Basic Information

Bahamas

Bahamas

Score

Bahamas | 2-5 years |

Bahamas | 2-5 years |https://toscex.com/

Website

Rating Index

Forex License

Forex License No forex trading license found. Please be aware of the risks.

Bahamas

Bahamas  toscex.com

toscex.com  United States

United States | SCEX Review Summary | |

| Founded | Within 1 year |

| Registered Country/Region | Bahamas |

| Regulation | Unregulated |

| Market Instruments | Forex, Index CFD, Commodities and Cryptocurrency |

| Demo Account | N/A |

| Leverage | N/A |

| Spread | 0 for SCEXS 0.0 account |

| Trading Platform | MT4, MT5, cTrader |

| Min Deposit | N/A |

| Customer Support | Email: support@scexus.com |

SCEX was founded in 2023 in Melbourne, Australia. It offers more than 800 tradable instruments, including Forex, index CFDs, commodities and cryptocurrencies, with competitive transaction fees.

| Pros | Cons |

| Over 800 tradable instruments | Lack of Regulation |

| The minimum spread and commission is 0 | Only email support is provided, lack of telephone and online customer serivice |

| Provide three platforms of MT4, MT5 and cTrader | AUD 20 is needed for International wire transfer (TT) |

| 24/7 Customer Support in multiple languages |

SCEXis currently in a state of no effective supervision.

SCEX provides various market opportunities with more than 800 tradable financial instruments, including Forex, Index CFD, Commodities and Cryptocurrency.

| Tradable Instruments | Supported |

| Indices | ✔ |

| Forex | ✔ |

| Commodities | ✔ |

| Crypto currencies | ✔ |

| Futures | ❌ |

| Bonds | ❌ |

SCEX offers two live account types, namely Standard Account and SCEXS 0.0 account.

Standard accounts do not charge any commission.

SCEXS 0.0 accounts offer institutional spreads as low as 0.0 points. There is a commission of AUD 7 per lot.

Standard account commission is zero, the spread is competitive; SCEXS 0.0 account has an extremely low spread of 0.0 points, but requires a commission of AUD 7 per lot.

Swap rates are published weekly and are calculated based on risk management analysis and market conditions. Each currency pair has its own swap rate, with a standard size of 1.0 lot (100,000 base units).

SCEX also charges overnight interest on overnight positions held in equity index CFDS, equity CFDS and commodities. The fee is based on the regional base rate plus (or minus) a fixed fee of 2.5%.

MT4, MT5 and cTrader are chosen by SCEX to serve clients of different preferences.

| Trading Platform | Supported | Available Devices | Suitable for which type of traders |

| MT4 | ✔ | Priority Customer SupportVPS hostingAdvanced Insights and ReportsProvide discounts for high volume traders | Traders who are new to the market or who prefer a simpler platform. |

| MT5 | ✔ | Priority Customer SupportVPS hostingAdvanced Insights and ReportsProvide discounts for high volume traders | Traders who are looking for a more advanced platform with more features. |

| cTrader | ✔ | Priority Customer SupportVPS hostingAdvanced Insights and ReportsProvide discounts for high volume traders | Traders who are looking for a fast and efficient platform with a focus on technology. |

