Company Summary

Note: Oval X (ETX)s services have now been discontinued.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| Oval X Review Summary in 10 Points | |

| Founded | 1965 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA (suspicious clone) |

| Market Instruments | Forex, indices, stocks, CFDs, commodities |

| Demo Account | N/A |

| Leverage | 1:200 |

| EUR/USD Spread | 0.6 pips |

| Trading Platforms | MT4, Oval X Trader Pro |

| Minimum deposit | $100 |

| Customer Support | Phone, email |

What is Oval X?

ETX have completed a re-branding exercise and it is called “Oval X”. Oval X is a trading brand of Monecor (London) Limited, company registration number 00851820. As a member firm of the London Stock Exchange, Monecor (London) Limited is regulated by the Financial Conduct Authority (Financial Services Registration Number. 124721), however, it is a suspicious clone.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Wide range of trading instruments | • Suspicious clone FCA license |

| • Flexible leverage | • Reports of unable to withdraw and scams |

| • Tight spreads | • Withdrawal fees applied after 5 withdrawals |

| • MT4 trading platform available | |

| • Multiple payment methods | |

| • Rich educational resources |

Oval X Alternative Brokers

Z.com Trade - a reputable online broker with a user-friendly platform and competitive trading conditions, making it a good choice for traders of all experience levels.

AETOS - a trusted broker known for its strong regulatory compliance, extensive product offerings, and comprehensive trading tools, making it a reliable option for traders looking for a diverse range of investment opportunities.

Hirose Financial - offers a reliable trading environment, competitive spreads, and a wide range of trading instruments, making it a recommended choice for traders seeking a trusted broker with a solid track record.

There are many alternative brokers to Oval X depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is Oval X Safe or Scam?

Based on the information available, Oval X is an unregulated broker with a suspicious Financial Conduct Authority (FCA, License No. 124721) license. Furthermore, there are reports of withdrawal issues and scams associated with the company. These factors raise significant concerns about the safety and legitimacy of Oval X as a trading platform.

Traders are advised to exercise caution and conduct thorough research before engaging with unregulated brokers, as the risks of financial loss and fraudulent activities are higher in such cases. It is recommended to choose regulated brokers that adhere to industry standards and provide a higher level of investor protection.

Market Instruments

Oval X offers investors a diverse range of tradeable financial instruments across various markets. Traders can access a wide selection of currency pairs in the Forex market, allowing them to participate in global currency trading. Additionally, Oval X provides access to popular stock indices, enabling traders to speculate on the performance of major equity markets.

The platform also offers a range of individual stocks, giving investors the opportunity to trade shares of well-known companies. Furthermore, Oval X provides access to Contracts for Difference (CFDs), allowing traders to speculate on the price movements of various underlying assets such as commodities and more. With this comprehensive offering of market instruments, Oval X aims to cater to the diverse trading preferences of its clients.

Accounts

Oval X provides two distinct account types that align with the trading platforms it offers. The first account type is the Trader Pro account, which is designed to cater to the needs of traders using Oval X's proprietary trading platform. The second account type is the MT4 account, specifically tailored for traders who prefer the popular MetaTrader4 platform.

One notable advantage of Oval X's account offerings is the relatively low minimum initial deposit requirement of $100. This lower entry barrier makes Oval X an attractive choice for new beginners in the trading industry who may have limited initial capital.

Leverage

Oval X offers traders different leverage options depending on the financial instruments they choose to trade. For currency pairs, Oval X provides leverage of up to 1:200, allowing traders to amplify their trading positions in the foreign exchange market. When it comes to indices, the leverage offered is 1:20, providing traders with increased exposure to a basket of stocks representing a specific market. For individual stocks, Oval X offers leverage of 1:5, enabling traders to potentially magnify their gains or losses based on their trading decisions.

In the case of precious metals like gold, Oval X provides leverage of 1:20, allowing traders to capitalize on price movements in this popular commodity. For silver, copper, and platinum, Oval X offers leverage of 1:10, giving traders the opportunity to participate in the market with enhanced trading power. It's important to note that while leverage can amplify potential profits, it also increases the risk of losses, and traders should exercise caution and proper risk management strategies when utilizing leverage in their trading activities.

