OWM

Vanuatu

Vanuatu

Time Machine

Check whenever you want

Download App for complete information

Exposure

No Data

OWM · Company Summary

| OWM | Basic Information |

| Company Name | OWM |

| Founded | 2017 |

| Headquarters | Vanuatu |

| Regulations | Suspected fake clone |

| Tradable Assets | Forex, Commodities, CFDs on Futures, Shares CFDs |

| Account Types | Standard, ECN |

| Minimum Deposit | Standard: $100, ECN: $3,000 |

| Maximum Leverage | Up to 400:1 |

| Spreads | Standard: As low as 0.45 (Not detailed), ECN: As low as 0.1 (Not detailed) |

| Commission | Not explicitly detailed |

| Deposit Methods | Contact customer support for information |

| Trading Platforms | MetaTrader 4 (MT4) |

| Customer Support | Live chat, phone: +678 29666, Email: support@owmtrade.com, Physical address: Govant Building, BP1276, Port Vila, Vanuatu |

| Education Resources | Terminology, Guides, Daily News, Analysis |

| Bonus Offerings | None |

Overview of OWM

OWM, a trading company founded in 2017 and headquartered in Vanuatu, specializes in providing a range of trading instruments, including Forex, Commodities, CFDs on Futures, and Shares CFDs. Notably, OWM is currently not verifiably regulated, which raises concerns about its legitimacy and the safety of traders' investments. The broker offers two main types of trading accounts: Standard and ECN, tailored to meet the varying needs and experiences of traders. With a maximum leverage of up to 400:1, OWM allows traders to control larger positions with a relatively smaller amount of capital. OWM utilizes the MetaTrader 4 (MT4) trading platform known for its user-friendly interface and advanced trading features.

Please note that the provided information is based on the data available and my knowledge as of September 2021. It's advisable to verify the details with the broker directly and conduct thorough research before engaging in any trading activities due to the potential risks associated with an unregulated broker.

Is OWM Legit?

