Company Summary

| Aspect | Information |

| Registered Country/Area | Cyprus |

| Company Name | FXlift |

| Regulation | Cyprus Securities and Exchange Commission (CySEC) |

| Minimum Deposit | Not provided (varies by account type) |

| Maximum Leverage | Up to 1:30 |

| Spreads | Competitive spreads (varies by account type) |

| Trading Platforms | MetaTrader 4 (MT4) on PC, Mac, Android, and iOS |

| Tradable Assets | Shares, Forex, Metals (XAU, XAG), Spot Indices, Commodities, Futures Contracts |

| Account Types | Standard, Gold, Platinum (Live accounts); Demo account available |

| Customer Support | Telephone and email support |

| Payment Methods | Credit/Debit Card, BANK WIRE, Neteller, Skrill |

| Educational Tools | Live Economic News, Economic Calendar, Live Currency Rates |

General Information& Regulation

FXlift is a trade name of Notesco Financial Services Limited. Notesco Financial Services Limited is a company registered in Bermuda, authorised and regulated by CySEC (CySEC no. 125/10).

FXLift is a multi-asset brokerage firm that provides a global clientele with straightforward access to the various financial markets, including forex, spot metals, indices, commodities, futures, shares, and more. However, FXlift does not offer its services to residents of certain jurisdictions such as USA, Iran, Cuba, Sudan, Syria and North Korea.

Regulation

FXlift operates under the regulatory authority of the Cyprus Securities and Exchange Commission (CySEC). It holds a Market Making (MM) license (License No. 125/10) issued to Notesco Financial Services Ltd., its parent company, since November 16, 2010. This regulatory status ensures that FXlift complies with rigorous standards set by CySEC and Cyprus, prioritizing investor protection and market integrity. Clients can trust in the institution's commitment to adhering to these regulations when engaging in financial activities.

Pros and Cons

| Pros | Cons |

| Regulation: Regulated by CySEC, ensuring investor protection and market integrity. | Limited Leverage: Maximum leverage up to 1:30 may be lower than some traders prefer. |

| Diverse Instruments: Offers a wide range of financial instruments, including shares, forex, metals, spot indices, commodities, and futures contracts. | No Cryptocurrency: Does not offer cryptocurrency trading, limiting exposure to this asset class. |

| Competitive Spreads: Competitive spreads across different account types. | Limited Account Types: Offers a limited number of live account types. |

| Educational Resources: Provides live economic news, an economic calendar, and live currency rates. | No Cryptocurrency: Does not offer cryptocurrency trading, limiting exposure to this asset class. |

| User-Friendly Platforms: Offers the versatile and popular MetaTrader 4 (MT4) platform on various devices. | Limited Customer Support Channels: Offers telephone and email support but lacks live chat support. |

| Transparent Fee Structure: Transparent fee structure with no commissions on live accounts. | Limited Cryptocurrency: Does not offer cryptocurrency trading, limiting exposure to this asset class. |

FXlift offers several advantages, including robust regulation, a diverse range of financial instruments, competitive spreads, and educational resources. The platform provides a user-friendly MT4 trading experience and a transparent fee structure with no commissions on live accounts. However, it has limited leverage options, a limited number of live account types, and lacks cryptocurrency trading. Customer support options could also be expanded to include live chat for more immediate assistance. Traders should consider these factors when choosing FXlift for their trading needs.

Market Instruments

FXLift is a multi-asset brokerage firm that provides a global investors with straightforward access to the various financial markets, including forex, spot metals, indices, commodities, futures, shares, and more.

