Company Summary

| Sanen Review Summary | |

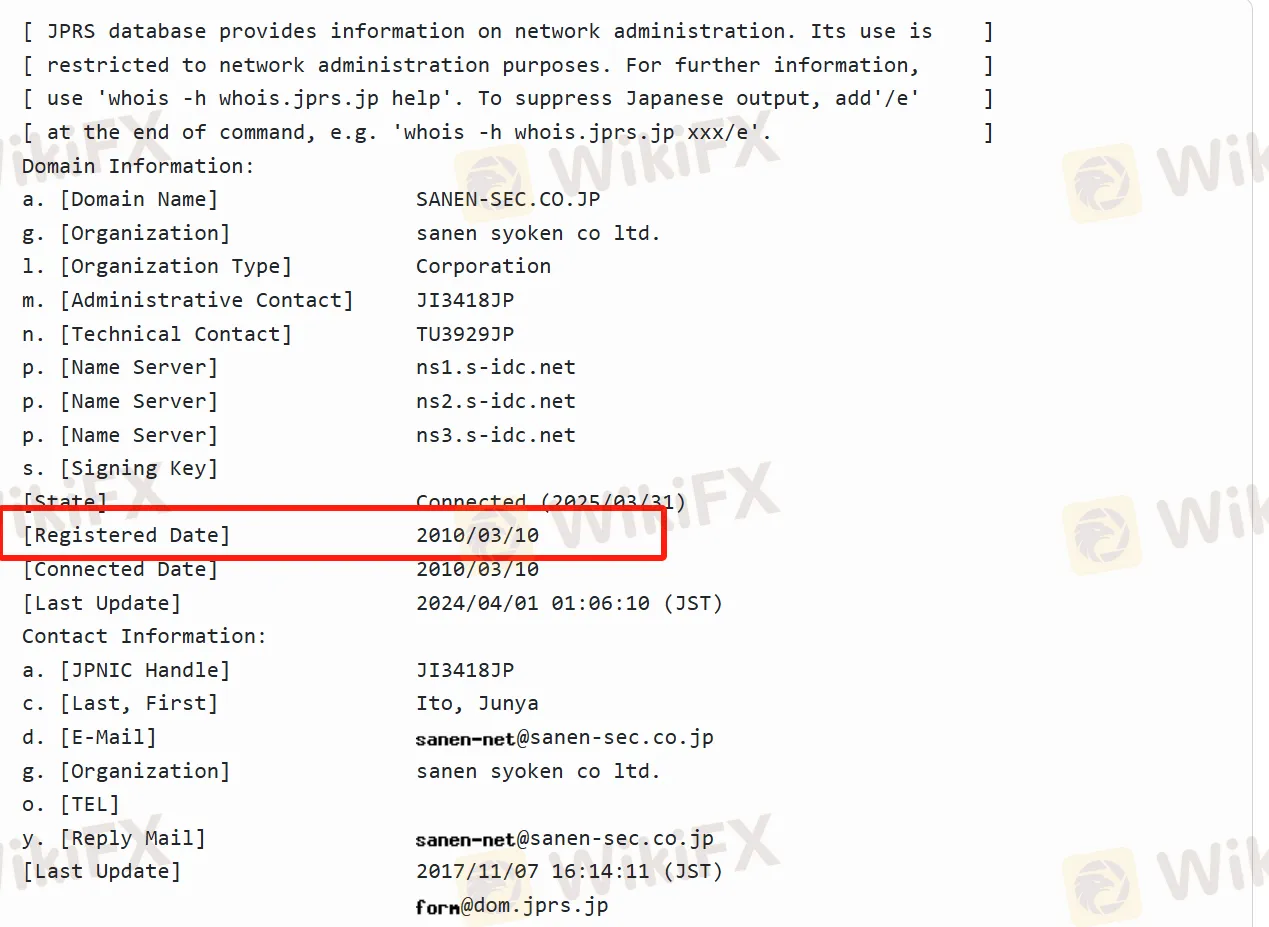

| Founded | 2010/03/10 |

| Registered Country/Region | Japan |

| Regulation | Regulated |

| Market Instruments | Stocks, investment trusts, bonds, and equity-based products |

| Customer Support | 052-561-1811 |

Sanen Information

Sanen Securities Co., Ltd. was founded in 1923 and has a history of over a hundred years. It is an established securities company rooted in Japan. Its business name is Sanen Securities Co., Ltd., and it qualifies as a financial instruments business operator numbered No. 22 issued by the Director of the Tokai Local Finance Bureau (Financial Instruments Business Operator). The platform offers a rich variety of trading products, covering Japanese stocks, US stocks, Chinese stocks, domestic and foreign bonds, investment trusts, ETFs (Exchange-Traded Funds), REITs (Real Estate Investment Trusts), and so on.

Pros and Cons

| Pros | Cons |

| Regulated | Limited internationalization level |

| Rich experience in securities business | Unclear details of handling fees and trading rules |

| Perfect offline service | Only supports Japanese |

| Various trading instruments |

Is Sanen Legit?

Sanen is a legitimate and legal financial institution. It qualifies as a financial instruments business operator issued by the Japanese official authorities and has joined the Japan Securities Dealers Association. It operates under industry supervision with the license number: No. 22 issued by the Director of the Tokai Local Finance Bureau (Financial Instruments Business Operator).

What Can I Trade in Sanen?

At Sanen, investors can trade various financial products. These include stocks, which cover Japanese domestic stocks as well as foreign stocks from countries such as the United States and China, thus expanding the geographical scope of investment. Bonds include Japanese domestic bonds (including national bonds for individuals) and foreign bonds (bonds denominated in foreign currencies), and investment trusts. In addition, it also offers other equity-based products, such as ETFs (Exchange-Traded Funds) and REITs (Real Estate Investment Trusts), which combine the characteristics of both stocks and funds.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Investment trusts | ✔ |

| Bonds | ✔ |

| Equity-based products | ✔ |