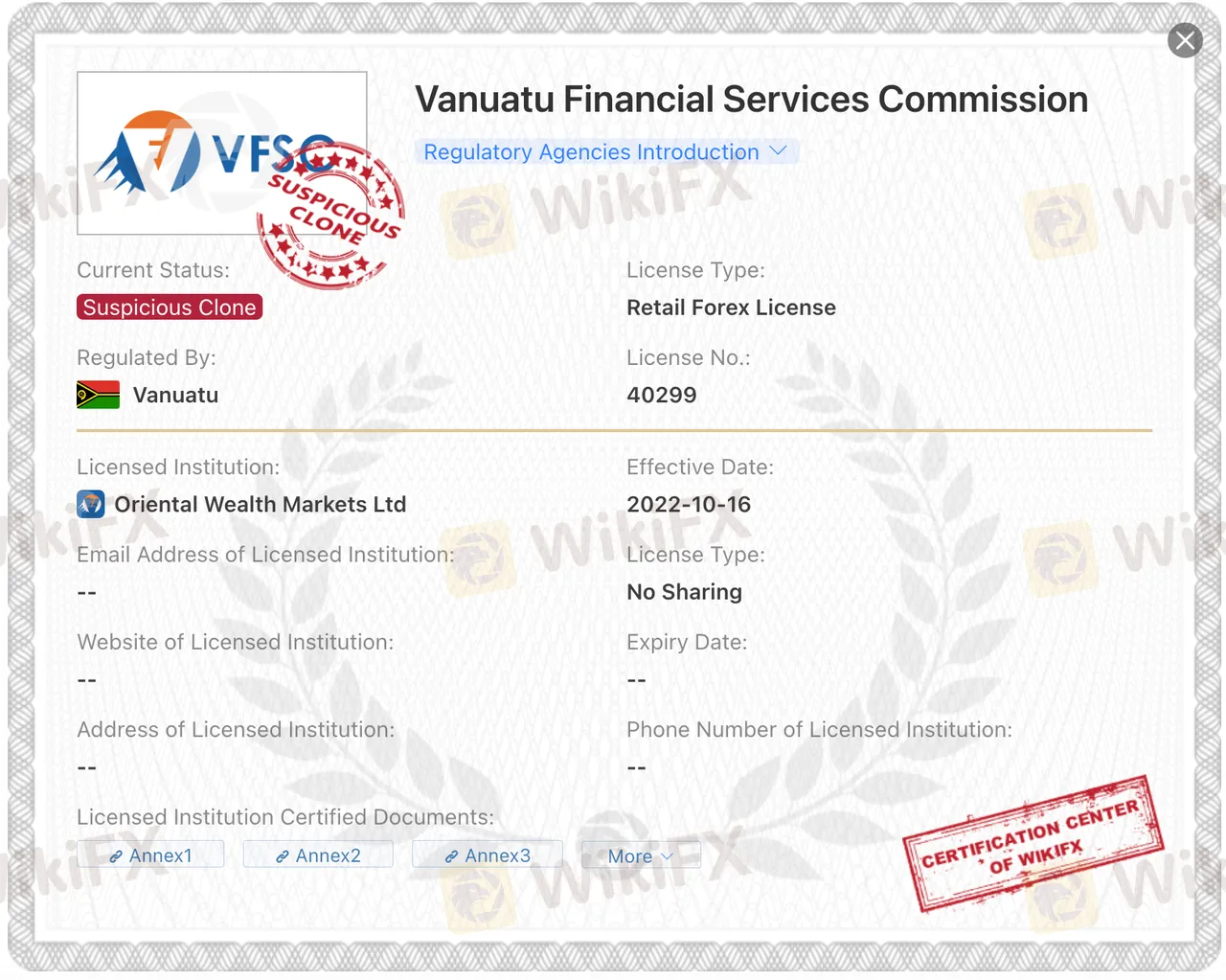

OWM, or any broker, should not be considered regulated or legitimate when there are concerns or doubts about the validity of its claimed regulatory status. In the case of OWM, it has been verified that the broker currently has no valid regulation. Additionally, the Vanuatu VFSC regulation (license number: 40299) claimed by this broker is suspected to be a clone, which raises significant red flags. Therefore, it is essential to exercise extreme caution and be aware of the associated risks when dealing with an unregulated or potentially fraudulent entity like OWM. Regulatory oversight is crucial for ensuring transparency, security, and compliance with industry standards, and the absence of proper regulation can expose traders to potential financial and operational risks.

Pros and Cons

OWM, a trading company founded in 2017 and headquartered in Vanuatu, offers a range of trading options including Forex, Commodities, and various CFDs. The company offers multiple account types catering to different trading needs and styles, and utilizes the popular MetaTrader 4 trading platform. The educational resources provided, such as terminology, guides, daily news, and analysis, are also valuable for traders. However, there are notable concerns, mainly related to its unclear regulation status, suspected to be a case of cloned regulation. Additionally, there is a lack of transparency in certain operational aspects, as information regarding commissions and deposit methods is not explicitly detailed.

| Pros | Cons |

|

|

|

|

|

Trading Instruments

OWM offers a range of trading instruments across various asset classes:

1. FOREX (Foreign Exchange): OWM provides foreign exchange trading, commonly known as FOREX or FX. This involves the exchange of one foreign currency for another in a currency pair. Traders can engage in the simultaneous purchase of one currency while selling the other in foreign exchange transactions. FOREX trading allows participants to speculate on currency price movements, making it one of the most liquid and actively traded markets globally.

2. Commodities: OWM offers the opportunity to trade in commodities, which are items used in commerce or on markets. These commodities are typically traded on various exchanges worldwide, often through futures contracts. Commodity trading enables investors to speculate on the price movements of raw materials like gold, oil, or agricultural products, offering diversification and potential profit opportunities.

3. CFDs on Futures: OWM provides Contracts for Difference (CFDs) on futures, particularly stock index CFDs. These financial derivatives are based on stock price indices, allowing traders to profit from changes in the price of a stock or index without owning the underlying assets. Stock index CFDs provide a way to invest profitably in the movements of major stock indices, offering opportunities for traders to capitalize on market trends.

4. Shares CFDs: Through the OWM trading platform, traders can engage in buying and selling shares of large companies listed on prominent exchanges such as NYSE (New York Stock Exchange), NASDAQ, and HKEx (Hong Kong Stock Exchange) without incurring the fees or complexities associated with traditional stock trading. Shares CFDs provide a more cost-effective and flexible way to trade shares and potentially benefit from the performance of renowned companies.