Account Types

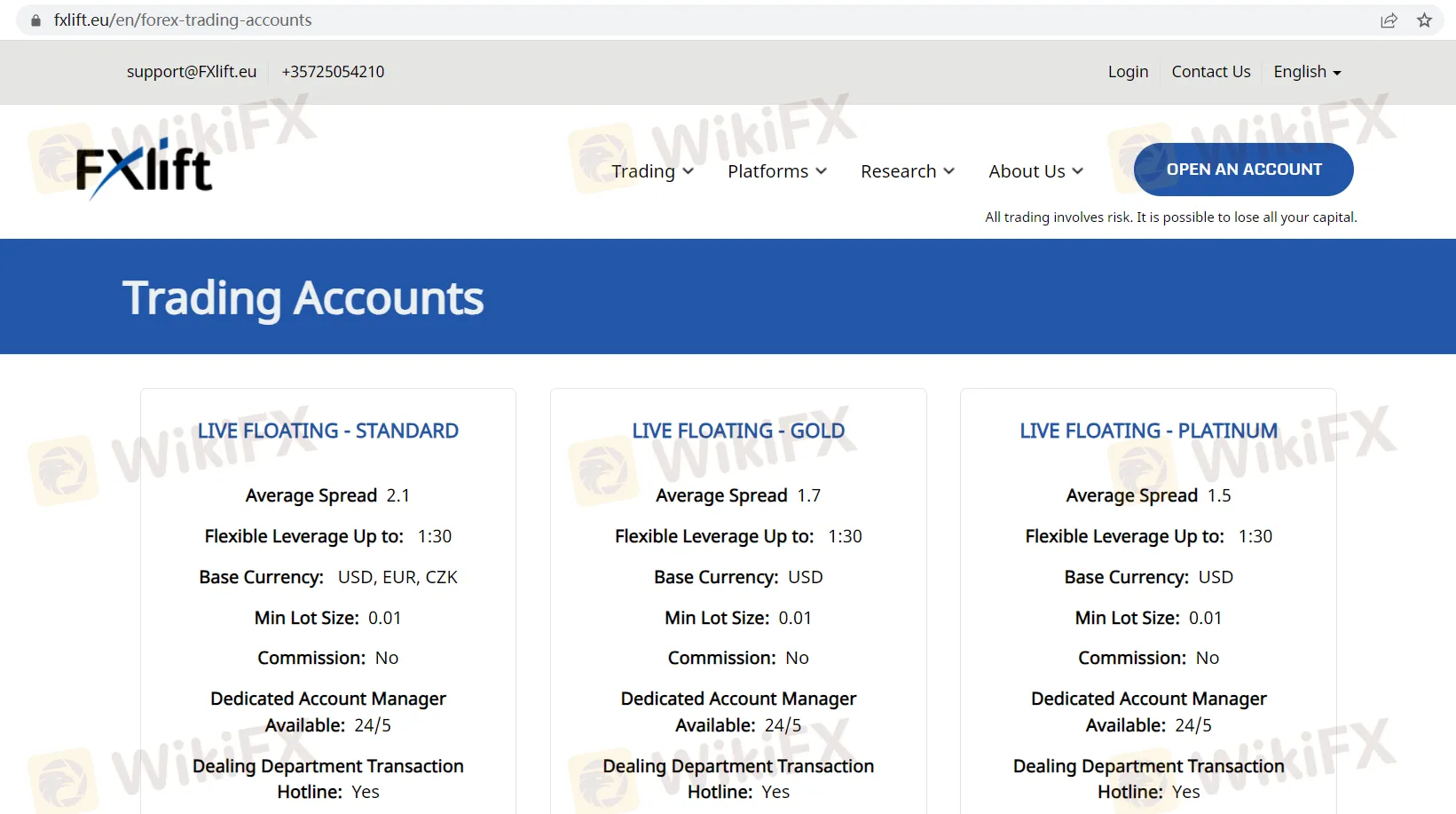

FXlift provides a variety of trading accounts, including three live options – LIVE FLOATING - STANDARD, LIVE FLOATING - GOLD, and LIVE FLOATING - PLATINUM – as well as a demo account for practice.

LIVE FLOATING - STANDARD:

The Standard account is suitable for traders of all levels. It offers an average spread of 2.1 pips, flexible leverage up to 1:30, and the choice of base currencies, including USD, EUR, and CZK. The minimum lot size is 0.01, and there are no commissions. Traders benefit from a dedicated account manager available 24/5 and a Dealing Department Transaction Hotline.

LIVE FLOATING - GOLD:

The LIVE FLOATING - GOLD account is ideal for those seeking tighter spreads, particularly in USD trading. It offers an average spread of 1.7 pips, leverage up to 1:30, and a minimum lot size of 0.01. There are no commissions, and traders have access to a dedicated account manager and a Dealing Department Transaction Hotline, both available 24/5.

