Company Summary

Company Summary

Company Profile

Basic Information & Regulatory Authorities

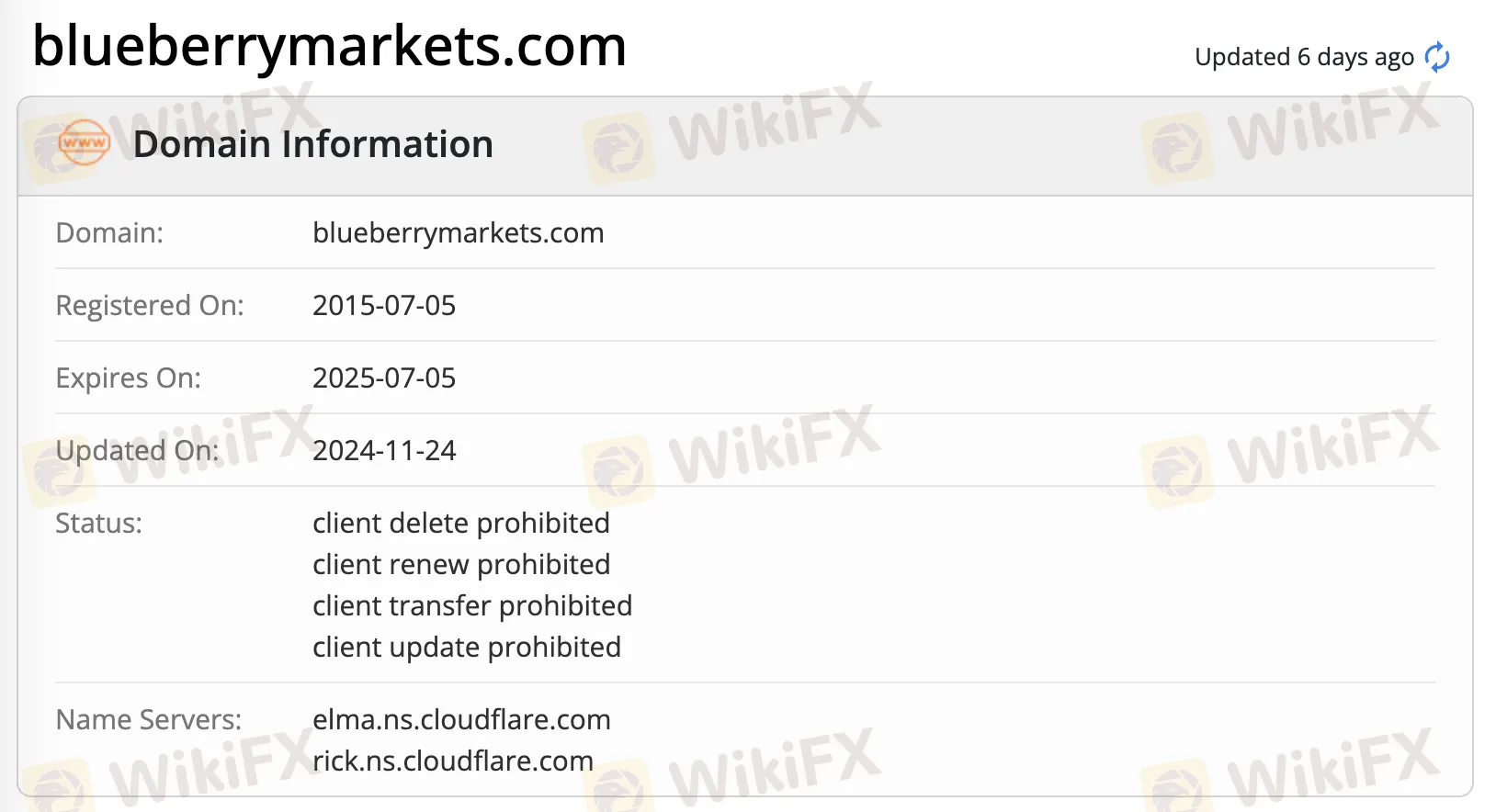

Blueberry Markets is an Australian broker founded in 2016, offering investors a range of currency pairs and contract for difference (CFD) trading services online. Blueberry Markets is currently regulated by the Australian Securities and Investments Commission (ASIC) with a full license (MM) regulation number: 535887, and a straight-through processing (STP) license number: 364411. It also holds a retail forex license from the Vanuatu Financial Services Commission (regulation number 700697).

