Company Summary

| Aspect | Information |

| country/registered area | United Kingdom |

| Foundation year | 2-5 years |

| Company Name | Fine Capitals |

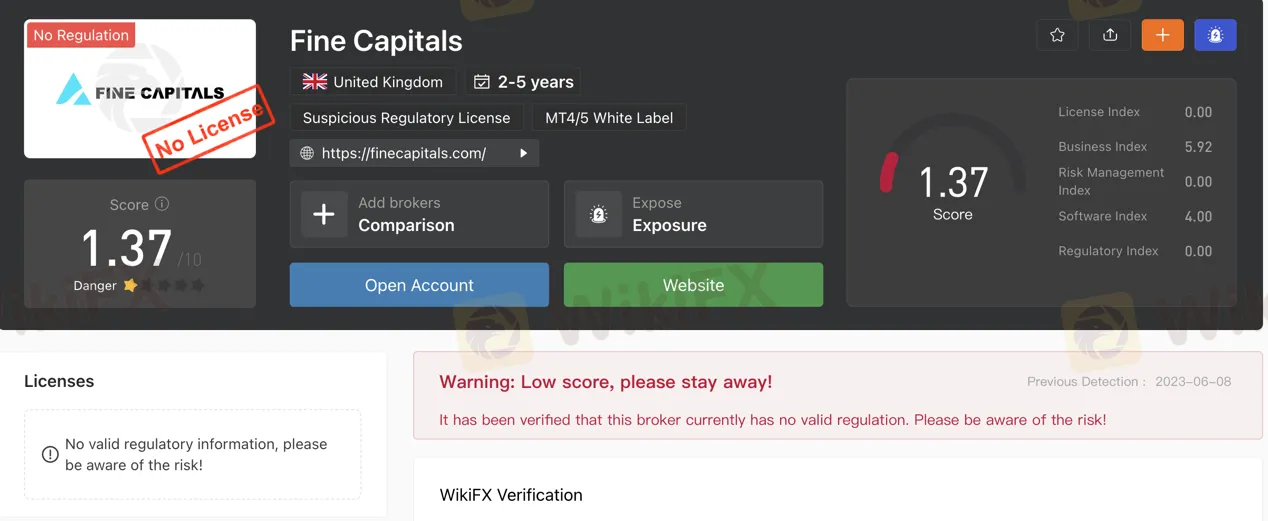

| Regulation | no regulation |

| minimum deposit | $100 |

| Maximum Leverage | Up to 1:1000 |

| Untables | Variable spreads from 1.2 pips |

| trading platforms | MT4 (MetaTrader 4) for Desktop |

| tradable assets | Currencies, Spot Metals, Indices, Energies |

| Account Types | Classic Account, VIP Account, ECN Account |

| demo account | Unmentioned |

| islamic account | Unmentioned |

| Customer Support | Phone, email, chatbot, contact form |

| Payment methods | B2BinPay (Crypto Deposits), Online Banking |

General information

established in 2022, Fine Capitals is a UK registered online forex broker, boasting of offering clients access to massive financial markets such as forex, spot metals, energies and indices. Fine Capitals is the trading name of fine capital ltd, a company incorporated in the united kingdom as limited liability company number 13120655, with its registered office at 20-22 wenlock road, london, n17gu, england.

Fine Capitalsis a financial broker that operates without current regulation, which makes it a risky option for investors. Fine Capitals offers different types of accounts, including classic, vip, and ecn, each with different deposit requirements, leverage options, spreads, and commission policies. however, the lack of regulatory oversight, limited customer support, and the potential for fraudulent practices are concerning aspects of Fine Capitals .

to open an account with Fine Capitals , visit their website and click the sign up button. fill in the personal information such as your name, email id and phone number. select your country and state, if applicable. Please read carefully and accept the terms and conditions. Once all required information is provided and terms are agreed, click the submit or register button to complete the account creation process.

in conclusion, Fine Capitals is an unregulated financial broker with inherent risks. traders should be careful and consider the possible consequences before hiring this broker. it is advisable to choose regulated brokers that provide transparency, responsibility and investor protection.

Pros and cons

Fine Capitalspresents advantages and disadvantages for investors to consider. On the plus side, the platform offers a variety of market instruments, allowing traders to access different sectors and diversify their investment portfolios. besides, Fine Capitals it provides multiple account options, catering to the different needs of traders and offers leverage to increase trading power. however, it is crucial to be aware of the cons as well. Fine Capitals lacks valid regulation, exposing clients to potential risks and lack of regulatory oversight. business processes also lack transparency, and customer support and educational resources are limited. In addition, there is the possibility of manipulation or fraudulent practices. It is important that investors carefully weigh these factors before committing to Fine Capitals .

| advantages | Contras |

| Access to various market instruments | Lack of valid regulation and regulatory oversight |

| Multiple account options to suit the different needs of merchants | Limited customer support and educational resources |

| Leverage capacity to increase trading power | Lack of transparency in business processes |

| Opportunity to diversify investment portfolios | Possibility of manipulation or fraudulent practices |

is Fine Capitals legal?

