company lacks regulation, notably a broker's license. This raises significant regulatory concerns, as operating without the necessary licenses can result in potential legal consequences.

Crucial details like the minimum deposit requirement and maximum leverage are notably absent from their provided information. Additionally, while they offer a detailed fee structure, specific spreads are not mentioned, leaving potential clients in the dark about trading costs.

The company provides a range of trading platforms, including NetInvestor, F-Trader, and Quik, but it falls short in providing information about available account types, demo accounts, Islamic accounts, and payment methods.

Clients looking for educational resources to improve their trading knowledge will be disappointed, as Freedom Securities Trading Inc. does not offer any educational tools or materials.

While customer support is available through email and phone, the lack of regulatory oversight and the absence of critical information about the company's services and offerings may give potential clients pause. It's crucial to conduct thorough due diligence and consider these factors carefully before engaging with this brokerage.

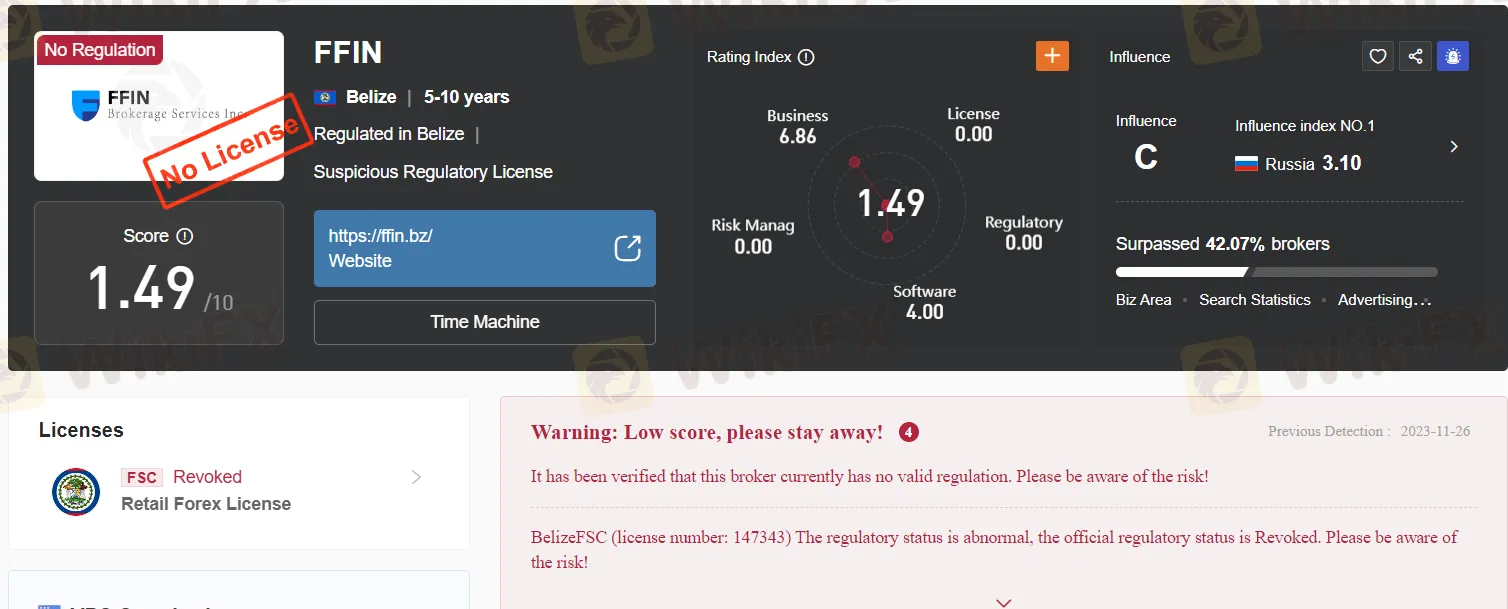

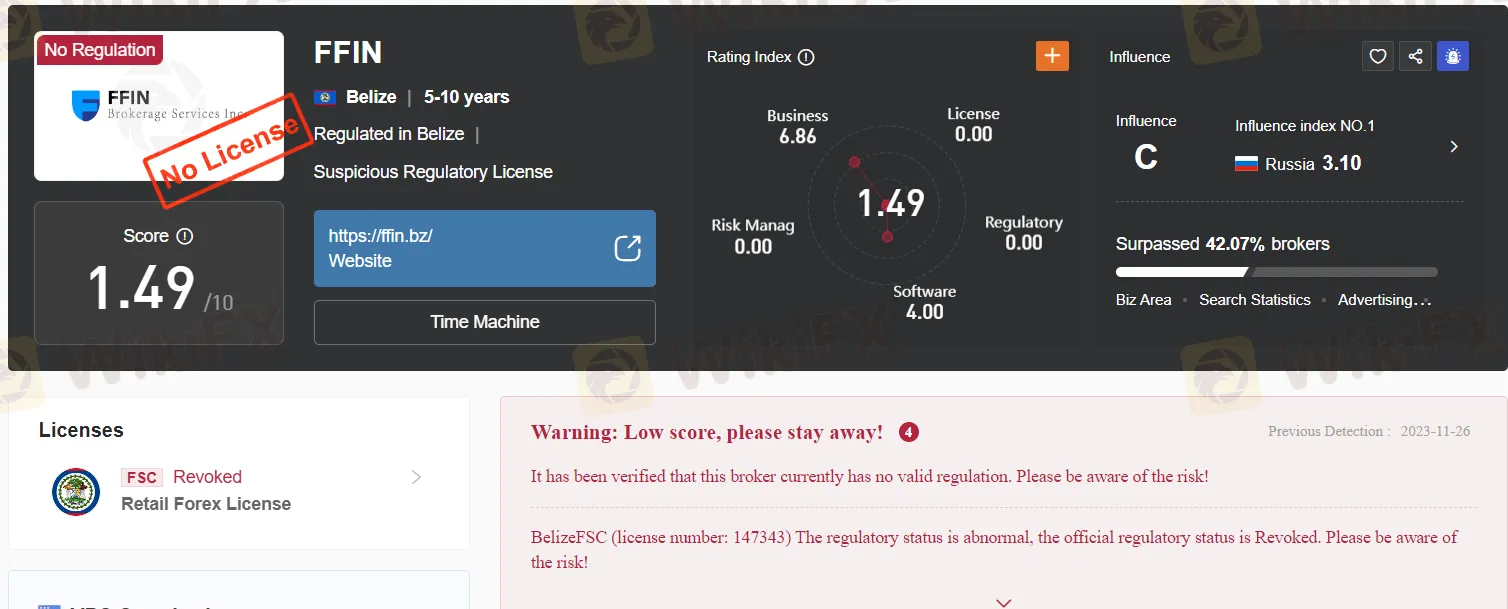

Regulation

FFIN does not hold a broker's license. This lack of a broker's license may raise concerns regarding its ability to legally engage in brokerage activities, such as buying and selling securities on behalf of clients. Operating as an unlicensed broker can lead to regulatory issues and potential legal consequences. Individuals and entities looking to engage in brokerage services should typically obtain the necessary licenses and comply with relevant financial regulations to ensure both the legality and credibility of their operations. It is essential to verify FFIN's current licensing status and regulatory compliance with relevant authorities if considering any financial dealings with the organization.

Pros and Cons

Freedom Securities Trading Inc. offers brokerage services and provides customer support in Russian, catering to clients who prefer that language. They offer a choice of trading platforms and a personalized advisory service, allowing clients to maintain control over their portfolios. However, the company lacks a broker's license, which raises regulatory concerns. Additionally, they do not provide educational resources, and their fee structure includes various commissions and charges. Key details about account types, leverage, deposit methods, and other important aspects are not clear, and the registered address in Belize may not be easily accessible to all clients. It's essential for potential clients to consider these factors when evaluating the company's suitability for their trading needs.