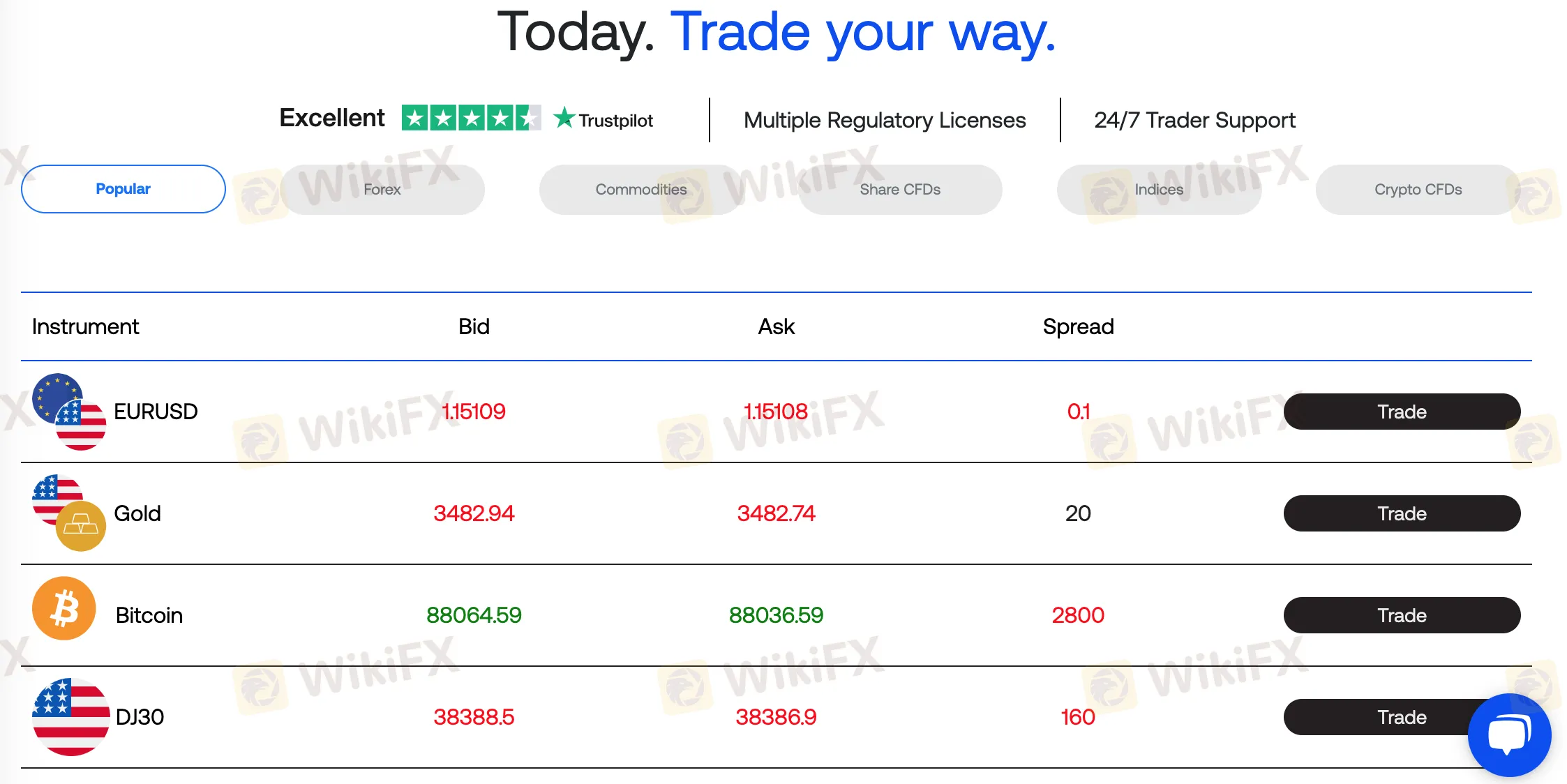

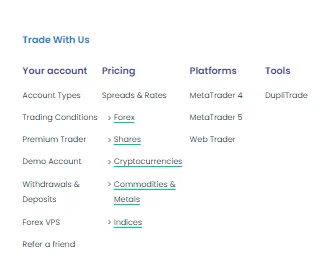

Financial Instruments

Blueberry Markets provides investors with a diversified range of investment assets, primarily including forex currency pairs, commodities, indices, metals, energy, and CFDs.

