Score

HSBC

China|2-5 years|

China|2-5 years| https://www.hsbc-tz.com/site/index

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

HSBC

HSBC

China

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

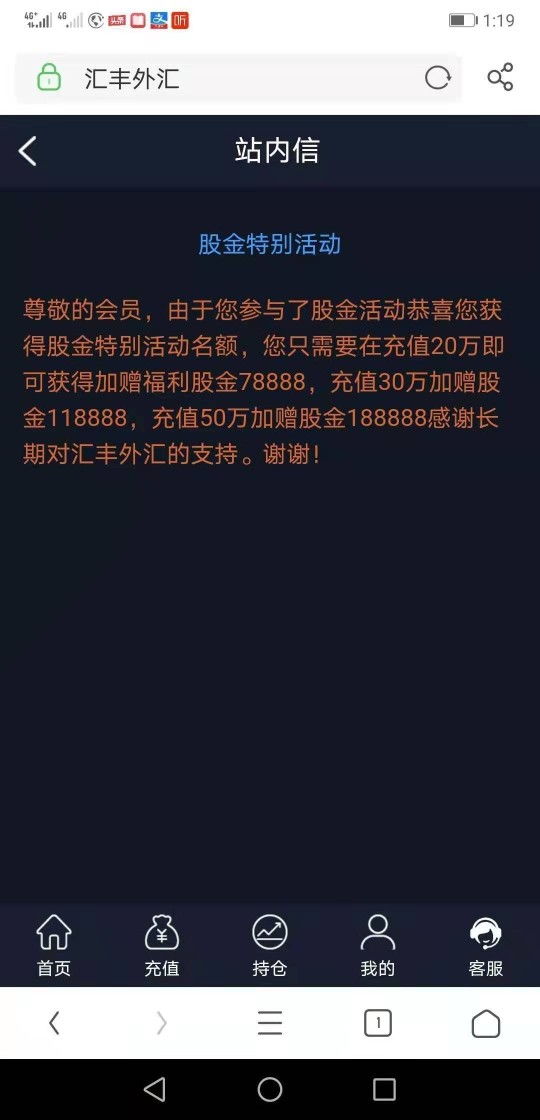

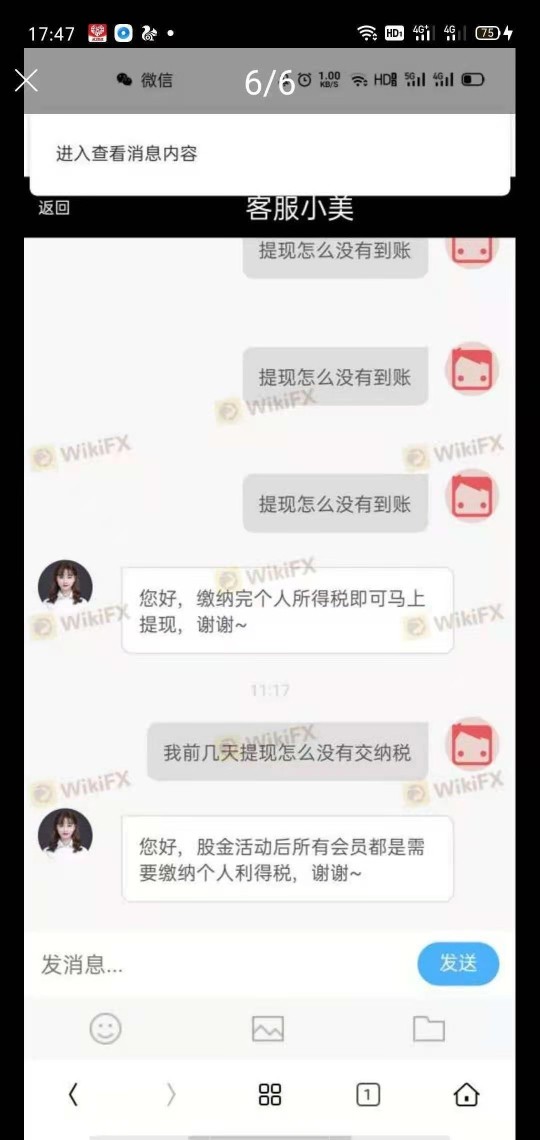