Service

kerage Services: The company offers brokerage services, which means it helps individuals and entities trade various financial instruments. Clients can open brokerage accounts to access leading trading exchanges and invest in stocks of companies worldwide. They can trade on markets such as the US and Kazakhstan. Trading can be conducted through trading systems or by placing voice orders over the phone.

Support in Russian: The company emphasizes that it provides customer support in the Russian language at any time of the day. This ensures that clients who are more comfortable communicating in Russian can receive assistance when needed.

Trading Platforms: The company mentions two trading platforms, namely NetInvestor and FTrader. These platforms likely serve as the tools through which clients can execute their trades, monitor market data, and manage their investment portfolios.

Advisory Office: Clients can opt for the “Consulting” tariff, which involves a personalized advisory service. A dedicated manager with more than five years of trading experience is assigned to the client. This manager assists clients in choosing the right investment strategy and identifies promising assets. Importantly, portfolio management remains in the hands of the client, meaning clients have control over their investment decisions. Clients can expect to receive regular status reports, either weekly or daily, to stay informed about their investments.

Contact Information: The company provides a contact form where interested parties can input their name, phone number, email address, and comments. They also ask for consent to process personal data in accordance with their Privacy Policy and agreement to receive information about the company's products and services via SMS and email.

In summary, this company offers a range of financial services, including brokerage services to facilitate trading on global exchanges, personalized investment advisory services, and access to trading platforms. They prioritize providing support in Russian and offer clients the opportunity to maintain control over their investment portfolios while receiving guidance from experienced managers. Clients can request more information and consultations by filling out the contact form provided. Please note that the specifics of their services may have evolved since my last knowledge update in January 2022, so it's essential to verify the current offerings and terms with the company directly.