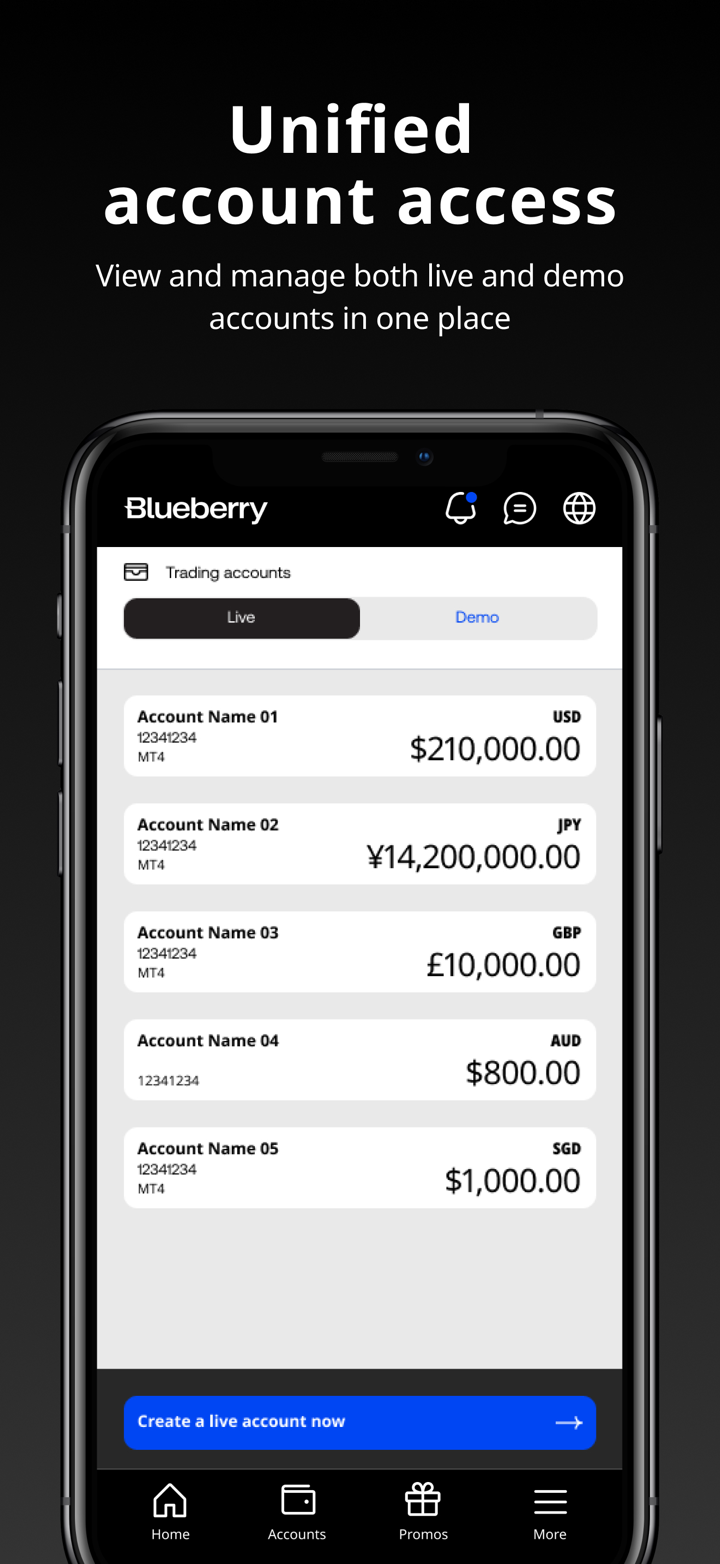

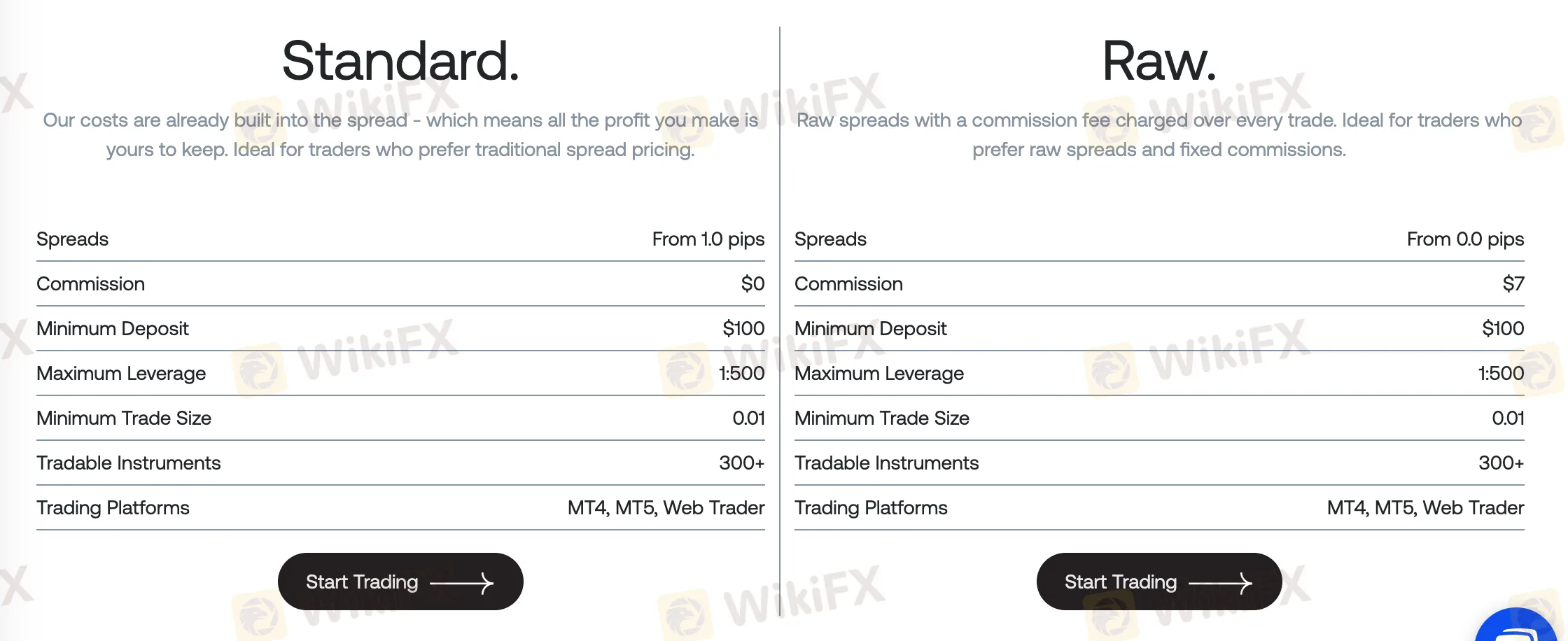

Accounts & Leverage

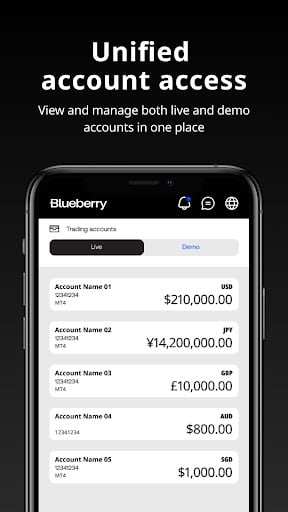

Blueberry Markets offers investors two main types of accounts: Standard and Professional accounts. The minimum initial deposit for a Standard account is $300, while for an ECN account, it is $500. Both account types have a maximum trading leverage of 1:500.

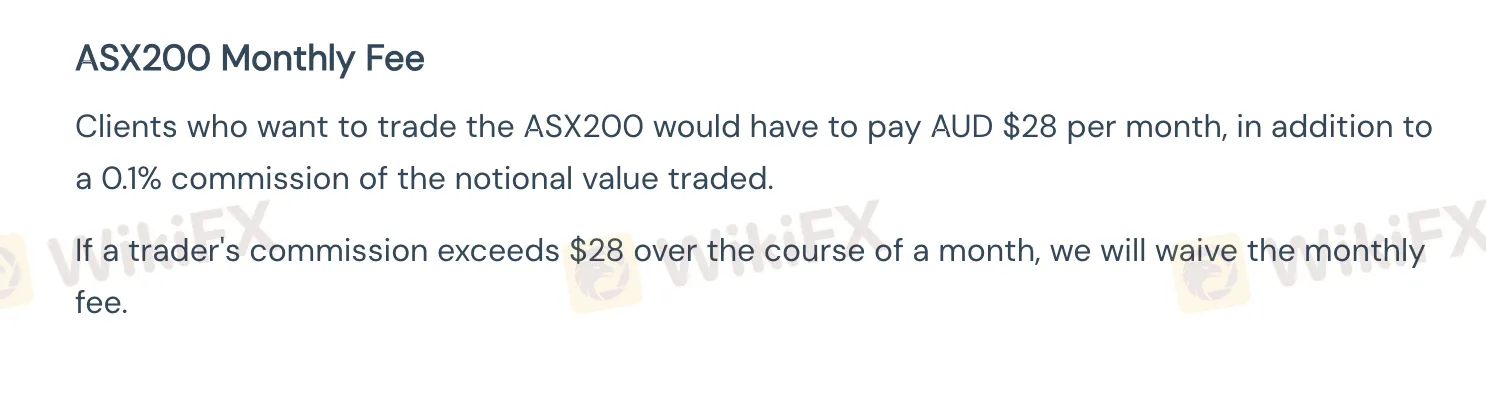

Spreads & Fees

The Standard account at Blueberry Markets has a spread starting from 1.0 pips with no trading commission. The ECN account has spreads starting from 0 pips with a trading commission of $6 per lot.

