Basic Information

Comoros

Comoros

Score

Comoros | 5-10 years |

Comoros | 5-10 years |https://gannmarkets.com

Website

Rating Index

MT4/5

Full License

GannMarkets-Live

Influence

C

Influence index NO.1

Germany3.76

Germany3.76

MT4/5 Identification

Full License

United Kingdom

United KingdomInfluence

C

Influence index NO.1

Germany3.76

Germany3.76 Forex License

Forex License No forex trading license found. Please be aware of the risks.

Comoros

Comoros

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Montenegro

Montenegro gannmarkets.com

gannmarkets.com  United States

United States  Montenegro

Montenegro

| GANN Review Summary | |

| Founded | 1996 |

| Registered Country/Region | Saint Lucia |

| Regulation | Not Regulated |

| Market Instruments | Forex, Commodities, Cryptocurrencies, Stocks, Indices |

| Demo Account | Not Mentioned |

| Leverage | Up to 1:400 |

| Trading Platform | Meta Trader 5 |

| Min Deposit | $100 |

| Customer Support | info@gannmarkets.com |

GANN is an online trading platform providing many assets such as forex, commodities, cryptocurrencies, stocks, and indices. Traders can choose between the Standard or ECN accounts with a minimum deposit of $100, and leverage is available up to 1:400. Yet, there is little said about commissions.

| Pros | Cons |

|

|

|

|

|

GANN is not regulated by any financial authorities.

GANN offers many tradable assets including Forex, Commodities, Cryptocurrencies, Stocks, and Indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stock | ✔ |

| Indices | ✔ |

| Cryptocurrency | ✔ |

| Shares | ❌ |

| Metals | ❌ |

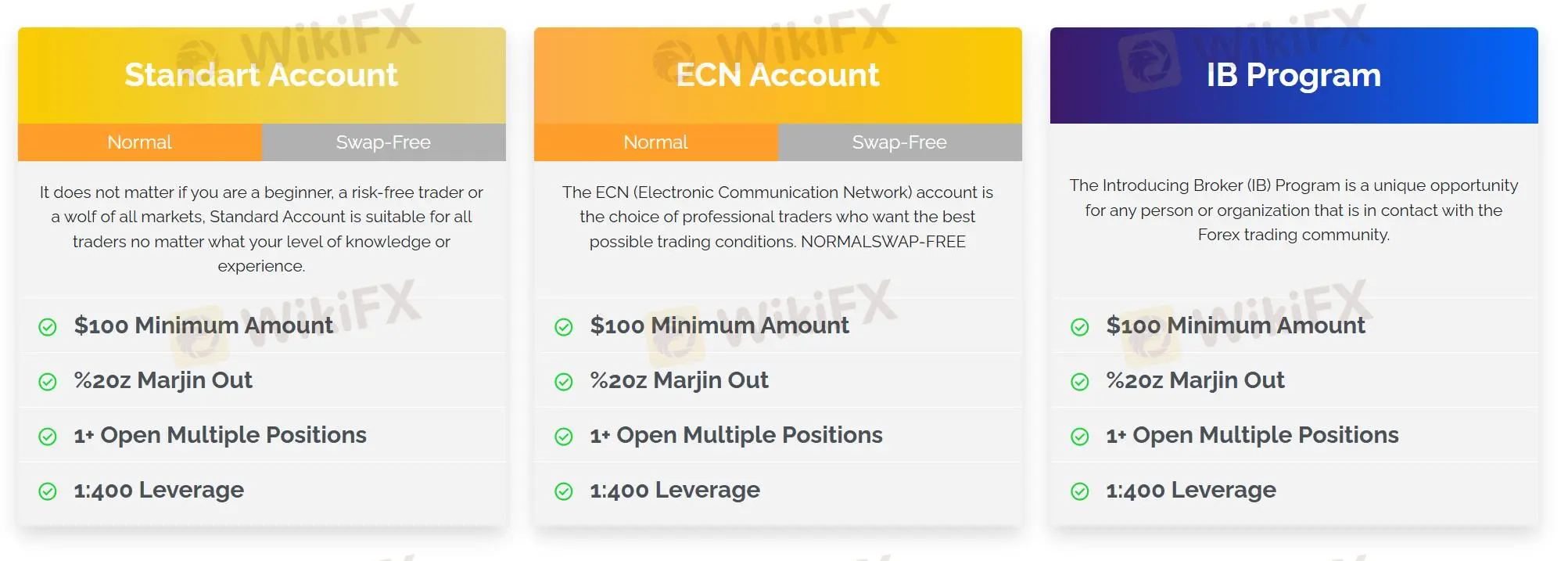

GANN offers three types of accounts: Standard, ECN, and IB Program. All accounts have high leverage up to 1:400 and a minimum deposit of $100.

| Account Type | Minimum Deposit | Margin Call | Maximum Open Positions | Leverage | Swap-Free Option |

| Standard | $100 | 20% | Unlimited | 1:400 | Yes |

| ECN | $100 | 20% | Unlimited | 1:400 | Yes |

| IB Program | $100 | 20% | Unlimited | 1:400 | Yes |

| Trading Platform | Supported | Available Devices | Suitable for |

| Meta Trader 5 | ✔ | PC and Mobile | Investors of all experience levels |

GANN requires a minimum deposit of $100 for all accounts.

Yes, GANN offers an Islamic account with no swap fees. This is important to me as I prefer to trade without interest charges. I would also note in my gann markets review that this account type requires a $100 minimum deposit, which makes it accessible to most traders.

GANN supports MetaTrader 5 (MT5), which is my preferred platform due to its advanced features and user-friendly interface. MT5 offers great charting tools and automated trading features, making it suitable for both beginner and experienced traders like myself. This is something I would mention positively in my gann markets review.

GANN does not clearly specify which payment methods it accepts for deposits or withdrawals. As a trader, I prefer to know this upfront, so I would need to confirm this with their support team before deciding to use the platform. This would also be something I’d include in my gann markets review.

GANN is not regulated by any financial authority, which is a significant concern for me. In my gann markets review, I would emphasize that trading with an unregulated broker carries increased risks, as there's no oversight to protect my funds. It’s essential for me to ensure that a broker is regulated to guarantee the safety of my investments.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now