Spreads & Commissions

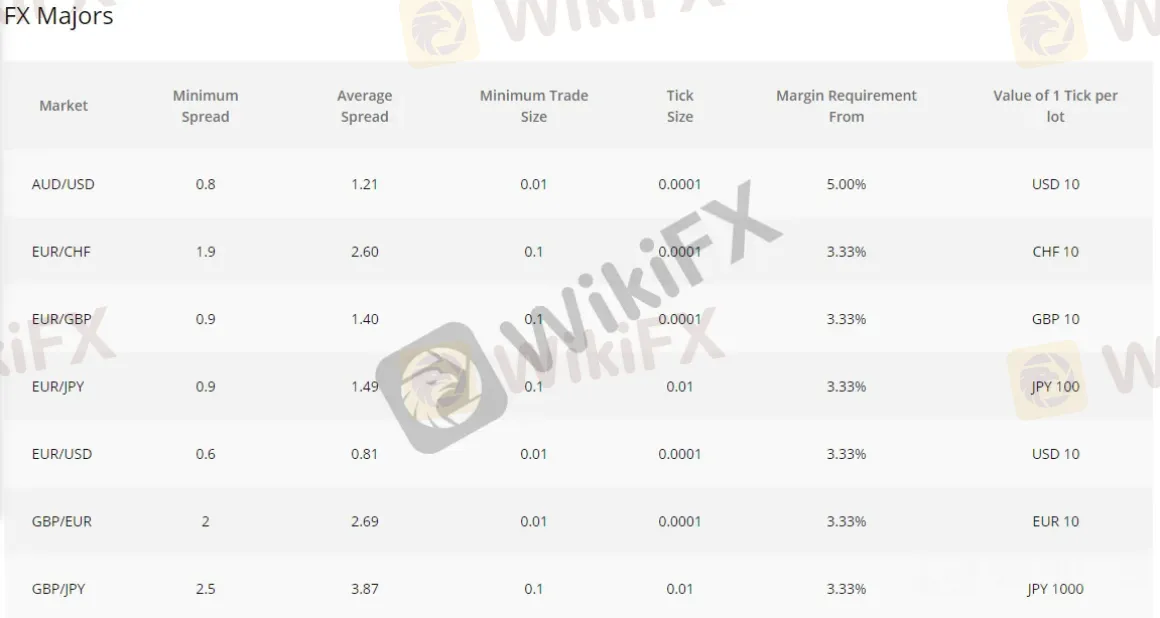

Oval X offers competitive spreads on a range of financial instruments. For popular currency pairs such as EUR/USD, the minimum spread is as low as 0.6 pips and the average spread is 0.81 pips, allowing traders to access tight pricing and potentially reduce trading costs. Similarly, for other currency pairs like EUR/JPY, the minimum spread is 0.9 pips, providing traders with favorable pricing conditions. When it comes to indices, Oval X offers spreads of 1 pip for both UK and Wall Street indices, enabling traders to participate in the movements of these key markets with competitive pricing.

For precious metals like gold, the minimum spread is as low as 0.4 pips, offering traders favorable conditions for trading this popular commodity. The spread for silver is even narrower at 0.03 pips, providing traders with tight pricing on this metal. For commodities such as crude oil and natural gas, Oval X offers spreads of 0.03 and 0.02 pips respectively, giving traders access to these markets with low trading costs.

In terms of commissions, Oval X charges 0.1% per deal for UK and European stock trades, 2 cents per share for US major and minor stock trades, and 0.2% per deal for Australian stock trades. These commission rates are competitive and transparent, allowing traders to have a clear understanding of the costs associated with their trades.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| Oval X | 0.6 pips | 0.1% per deal (UK & EU stocks) |

| Z.com Trade | 0.2 pips | No |

| AETOS | 0.3 pips | No |

| Hirose Financial | 0.8 pips | No |

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

Please note that spreads and commissions may vary based on market conditions and account type. It's always recommended to check with the respective broker for the most up-to-date information.

Trading Platforms

Oval X offers traders a choice between two robust and versatile trading platforms: MetaTrader4 and Oval X Trader Pro. The MetaTrader4 platform is widely recognized and highly regarded in the industry, known for its user-friendly interface, advanced charting capabilities, and a wide range of technical indicators. Traders can access the MetaTrader4 platform on their computers, smartphones, or tablets, providing flexibility and convenience in managing their trades.

On the other hand, Oval X Trader Pro is the broker's own developed trading platform, offering similar features and functionality to MetaTrader4. Traders using Oval X Trader Pro can also enjoy multiple chart types, a comprehensive suite of technical indicators, and customizable tools to suit their trading preferences.

Whether traders prefer the familiarity of MetaTrader4 or the tailored experience of Oval X Trader Pro, both platforms offer a seamless trading experience across different devices, allowing traders to access the markets and execute trades with ease and efficiency.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Oval X | MetaTrader 4, Oval X Trader Pro |

| Z.com Trade | MetaTrader 4, Z.com Trader |

| AETOS | MetaTrader 4, AETOS WebTrader |

| Hirose Financial | MetaTrader 4, LION Trader |

Deposits & Withdrawals

Oval X provides its clients with a variety of convenient and secure deposit methods. Traders can fund their accounts using bank wire transfers, internet wire transfers, VISA/MasterCard/Maestro, UnionPay, e-wallets including Skrill and NETELLER, with no commissions charged for these transactions. This flexibility allows traders to choose the payment method that suits them best.

Oval X minimum deposit vs other brokers

| Oval X | Most other | |

| Minimum Deposit | $100 | $100 |

When it comes to withdrawals, Oval X Capital offers its clients the benefit of 5 free withdrawals per calendar month for amounts over $100, ensuring that traders can access their funds without incurring additional costs. However, it is important to note that Oval X Capital incurs fees from the bank for processing withdrawal requests. As a result, if a client exceeds the 5 monthly free withdrawals, a fee of $25 per withdrawal will be charged. This fee applies to withdrawals made after the fifth withdrawal in a calendar month and ensures the sustainability of the withdrawal process while maintaining the convenience and affordability of withdrawals for most traders.

