Company Summary

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | Not specified |

| Company Name | OctaForex |

| Regulation | Unregulated |

| Minimum Deposit | Not specified |

| Maximum Leverage | Up to 1:500 |

| Spreads (Forex) | EUR/USD: 1.2 pips, GBP/USD: 1.5 pips, USD/JPY: 1.0 pips (values for specific pairs) |

| Trading Platforms | MetaTrader 4 |

| Tradable Assets | Forex and Cryptocurrencies |

| Account Types | Standard and Demo |

| Demo Account | Available |

| Customer Support | Limited support channels, slow response times |

| Payment Methods | Information not provided |

| Educational Tools | Not available |

| Website Status | Reported as “website down” |

| Reputation (Scam) | Reports of being a scam |

Overview

OctaForex, an unregulated brokerage based in the United Kingdom, offers trading services with several concerning aspects. The lack of regulation raises significant doubts about the safety and reliability of this company. Founded year and minimum deposit information are unspecified, adding to the opacity of their operations. While they provide high leverage of up to 1:500, the absence of regulatory oversight can expose traders to elevated risks.

Furthermore, OctaForex's spreads are disclosed only for specific currency pairs, leaving traders in the dark about the full range of their offerings. Their trading platform is limited to MetaTrader 4, and the available assets include forex and cryptocurrencies. The absence of educational resources and limited customer support channels with slow response times further diminish the overall trading experience.

Notably, OctaForex's website has been reported as “website down,” casting serious doubts about the broker's reliability. Reports of being a scam add to the concerns surrounding OctaForex, making it a risky choice for potential traders. Caution is paramount when considering this brokerage for any trading activities.

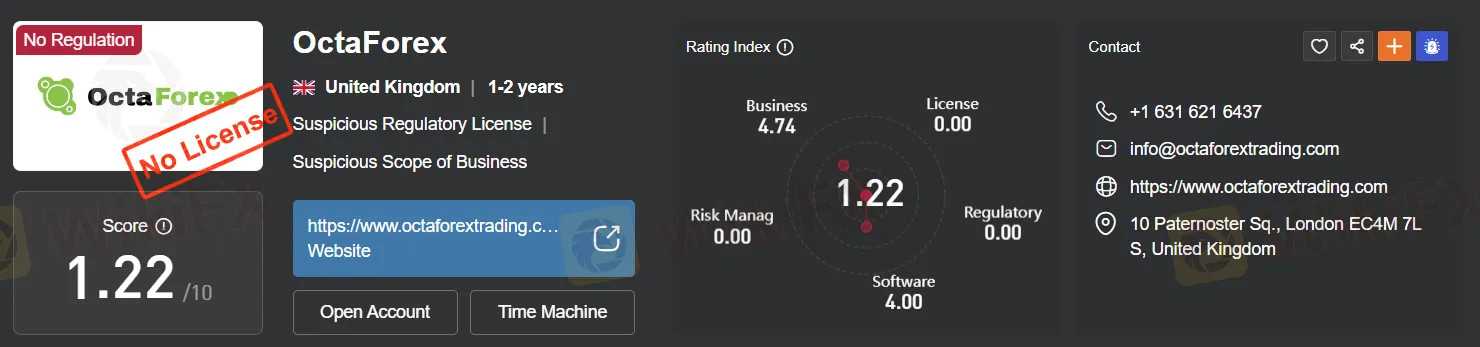

Regulation

OctaForex is an unregulated broker, which raises significant concerns about the safety and security of traders' investments. Unregulated brokers typically operate without oversight from financial regulatory authorities, which means that they may not adhere to the stringent standards and safeguards that regulated brokers are required to follow. This lack of regulation can leave traders vulnerable to various risks, including fraudulent activities, unfair trading practices, and the potential loss of their funds with little recourse for recovery. It is essential for individuals considering trading with OctaForex or any other broker to exercise caution and thoroughly research their chosen platform, prioritizing regulated alternatives that provide a higher level of investor protection.

Pros and Cons

OctaForex presents a mixed picture for traders, with both advantages and disadvantages to consider. The table below summarizes the key pros and cons of trading with OctaForex.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In summary, OctaForex offers a range of market instruments, including access to both forex and cryptocurrency markets. Demo accounts are available for practice, and the MetaTrader 4 platform enhances trading. However, the broker's unregulated status, high leverage, issues with cryptocurrency deposits/withdrawals, and limited customer support channels raise significant concerns. Traders should also be cautious due to reported scam status and website downtime.