LIVE FLOATING - PLATINUM:

The LIVE FLOATING - PLATINUM account is the premium choice, providing an average spread of just 1.5 pips for USD trading. It features leverage up to 1:30, a minimum lot size of 0.01, and no commissions. Traders receive dedicated account manager support, available 24/5, as well as access to a Dealing Department Transaction Hotline.

Demo Account:

FXlift also offers a demo account, allowing traders to practice and refine their strategies without risking real capital. It's a valuable tool for both novice and experienced traders to explore the platform and build confidence before live trading.

Leverage

FXlift offers a maximum trading leverage of up to 1:30 for its trading accounts. This means that traders can control a position size up to 30 times their initial capital. Leverage can amplify both potential profits and losses, so it's important for traders to use it judiciously and fully understand the risks involved. FXlift provides this leverage option to accommodate various trading strategies and risk tolerance levels while ensuring responsible trading practices. Traders should always consider their risk management strategies and the impact of leverage on their trading decisions.

Leverage

FXlift offers a maximum trading leverage of up to 1:30 for its trading accounts. This means that traders can control a position size up to 30 times their initial capital. Leverage can amplify both potential profits and losses, so it's important for traders to use it judiciously and fully understand the risks involved. FXlift provides this leverage option to accommodate various trading strategies and risk tolerance levels while ensuring responsible trading practices. Traders should always consider their risk management strategies and the impact of leverage on their trading decisions.

Spreads & Commissions

Spreads:

Spreads refer to the difference between the buying (ask) and selling (bid) prices of a financial instrument, such as a currency pair, and they play a crucial role in trading. FXlift provides varying spreads depending on the chosen trading account type:

LIVE FLOATING - STANDARD: Traders opting for the Standard account can expect an average spread of 2.1 pips. This means that when entering a trade, there is a 2.1-pip difference between the price at which they can buy and sell a currency pair. The Standard account offers competitive spreads for traders looking for a solid foundation to start their trading journey.

LIVE FLOATING - GOLD: The Gold account offers a tighter average spread of 1.7 pips, making it particularly suitable for those who focus on USD-based trading. A lower spread can potentially reduce trading costs and enhance profitability, especially for traders who frequently deal with USD currency pairs.

LIVE FLOATING - PLATINUM: The Platinum account stands out with its highly competitive average spread of just 1.5 pips for USD trading. This tight spread is designed for traders who prioritize minimal costs and seek the most favorable pricing conditions for their trades.

Commissions:

FXlift has a transparent fee structure, and it's important to note that there are no commissions charged on trades for any of its live accounts. This means that traders can execute trades without incurring additional commission fees, regardless of the chosen account type—Standard, Gold, or Platinum.

By offering commission-free trading, FXlift aims to provide traders with cost-effective options and flexibility in their trading strategies. Traders can focus on managing their positions and risk without the burden of commission costs, which can be especially advantageous for those who engage in high-frequency or short-term trading.

In summary, FXlift provides varying spreads across its live account types to cater to different trading preferences and strategies. Additionally, the broker offers a commission-free trading model, allowing traders to execute trades without incurring commission charges, enhancing the cost-efficiency of their trading activities.

Trading Platform

FXlift provides a versatile and secure trading experience through the MetaTrader 4 (MT4) platform on PC, Mac, Android, and iOS devices. Here are the key features:

MT4 for PC and Mac:

Security: Ensures safe trading.

Trading Signals: Access trading signals.

Portfolio Management: Monitor and manage positions.

Real-time Quotes: Get live pricing data.

Advanced Charting: Use in-depth charting tools.

News: Stay updated with streaming news.

Activity Reports: Detailed trading reports.

MT4 Android and iOS Traders:

Order Flexibility: Supports various order types.

Real-time Quotes: Provides live market prices.

Interactive Charts: Analyze trends with interactive charts.

News Updates: Stay informed with real-time news.

Trading History: Review past trades.

Execution Options: Choose from different execution modes.

User-Friendly: Easy-to-use interface.

FXlift's MT4 platform ensures a secure and feature-rich trading experience across different devices, meeting traders' diverse needs.