See the deposit/withdrawal fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee |

| Oval X | No deposit fees | No withdrawal fees for the first 5 withdrawals per month; subsequent withdrawals incur a fee of $25 per withdrawal |

| Z.com Trade | No deposit fees | No withdrawal fees |

| AETOS | No deposit fees | No withdrawal fees |

| Hirose Financial | No deposit fees | No withdrawal fees |

Customer Service

Service Time: Monday to Friday: 7:30 am to 9 am - UK time

Telephone: +44 (0)207 392 1434, +44 (0)207 392 1400

Email: customer.service@ovalx.com

If potential clients or existing clients encounter some problems during their trading process, they can reach out to this Oval X through the following contact channels:

Or you can also follow this broker on some social media platforms, such as Facebook, Twitter, YouTube, LinkedIn and Telegram.

Overall, Oval X's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • Multiple contact channels | • Limited customer service hours |

| • Active presence on social media platforms | • No 24/7 customer support |

| • No live chat support |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Oval X's customer service.

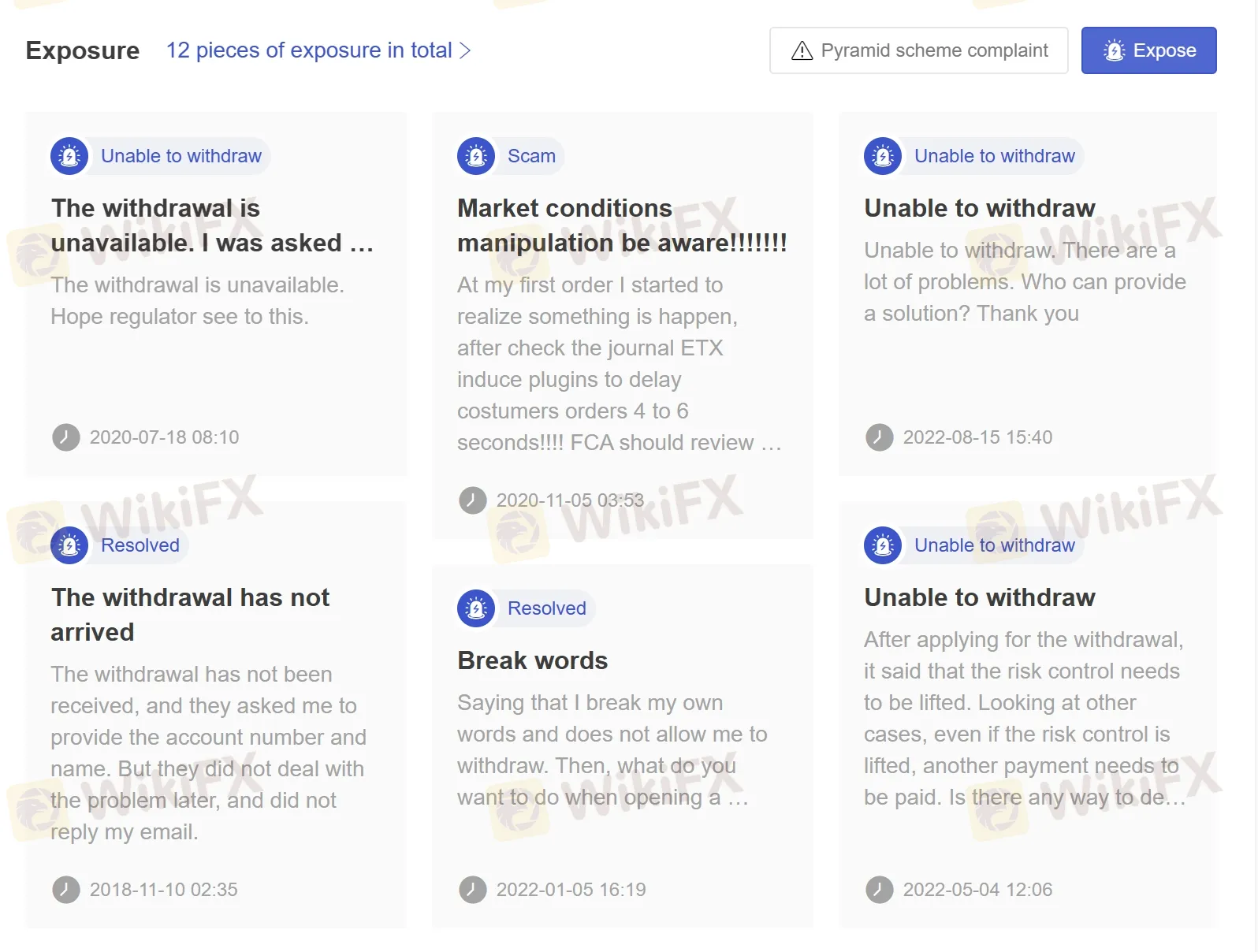

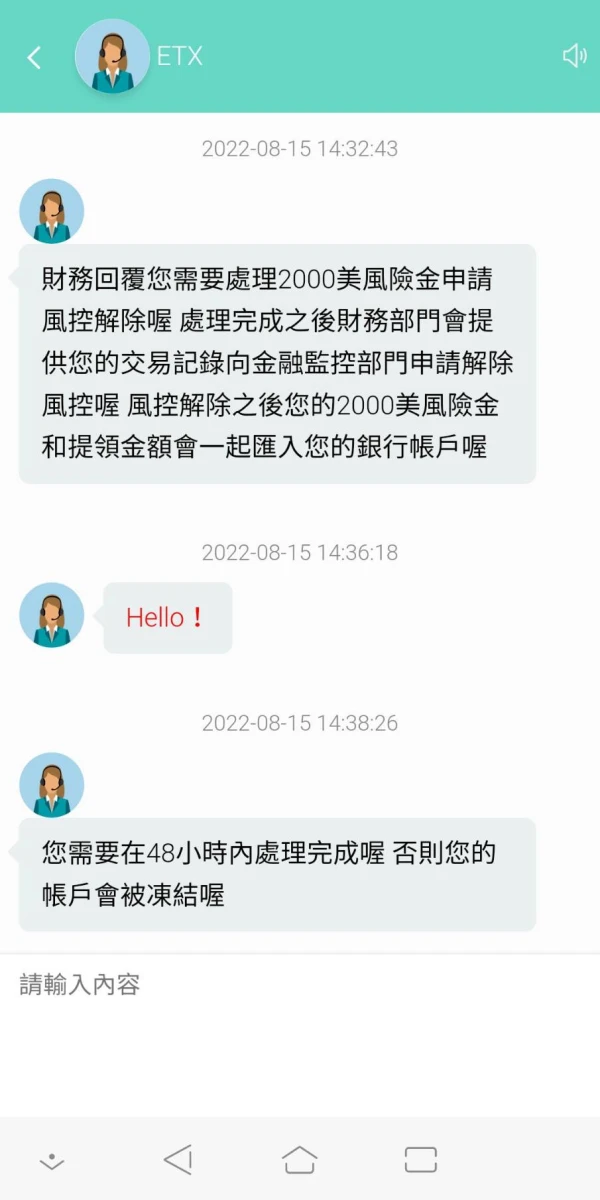

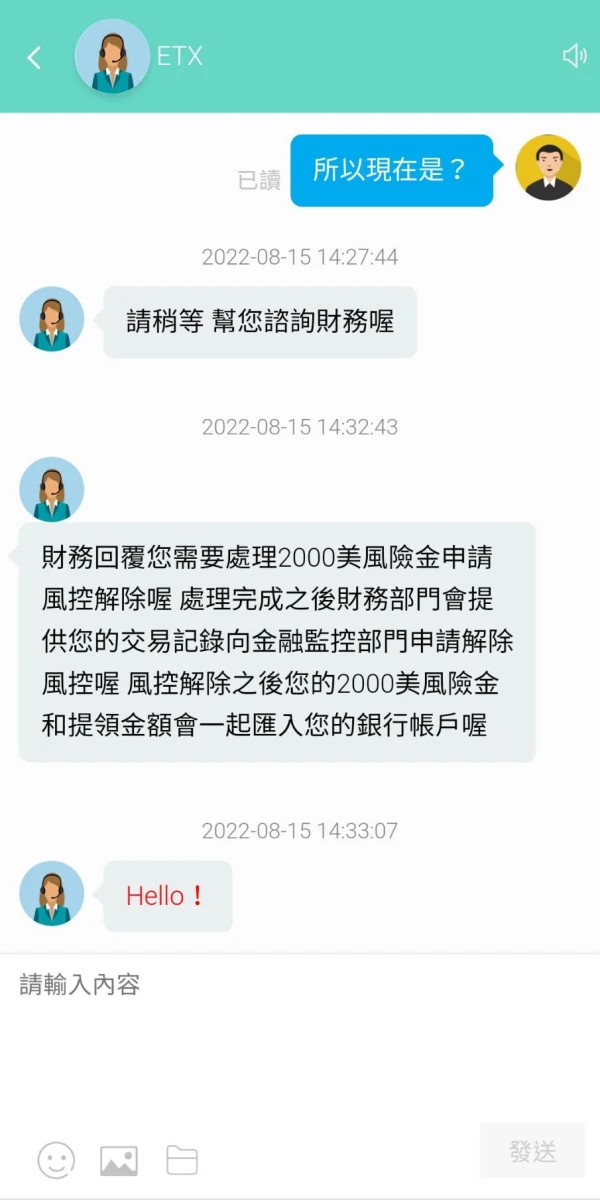

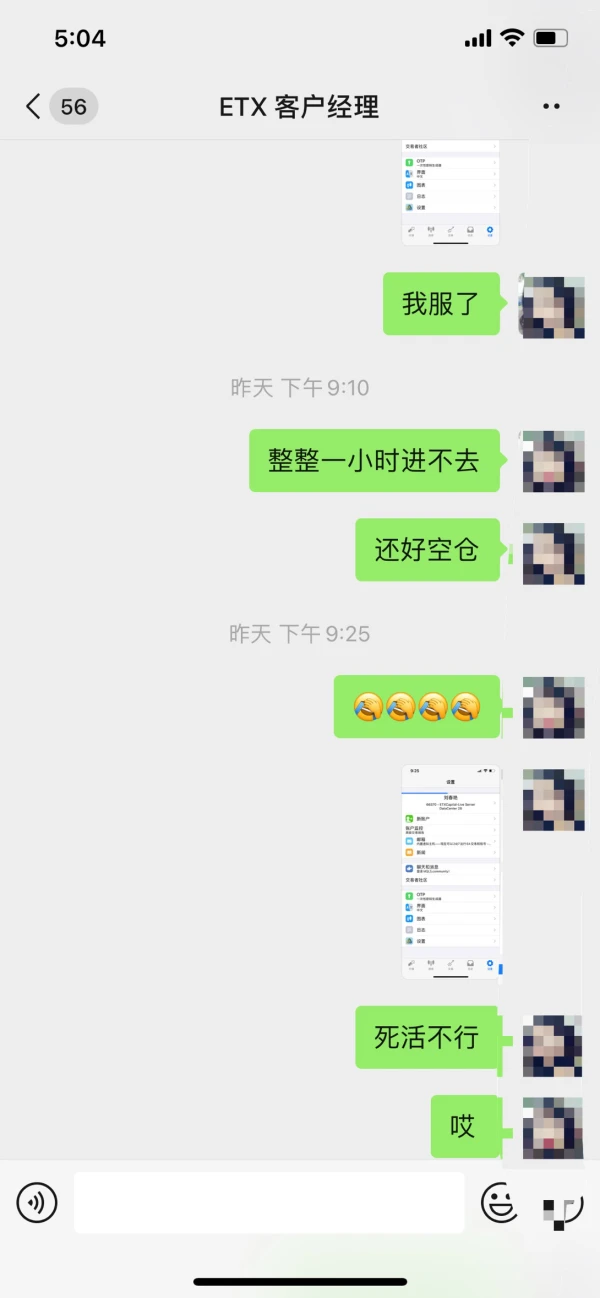

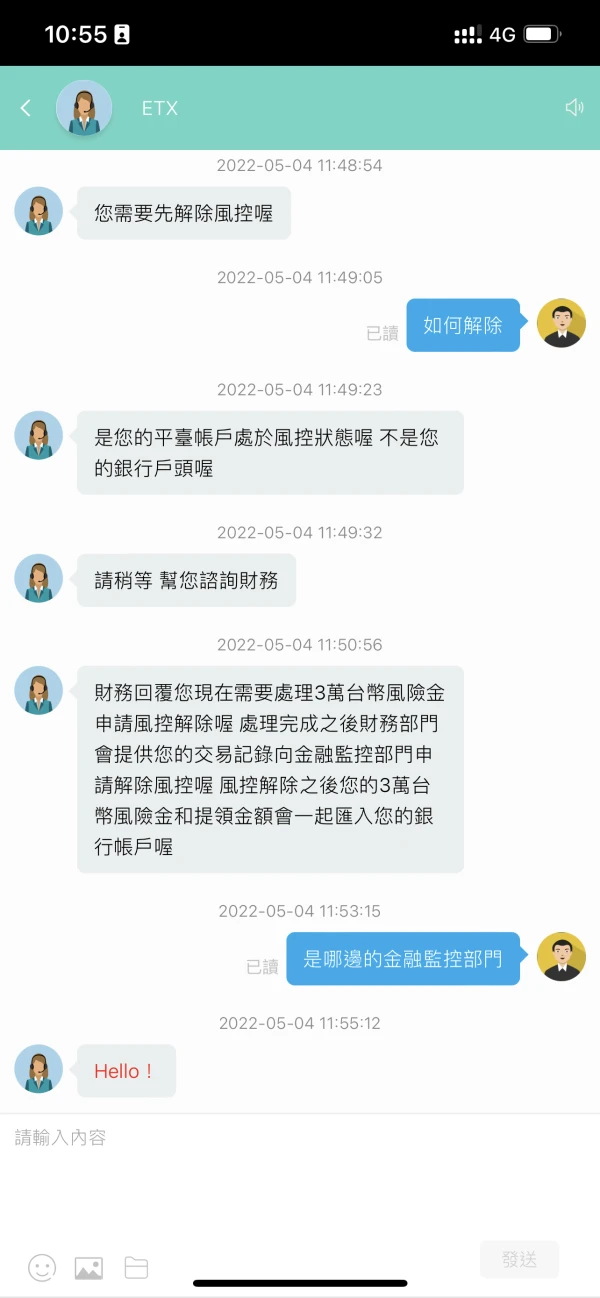

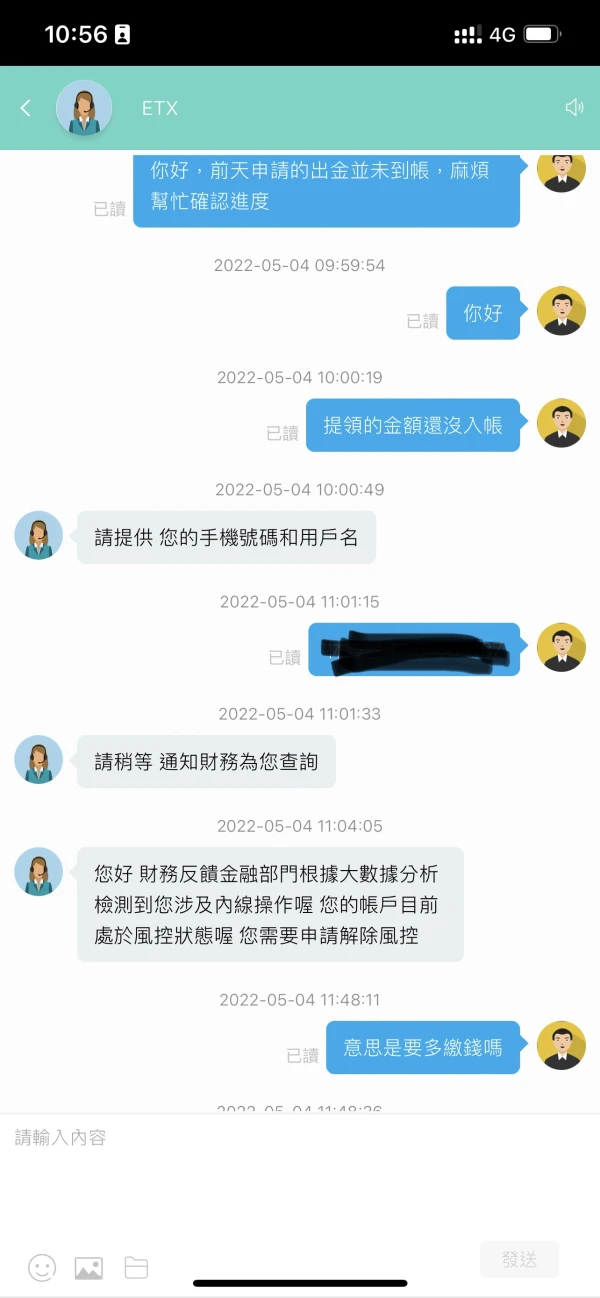

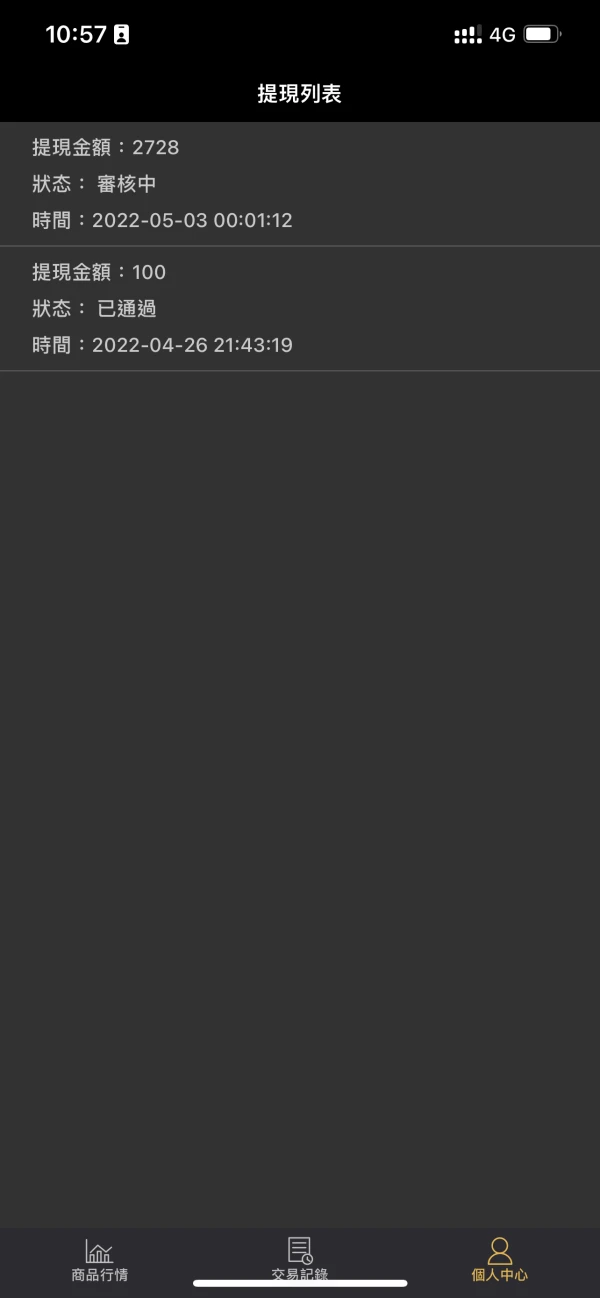

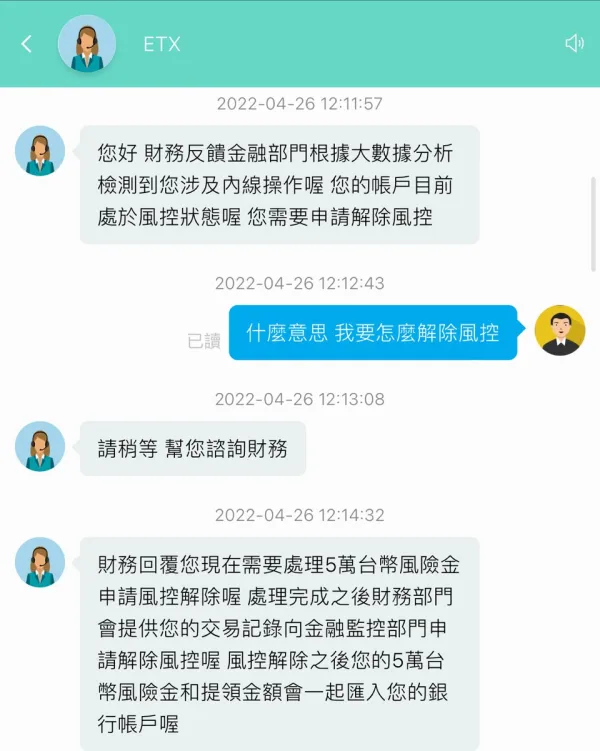

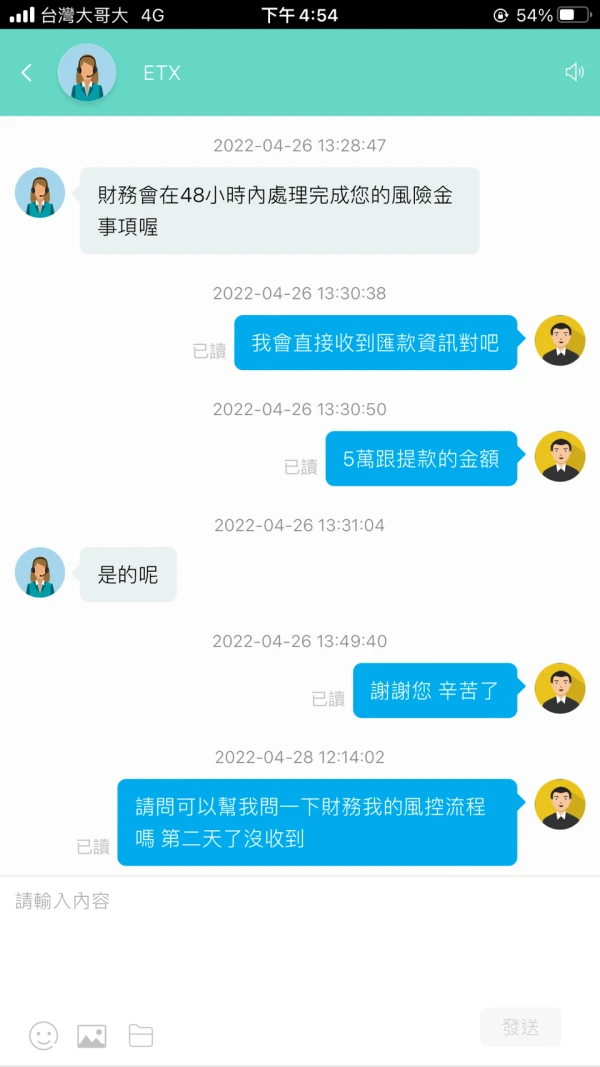

User Exposure on WikiFX

On our website, you can see that some reports of unable to withdraw and scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Education