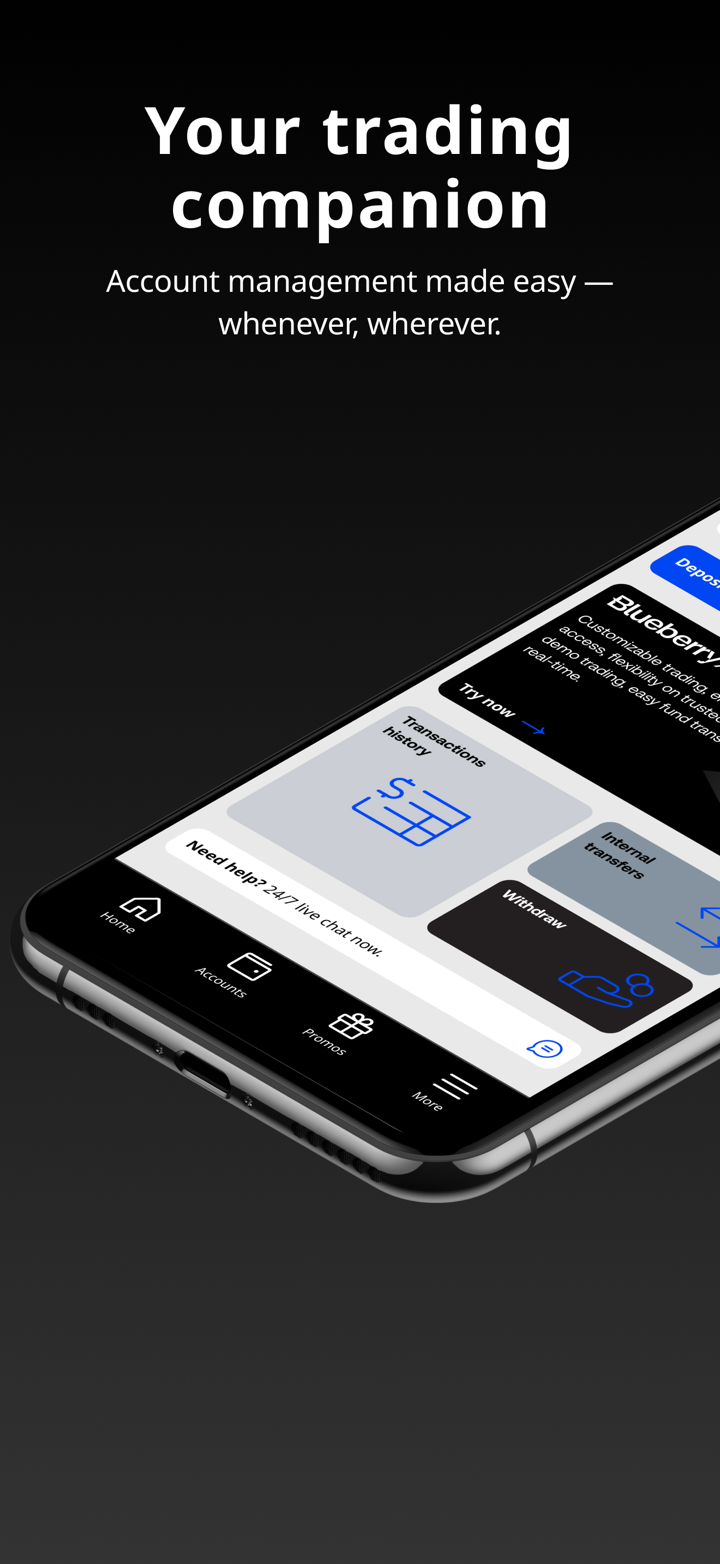

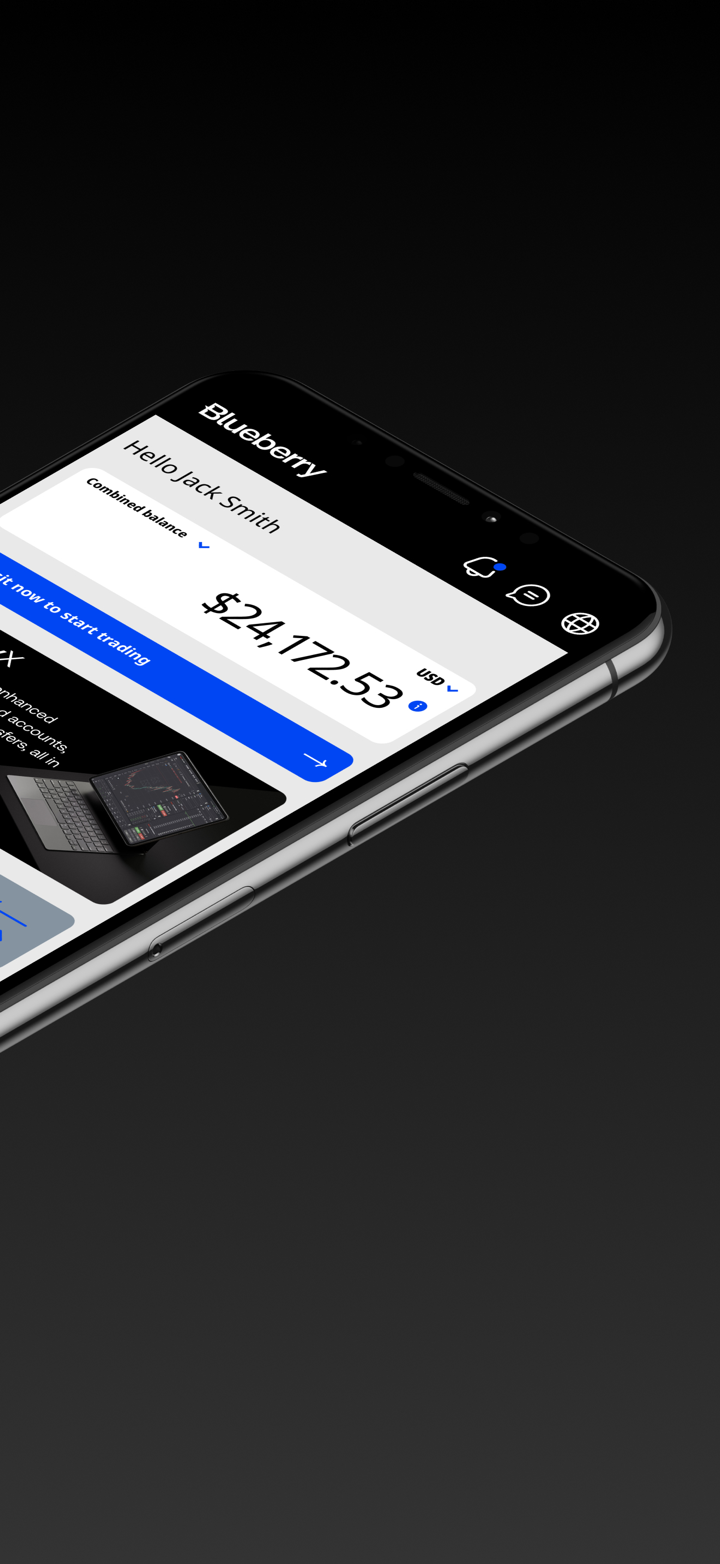

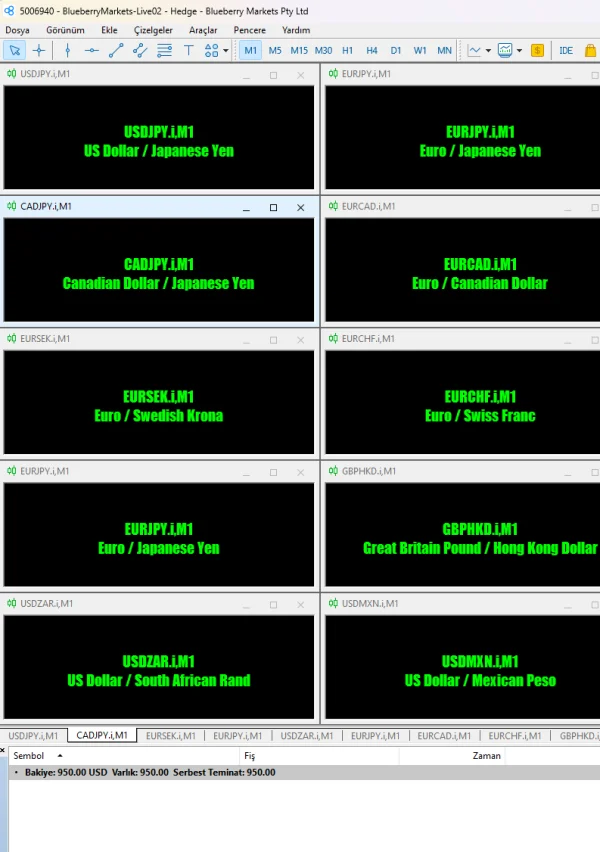

Trading Platforms

Blueberry Markets provides traders with the highly acclaimed MT4/MT5 trading platforms. MT4 is used by millions of traders with various experience levels, featuring a user-friendly interface and a range of trading tools, including over 30 built-in technical indicators, 23 analysis tools, and support for EA automated trading. MT4 allows traders to create custom indicators and EAs using the MQL programming language and includes a strategy tester for backtesting using historical data downloaded from the broker.

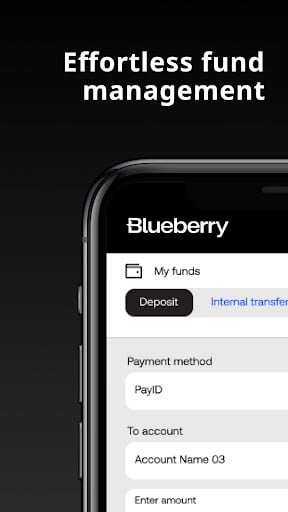

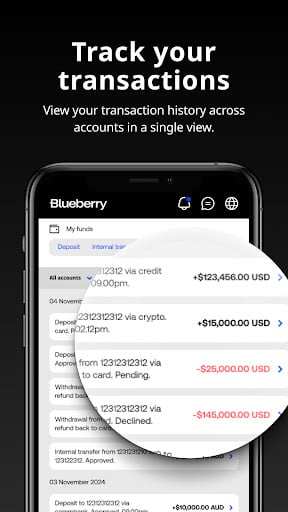

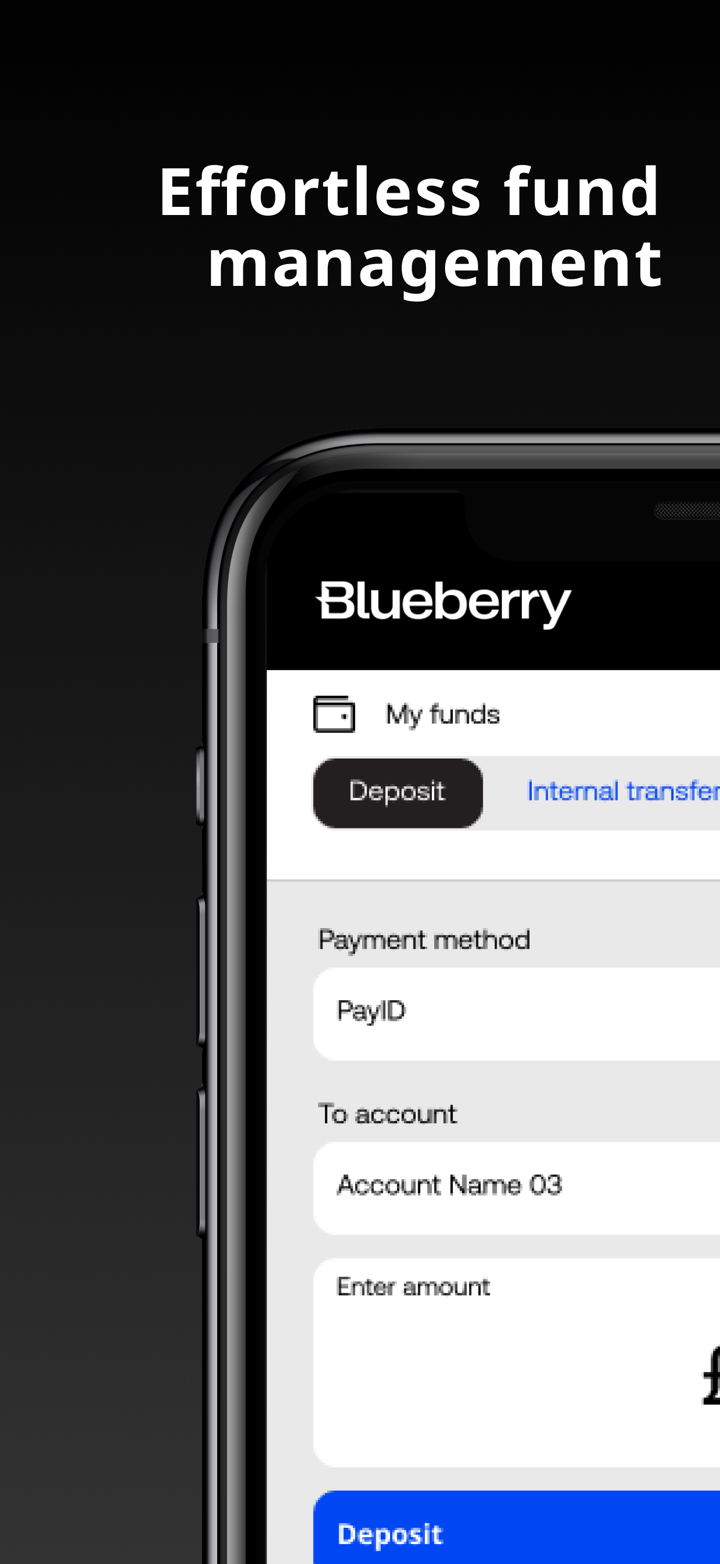

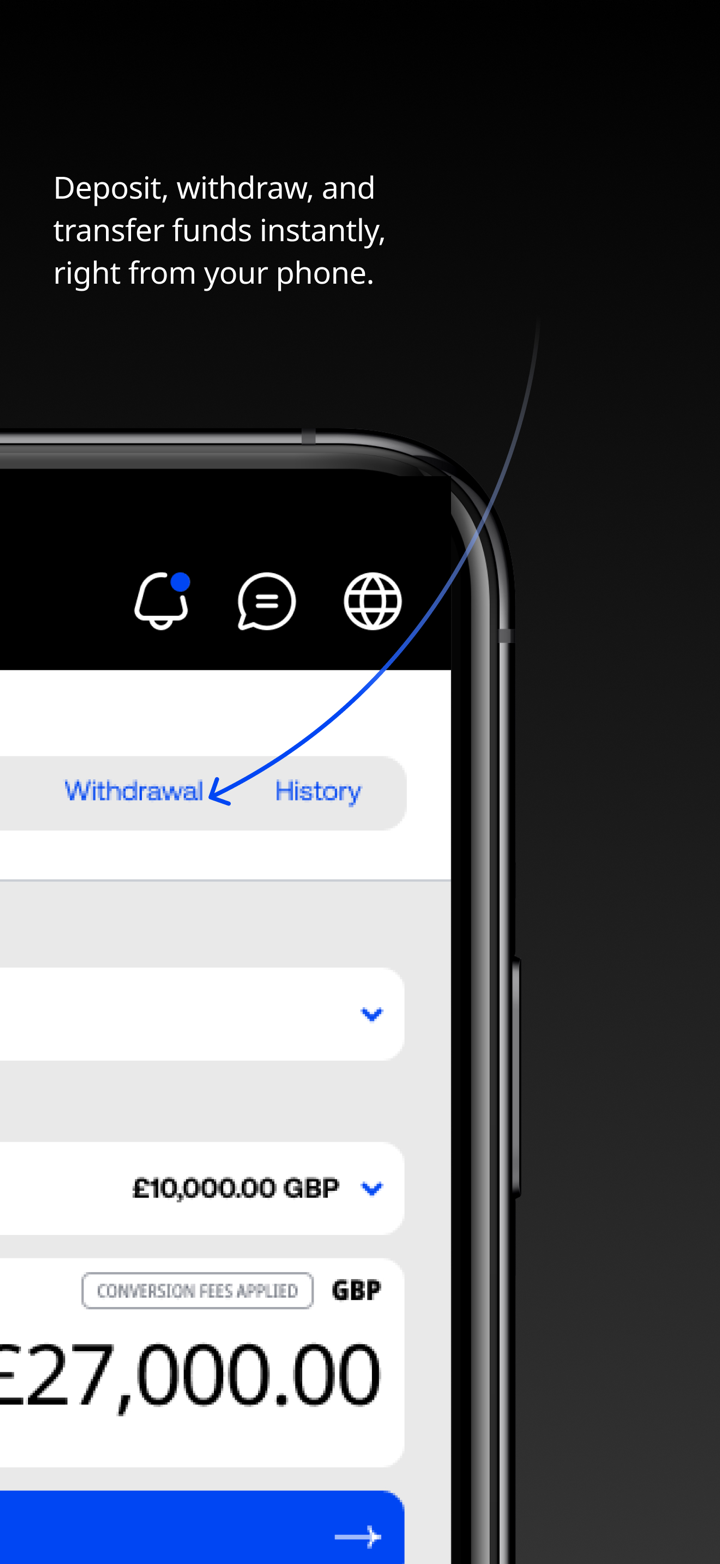

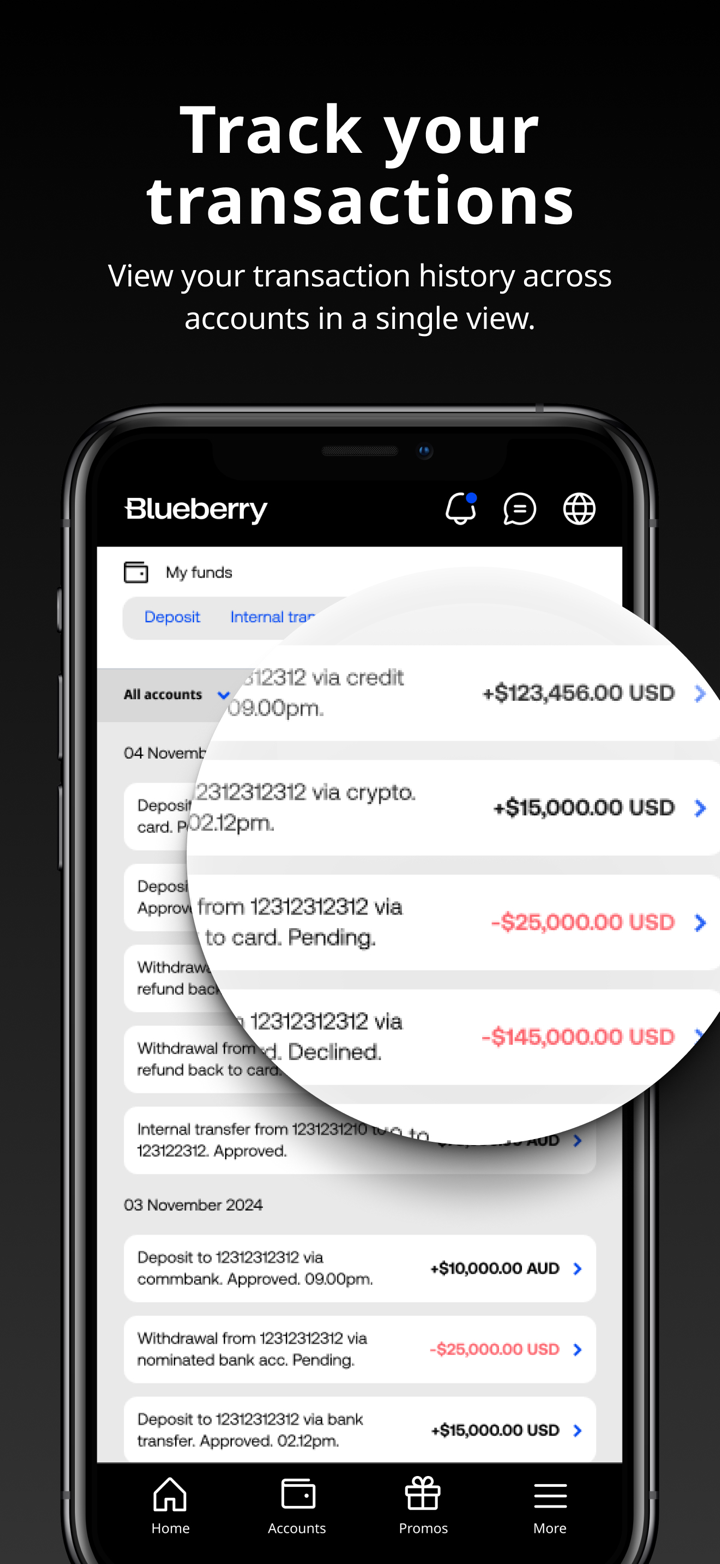

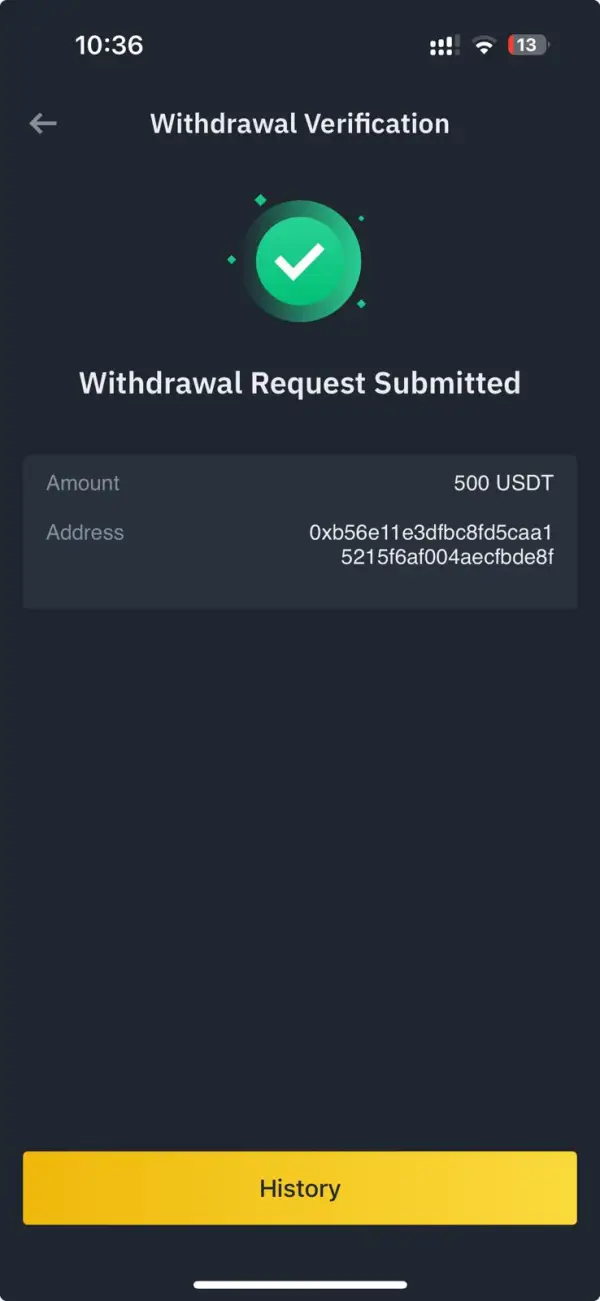

Deposits & Withdrawals

Blueberry Markets supports global users in funding and withdrawing from their investment accounts through Alipay, UnionPay, bank transfers, VISA, MasterCard credit cards, POLi, Skrill, and other electronic payment methods.