Fine Capitalsis a financial broker that operates without any valid regulation. this means that it is not supervised or authorized by any recognized financial regulatory authority. the lack of regulation indicates a significant risk for anyone considering engaging in financial activities or investments with Fine Capitals .

Market Instruments

On the Fine Capital platform, it offers four trading asset classes, including currencies, spot metals, indices, and energies.

Fine Capitalsprovides a range of market instruments to trade on its platform. These instruments are divided into four classes, namely currencies, spot metals, indices and energies.

Foreign exchange: Fine Capitalsoffers a variety of currency pairs to trade in the forex market. this allows traders to speculate on exchange rate fluctuations between different currencies. Forex trading provides opportunities to profit from both rising and falling currency values, making it a popular choice for many traders.

Spot Metals: merchants in the Fine Capitals The platform can also engage in spot metal trading. this involves trading precious metals such as gold, silver, platinum, and palladium. Spot metal trading allows investors to take advantage of the price movements of these commodities, which can be influenced by factors such as supply and demand dynamics, economic conditions, and geopolitical events.

Indexes: Fine Capitalsprovides access to a variety of global indices. These indices represent the performance of a specific group of stocks in a particular market or sector. By trading indices, investors can speculate on the overall performance of the underlying stock and potentially benefit from market trends and movements. Index trading allows diversification across multiple stocks, providing exposure to broader market movements.

Energies: Fine Capitalsit also offers business opportunities in the energy markets. this includes commodities such as crude oil, natural gas, and other energy products. Energy trading allows investors to participate in the price movements of these commodities, which can be influenced by factors such as global supply and demand, geopolitical events, and weather conditions.

Pros and cons

| advantages | Contras |

| Profit potential from various market movements | Risk of losses due to market volatility |

| Access to a wide range of trading opportunities | lack of regulatory oversight for Fine Capitals |

| Ability to diversify investment portfolios. | Lack of transparency in business processes |

| Exposure to global markets and economic trends | Limited customer support and educational resources |

| Availability of leverage to increase bargaining power | Possibility of manipulation or fraudulent practices |

Account Types

Fine Capital offers three-tier trading accounts for retail and professional clients.

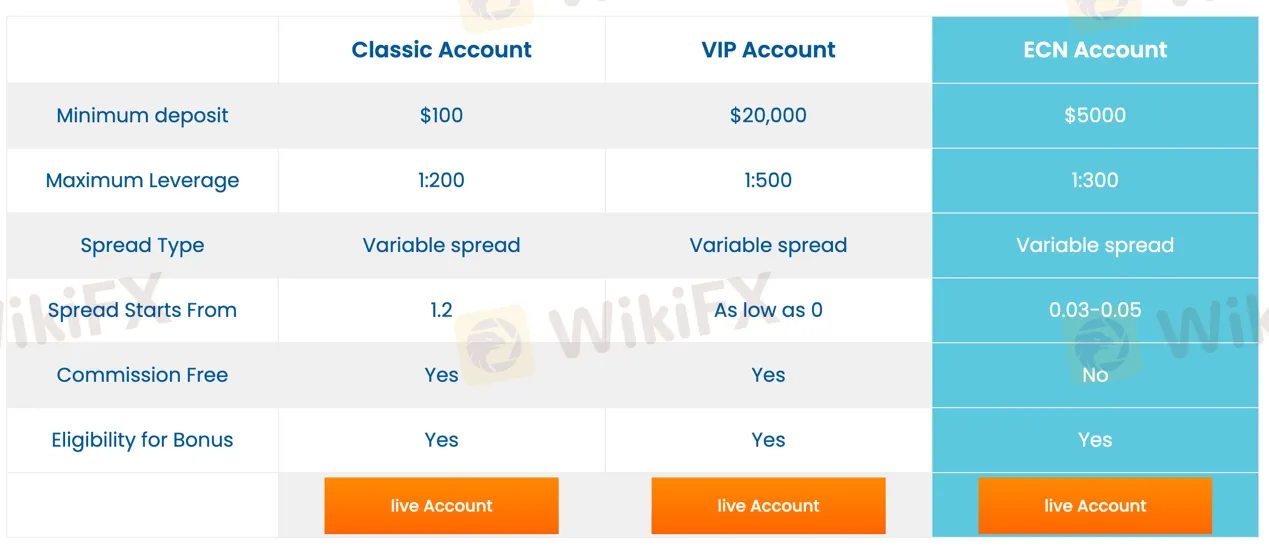

Fine Capitalsoffers three types of accounts: classic account, vip account and ecn account. each account type has its own minimum deposit requirement, maximum leverage, margin type, margin start point, commission policy, bonus eligibility and access to live trading.

