Company Summary

| Aspect | Information |

| Registered Country/Area | Mauritius |

| Founded Year | 2-5 years |

| Company Name | Capitist |

| Regulation | Financial Services Commission (FSC) of Mauritius, Retail Forex License with license number GB21026886 (Offshore Regulation) |

| Minimum Deposit | $100 for Micro Account, $5,000 for Capitist Premium, $20,000 for Professional Account, $500,000 for Institutional Account |

| Maximum Leverage | Varies across different markets and instruments |

| Spreads | Micro Account: Starting from 2.0 pips; Capitist Premium: Starting from 1.6 pips; Professional Account: Starting from 0.8 pips; Institutional Account: Starting from 0.0 pips (indicating potential absence of spread markup) |

| Trading Platforms | MetaTrader 5 |

| Tradable Assets | Currencies, Commodities, Cryptocurrencies, Stocks |

| Account Types | Micro Account, Capitist Premium, Professional Account, Institutional Account |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | 24/5 customer support via phone, email, and live chat |

| Payment Methods | Bitcoin, Ethereum, bank transfer, Visa, Mastercard, USDT |

| Educational Tools | Beginner, intermediate, and advanced videos in the Education Center |

General Information

Capitist is a registered company based in Mauritius and has been founded within the last 2-5 years. It is regulated by the Financial Services Commission (FSC) of Mauritius and holds a retail forex license. Capitist offers different account types, including Micro, Capitist Premium, Professional, and Institutional accounts, catering to traders with various capital levels and trading experience.

The trading platform provided by Capitist is MetaTrader 5, which offers advanced trading features, customization options, and mobile accessibility. Traders can access a wide range of tradable assets, including currencies, commodities, cryptocurrencies, and stocks. Capitist provides educational resources in the form of beginner, intermediate, and advanced videos to help traders enhance their knowledge and skills.

Deposits and withdrawals on Capitist can be made using various methods such as Bitcoin, Ethereum, bank transfer, Visa, Mastercard, and USDT. The platform has different spreads depending on the account type chosen, starting from 2.0 pips for the Micro Account. Capitist offers leverage, allowing traders to amplify their trading positions and potentially increase their profits.

While Capitist is regulated, it's important for traders to be aware of the associated risks of trading under offshore regulations. It is recommended to conduct thorough research, review terms and conditions, and consider the risks involved before engaging in any trading activities. Traders should also seek professional advice or consult relevant financial authorities for a comprehensive understanding of the regulatory framework and the protection it provides.

Overall, Capitist aims to provide a comprehensive trading experience with a range of features, account types, and tradable assets, supported by customer support available 24/5.

Pros and Cons

Capitist offers several advantages to traders. Firstly, it is regulated by the Financial Services Commission (FSC) of Mauritius, ensuring that it operates within the legal framework and complies with financial regulations. The availability of multiple account types, including Micro Account, Capitist Premium, Professional Account, and Institutional Account, allows traders to choose an account that suits their trading style and capital level. The trading platform, MetaTrader 5, offers advanced features and customization options, enabling traders to perform technical analysis and automate their trading strategies. Capitist also provides access to a wide range of tradable assets, including currencies, commodities, cryptocurrencies, and stocks. Moreover, the customer support is available 24/5 via phone, email, and live chat.

However, there are some potential drawbacks to consider. One concern is that Capitist operates under offshore regulation, which may entail associated risks. The lack of information about Islamic accounts may be a disadvantage for traders who require such accounts. Additionally, while Capitist offers various payment methods, the absence of specific details about fees and transaction processing times for each method makes it difficult to assess the cost and convenience of deposits and withdrawals. Traders should also be aware that leverage availability and maximum leverage ratios vary across different markets and instruments.

| Pros | Cons |

| Regulated by FSC of Mauritius | Potential risks of offshore regulation |

| