Company Summary

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2-5 years |

| Company Name | TBX CAPITAL |

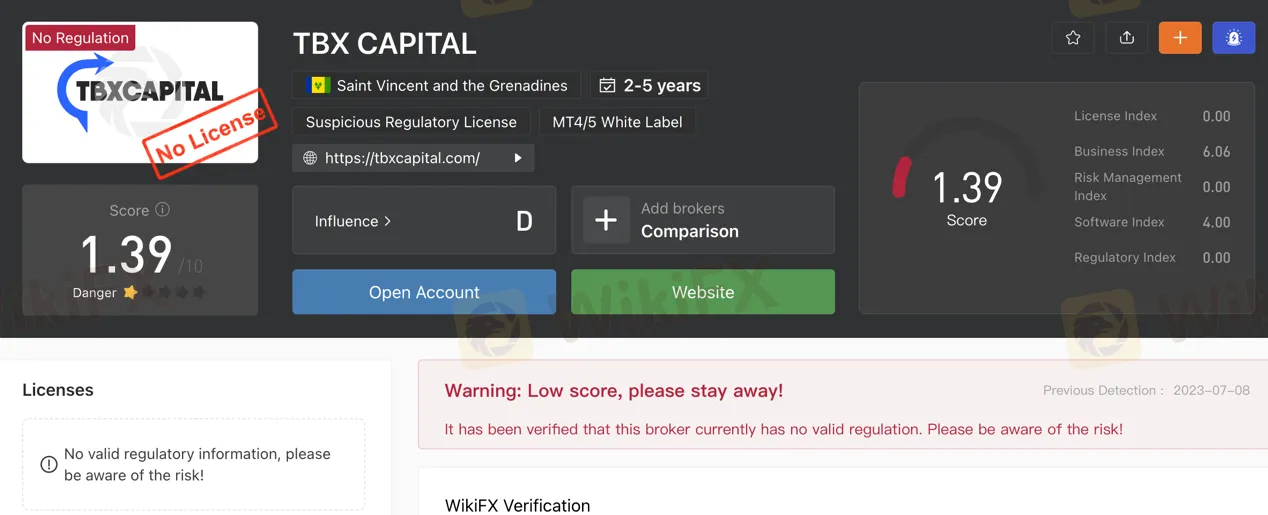

| Regulation | Not regulated |

| Minimum Deposit | Not specified |

| Maximum Leverage | Up to 1:400 |

| Spreads | Around 0.20% - 0.40% |

| Trading Platforms | MetaTrader 4 (Windows) |

| Tradable Assets | FX, indices, commodities, shares, futures |

| Account Types | Basic account |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | Phone: +442080895792, Email: support@tbx-capital.com |

| Payment Methods | Debit/credit cards with a 2.5% fee (other methods unclear) |

| Educational Tools | Not mentioned |

Overview of TBX CAPITAL

TBX CAPITAL, operated by KeyStart Trading LTD in Saint Vincent and the Grenadines, is an unregulated broker that lacks valid regulation. This raises concerns about the security and reliability of its services, posing a significant risk to investors. They offer a range of market instruments, including foreign exchange (FX), indices, commodities, shares, and futures. Traders can engage in currency trading with major, minor, and exotic pairs, speculate on stock market indices such as the S&P 500 and Dow Jones, participate in commodity markets with assets like gold and oil, trade shares of various companies, and engage in futures trading.

TBX CAPITAL offers a Basic account for traders starting their journey, but specific details regarding minimum deposit requirements and available trading instruments are not mentioned. They also provide a Demo Account for users to practice trading with virtual funds. The broker offers a high leverage option of up to 1:400, which exceeds the limits set by regulated brokers, carrying increased risk. Spreads and commissions are charged on trades, with spreads ranging from 0.20% to 0.40% and commissions around 0.05% to 0.10%.

While TBX CAPITAL provides customer support through phone and email channels, their lack of transparency regarding deposit requirements and potential fees for deposits raises concerns about reliability and clarity. Traders should exercise caution when considering engaging with TBX CAPITAL due to the potential risks associated with an unregulated broker.

Pros and Cons

TBX CAPITAL has a number of pros and cons that should be considered before engaging with this brokerage. On the positive side, TBX CAPITAL offers a wide range of market instruments, including FX, indices, commodities, shares, and futures, providing traders with diverse trading opportunities. The platform also provides the popular MetaTrader 4 platform for Windows, which offers a user-friendly interface and advanced trading capabilities. Additionally, TBX CAPITAL offers a high leverage option of up to 1:400, allowing traders to potentially amplify their gains. The brokerage also provides multiple customer support channels, ensuring that clients can seek assistance when needed. Moreover, TBX CAPITAL offers a Demo Account for practice trading, enabling users to gain hands-on experience without risking real money. However, there are several drawbacks to consider. TBX CAPITAL operates without valid regulation, which raises concerns about the security and reliability of its services. The lack of transparency regarding the minimum deposit requirement and inconsistent information on deposit fees create uncertainty for potential clients. Additionally, TBX CAPITAL charges spreads and commissions on all trades, which can impact overall profitability. Lastly, there is limited information available on the Basic account details, potentially leaving traders unaware of important features and restrictions. It is essential to carefully evaluate these pros and cons before deciding to engage with TBX CAPITAL.

| Pros | Cons |

| Offers a range of market instruments (FX, indices, commodities, shares, futures) | Operates without valid regulation, raising concerns about security and reliability |

| Provides MetaTrader 4 platform for Windows, user-friendly interface, and advanced trading capabilities | Lack of transparency regarding minimum deposit requirement |

| High leverage option of up to 1:400 | Inconsistent information on deposit fees |

| Multiple customer support channels available | Charges spreads and commissions on all trades |

| Offers a Demo Account for practice trading | Limited information on Basic account details |

Is TBX CAPITAL Legit?

TBX CAPITAL operates without any valid regulation, which raises concerns about the security and reliability of its services. The lack of regulatory oversight poses a significant risk to investors. It is crucial to exercise caution and carefully consider the potential consequences before engaging with an unregulated broker like TBX CAPITAL.

Market Instruments

TBX CAPITAL offers a range of market instruments to its clients, including FX, indices, commodities, shares, and futures.

1. FX: TBX CAPITAL provides foreign exchange trading, allowing investors to trade currency pairs. They facilitate transactions in major pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic currency pairs.

2. Indices: The platform also offers trading opportunities in various stock market indices. These include popular indices such as the S&P 500, Dow Jones Industrial Average, and FTSE 100, enabling investors to speculate on the performance of multiple companies within a specific market.

3. Commodities: TBX CAPITAL allows traders to participate in commodity markets, providing access to commodities such as gold, silver, oil, natural gas, and agricultural products. Investors can take positions based on their market outlook and potential price movements.

4. Shares: The platform enables clients to trade shares of various companies listed on major stock exchanges. Examples of shares available for trading through TBX CAPITAL may include well-known companies like Apple, Microsoft, Amazon, and Google, among others.

5. Futures: TBX CAPITAL also offers futures trading, allowing investors to speculate on the future price of commodities, currencies, indices, and other assets. Futures contracts provide opportunities for investors to engage in both hedging strategies and speculative trading.

Pros and Cons

| Pros | Cons |

| Offers a diverse range of market instruments (FX, indices, commodities, shares, futures) | Lack of regulatory oversight raises concerns about security and reliability |

| Provides access to major and minor currency pairs, allowing forex trading | |

| Trading opportunities in popular stock market indices |

Account Types

TBX CAPITAL offers a Basic account for traders. This account type provides essential features and services for those who are starting their trading journey. The Basic account allows users to familiarize themselves with the platform and its functionalities. However, it is important to note that specific details regarding the Basic account, such as minimum deposit requirements or available trading instruments, are not mentioned.

TBX CAPITAL also offers a Demo Account for users who want to practice trading without risking real money. The Demo Account simulates the trading environment and allows individuals to execute trades using virtual funds. It serves as a valuable tool for beginners to gain hands-on experience and test various trading strategies before venturing into live trading.

Pros and Cons

| Pros | Cons |

| Offers a Basic account for traders, providing essential features and services | Lack of specific details on Basic account requirements and instruments |

| Provides a Demo Account for practice trading, allowing users to gain hands-on experience without risking real money | Limited information on Basic account features and restrictions |

Leverage

TBX CAPITAL provides a high leverage option of up to 1:400, which surpasses the limits imposed by EU and USA-regulated brokers. It is important to note that EU and USA-regulated brokers typically restrict leverage to 1:30 or 1:50 as a safety precaution. The significantly higher leverage offered by TBX CAPITAL carries increased risk and requires careful consideration before engaging in trading activities.

Spreads & Commissions

TBX CAPITAL charges spreads and commissions on all trades. The spreads are typically around 0.20% - 0.40% and the commissions are typically around 0.05% - 0.10%. This means that traders can expect to pay around 0.25% - 0.50% in fees for each trade.

Deposit & Withdraw

TBX CAPITAL lacks transparency regarding their minimum deposit requirement for opening an account, leaving potential clients uncertain about the initial investment amount. Additionally, the broker states that card deposits are subject to a 2.5% fee, while other methods are supposedly free of charge. However, upon reviewing the available payment methods, only debit/credit cards are listed, implying that clients will inevitably incur the fee regardless of the chosen payment option. This inconsistency raises concerns about the clarity and reliability of TBX CAPITAL's deposit and withdrawal policies.

Pros and Cons

| Pros | Cons |

| Multiple payment methods available | Lack of transparency regarding minimum deposit requirement |

| Quick withdrawal process | Inconsistent information on deposit fees |

| Potential 2.5% fee on card deposits, regardless of the chosen payment option |

Trading Platforms

TBX CAPITAL provides traders with the MetaTrader 4 platform for Windows, offering a user-friendly interface and advanced trading capabilities. Traders can access the platform directly from their web browser through the Webtrader, eliminating the need for software installation. These platforms allow for trade execution, chart analysis, and access to a wide range of financial instruments, providing users with a reliable and accessible trading experience.

Pros and Cons

| Pros | Cons |

| Provides MetaTrader 4 platform for Windows | No alternative platforms available |

| User-friendly interface and advanced trading capabilities | |

| Accessible via web browser through Webtrader |

Customer Support

TBX CAPITAL provides customer support to its clients through multiple channels. For English-speaking customers, they can reach customer support by dialing +442080895792. Additionally, customers can also contact TBX CAPITAL's support team via email at support@tbx-capital.com. These contact options offer clients direct access to the customer support team, allowing them to seek assistance or address any queries they may have.

Conclusion

In conclusion, TBX CAPITAL operates without valid regulation, which raises concerns about the security and reliability of its services. The lack of regulatory oversight poses a significant risk to investors. On the positive side, TBX CAPITAL offers a range of market instruments including foreign exchange, indices, commodities, shares, and futures. They provide a Basic account for traders to familiarize themselves with the platform, as well as a Demo Account for practicing trading. However, specific details about the Basic account are not mentioned. TBX CAPITAL offers high leverage of up to 1:400, which surpasses limits imposed by regulated brokers, but this carries increased risk. They charge spreads and commissions on trades, and their transparency regarding deposit and withdrawal policies is lacking. TBX CAPITAL provides the MetaTrader 4 platform for Windows, which offers advanced trading capabilities. They offer customer support through phone and email. It is important for potential clients to carefully consider the risks and uncertainties associated with engaging with an unregulated broker like TBX CAPITAL.

FAQs

Q: Is TBX CAPITAL a regulated broker?

A: No, TBX CAPITAL operates without any valid regulation.

Q: What market instruments does TBX CAPITAL offer?

A: TBX CAPITAL offers FX, indices, commodities, shares, and futures trading.

Q: What types of accounts does TBX CAPITAL offer?

A: TBX CAPITAL offers a Basic account and a Demo Account.

Q: What is the leverage provided by TBX CAPITAL?

A: TBX CAPITAL offers a high leverage of up to 1:400.

Q: What are the spreads and commissions charged by TBX CAPITAL?

A: TBX CAPITAL charges spreads around 0.20% - 0.40% and commissions around 0.05% - 0.10%.

Q: What are the deposit and withdrawal policies of TBX CAPITAL?

A: TBX CAPITAL lacks transparency regarding minimum deposits and charges a fee for card deposits.

Q: What trading platforms does TBX CAPITAL provide?

A: TBX CAPITAL offers the MetaTrader 4 platform for Windows and a Webtrader for browser-based trading.

Q: How can I contact customer support at TBX CAPITAL?

A: You can reach TBX CAPITAL's customer support by phone or email.