CLASSIC ACCOUNT

The Classic Account has a minimum deposit requirement of $100 Offers maximum leverage of 1:200, which means that clients can trade with a leverage ratio of up to 200 times their initial investment. The spread rate is variable, which means that it can fluctuate based on market conditions. The spread starts from 1.2 anyone. The Classic Account is commission-free, which means that clients do not have to pay additional fees for each trade. It is eligible for bonuses, providing potential incentives for traders. Clients with a classic account have access to live trading.

VIP ACCOUNT

The VIP account is designed for more experienced and high net worth traders. Requires a minimum deposit of $20,000. The maximum leverage is higher, in 1:500, allowing for more substantial trading positions. The type of spread is variable, starting as low as 0 anyone. Like the Classic Account, the VIP Account is also commission-free. It is eligible for bonuses and provides access to live trading.

ECN ACCOUNT

The ECN account is suitable for traders who prefer direct market access and a higher level of liquidity. Requires a minimum deposit of $5,000. The maximum leverage offered is 1:300. The spread type is variable, with spreads ranging from 0,03 a 0,05 pips. Unlike the Classic and VIP Accounts, the ECN Account charges commissions for each operation. However, it is still eligible for bonuses and grants access to live trading.

| advantages | Contras |

| Offers multiple account options that meet the different needs of merchants | Unregulated, exposing clients to potential risks |

| Allows various deposit amounts to suit different budgets | Commissions per ECN account |

| Provides different leverage options for different risk appetites | The starting point of the spread can be higher for the classic account |

| Offers Variable Spreads | Lack of information about additional features or benefits |

| Eligible for bonuses, providing potential incentives for merchants |

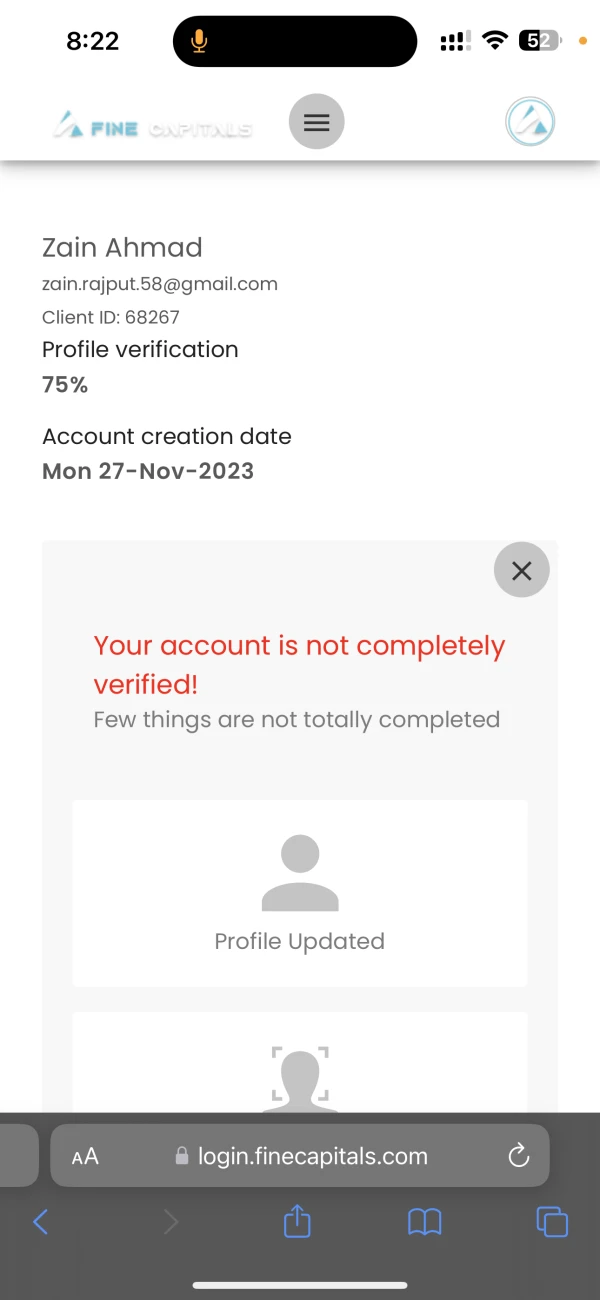

How to open a real account with Fine Capital?