Please note that the information provided here is for informational purposes only, and traders should conduct their own thorough research and due diligence before choosing a broker.

Market Instruments

OctaForex offers a variety of market instruments for trading in both the forex and cryptocurrency markets. These instruments cater to traders with different preferences and risk profiles:

Forex Market Instruments:

Currency Pairs: OctaForex provides access to a wide range of currency pairs, including major, minor, and exotic pairs. Popular pairs like EUR/USD, GBP/USD, and USD/JPY are available for trading, allowing for diverse forex strategies.

Spot Forex Trading: Traders can engage in spot forex trading, where currencies are bought or sold for immediate delivery at the current market rate.

Forex Futures and Forwards: OctaForex offers futures and forwards contracts, allowing traders to speculate on future currency exchange rates or use them for hedging purposes.

Forex Options: Forex options give traders the right, but not the obligation, to buy or sell a currency pair at a predetermined price on or before a specific date. This instrument can be used for risk management or speculative purposes.

Cryptocurrency Market Instruments:

Cryptocurrencies: OctaForex facilitates trading in various cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP). Traders can speculate on the price movements of these digital assets.

Crypto Exchanges: OctaForex provides access to cryptocurrency exchanges, allowing users to buy, sell, and trade a range of digital currencies.

Cryptocurrency Derivatives: For those interested in derivatives, OctaForex offers cryptocurrency futures and options contracts, enabling traders to profit from price fluctuations without owning the underlying assets.

While OctaForex offers these market instruments, it's crucial for traders to conduct thorough research and consider their risk tolerance. Notably, OctaForex operates as an unregulated broker, which means traders may have fewer protections compared to trading with regulated entities. Potential clients should carefully evaluate the associated risks and consider alternative options if regulatory oversight is a priority for them.

Account Types

OctaForex offers two primary types of trading accounts to cater to the diverse needs and experience levels of traders: Standard Accounts and Demo Accounts.

Standard Account:

Real-Money Trading: A Standard Account is designed for live, real-money trading in the forex and cryptocurrency markets.

Access to Live Markets: With a Standard Account, traders can access the live financial markets, enabling them to buy and sell actual assets like currencies or cryptocurrencies.

Risk and Reward: Standard Accounts involve real financial risk, as traders use their own capital for trading. Profits and losses are reflected in the account balance.

Leverage: Depending on the broker's policies and regulatory requirements, Standard Accounts may offer leverage, allowing traders to control larger positions with a relatively smaller amount of capital. However, it's important to exercise caution with leverage due to its potential to magnify both gains and losses.

Live Support: Traders with Standard Accounts typically have access to customer support services provided by the broker to address inquiries and resolve issues.

Demo Account:

Simulated Trading: A Demo Account, also known as a practice or virtual account, is intended for simulated trading purposes.

No Real Money at Risk: Traders use virtual funds provided by the broker, so there is no financial risk associated with trading on a Demo Account.

Learning and Strategy Development: Demo Accounts are valuable for new traders who want to learn the ropes of trading or experienced traders who want to test new strategies. It's a risk-free environment to practice and refine trading skills.

Platform Familiarization: Traders can become familiar with the trading platform's features, tools, and functionality without risking their own money.

No Profits or Losses: Any gains or losses incurred while trading on a Demo Account do not affect the trader's actual finances.

Both Standard and Demo Accounts have their distinct advantages and serve different purposes. Traders often start with a Demo Account to build confidence and refine their strategies before transitioning to a Standard Account for live trading. It's essential for traders to choose the account type that aligns with their goals and level of experience, keeping in mind that Demo Accounts are valuable for educational purposes, while Standard Accounts involve real financial exposure and should be managed with care.

Leverage

A leverage ratio of 1:500 means this broker offers traders the ability to control a position up to 500 times the size of their capital. While high leverage can amplify profits, it also significantly increases the risk of losses. Traders need to implement robust risk management strategies, maintain sufficient margin, and consider their experience level before using such high leverage. Regulatory restrictions may also apply, limiting leverage in certain jurisdictions.

Spreads and Commissions

OctaForex offers spreads for different trading instruments, with specific values for each pair. For example, the EUR/USD pair has a spread of 1.2 pips, while the GBP/USD pair has a spread of 1.5 pips. The USD/JPY pair comes with a spread of 1.0 pips. As for cryptocurrency trading, OctaForex charges a fixed commission of 0.2% of the total trade value for assets like BTC/USD and ETH/USD. This commission is calculated as a percentage of the entire trade amount.