Pros & Cons

Client Distribution and Office Locations:

Blueberry Markets is a globally leading financial services company. We are committed to providing top-notch forex trading services to traders around the world, ensuring competitive spreads and round-the-clock support. We have earned the trust of over 50,000 traders from 60+ countries.

Blueberry Markets consistently adheres to a customer-centric business philosophy, offering advanced trading technology, top-tier industry platforms, and exceptional customer service, garnering over a thousand five-star reviews across major platforms.

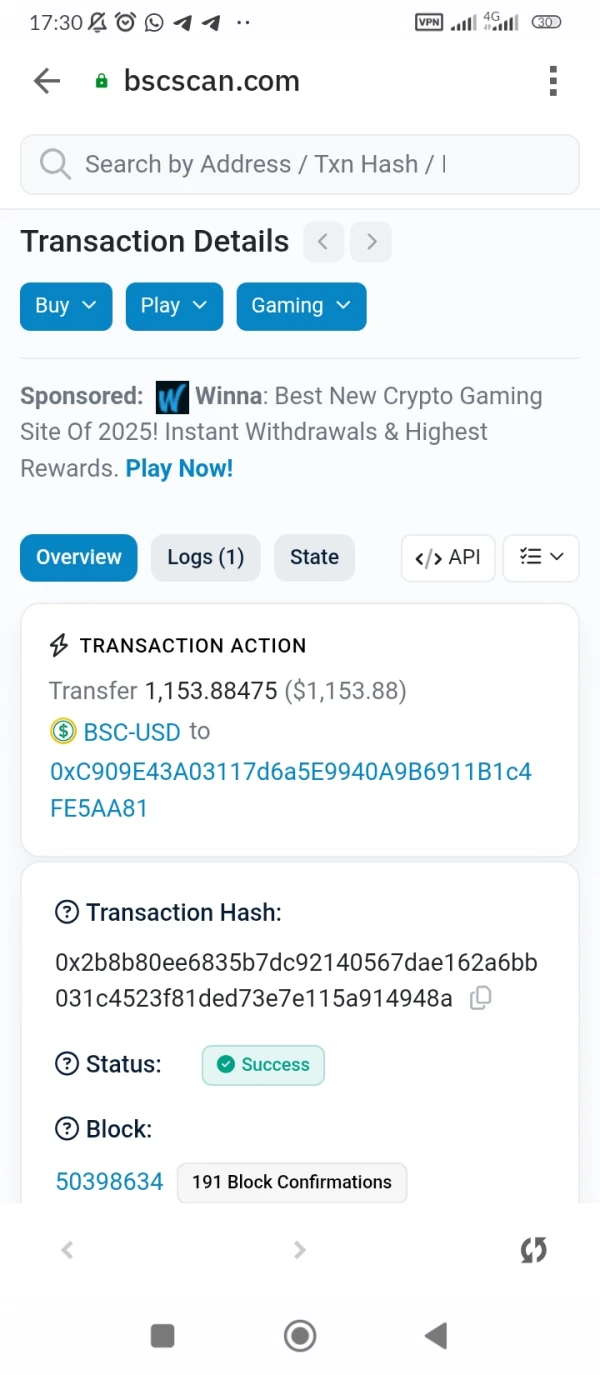

FX3971696058

Indonesia

My $1154 deposit has not been credited for 3 days now. I have contacted customer service and emailed proof with screenshots and Trx hash. However, there has been no action taken yet. It has been 3 days and my deposit is still missing, with email responses only asking me to wait. This is truly disappointing and very slow in handling the issue.