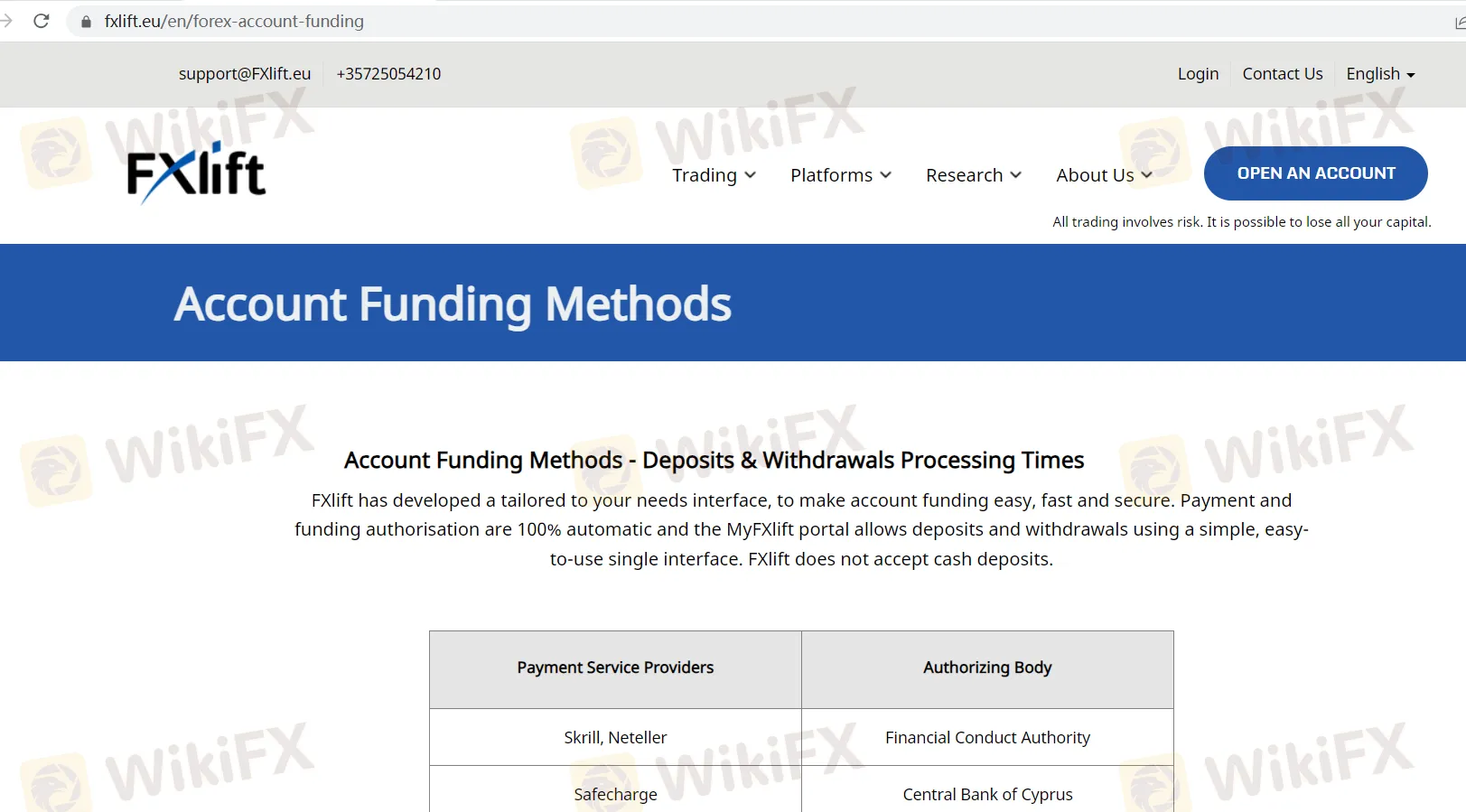

Deposit & Withdrawal

FXlift offers an efficient and secure system for depositing and withdrawing funds. Here's a brief description of the options:

Deposit Options:

Credit/Debit Card: No deposit fees, up to USD 5,000 per transaction.

BANK WIRE: No FXlift fees, but fees may apply from corresponding and intermediary banks.

Neteller: Fee-free deposits, up to USD 50,000 per transaction.

Skrill: Fee-free deposits, up to USD 50,000 per transaction.

Withdrawal Options:

FXlift allows easy withdrawals using the same methods mentioned above. Transactions are automated for swift processing. Cash deposits are not accepted for security reasons. Please note that maximum transaction amounts and potential bank fees may vary based on the chosen method.