Opening an account with Fine Capital is simple and easy, with a few simple steps to follow:

1. Click on the "Open a Live Account" link and fill out the application form.

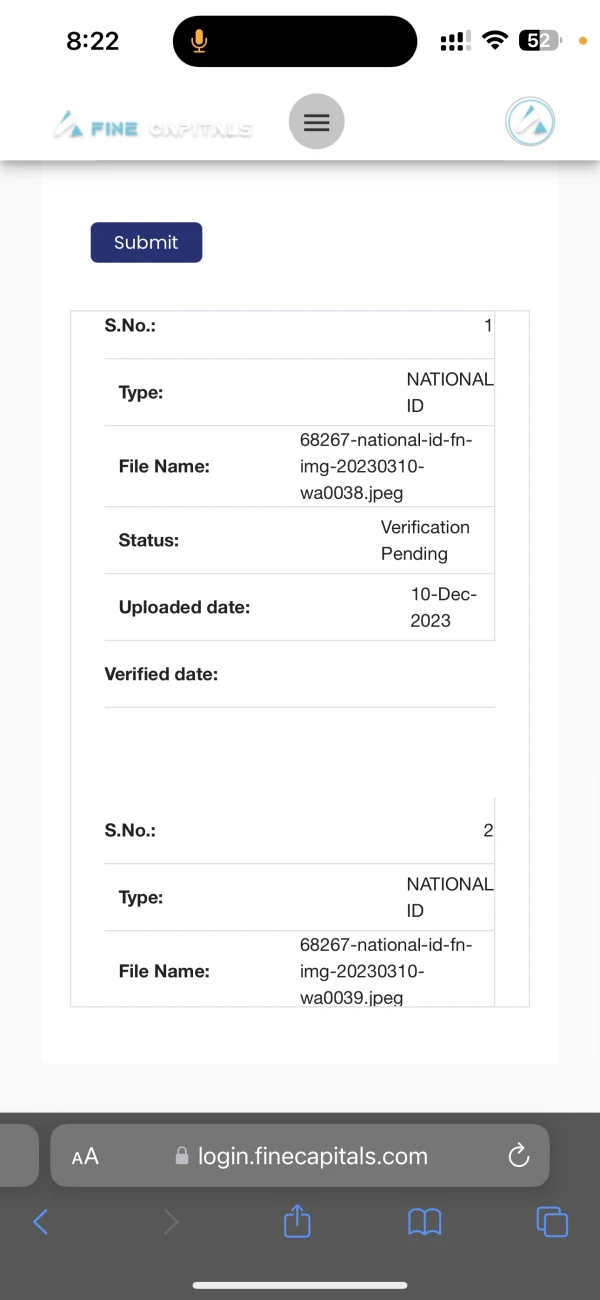

2. Upload your photo ID and proof of address document from within your customer portal, which will be verified by these business accounts.

3. After verification, your account was successfully registered. Deposit funds into your account and then start trading.

Leverage

The maximum trading leverage offered by Fine Capital is absurdly high, reaching up to 1:1000, which is well above the levels considered appropriate by many regulatory authorities. Offering high leverage to lure investors into their traps is a typical tactic employed by most offshore brokers.

Spreads and Commissions

Fine Capitalsoffers different types of trading accounts with different spreads and commissions. The cent account provides a commission-free trading environment with variable spreads from 2.1 anyone. The Classic account also offers commission-free trading with variable spreads starting at 1.2 anyone. For traders looking for gross spreads, the ECN account offers low spreads as low as 0.1 pipes, but with a certain commission charged.

exchange fees

If you plan to hold your position overnight, you should always consider swap fees as an additional cost. Each currency pair has its own trading fee and is measured in standard 1.0 lot size. Trading fees are calculated in points, which are automatically converted by MT4 to the base currency of your account.

Please note that swaps are charged at a triple rate on Wednesday nights.

business platform

Fine Capitalsprovides a trading platform called MT4 (Meta Trader 4) for desktop, which offers a user-friendly interface and supports multiple languages. This platform is equipped with a range of advanced tools and resources, allowing traders to analyze charts and price movements effectively. With MT4, traders can seamlessly execute trades, open and close positions, manage their accounts, receive real-time updates on the Forex market, and use expert advisors.

| advantages | Contras |

| friendly interface | Lack of regulatory oversight |

| multilingual support | Limited platform options (MT4 desktop only) |

| Advanced tools and resources for analysis | Potential security risks |

| Availability of Expert Advisors | Limited features compared to other platforms. |

| Access to live updates on the Forex market | No mobile or web-based platforms |

| No mobile or web-based platforms |

deposit and withdrawal

Fine Capitalsoffers its clients the option of funding their accounts through two methods: B2BinPay for crypto deposits and On line bank. The minimum deposit required is $ 1,000, and customers can choose from multiple currencies, including USD, GBP, ZAR, and EUR. B2BinPay allows customers to deposit funds using various cryptocurrencies, while Online Banking allows deposits through traditional banking channels.

clients of Fine Capitals you can withdraw funds by logging into your client portal and selecting the withdrawal tab from the menu. the minimum withdrawal amount is $5, allowing access to funds. It is worth noting that withdrawals to South African bank accounts via bank transfers have a cut-off time of 13:30 GMT +2, indicating a specific time limit for processing such transactions.

| advantages | Contras |

| Various deposit options | Limited cryptocurrency deposit options |

| Variety of Coins | Specific withdrawal cut-off time for bank transfer (13:30 GMT +2 for South African accounts) |

| Low minimum withdrawal amount |

Customer Support

Fine Capital relies heavily on its FAQ section and its chatbot to help clients. Multilingual support staff are available by phone and email whenever the markets are open.

