Basic Information

United Kingdom

United Kingdom

Score

United Kingdom | 5-10 years |

United Kingdom | 5-10 years |--

Website

Rating Index

Forex License

Forex License No forex trading license found. Please be aware of the risks.

United Kingdom

United Kingdom | Aspect | Information |

| Company Name | SCOTT MARKETS |

| Registered Country/Area | United Kingdom |

| Founded Year | 2018 |

| Regulation | Unregulated |

| Minimum Deposit | $100,000 |

| Leverage | Top to 1:100 |

| Market Instruments | Forex,Indices,Commodities,Stocks,Crypto currencies |

| Account Types | Individual account,joint account |

| Spreads&commissions | As low as 0 pips |

| Trading Platforms | MetaTrader 4,Meta Trader 5 |

| Demo Account | Available |

| Customer Support | Email:scottmarkets@support.com |

| Deposit & Withdrawal | Bank transfer,credit/debit card |

Scott Markets, founded in 2018 and based in the United Kingdom, is an unregulated financial services company. They offer a wide range of market instruments, including Forex, indices, commodities, stocks, and cryptocurrencies, catering to both individual and joint accounts.

With a substantial minimum deposit requirement of $100,000, they provide leverage up to 1:100 and boast competitive spreads and commissions, starting as low as 0 pips. The company operates on popular trading platforms like MetaTrader 4 and MetaTrader 5 and also offers a demo account for practice trading.

For customer support, clients can reach out via email at scottmarkets@support.com. Deposits and withdrawals can be made through bank transfers or credit/debit cards.

Scott Markets is an unregulated financial services company, operating without the oversight of any official regulatory body. This lack of regulation means that they are not bound by the stringent rules and protections that typically govern regulated financial entities.

As a result, clients of Scott Markets may not have access to certain safeguards and recourse mechanisms that are standard in regulated markets. This unregulated status is an important consideration for potential clients, especially regarding the security of their investments and the transparency of the company's operations.

| Pros | Cons |

| Wide Range of Instruments | Unregulated |

| Advanced Trading Platforms | High Minimum Deposit |

| Competitive Spreads and Commissions | Limited Recourse for Disputes |

| High Leverage Options | Potential for Increased Risk |

| Demo Account Availability | Geographical Restrictions |

Pros of Scott Markets:

Wide Range of Instruments: They offer a diverse portfolio of trading options, including Forex, indices, commodities, stocks, and cryptocurrencies, which provides ample opportunities for traders to diversify their investments.

Advanced Trading Platforms: The availability of MetaTrader 4 and MetaTrader 5, two of the most renowned and user-friendly trading platforms, enhances the trading experience with advanced tools and features.

Competitive Spreads and Commissions: Scott Markets advertises spreads and commissions as low as 0 pips, which can be advantageous for traders looking to minimize trading costs.

High Leverage Options: With leverage up to 1:100, traders have the potential to magnify their profits, although this also increases risk.

Demo Account Availability: The provision of a demo account is beneficial for new traders or those looking to test strategies without risking real capital.

Cons of Scott Markets:

Unregulated: The lack of regulation is a significant risk factor, as it means less protection for clients in terms of investment security and company transparency.

High Minimum Deposit: A minimum deposit of $100,000 is quite steep, making it inaccessible for small or average investors.

Limited Recourse for Disputes: Being unregulated, clients might have limited options for legal recourse in case of disputes or issues with the company.

Potential for Increased Risk: While high leverage can be an advantage, it also significantly increases the risk of substantial losses, especially for inexperienced traders.

Geographical Restrictions: Operating primarily in the United Kingdom, the services might not be accessible or suitable for traders in other regions, depending on their specific investment needs and local regulations.

Scott Markets offers a comprehensive range of market instruments, allowing traders to diversify their investment portfolios across various asset classes:

Forex (Foreign Exchange):

Scott Markets enables traders to engage in the forex market, offering the ability to trade in a broad spectrum of currency pairs. This includes major, minor, and potentially exotic pairs, providing opportunities to capitalize on global currency market fluctuations.

Indices:

The platform allows trading in various global indices, giving traders exposure to different international stock markets. This includes well-known indices that track the performance of groups of stocks, offering a macro-level investment approach in the equity markets.

Commodities:

Scott Markets provides options for trading in commodities, potentially including both hard commodities like metals and energy, as well as soft commodities such as agricultural products. This diversification option allows traders to hedge against inflation or market volatility.

Stocks:

Traders with Scott Markets can invest in the stock market, accessing a variety of companies across different sectors and regions. This offers the chance to invest in various equity markets, encompassing a range from large-cap companies to potentially emerging small-cap stocks.

Cryptocurrencies:

The platform also caters to the growing interest in digital assets by offering cryptocurrency trading. This allows traders to delve into the dynamic and rapidly evolving crypto market, trading popular and potentially emerging digital currencies.

By providing such a varied range of market instruments, Scott Markets addresses the diverse needs and preferences of traders, enabling them to participate in different markets, from foreign currencies and stocks to commodities and innovative digital assets.

Scott Markets offers two primary types of accounts, catering to different needs and preferences of traders:

Individual Account:

This account type is designed for a single user, providing a straightforward and personalized trading experience. It's suited for individual traders who manage their own funds and make independent trading decisions. The individual account allows for full control over trading activities and investment choices, making it ideal for solo traders looking for a direct and customized trading experience.

Joint Account:

The joint account option is tailored for two or more individuals who want to manage a trading account together. This type of account is often chosen by partners, family members, or close associates who wish to combine their investment resources and make joint decisions on trades. It provides a collaborative approach to trading, where the responsibilities and benefits of the trading account are shared among the account holders.

Both account types are designed to meet the varying needs of traders, whether they prefer to trade independently or collaboratively. Each type comes with its own set of features and capabilities, allowing traders to choose the one that best aligns with their trading style and objectives.

Visit the Website and Choose Account Type:

Begin by navigating to the official website of Scott Markets. Once there, review the available account types — individual or joint — and select the one that best suits your trading needs and preferences.

Complete the Registration Form:

After selecting the account type, you will need to fill out a registration form. This form usually requires personal information such as your name, address, contact details, and possibly financial information. Ensure all details are accurate and up-to-date, as they will be crucial for the verification process.

Verification of Identity and Documents:

To comply with financial regulations and security measures, Scott Markets will require you to verify your identity. This step typically involves submitting copies of personal identification documents, such as a passport or driver's license, and possibly proof of address, like a utility bill or bank statement. The verification process is crucial to ensure the security and legitimacy of the account.

Fund the Account:

Once your account is verified, the final step is to deposit funds. Scott Markets requires a minimum deposit, which you can make via the available payment methods, such as bank transfer or credit/debit card. After funding your account, you can start trading on the platform using the market instruments offered by Scott Markets.

After completing these steps, you should have full access to your trading account and be able to utilize the trading platforms and tools provided by Scott Markets.

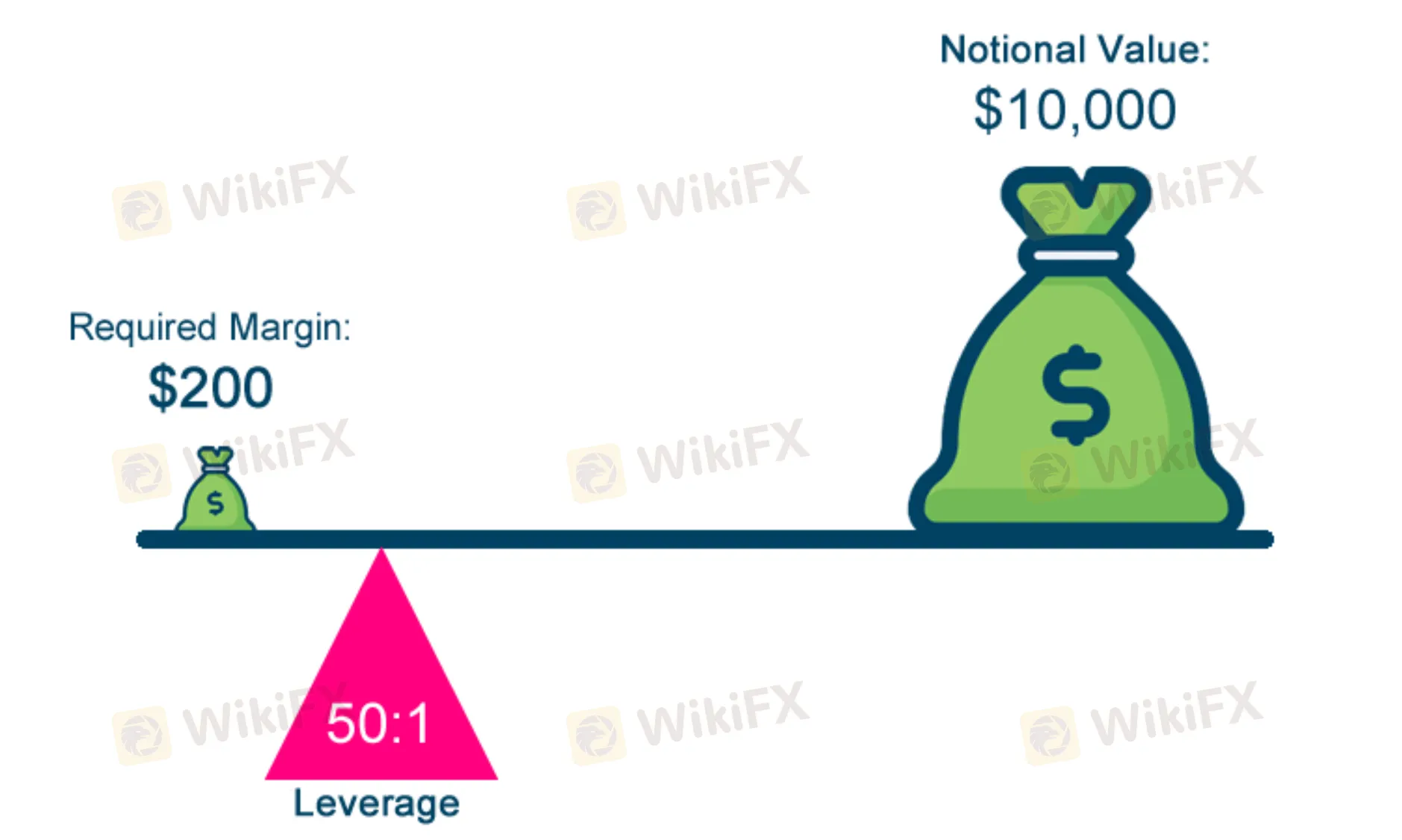

Scott Markets offers leverage up to 1:100, providing traders with the opportunity to control a large position with a relatively small amount of capital. This high leverage ratio can be a powerful tool, amplifying potential profits from successful trades.

However, it's important to note that while high leverage can increase the potential for significant gains, it also raises the risk of substantial losses, especially in volatile market conditions. Traders should approach leverage with caution and consider their risk tolerance, experience level, and trading strategy.

It's advisable for traders, particularly those who are less experienced, to use leverage judiciously and be fully aware of the implications it has on their trading positions.

Scott Markets advertises highly competitive spreads and commissions, with spreads starting as low as 0 pips. This low-spread environment is particularly beneficial for traders looking to minimize their trading costs, especially those engaged in high-frequency or volume trading.

The exact spreads and commission rates may vary depending on the market instrument being traded and the type of account held by the trader. For instance, major currency pairs in the Forex market typically have tighter spreads compared to exotic pairs or other instruments like commodities or stocks.