Spreads and Commissions

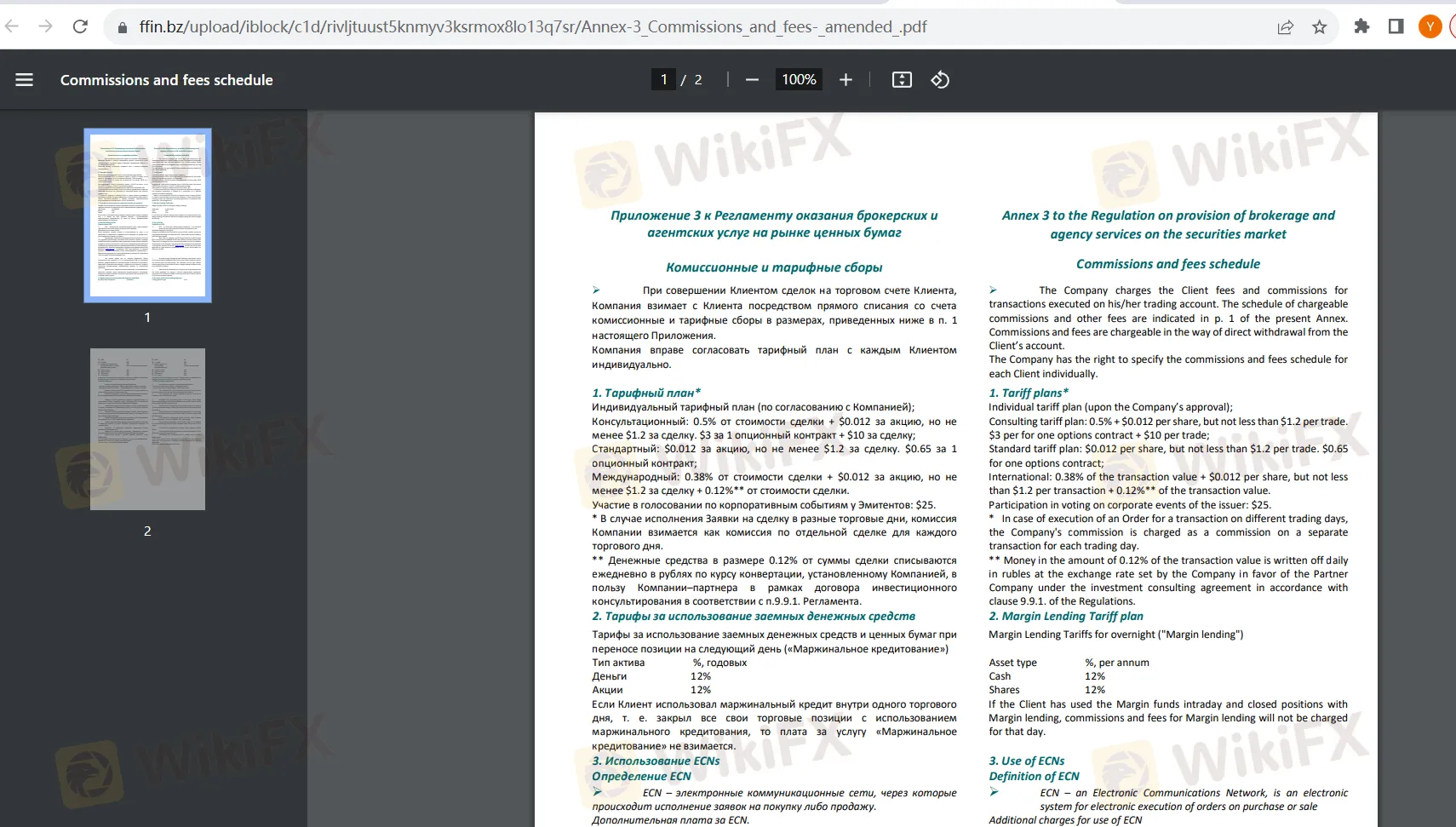

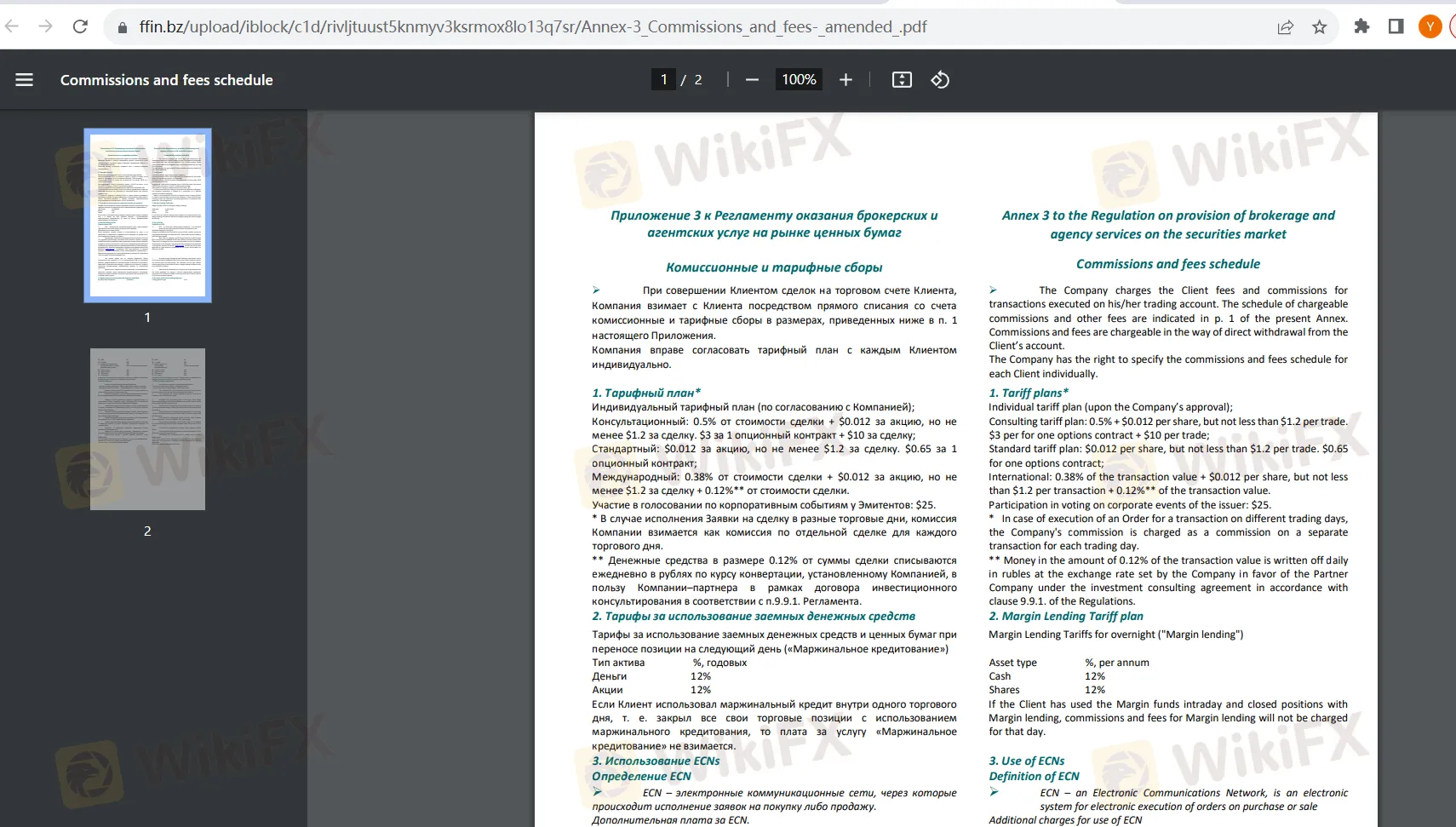

The document you provided outlines the commissions and fees schedule for a company that offers brokerage and agency services in the securities market. Here's a breakdown of the key points:

Tariff Plans (Commissions for Trading):

Individual Tariff Plan: This plan is negotiated individually with each client.

Consulting Tariff Plan: Charges 0.5% of the transaction value plus $0.012 per share, with a minimum fee of $1.2 per trade. For options contracts, it charges $3 per contract plus $10 per trade.

Standard Tariff Plan: Charges $0.012 per share, with a minimum fee of $1.2 per trade. For options contracts, it charges $0.65 per contract.

International Tariff Plan: Charges 0.38% of the transaction value plus $0.012 per share, with a minimum fee of $1.2 per trade, and an additional 0.12% of the transaction value. There is also a fee of $25 for participation in voting on corporate events of issuers.

Margin Lending Tariff Plan: The company charges 12% per annum for using margin funds for both cash and shares. However, if the client uses margin funds intraday and closes positions the same day, no fees are charged.

Use of ECNs (Electronic Communications Networks):

ECNs are electronic systems for executing purchase or sale orders.

Additional charges for using ECNs are levied by the ECN providers themselves, not the company. The tariffs for these ECNs can be provided upon request.

Other Fees and Commissions:

Transfer of securities between brokers has specific fees for assets transferred to and from the company.

OTC (Over-the-Counter) transaction commissions are 2% of the transaction amount, with a minimum of $25.

Commissions for buying/selling bonds are 0.1% of the transaction amount.

Withdrawal fees for funds to third-party banks vary depending on the bank location, ranging from 0.5% to 1% of the withdrawn amount.

Various other fees include charges for providing certificates, responding to third-party requests regarding the client, preparing Broker reports, early expiration of option contracts, and specific fees for transactions involving securities with a particular ticker.

Provision of Internet Trading Platforms: Fees are charged for accessing different trading platforms, including web platforms, F-Trader, mobile applications, and voice trading. Additionally, exchange data access has associated costs based on the type of data required.