Phone: +44 203 807 7928

Email: support@finecapitals.com

Registered company address: 20-22 Wenlock Road, London, N1 7GU, England

Furthermore, you can also follow this brokerage on some social media platforms, such as Facebook, Twitter, Linkedin, Instagram.

risk warning

Online forex trading and leverage contain a high level of risk and are not suitable for all investors.

Please note that the information contained in this information is for general information purposes only.

Conclusion

in conclusion, Fine Capitals is a financial broker that operates without any valid regulation, which presents significant risks to investors. While it offers a variety of market instruments and multiple account options, the lack of regulatory oversight raises concerns about transparency and the potential for fraudulent practices. Traders have the potential to profit from various market movements and access to a wide range of trading opportunities, but they also face the risk of loss due to market volatility. limited customer support and educational resources further contribute to the disadvantages. therefore, caution is advised when considering Fine Capitals as a trading option, and thorough research into its offers and risks is crucial.

frequent questions

what is it Fine Capitals regulated?

a: no, Fine Capitals it operates without any valid regulation and is not supervised or authorized by any recognized financial regulatory authority.

q: what market instruments are available to trade with Fine Capitals ?

to: Fine Capitals offers trading opportunities in currencies (forex), spot metals, indices and energies.

q: what types of business accounts do you have Fine Capitals offer?

to: Fine Capitals offers three types of accounts: classic account, vip account and ecn account. each type of account has its own characteristics, minimum deposit requirement, leverage, margin type, commission policy, bonus eligibility and access to live trading.

q: how can i open an account with Fine Capitals ?

a: to open an account with Fine Capitals , you need to visit their website, click the registration button, fill in the required personal information, select your country and state, carefully read and agree to the terms and conditions, and submit the registration form.

q: what leverage options Fine Capitals offer?

to: Fine Capitals offers high leverage of up to 1:1000, allowing traders to extend their trading positions. however, it is worth noting that many regulatory authorities do not recommend such high leverage.

Q: What are the deposit and withdrawal options with Fine Capitals ?

to: Fine Capitals offers deposit options through b2binpay for crypto deposits and online banking for traditional banking channels. the minimum deposit required is $1,000. Withdrawals can be made through the client portal, and the minimum withdrawal amount is $5.

q: what trading platform does Fine Capitals provide?

to: Fine Capitals provides the desktop metatrader 4 (mt4) platform, offering a user-friendly interface, multilingual support, advanced analysis tools, and access to real-time forex market updates. however, Fine Capitals does not offer mobile or web-based platforms.

Q: How can I contact you? Fine Capitals Customer Support?

to: Fine Capitals offers customer support through various channels, including FAQs on its website, a chatbot, phone support, email (support@finecapitals.com) and a contact form on its website. They also have a presence on social media platforms.