Customer Support

Summary

FXlift is a regulated online trading platform under the authority of the Cyprus Securities and Exchange Commission (CySEC). It offers a diverse range of financial instruments, including shares, forex, metals, spot indices, commodities, and futures contracts. Traders can choose from various account types, including Standard, Gold, and Platinum live accounts, as well as a demo account for practice. FXlift provides a maximum trading leverage of up to 1:30 and competitive spreads across its account types. The platform offers efficient deposit and withdrawal options, automated trading, and educational resources to cater to traders of all levels. With the versatile MetaTrader 4 (MT4) trading platform available on multiple devices and responsive customer support, FXlift aims to empower traders to navigate the financial markets effectively.

FAQs

Q1: What is the regulatory authority for FXlift?A1: FXlift operates under the regulatory authority of the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with rigorous standards to prioritize investor protection and market integrity.

Q2: What financial instruments can I trade on FXlift?A2: FXlift offers a wide range of financial instruments, including shares, forex, metals, spot indices, commodities, and futures contracts, providing diverse trading opportunities.

Q3: What are the account options available on FXlift?A3: FXlift provides several account types, including Standard, Gold, and Platinum live accounts, accommodating different trading preferences. Additionally, there's a demo account for practice.

Q4: What is the maximum leverage offered by FXlift?A4: FXlift offers a maximum trading leverage of up to 1:30, allowing traders to control positions up to 30 times their initial capital.

Q5: Are there any commissions on FXlift's live accounts?A5: No, there are no commissions on trades for FXlift's live accounts, providing cost-effective trading options for traders.

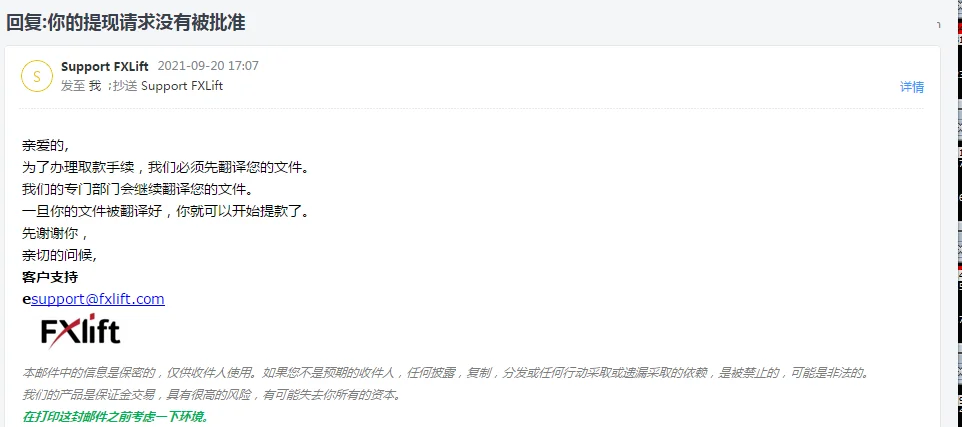

FX4218119986

Turkey

On September 5, 2025, I invested $600 using cryptocurrency through Fx Lift and was awarded a $240 bonus. As a result of my transactions, a total of $2636 accumulated in my account. After deducting the bonus, I attempted to withdraw the remaining $2250. However, after a four-day hold, I was informed, without any explanation, that I could only withdraw $1883. Even though I didn't even have $300 in bonus funds in my account, a $752 bonus deduction was applied, and approximately $400 of my earnings were not paid to me due to the bonus. Reaching live support was nearly impossible; with only one employee, they were available every 2-3 days. My email requests were responded to within three days, at the earliest, with no explanation provided. My account number is 11215841. I did not sign any contracts, bonus terms, or additional documents, and I was not informed of the deduction in advance. I demand that all of my earnings be paid to me and a detailed explanation be made on this matter.

Exposure

外汇坏小子

Hong Kong

It rejected withdrawal for many reasons. Severe slippage.

Exposure

Đỗ Văn Ngọc

Australia

FXlift seems solid. However, I'm not going to make a deposit right now, I'm going to open a demo account and try it out. This way I can learn about the company's transactions without risk.

Neutral

叮 当

United Kingdom

I have been trading with this company for a few months, and I am very satisfied so far, deposits and withdrawals are normal. It has been established for more than ten years, and I trust these long-established companies.

Positive