These fees and commissions may vary depending on the type of service or transaction and are subject to negotiation or specific terms. It's important for clients to review and understand the fee structure before engaging in any financial transactions with the company, as they can significantly impact the overall cost of trading and investing. Clients should also consider the potential impact of additional fees, such as those imposed by ECNs and regulatory bodies like the U.S. Securities and Exchange Commission (SEC).

Trading Platforms

FFIN provides traders with a versatile selection of trading platforms, with a focus on three primary options: Quik, Netlnevestor, and F-Trader. This diverse range of trading platforms allows traders to choose the one that best suits their individual preferences and trading styles. Whether traders prefer the speed and simplicity of Quik, the comprehensive features of Netlnevestor, or the functionality offered by F-Trader, FFIN ensures that they have access to the tools and technology necessary to make informed investment decisions. This flexibility in platform choice underscores FFIN's commitment to meeting the diverse needs of its trading clientele and enhancing their trading experience.

Customer Support

Freedom Securities Trading Inc. appears to provide customer support through various channels to assist its clients with their inquiries and concerns. Here's a description of its customer support:

Customer Support Department: Clients can reach out to the Customer Support Department by emailing them at clients@ffin.bz. This channel is likely suitable for addressing specific account-related questions, technical issues, or any other inquiries clients may have regarding their trading or investment activities.

General Issues: For more general inquiries or questions that may not be account-specific, clients can contact the company's general support team via info@ffin.bz. This email address is typically used for broader inquiries about the company's services, policies, or any other non-account-specific matters.

Phone Support: The company provides phone support with multiple contact numbers, including +357 251 238 85, +501-227-94-27, and 8 800 333 5 888. These phone numbers offer clients the option to speak directly with a representative for immediate assistance or to discuss their trading needs.

Registered Address: The company's registered address, located in Belize City, Belize, may serve as a physical contact point where clients can potentially visit or send correspondence if necessary.

Overall, it appears that Freedom Securities Trading Inc. offers a comprehensive customer support system with various contact options, including email and phone support, to cater to the needs of its clients. This multi-channel approach allows clients to reach out for assistance in a way that is convenient for them, whether they have specific account-related concerns or general inquiries about the company's services and policies.

Educational Resources

Freedom Securities Trading Inc. does not offer educational resources as part of its service offerings. This means that the company primarily focuses on providing trading and brokerage services without providing additional educational materials or tools to help clients improve their knowledge of financial markets or trading strategies. While some traders may prefer a broker that offers a comprehensive set of educational resources to enhance their skills and understanding, clients of Freedom Securities Trading Inc. may need to seek educational materials and information from other sources independently if they wish to further their financial knowledge and trading expertise. It's important for potential clients to consider their individual educational needs and preferences when choosing a brokerage firm for their trading activities.

Summary

Freedom Securities Trading Inc. operates as a brokerage firm that offers a range of services to traders and investors. While it does not hold a broker's license, it provides brokerage services for clients interested in trading various financial instruments, including stocks, on global exchanges. The company highlights its support in the Russian language, catering to clients who prefer communication in Russian. It offers access to trading platforms like NetInvestor and F-Trader and provides a personalized advisory service for clients who opt for the “Consulting” tariff. Clients can maintain control over their portfolios while receiving guidance from experienced managers. However, the company does not provide educational resources. It's essential to review their fee structure, which includes various commissions and charges, before engaging in financial transactions.

FAQs

Q1: Is Freedom Securities Trading Inc. regulated?

A1: No, Freedom Securities Trading Inc. does not hold a broker's license, which raises regulatory concerns.

Q2: What services does the company offer?

A2: The company offers brokerage services, personalized advisory services, and access to trading platforms.

Q3: Is customer support available in Russian?

A3: Yes, the company offers customer support in the Russian language at any time of the day.

Q4: What trading platforms are available?

A4: Clients can use trading platforms like NetInvestor and F-Trader to execute trades and manage portfolios.

Q5: Does the company provide educational resources?

A5: No, Freedom Securities Trading Inc. does not offer educational resources for clients.