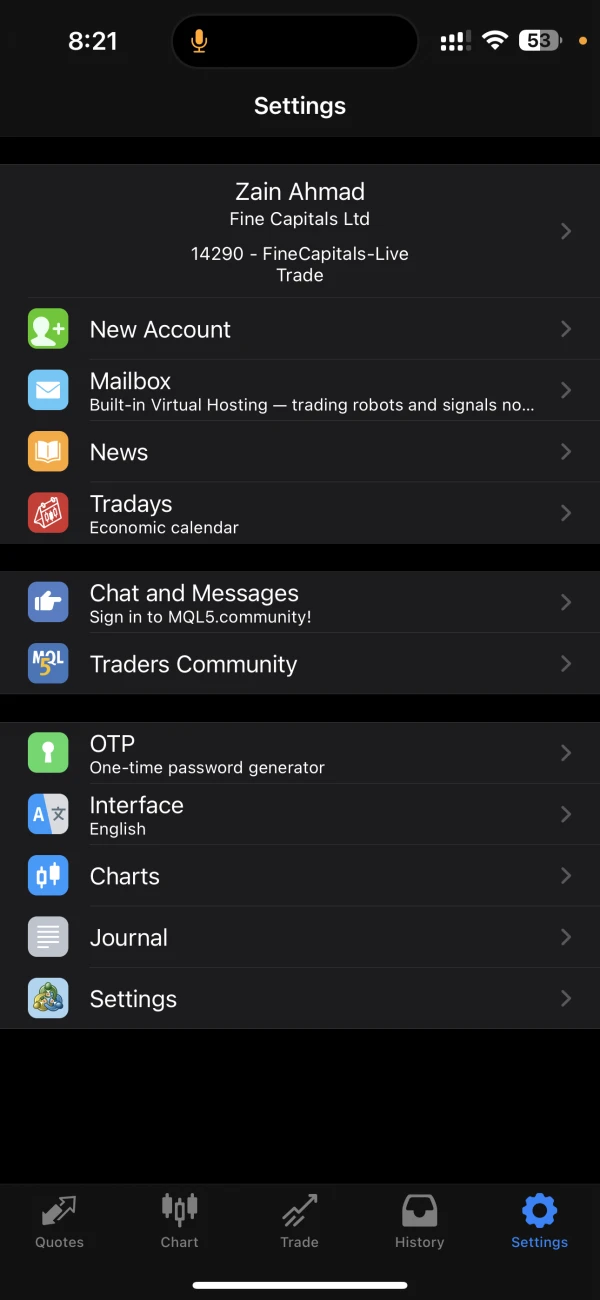

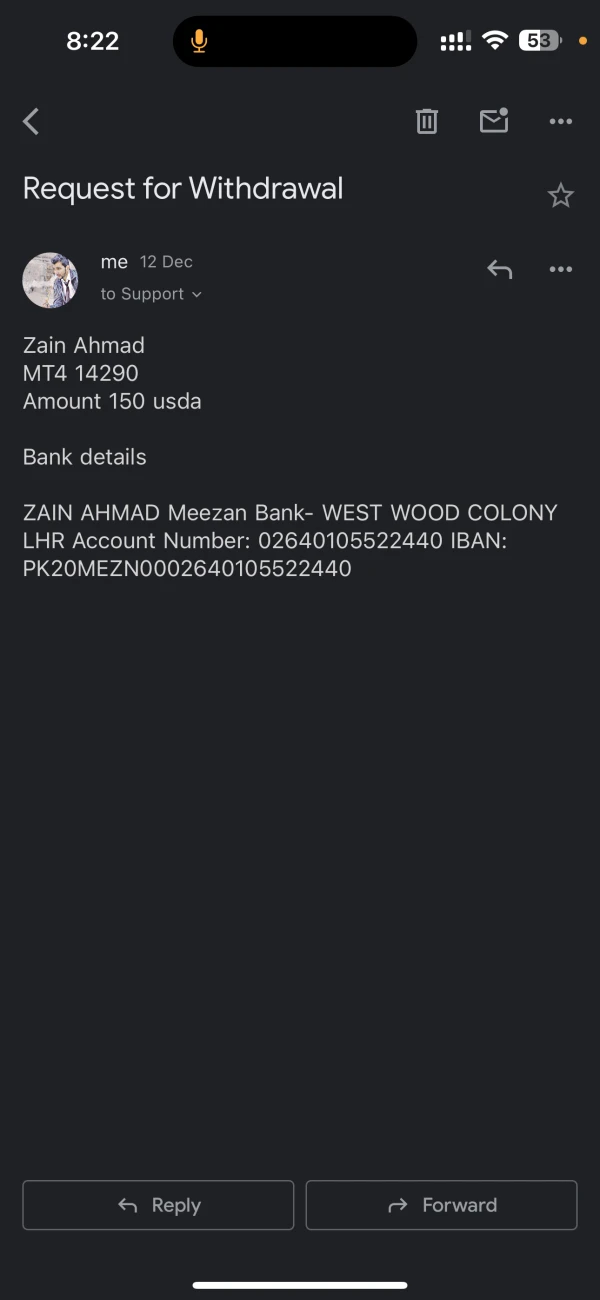

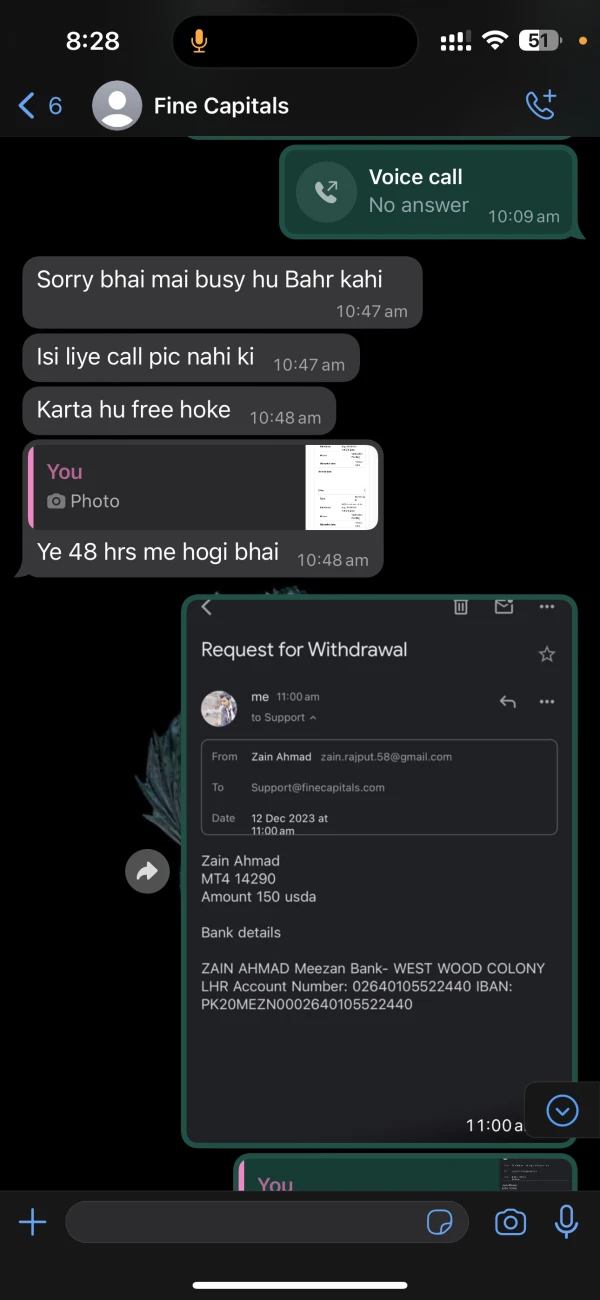

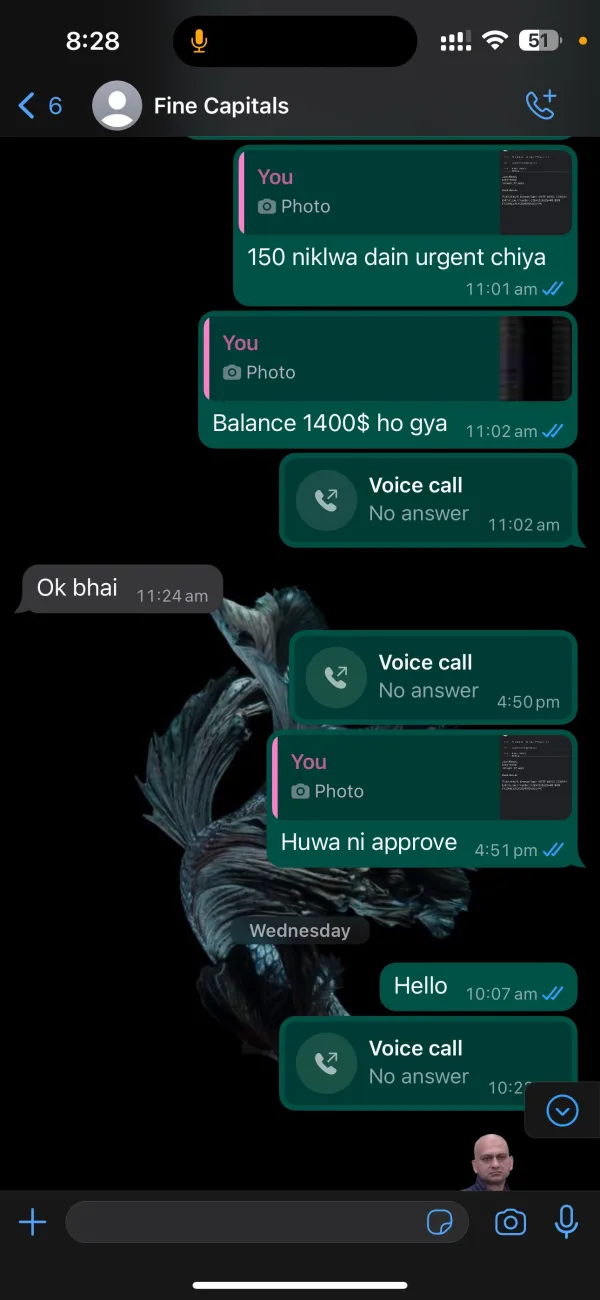

ZAIN58X

Pakistan

Hello My name is Zain Ahmad My Fine Capital Id MT4 id is 14290 I submitted kyc on website on 10 December 2023 but still on pending broker is saying that approve in 48 hours but today is 4th day but still on pending kyc. he says you can get withdraw from the email on Support@finecapitals.com I mail but no response and broker agent is not replying me and also not picking up my calls from 3 days i want my funds back please I deposit 1000$ and thy give me 200$ bonus now balance is 1430$ + I request you to slove my issue