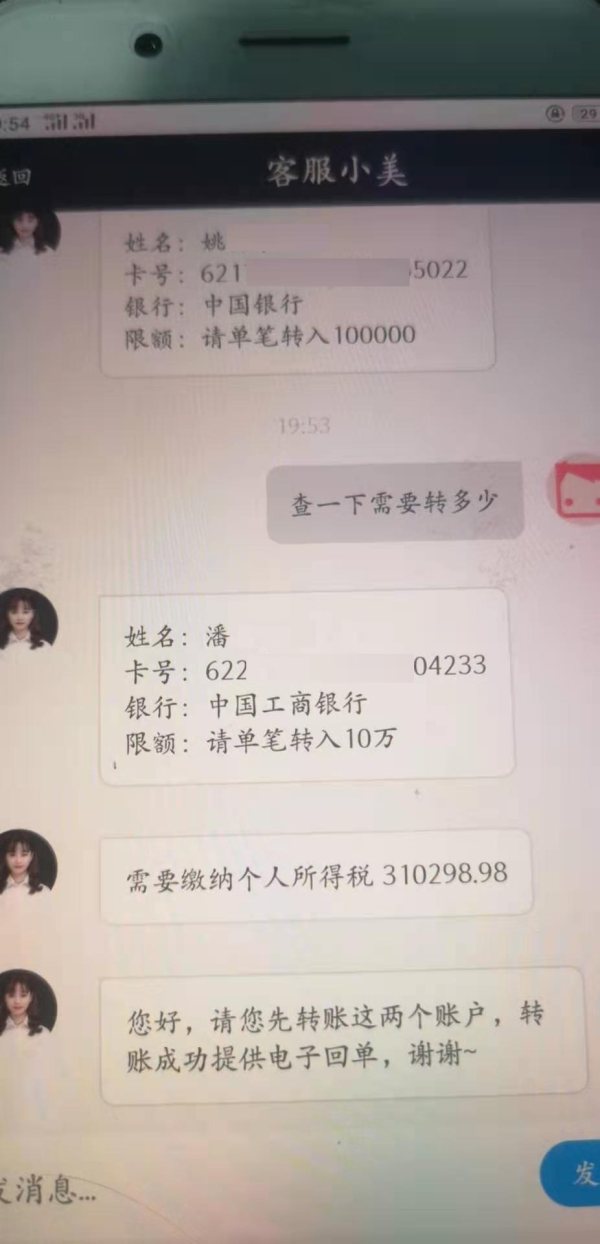

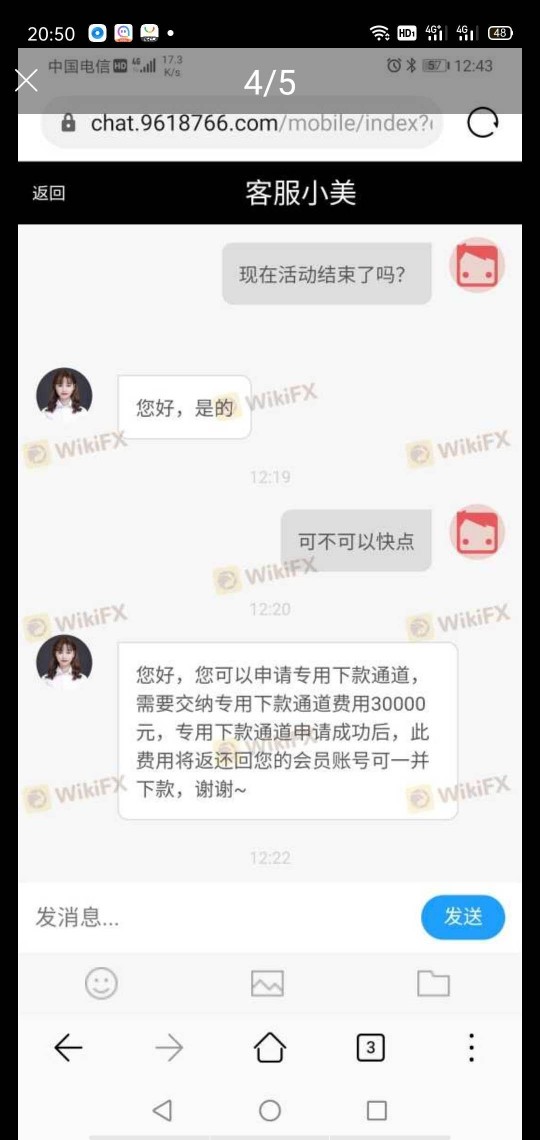

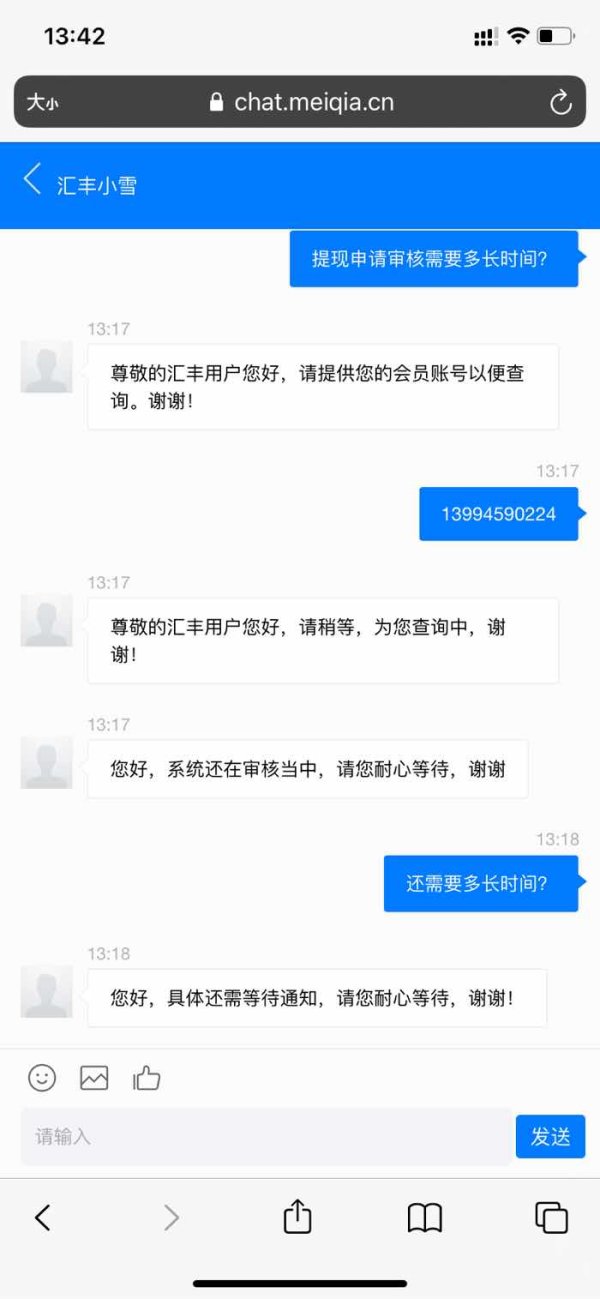