Oval X places great emphasis on providing valuable educational resources to its clients. Through regular publication of webinars, blogs, news, and analysis, Oval X aims to empower traders with knowledge and insights to enhance their understanding of the market and refine their investment strategies. These educational materials cover a wide range of topics, including market trends, trading techniques, risk management, and fundamental and technical analysis.

Conclusion

Based on the available information, it is important to approach Oval X with caution. The lack of regulation and reports of withdrawal issues raise concerns about the safety and reliability of the platform. Traders are advised to thoroughly assess the risks associated with trading on an unregulated platform and consider alternative options that offer stronger regulatory oversight. It is crucial to prioritize the security of funds and ensure transparency when choosing a trading platform.

Frequently Asked Questions (FAQs)

| Q 1: | Is Oval X regulated? |

| A 1: | No. Oval X FCA (Financial Conduct Authority, License No. 124721) license is a suspicious clone. |

| Q 2: | What is the maximum trading leverage offered by Oval X? |

| A 2: | The maximum trading leverage offered by Oval X Capital is up to 1:200. |

| Q 3: | Does Oval X offer the industry leading MT4 & MT5? |

| A 3: | Yes. Oval X provides MT4 and a proprietary platform - Oval X Trader Pro. |

| Q 4: | What is the minimum deposit for Oval X? |

| A 4: | The minimum initial deposit to open an account is $100. |

| Q 5: | Can I deposit cash into my account? |

| A 5: | Oval X does not accept cash deposits due to AML regulations. |

| Q 6: | Is Oval X a good broker for beginners? |

| A 6: | No. It is not a good choice for beginners. We dont advise any traders trade with unregulated brokers. |

FX1505337907

Hong Kong

The withdrawal is unavailable. Hope regulator see to this.

Exposure

ViVi~Lee

Hong Kong

The withdrawal is unavailable in wake of wrong information. A 20% margin was asked for before I can modify it.

Exposure

BollinguerBand

Portugal

At my first order I started to realize something is happen, after check the journal ETX induce plugins to delay costumers orders 4 to 6 seconds!!!! FCA should review their license!!! Pure Market Maker with a dealing desk!

Exposure

Chiran Bawornkitiwong

United Kingdom

Funny! This ETX promised that it is regulated by FCA, but when I investigated its real regulation status, I know they are talking nonsense! This broker does not hold any license at all! it is just a fake broker! you can easily find its regulatory info on some professional regulation-chekcing websites.