Exposure

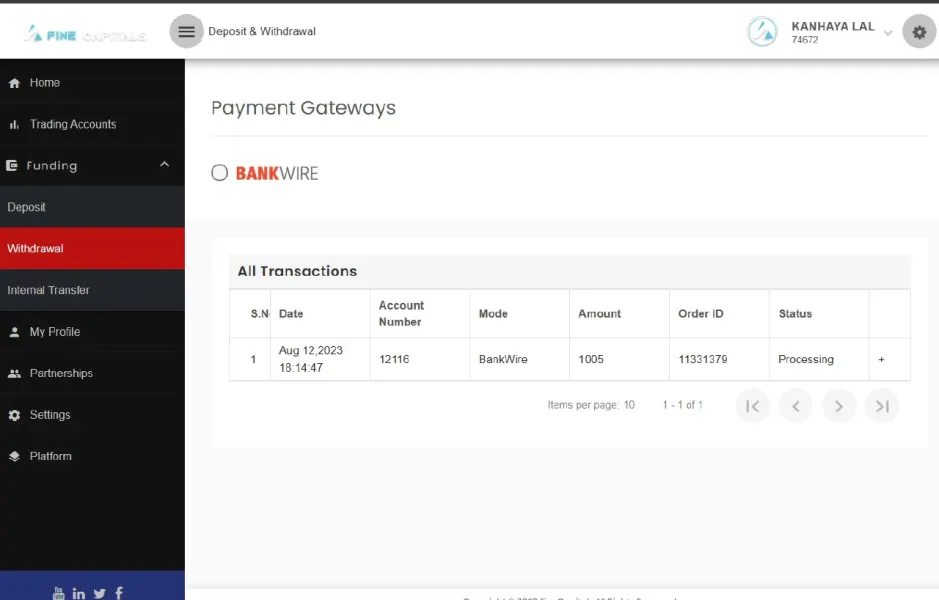

Kanhaya Lal

India

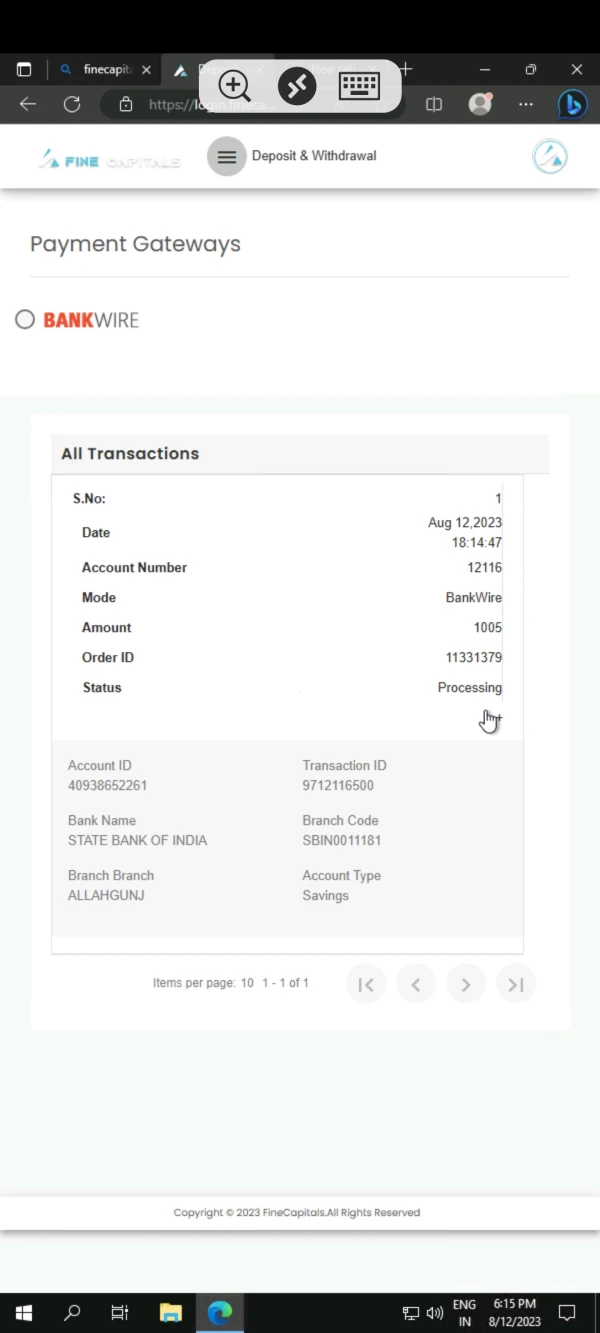

Sir I don't receive my fund. withdrawal request was sent for $1005 USD Withdrawal on 12 August with order ID 11331379 and transection ID 9712116500 . My mt4 ID is 12116. Curency INR Send request for withdrawal in India to local dipositer or local vendor. kanhayalal5893@gmail.com No response from email in three days

Exposure

Suleman Ansari

India

Best Broker I Have Ever seen. i had started with 100$ now my Account balance is 3200$. I withdraw my profit's every week.

Positive

Harry2937

India

Nice broker , Assist regarding trades , team is really helpful, easy withdrawal.

Positive

名难起

Australia

Fine Capital supports Cent accounts and also offers the most famous MT4 trading platform, which is very attractive for newbies. Many newbies often forget to check the regulations before trading because they have been attracted by the trading conditions.

Neutral

Abdulre

India

I Think This is a Good Broker for New Peoples who want to become a Perfect Trader. There is Lots of Options to Make Money Online. 1st one is Buy/Sell & 2nd One is References. Overall is Good for Behalf of me. I Hardly Recommend This Broker.

Positive

江婉琦

Singapore

I have to say, Fine Capital’s cent account is super suitable for me, only $10 required. This platform offers a commission-free trading environment. I like it, for I just don’t want it to be so troublesome. Trading experience on this platform is so far so good!

Positive