Here is a comparison table of trading instruments offered by different brokers:

| Instruments | OWM | IG Group | Just2Trade | Forex.com |

| CFDs | Yes | No | No | Yes |

| Forex | Yes | Yes | No | Yes |

| Indices | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | No | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Cryptocurrencies | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | No |

| Shares | Yes | Yes | No | No |

| Options | No | Yes | Yes | Yes |

| Spread Betting | No | Yes | No | No |

| Stocks | Yes | No | Yes | Yes |

| ADRs | No | No | Yes | No |

| Bonds | No | No | Yes | No |

Account Types

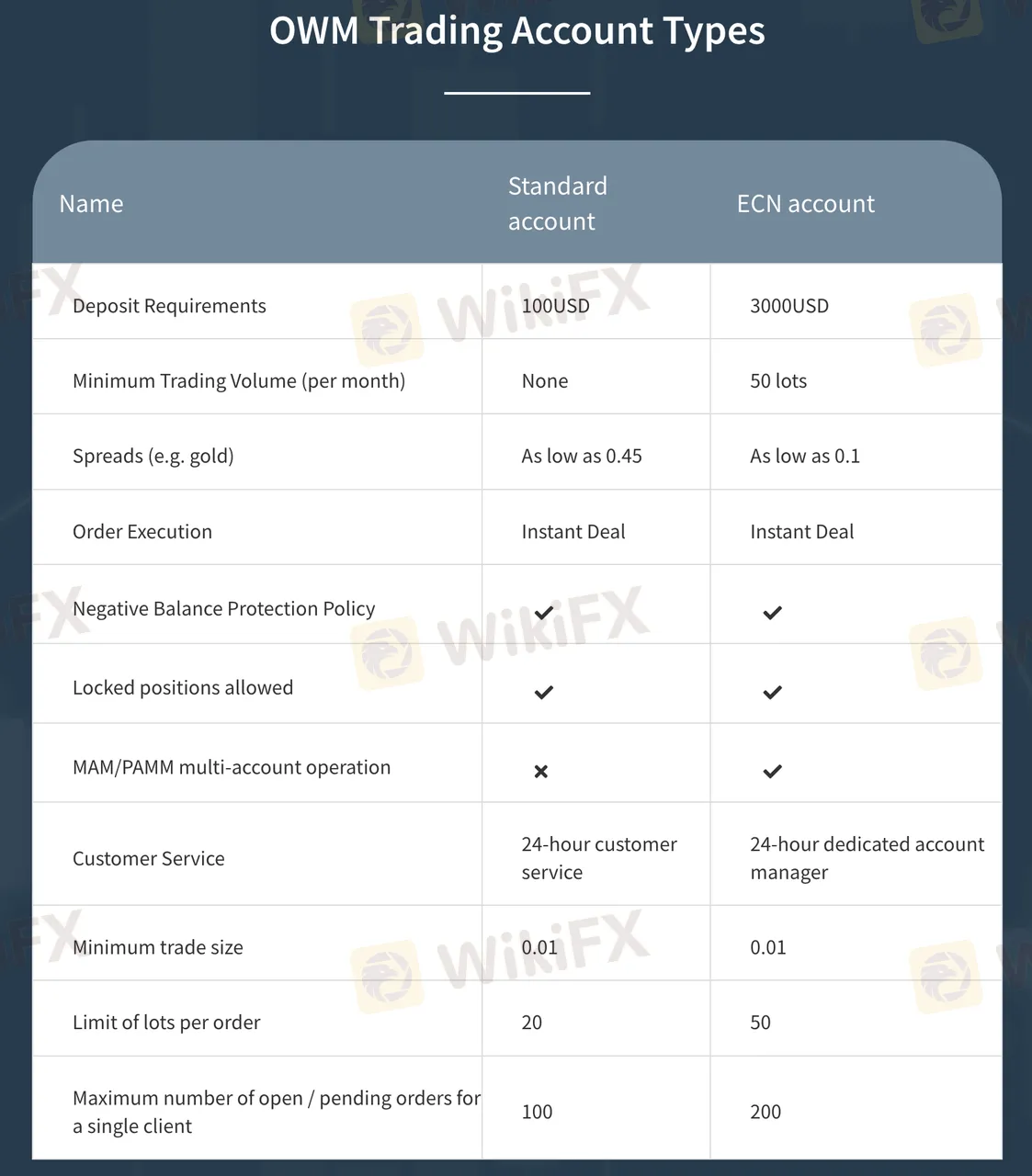

OWM offers two main types of trading accounts to cater to the diverse needs of its clients: the Standard account and the ECN account.