It's important for potential clients to review the specific details of spreads and commissions for their chosen instruments and account types, as these can significantly impact trading profitability and strategy.

Scott Markets utilizes two of the most renowned and widely-used trading platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are celebrated for their user-friendly interfaces, robust functionality, and flexibility, catering to both novice and experienced traders.

MT4 is particularly known for its advanced charting tools, automated trading capabilities through Expert Advisors (EAs), and a vast array of technical indicators. MT5, while retaining the core strengths of MT4, offers additional features like more timeframes, enhanced graphical tools, and advanced financial trading functions.

Both platforms support a wide range of devices and operating systems, including desktop computers and mobile devices, ensuring traders can monitor and execute trades seamlessly from anywhere at any time.

The choice between MT4 and MT5 allows traders at Scott Markets to select the platform that best fits their trading style and needs.

Scott Markets offers its clients convenient options for depositing and withdrawing funds, primarily focusing on bank transfers and credit/debit card transactions. Bank transfers are a reliable and widely-used method for moving larger sums of money, although they may take several days to process.The minimum deposit is $100,000.

Credit and debit card transactions, on the other hand, are generally faster and more convenient for smaller, more frequent transfers. Both methods are designed to provide security and ease of use, ensuring clients can manage their funds efficiently.

It is important for clients to check for any associated fees or processing times specific to their region or bank, as these can vary and may impact the overall efficiency of their financial transactions. Additionally, clients should be aware of the minimum deposit requirements and any withdrawal limits or conditions that Scott Markets may impose.

Scott Markets offers customer support primarily through email, with their support address being scottmarkets@support.com. This email-based support system allows clients to reach out with inquiries, concerns, or issues they may encounter while using the platform.

Email support is beneficial for detailed, non-urgent queries as it provides a written record of the communication and allows for comprehensive responses. While Scott Markets currently relies on email for customer support, clients might benefit from checking if additional support options, such as live chat or phone support, become available in the future, offering more immediate or personalized assistance.

In conclusion, Scott Markets is a UK-based financial services provider offering a range of trading options across various markets, including Forex, indices, commodities, stocks, and cryptocurrencies.

With advanced trading platforms like MetaTrader 4 and MetaTrader 5, competitive spreads and commissions, and high leverage options, it caters to both individual and joint account holders. However, it's noteworthy that Scott Markets operates unregulated, lacks diverse customer support channels, and requires a high minimum deposit, aspects that potential clients should carefully consider.

The company's focus on email-based customer support and standard deposit and withdrawal methods via bank transfers and credit/debit cards, while efficient, also points to areas where more diversity and immediacy in services could enhance the overall client experience.

Q:Is Scott Markets regulated?

A:No, Scott Markets is not regulated by any financial regulatory authority, which is an important consideration for potential clients in terms of investment security and operational transparency.

Q:What types of accounts does Scott Markets offer?

A:Scott Markets offers two types of accounts: individual accounts, for solo traders, and joint accounts, suitable for multiple individuals wanting to manage a trading account together.

Q:What is the minimum deposit required to open an account with Scott Markets?

A:The minimum deposit required to open an account with Scott Markets is $100,000, which is considerably high compared to many other financial service providers.

Q:What trading platforms are available with Scott Markets?

A:Scott Markets provides the MetaTrader 4 and MetaTrader 5 platforms, both of which are renowned for their user-friendly interfaces and advanced trading features.

Q:Does Scott Markets offer a demo account?

A:Yes, Scott Markets offers a demo account, allowing traders to practice trading and test strategies without risking real capital.

Q:How can I contact customer support at Scott Markets?

A:Customer support at Scott Markets can be reached via email at scottmarkets@support.com. This is currently the primary method for support and inquiries.

Q:What are the deposit and withdrawal methods available at Scott Markets?

A:Deposits and withdrawals at Scott Markets can be made through bank transfers and credit/debit cards. Clients should check for any fees or processing times associated with these methods.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now