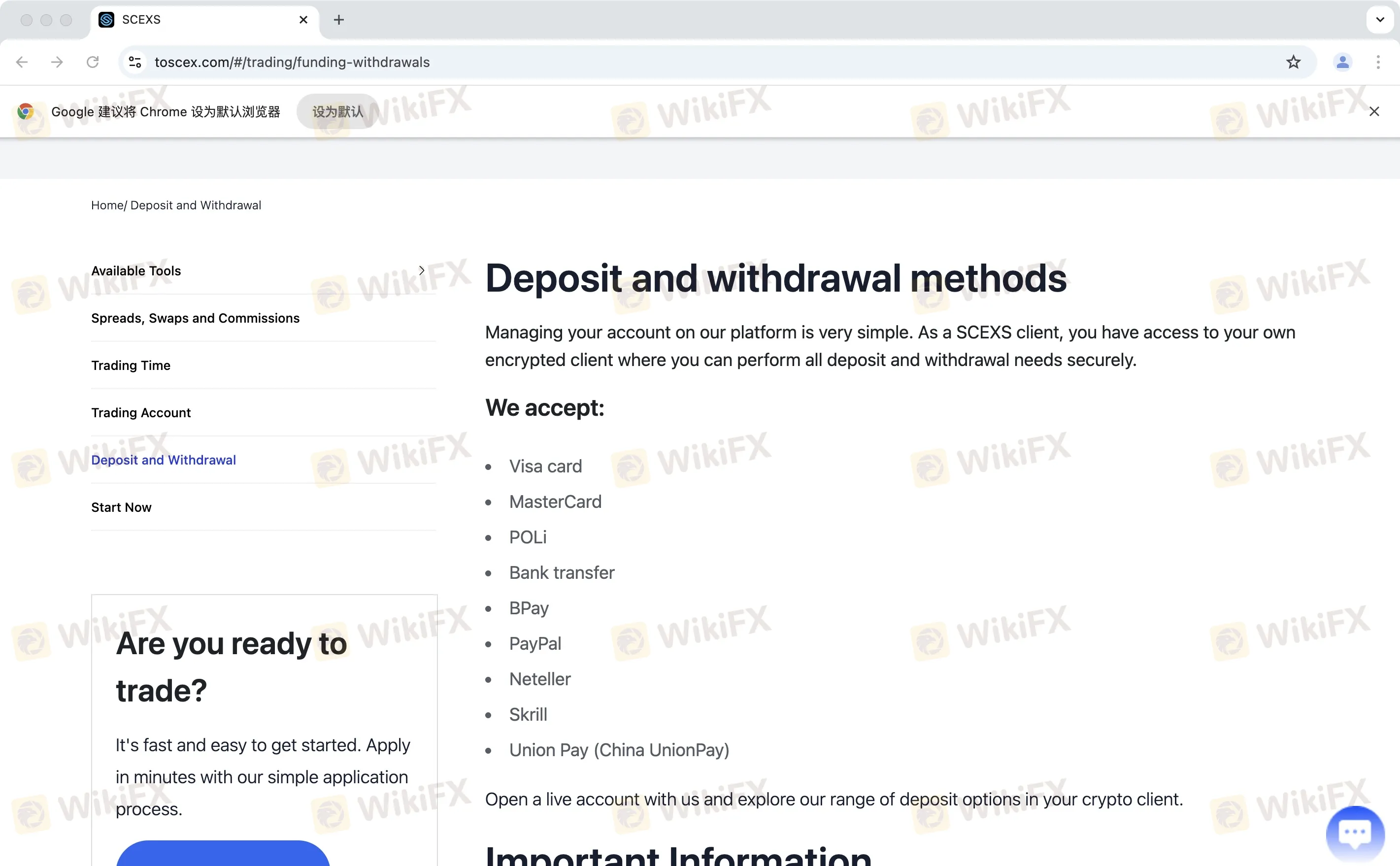

SCEX accepts multiple financing methods: credit and debit cards, online wallet options and bank transfers.

For credit and debit cards as well as online wallet options, brokers do not require deposit and withdrawal fees. For bank transfers, the International wire transfer (TT) fee is AUD 20.

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Credit cards: Visa and MasterCard | / | No | / |

| Online wallet options: POLi, BPay, PayPal, Neteller, Skrill, and Union Pay | / | No | / |

| Bank transfers:Local (BPay) and International (TT) | / | International wire transfer (TT) fees: AUD 20 | / |

| Withdrawal Options | Min. Withdrawal | Fees | Processing Time |

| Credit cards: Visa and MasterCard | / | No | Withdrawals requested before 21:00 GMT will be processed the next day, while those received before 07:00 AEST will be processed on the same day. |

| Online wallet options: POLi, BPay, PayPal, Neteller, Skrill, and Union Pay | / | No | Withdrawals requested before 21:00 GMT will be processed the next day, while those received before 07:00 AEST will be processed on the same day. |

| Bank transfers:Local (BPay) and International (TT) | / | International wire transfer (TT) fees: AUD 20 | 3-5 business days |

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now