1. Standard Account: This is the basic account type at OWM, requiring a minimum deposit of $100. It does not impose a minimum trading volume per month, making it suitable for traders with varying levels of experience. The spreads on this account type are as low as 0.45 pips for instruments like gold. OWM provides negative balance protection on standard accounts, preventing traders from incurring more significant losses than their initial deposits. Additionally, traders with standard accounts can execute instant deals and hold locked positions.

2. ECN Account: The ECN account is designed for more advanced and active traders. It necessitates a higher minimum deposit of $3,000 and a minimum trading volume of 50 lots per month. Spreads are even tighter on this account, starting as low as 0.1 pips for gold. Like the standard account, ECN account holders also benefit from negative balance protection and are allowed to execute instant deals and hold locked positions. However, the ECN account offers the additional feature of Multi-Account Manager (MAM)/Percent Allocation Management Module (PAMM) functionality, allowing traders to manage multiple accounts efficiently.

Both account types come with 24-hour customer service, ensuring that clients can access assistance around the clock. The minimum trade size for both account types is 0.01 lots, and traders can place a maximum of 20 lots per order on a standard account and 50 lots per order on an ECN account. Each client can have up to 100 open or pending orders with a standard account and up to 200 with an ECN account. The choice between these two account types depends on a trader's experience level, trading volume, and specific requirements.

How to Open an Account?

To open an account with OWM, follow these steps.

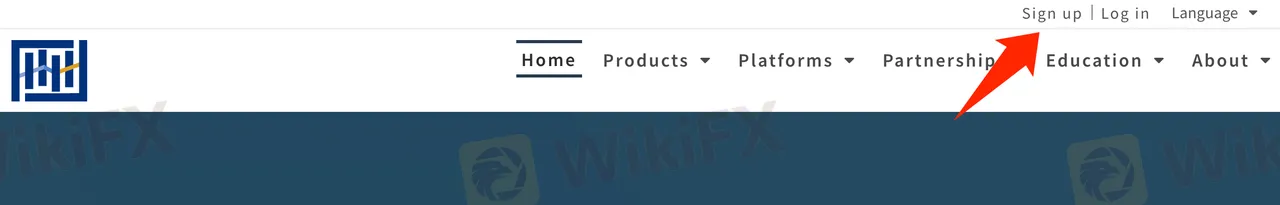

Visit the OWM website. Look for the “Sign up” button on the homepage and click on it.

2. Sign up on websites registration page.

3. Receive your personal account login from an automated email

4. Log in

5. Proceed to deposit funds to your account

6. Download the platform and start trading

Leverage

OWM provides traders with access to leverage, which can significantly amplify their trading potential. In the world of forex trading, the broker offers leverage of up to 400:1. This means that for every $1,000 in a trader's account, they can control a position worth up to $400,000. This level of leverage is notably higher than what is typically available in stock trading, where it's often 2:1 or 4:1, making forex trading a more cost-effective choice for traders with limited capital.

Leverage, however, comes with a double-edged sword. While it has the potential to magnify profits, it also magnifies losses. Traders must exercise caution and use leverage wisely to manage their risk effectively. It's crucial to understand the implications of trading with leverage and only engage in leveraged trading if you are fully aware of the associated risks and can afford to do so. OWM also offers leverage of up to 100 times on CFD contracts, which can further enhance traders' trading capabilities, but again, it's essential to approach this with a sound risk management strategy.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | OWM | FxPro | VantageFX | RoboForex |

| Maximum Leverage | 1:400 | 1:200 | 1:500 | 1:2000 |

Spreads and Commissions (Trading Fees)

OWM offers two distinct account types, each with varying spreads and potential commission structures. The Standard account presents spreads that start at 0.45 pips for instruments like gold. However, OWM does not explicitly detail the commission rates for this account type. Traders considering the Standard account should contact OWM directly to acquire precise commission information.