It's worth noting that OctaForex adopts a commission-free approach for forex trading, which means there are no additional charges beyond the specified spreads for forex pairs. However, traders need to be aware of the commission fee for cryptocurrency trading and factor it into their overall trading strategy when considering OctaForex as their trading platform. These cost structures are important considerations for traders to evaluate how they may impact their trading objectives and preferences.

Deposit & Withdrawal

OctaForex's deposit and withdrawal processes for cryptocurrencies are marred by various shortcomings. When it comes to depositing funds, users often encounter frustrating delays and complications. The platform's deposit interface lacks user-friendliness, making it challenging for traders to initiate transactions smoothly. Additionally, the deposit confirmation process is sluggish, leading to unnecessary waiting times.

Withdrawals of cryptocurrency funds on OctaForex are equally problematic. Users frequently report extended processing times, causing significant inconvenience. The withdrawal interface is not intuitive, adding to the overall frustration. Furthermore, the platform imposes withdrawal limits that restrict users from accessing their funds freely, which can be highly restrictive and irritating for traders.

OctaForex's customer support for cryptocurrency-related issues is notably deficient. Traders often find it challenging to obtain timely assistance, exacerbating their difficulties with deposits and withdrawals. The lack of responsiveness and effective communication further diminishes the overall experience for users looking to manage their cryptocurrency assets on the platform.

In summary, OctaForex's cryptocurrency deposit and withdrawal processes are marred by inefficiencies, delays, and limitations, which can significantly hinder the user experience and disrupt traders' ability to manage their digital assets effectively.

Trading Platforms

OctaForex offers traders the MetaTrader 4 (MT4) platform, known for its user-friendly interface, advanced charting, order execution, support for Expert Advisors, backtesting, real-time news, custom indicators, and mobile trading. Security measures ensure data protection, and the platform connects traders to a community and marketplace. MT4, integrated with OctaForex's brokerage services, serves both beginners and experienced traders, delivering reliability and comprehensive features.

Customer Support

OctaForex's customer support is notably lacking. They have no presence on major social media platforms, such as Twitter, Facebook, Instagram, or YouTube. Their unresponsiveness on LinkedIn, WhatsApp, QQ, and absence on WeChat further limits customer communication options. While they offer an email address (info@octaforextrading.com), response times are frustratingly slow, and the absence of a dedicated customer support phone number hinders urgent issue resolution, resulting in a subpar customer support experience.

Educational Resources

OctaForex lacks educational resources, which can be a significant drawback for traders seeking to enhance their knowledge and skills in the financial markets.

Summary

OctaForex presents a troubling picture for potential traders. Being an unregulated broker raises serious concerns about the safety of investments. The absence of regulatory oversight leaves traders vulnerable to risks such as fraud and unfair practices.

While the broker offers various market instruments, its unregulated status should give traders pause, as it may result in fewer protections.

The high leverage of up to 1:500 amplifies potential profits but also substantially increases the risk of significant losses, requiring careful risk management.

Furthermore, OctaForex's cryptocurrency deposit and withdrawal processes appear plagued by delays and complications, hindering a smooth user experience. The deficient customer support, lack of presence on major social media platforms, and slow response times add to the overall negative impression.

What's more, the website's continuous downtime and reported scam status, coupled with the domain being up for sale, cast serious doubts on OctaForex's credibility and reliability. Traders should exercise extreme caution when considering this platform for their trading needs.

FAQs

Q1: What is leverage in trading, and how does it work?

A1: Leverage allows traders to control a larger position with a smaller amount of capital. For example, with 1:100 leverage, a trader can control a $10,000 position with just $100. While it can magnify profits, it also increases potential losses and should be used with caution.

Q2: What is the difference between a Standard and Demo trading account?

A2: A Standard Account is for live, real-money trading, where you use your own capital. In contrast, a Demo Account is for practice and uses virtual funds provided by the broker, allowing risk-free learning and strategy testing.

Q3: What are the risks of trading with an unregulated broker?

A3: Unregulated brokers operate without oversight, which can lead to risks such as fraud, unfair practices, and a lack of investor protection. Traders should exercise caution when dealing with such brokers.

Q4: How are spreads and commissions calculated in trading?

A4: Spreads are the difference between the buying (ask) and selling (bid) prices of an asset and are typically measured in pips. Commissions are fees charged by some brokers, often as a percentage of the trade value or a fixed amount per trade.

Q5: What is the purpose of backtesting in trading?

A5: Backtesting involves testing a trading strategy using historical data to assess its performance. It helps traders evaluate strategy viability, refine it, and gain confidence before applying it to live markets.