Neutral

牙鋼

Taiwan

Unable to withdraw. There are a lot of problems. Who can provide a solution? Thank you

Exposure

1277

Hong Kong

I cannot update the data and transaction after log in. The customer service is lost the contact. All the funding pages cannot be opened. The email address cannot be sent. What if I had orders that cannot be closed and causing a loss?

Exposure

FX3976003619

Taiwan

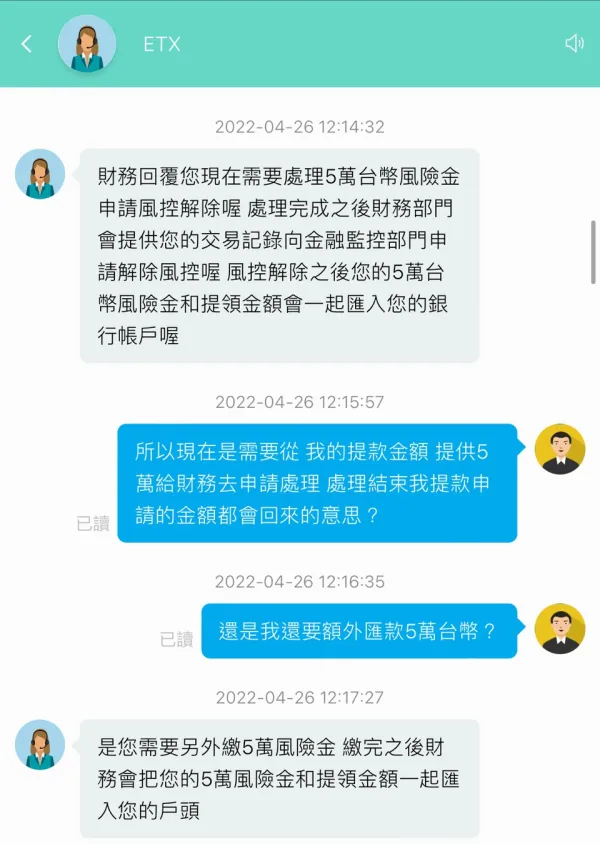

After applying for the withdrawal, it said that the risk control needs to be lifted. Looking at other cases, even if the risk control is lifted, another payment needs to be paid. Is there any way to deal with it?

Exposure

謝29409

Taiwan

From 4/21 to the 26th, the application for withdrawal was delayed until the 26th. After I asked, I told me that my account was subject to risk control and asked for a risk control fund of NT$50,000. I gave it. The remaining issues of risk control require an account opening deposit of 80,000 yuan. I don’t want to use the account to directly contact the commissioner. LINE has no connection to overcome it. I also gave 80,000 Taiwan dollars. I want to remit another 80,000 yuan. After processing, the withdrawal fund + 50,000 risk control fund + 80,000 account opening deposit will be remitted to me together. I don’t have so much money, what kind of gold, and return all the money I should take! It doesn’t belong to me You can take it back and withdraw the money of 50,000 risk control money and of 80,000 account opening deposit and return it to me!!!

Exposure

FX1574919362

Taiwan

Maybe this is the stupidest thing I've ever done. I believe that this platform can withdraw funds smoothly, but in the end, I still don't see the funds coming into the account. The original risk control account charged me 900,000, and then the new account was charged 900,000, but the result did not come out and told me to pay the internal tax, all of which will be handled according to your method, and let me wait for 3 days to be credited. As a result, after waiting for so many days, I still did not see the news of the credit, even the app system can’t use, I really don’t think I can trust this platform. The platform keeps saying that it will withdraw money. Eveything is a fake. They say that I break my own words, but you are the one who did this. They do not withdraw and charges a high fees. Terrible platform and bad system

Exposure

FX4157160605

Taiwan

Saying that I break my words, and you don’t allow me to withdraw cash, then why do you open the platform? When you withdraw money, you lock me in risk control, and you need me to pay the risk fund. After paying the risk fund, you will need to open a new account, but my money was stucked, how to deal with it? It costs 150,000. Is everyone on the platform rich? If I were rich, I wouldn't invest in these either. The funds invested by investors are originally intended to make money. If they take away their own money, they will also be locked in risk control. They say that I am insider trading. Where do I get insider information, the platform should let people withdraw as soon as possible...

Exposure

FX1574919362

Taiwan

Saying that I break my own words and does not allow me to withdraw. Then, what do you want to do when opening a platform, lock my risk-manage when withdrawing, and also have to pay the risk fund, and then I have to open a new account and pay risk fund after payment. That’s right, it was originally promised to address on Jan.1, but my money is also stuck, how to deal with it. They just asked for 900,000. You think that everyone on the platform is a rich person? If I were a rich person, I would not invest in these. The funds invested by investors were originally intended to make money, and to take away the money they earned, they must also be locked for risk control. It said that I was trading inside, where did I get the inside news, the platform should let people withdraw as soon as possible...

Exposure

FX1574919362

Taiwan

The paltform requires to pay the risk-control fee and tells me that I can get my money after 2 days. After paying risk-control fee, they require me pay the fee of opening new account. Why? Can the regulators deal with it?

Exposure

FX8569475288

Hong Kong

The withdrawal has not been received, and they asked me to provide the account number and name. But they did not deal with the problem later, and did not reply my email.

Exposure