For traders in search of narrower spreads, OWM provides an ECN account. This account type features highly competitive spreads, commencing at 0.1 pips, particularly for assets like gold. Like the Standard account, explicit commission rates for the ECN account are not provided in the available information. Consequently, traders interested in the ECN account should reach out to OWM directly to obtain a comprehensive understanding of the associated commission structure.

Having a clear understanding of spreads and commissions is crucial for traders to effectively manage their trading costs and to make well-informed decisions regarding their trading strategies. While OWM's pricing may seem advantageous, obtaining detailed commission information, especially for the ECN account, is essential for traders to evaluate the overall cost structure of their trades.

Deposit & Withdraw Methods

The official website of OWM does not provide specific information regarding deposit and withdrawal methods. For accurate and up-to-date information on deposit and withdrawal options, it is advisable to contact their customer support. You can typically find contact details for customer support on the broker's website. They will be able to guide you on the available methods, associated fees, and processing times to facilitate your financial transactions with the broker.

Trading Platforms

OWM offers the MetaTrader 4 (MT4) trading platform to its clients. MT4 is a popular and widely recognized trading platform known for its powerful features and user-friendly interface. Traders using MT4 can benefit from advanced charting tools, a wide array of technical indicators, and the ability to automate their trading strategies with the help of Expert Advisors (EAs). The platform is accessible on various devices, including desktop computers, web browsers, and mobile applications, providing traders with flexibility in monitoring and managing their trades from virtually anywhere.

MetaTrader 4 is known for its stability, security, and robust analytical capabilities, making it a suitable choice for traders of varying experience levels. The platform also supports one-click trading, multiple timeframes, and a variety of order types, enhancing the trading experience. Additionally, it offers a straightforward and efficient way to execute trades, manage portfolios, and analyze market data, making it a reliable tool for traders looking to engage in different markets, including forex, commodities, stock indices, and shares CFDs.