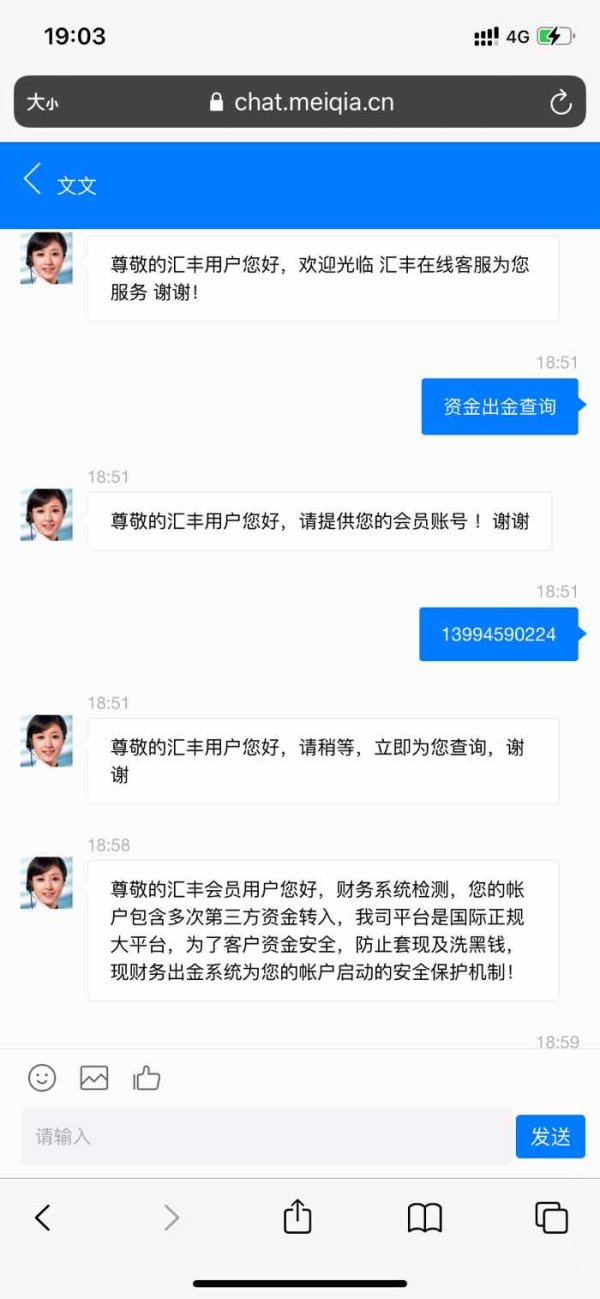

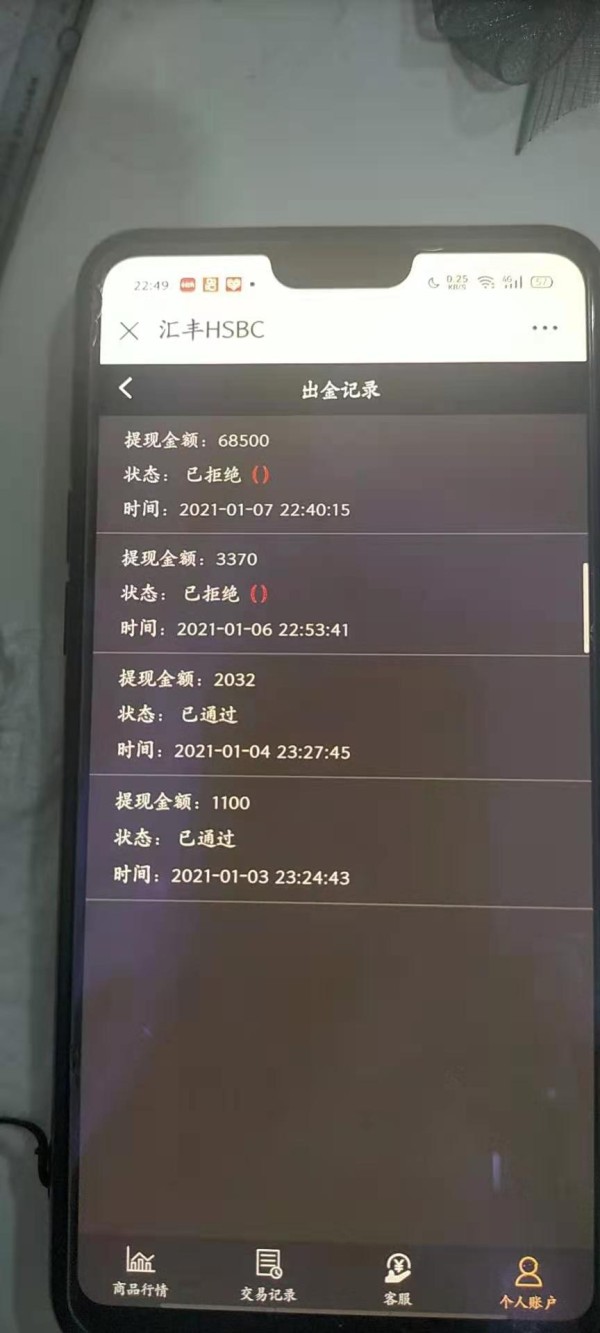

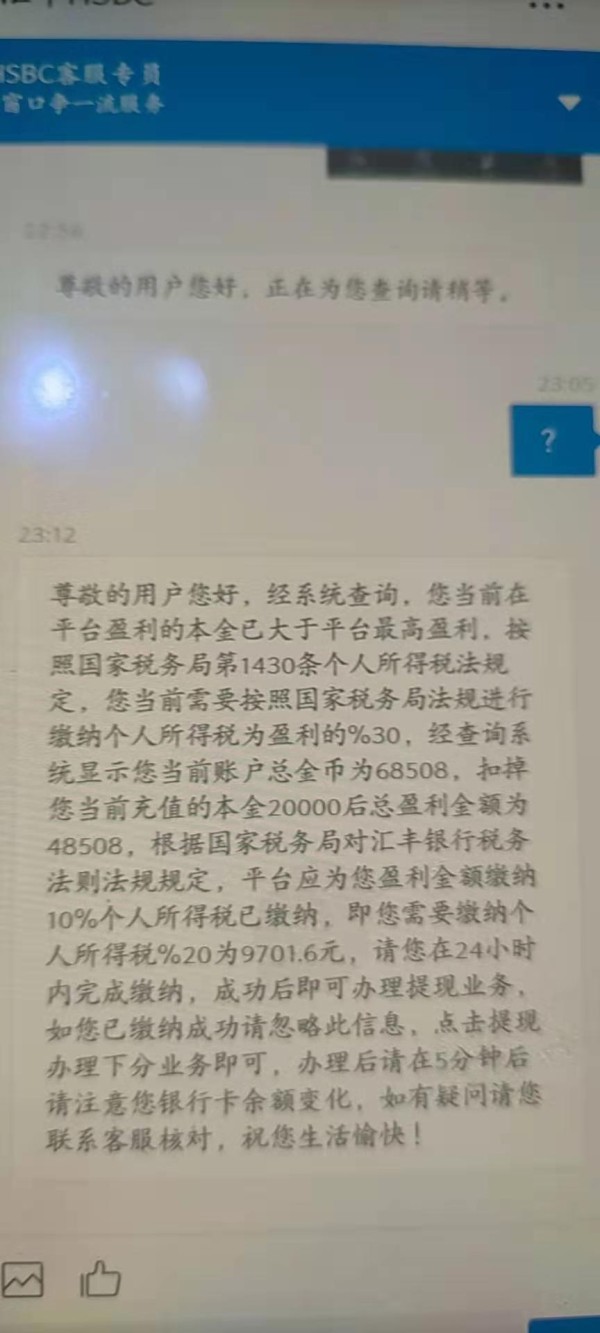

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 7 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

WikiFX Verification

Users who viewed HSBC also viewed..