Exposure

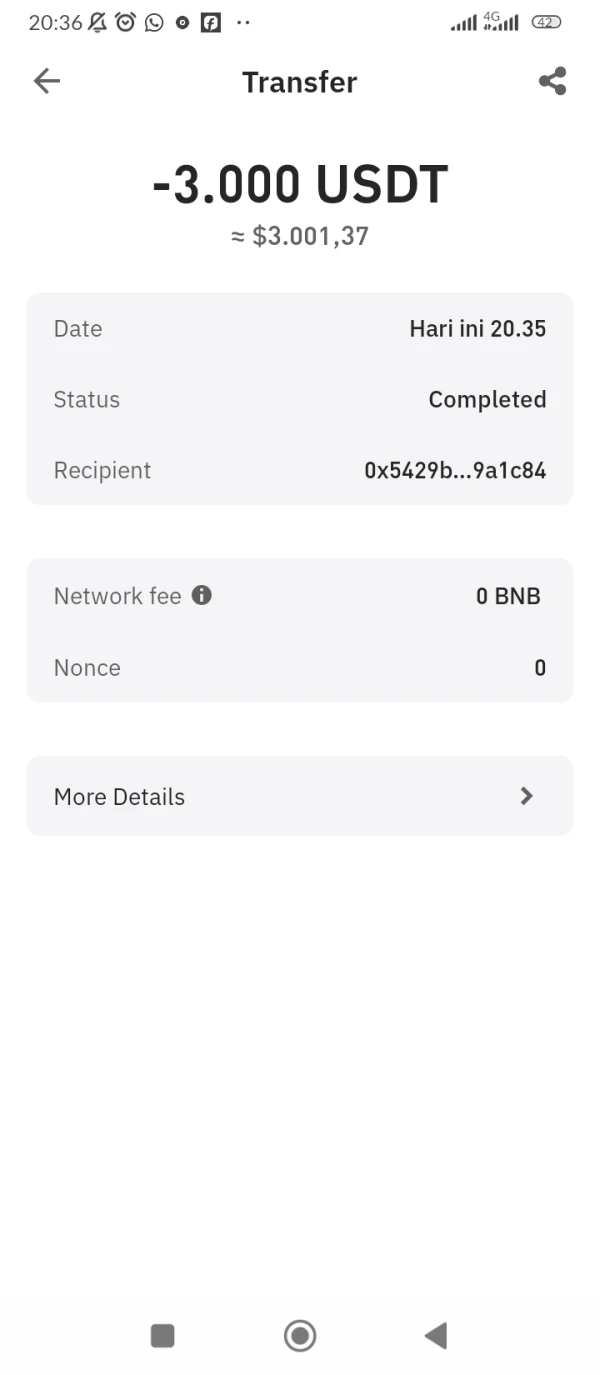

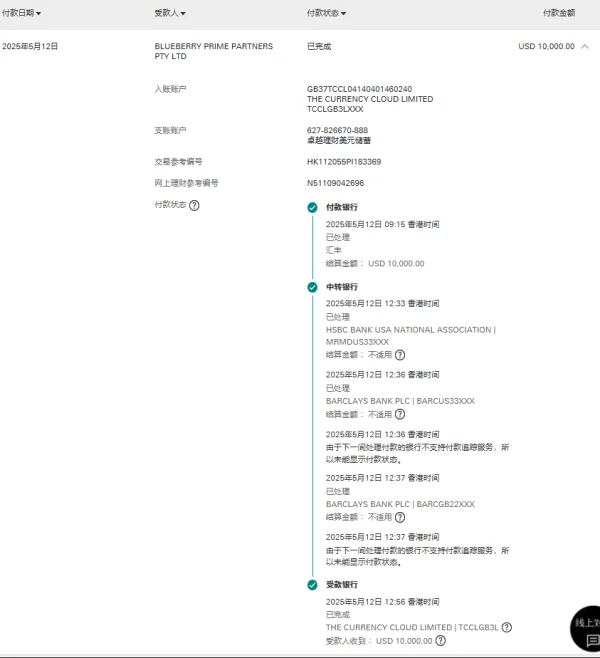

FX3581727715

Taiwan

I. Statement of facts: Deposit and trading: On May 12, 2025, I deposited $10,000 USD into your platform via wire transfer. The transaction record can be reviewed on your platform. After the deposit, I engaged in gold trading through your platform's MT4/MT5 system and made a profit of approximately $21,130 USD. Along with the initial capital, the account balance is approximately $31,130 USD. Refusal of withdrawal and account ban: On May 23, 2025, I submitted a withdrawal request for $10,000 USD via your platform but have not received any funds as of yet. In the following days, your customer service team asked me to 'submit my registered email' and afterward offered no response. Currently, my trading account and backend management page have been forcibly banned and I can no longer log in.

Exposure

FX3370591287

Pakistan

this is a scam broker which manipulate the prices and when i tried to withdraw the funds from my account they prolonged processing and after a week i'm still waiting to get back my withdrawn amount.

Exposure

FX2341972464

Turkey

This company closed my account without unconditional notice. They're not fair, 5006940 5016017 5006979 they literally confiscated the $8000 I had in my trading accounts like a mafia. Stay away from these mafias.

Exposure

Samber

Belarus

Blueberry Markets is seriously great! They've got a really low minimum deposit, so even if you're just starting out with a small budget, you can still give it a go. And their trading platforms, like MetaTrader 4 and 5, are super smooth and packed with all the tools you need to trade like a pro.

Positive

USDT@

South Africa

User-friendly and reliable platform. Deposits and withdrawals are processed swiftly.

Positive

FX2548725189

Singapore

Blueberry Market's Personal Touch: My Experience After initially failing to claim my cash bonus from Blueberry Market, I was informed they weren't aware of the promotion. Disappointed, I decided to withdraw my account and move to RichSmart, giving up on the $1,000 bonus. However, the next morning, I received a call from Azima, my account manager at Blueberry Market. She apologized and explained that due to my withdrawal, they couldn't process my bonus claim. Shortly after, Ernest, the Head of Asia Pacific, reached out to verify the situation. He requested that I redeposit the funds as a commitment and assured me the bonus would be processed once the deposit was made. Blueberry Market truly went the extra mile to ensure I was taken care of and that their promises were delivered. Their commitment to resolving my issue and ensuring my satisfaction was remarkable. Thanks to Azima and Ernest's dedicated efforts, I will be receiving my $1,000 bonus within the next 24 hours. If it weren't for their exceptional customer service, I would have switched platforms. Blueberry Market's commitment to going above and beyond for their customers sets them apart.

Positive

Vfghu

Belarus

Here's my experience of forex trading with the broker:Stay well diversified, use portfolio margin, try to keep leverage below 1.2 under normal market conditions and you can significantly increase your return over time, while allowing enough margin for error and minimize the risk of margin calls in a bear market. Don't trade excessively, or the fees will eat you alive. Keep turnover below 10% annually. Ideally, you should find high quality stocks to buy at reasonable prices and hold them forever.

Neutral

sunny91

Malaysia

Hello fellow traders! Let me paint a picture for you, you're trading in your comfy home Down Under, with Blueberry Markets as your faithful companion. Entered the market in 2016 and been making strides since. Their wide array of instruments had me spoilt for choice and I loved every minute of trading commodities, shares, and more. I chose the Direct account for my trading escapades, well worth the 7 bucks commission. And boy, do they give you the flexibility to deposit and withdraw with ease; Credit cards, PayPal, you name it. What does bring them down a notch though, is the lack of a demo account. Apart from that, heaps of fun trading with them!

Neutral

Kikoyo

Australia

G'day mates! Just your standard Aussie trader here, and I've got to say, trading with Blueberry Markets has been a bonza experience. I love how they've got everything regulated by ASIC, gives me that peace of mind, you know? From forex to CFDs and everything in between, they've been right there with me all along. I'm usually a standard type of guy, but I tested the waters with a Direct account and it ain't half bad. Been getting solid spreads, especially on EUR/USD, starting from just 0.8 pips. Choosing a deposit and withdrawal method is never a headache, with a buffet of options right from cards to crypto wallets. Bit of a downside - no demo account, so if you're a newbie better come prepared to this trading barbecue!

Neutral

金诗尧[福]奥美ᴼᵀᴹ

Hong Kong

I had no issues all around for the two years I have trading with Blueberry Markets, no slippage, patient customer service, stable trading platform.

Positive

FX1176109635

Australia

Everything is gonna be okay as long as you don't ask for your money back. However, if you request a withdrawal, you're going to have a problem. They will keep coming up with all kinds of silly excuses for why you can't take your money out.

Neutral

FX2924681881

Taiwan

All the investment cannot be withdrawn when I need it.

Exposure

FX2594832620

Nigeria

Here's a cryptocurrency scam going around right now. They'll befriend you through social media and direct you here to make profit via day trading. As soon as you deposit the money is gone for good. They claim to be a trader of bluberry market

Exposure

FX7254318792

Nigeria

I have been a victim of a scam broker with the name: BlueberryMarkets. When I had wanted to open an account, I spoke to an employee on their live chat and was explicitly told they were an ECN broker when I asked about it. Screenshot of the chat transcript is attached below.

Exposure

FX7359315392

Bangladesh

They use a combination of tactics to ensure your money is gone (even when you’re profiting one way they will find a way to minimise or spike your stop loss). Their best used manipulation method is the games they play with their spreads and the way they increase those spreads as they please (reaches over 350 pips at one point). They will do price hikes that are not seen in any chart and suddenly your money is gone without a trace.

Exposure