Customer Support

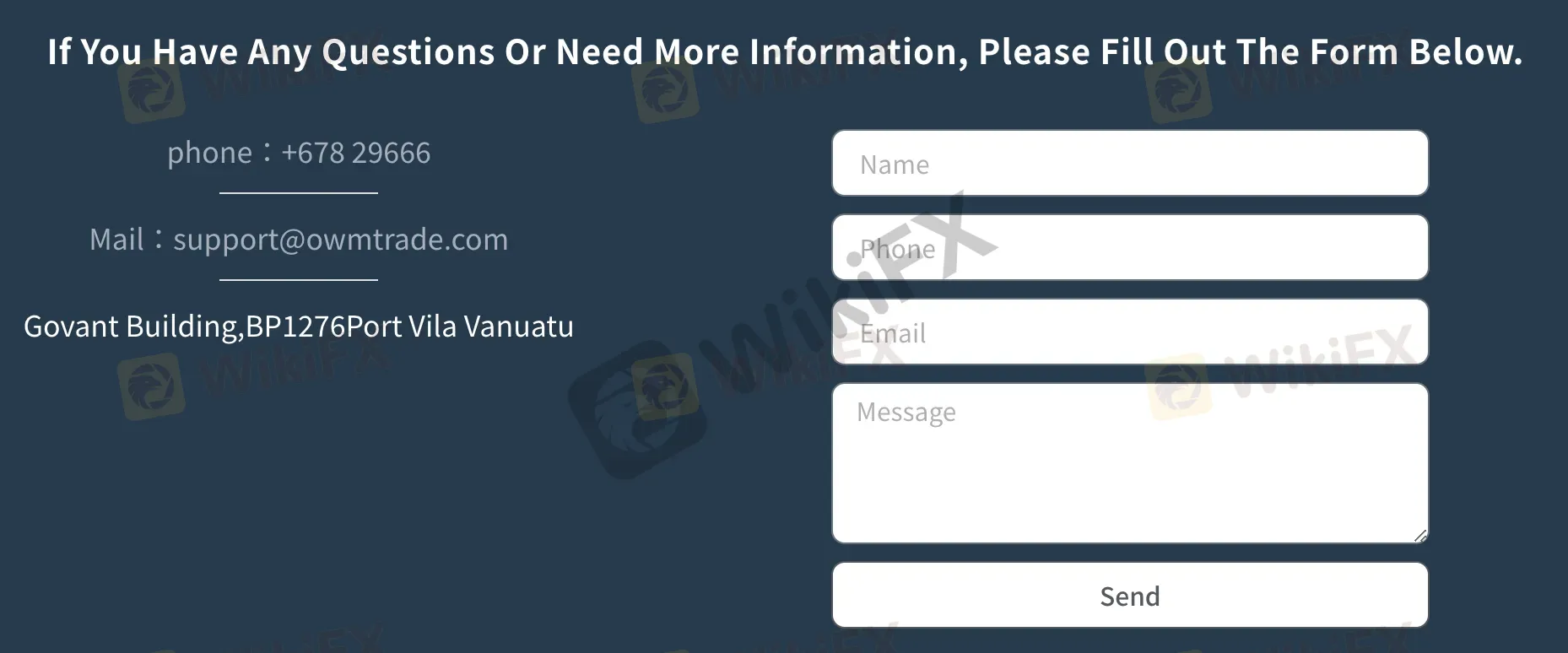

OWM offers multiple avenues for customer support to cater to the diverse needs of its clients. You can reach out to their support team via a live chat feature, providing you with real-time assistance and quick answers to your queries. Additionally, they offer telephone support, and you can contact them at +678 29666 for more direct and immediate communication.

For those who prefer email correspondence, OWM provides an email address, support@owmtrade.com, through which you can contact their customer support. This option allows you to send detailed inquiries or requests at your convenience, and you can expect a response in a timely manner.

Furthermore, OWM lists its physical address at Govant Building, BP1276, Port Vila, Vanuatu. While you may not typically visit their office in person for support, having a physical location can provide a sense of transparency and credibility.

The broker also offers a web-based contact form that you can fill out with your name, phone number, email address, and a message. This form is a convenient way to reach out to their customer support team, and it allows you to specify your inquiries or concerns in detail.

Educational Resources

OWM offers a variety of educational resources designed to help traders improve their skills and knowledge. These resources include:

1. Terminology: OWM provides a section dedicated to trading and financial terminology. This resource is valuable for traders, especially beginners, as it helps them understand the specific language used in the trading industry.

2. Guides: OWM's guides cover a wide range of topics, from the basics of trading to more advanced strategies and risk management. These guides are beneficial for traders at all levels who want to enhance their trading skills.

3. Daily News: Staying informed about market news and events is essential for making informed trading decisions. OWM's daily news section keeps traders updated with relevant news articles, economic reports, and global events that may impact financial markets.

4. Analysis: The analysis section offers technical and fundamental analysis reports. Technical analysis involves the study of price charts and patterns, while fundamental analysis considers economic, political, and social factors influencing asset prices. These analyses help traders formulate strategies and identify potential trading opportunities.

Conclusion

OWM presents a spectrum of trading opportunities through various instruments and a high leverage option, supported by the robust MetaTrader 4 platform. However, a cloud of uncertainty hovers due to its unverified regulation status, urging potential investors to tread with caution. The lack of clarity on certain operational aspects, like commissions and deposit methods, also calls for enhanced transparency to bolster trader confidence and decision-making.

FAQs

Q: Is OWM a regulated broker?

A: OWMs regulatory status is currently unverified, and there is ambiguity regarding its legitimacy.

Q: What types of trading accounts are available at OWM?

A: OWM provides two account types: Standard and ECN, each catering to different trader needs and experiences.

Q: What trading platforms does OWM offer?

A: OWM offers the MetaTrader 4 trading platform, known for its versatility and comprehensive trading tools.

Q: What is the maximum leverage offered by OWM?

A: OWM offers a maximum leverage of up to 400:1, allowing traders to manage larger positions with relatively smaller capital.

Q: What educational resources does OWM provide?

A: OWM offers educational resources such as terminology guides, daily news, and analysis to assist traders in improving their trading knowledge and strategies.

News

No Data