Company Summary

| Rakuten Bank Review Summary | |

| Founded | 2000 |

| Registered Country/Region | Japan |

| Regulation | Not Regulated |

| Services | Deposits and withdrawals, transfers and remittances, save and increase, borrowing, payment |

| Platform/APP | Rakuten Bank App |

| Customer Support | / |

Rakuten Bank Information

Rakuten Bank, Ltd. is a prominent Japanese digital bank headquartered in Tokyo, Japan. Established on January 14, 2000, the bank operates primarily through electronic channels, offering a wide range of financial services to individual and business customers.

As of June 10, 2025, Rakuten Bank's capital stands at ¥32,617 million. The bank has shown significant growth, surpassing 17 million customer accounts and achieving a total deposit balance exceeding ¥12 trillion by January 2025.

In April 2023, Rakuten Bank was listed on the Tokyo Stock Exchange.

Pros and Cons

| Pros | Cons |

| Long operational history | Not regulated |

| Wide range of services | Contact information only supports Japanese |

| Lack of customer support |

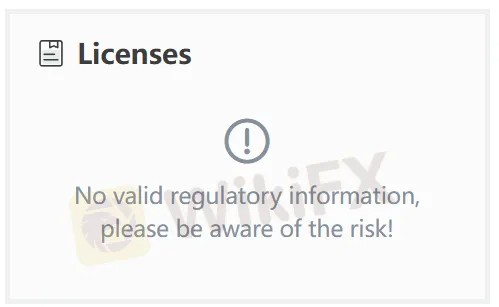

Is Rakuten Bank Legit?

No. Rakuten Bank has not been regulated by any authorities. Please be aware of the risk!

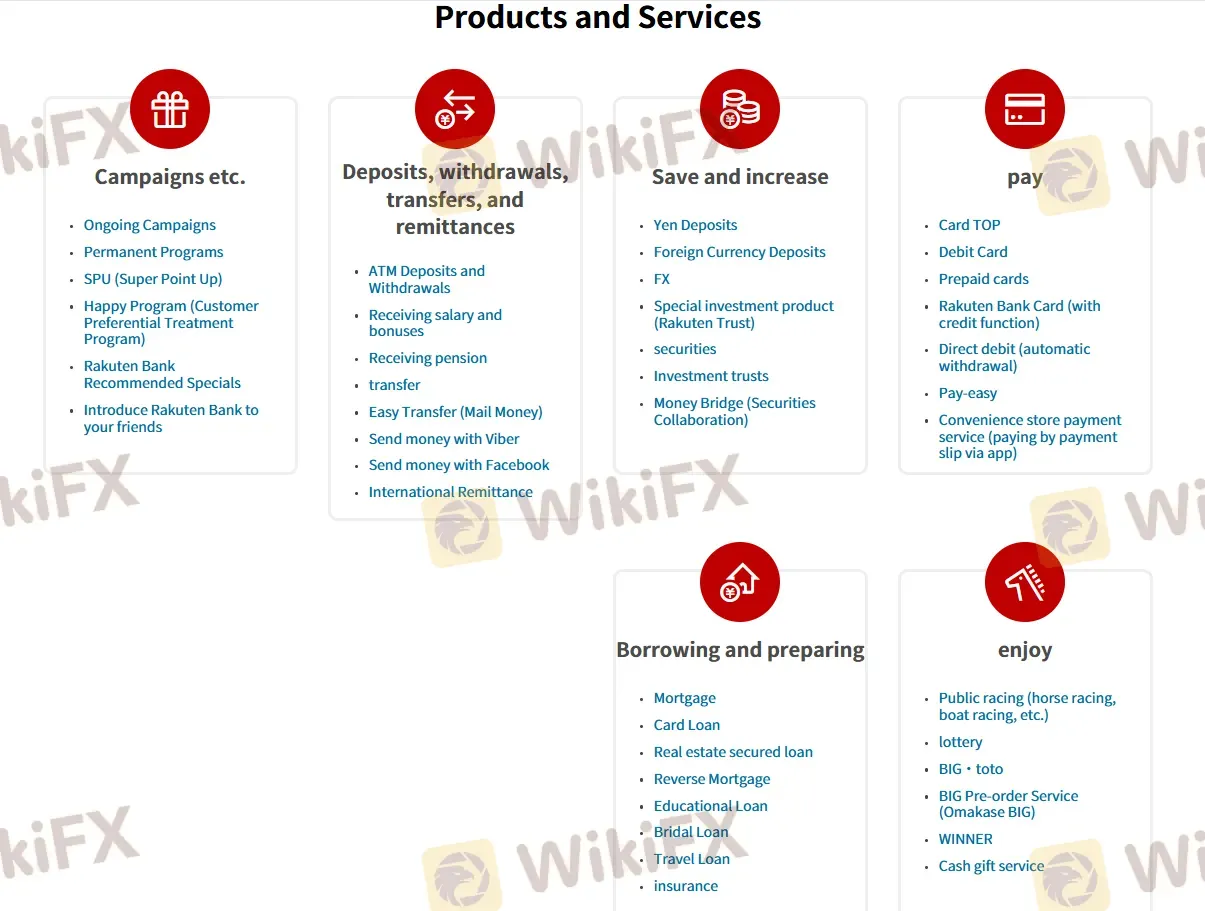

Services

As a bank in Japan, Rakuten Bank provides multiple services, which are deposits and withdrawals, transfers and remittances, save and increase, borrowing, and payment.

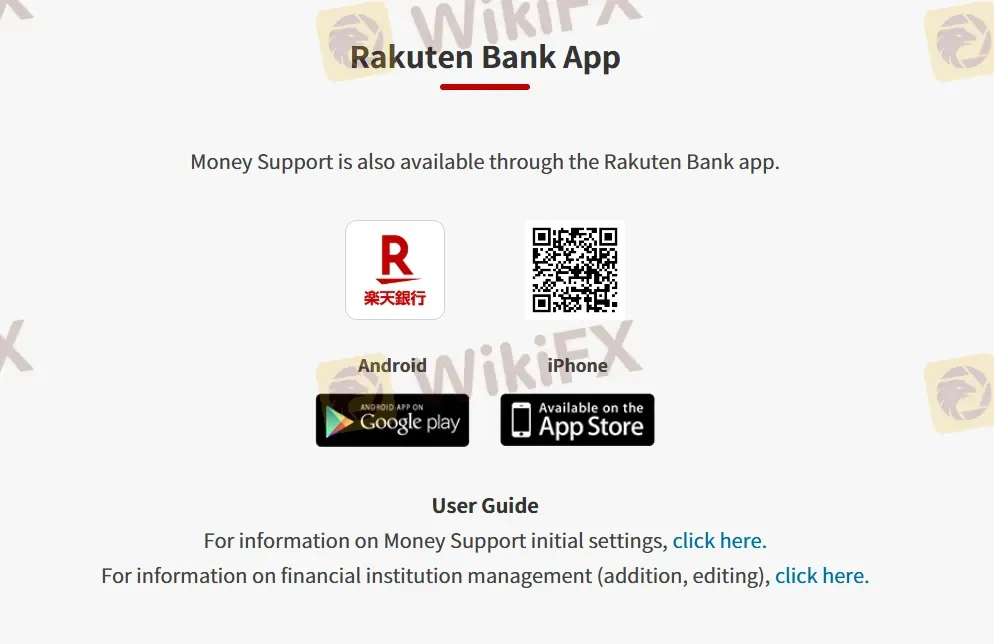

Platform/APP

Rakuten Bank's platform is Rakuten Bank App, which supports traders on iPhone and Android.