XM

MiTRADE

GO MARKETS

Decode Global

HSBC · Company Summary

General Information of HSBC

The Hongkong and Shanghai Banking Corporation Limited (HSBC, for short), a wholly-owned subsidiary of HSBC Holdings, is the largest registered bank in Hong Kong, China. HSBC is one of the three largest note-issuing banks in Hong Kong, China (the other two are Bank of China (Hong Kong) and Standard Chartered Bank, respectively). HSBC's head office is located at HSBC Head Office Building, 1 Queen's Road Central, Hong Kong. HSBC and its subsidiaries currently operate approximately 700 branches and offices, mainly in the Asia Pacific region. HSBC has an annual turnover of US$79.6 billion (2018) and 235,217 employees (2019), with Kee Chin as Chairman of the Board and Wang Dongsheng as Chief Executive Officer. In the morning of July 24, 2020, Beijing time, the High Court of British Columbia, Canada, made public the evidentiary materials for the next stage of the trial of Meng Wanzhou's extradition case. As early as May 28, the court ruled that Meng's case was essentially a fraud case. The public evidence shows that the so-called Meng Wanzhou case is a political case concocted by the United States. HSBC played a disgraceful role by participating in the framing, malicious manipulation, piecing together materials, and fabricating incriminating evidence.

Regulation of HSBC

HSBC is regulated by the Securities and Futures Commission in Hong Kong and holds a full license from the Labuan Financial Services Authority in Malaysia. However, the full license it claims to hold from ASIC in Australia is suspected to be a fraudulent one.

Personal

HSBC's personal finance business includes banking services (accounts and online banking), debit (credit cards and loans), investment (securities and foreign exchange), insurance (insurance and planning), and wealth foresight (analysis and market data). Banking services include all-in-one accounts (HSBC One, HSBC Premier, etc.), deposits, debit cards, foreign currency and RMB services, community banking services, HSBC FinFit, banking services and payments, MPF, global banking services, and Greater Bay Area services. Lending services cover credit card applications, overdraft services, mortgages, loans, etc. Investment products and services mainly include stocks, bonds, trust funds, warrants, foreign exchange, etc. Insurance products mainly include life insurance, savings plans, medical insurance, retirement planning, home insurance, travel protection wealth, etc. The Wealth Vision section mainly includes investment classes, selected articles, and wealth vision, etc.

Business

Business finance mainly includes daily finance, financing and credit card, payment (income and expense service), protection and investment (insurance and asset appreciation), and import/export deposit service. Daily wealth management mainly includes commercial cards, commercial integrated accounts, foreign exchange, deposit and investment services, and wealth management services. Financing and credit card services mainly include export services, commercial cards, commercial loans, accounts receivable financing, and import services. Payment services mainly include commercial cards, international and local payments, foreign exchange, accounts receivable services, and payment services. Protection and investment services mainly include life insurance, unit trusts, commercial insurance, foreign exchange, fixed interest investments, stocks, trade-related insurance, employee services, and MPF. Import and export charge services include export services, accounts receivable financing, account opening, trade-related insurance, import services, and bank guarantees.

Global Banking & Markets

HSBC Global Banking & Capital Markets offers a range of solutions such as financing and advisory services, mergers and acquisitions, a global research, global trade and receivables financing, trading markets, global liquidity and cash management, securities services, sustainable finance, and spiritual leadership.

Private Banking of HSBC

Private Banking covers banking (accounts and services), lending (loans and financing), investments (services & analysis), planning (wealth solutions), and insights (proprietary analysis). Banking services mainly include transaction banking, credit and debit cards, foreign exchange, and margin trading. Lending services mainly include customized loan services, financing backed by oil-priced securities, residential mortgages, and specialized asset financing. Investment services cover advisory services, discretionary services, multi-asset solutions, single-asset solutions, hedge funds, private equity, real estate, and other alternative investments. Planning services include succession planning, trust administration, private family funds, estate administration, liquidity planning, family business succession planning, family governance, philanthropy, and insurance services.

Service Fees of HSBC

The latest service fees for credit cards, loans, overdraft services, investments, insurance, and MPF are available on HSBC's official website. Details of the fees are available on HSBC's website.

Review 7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now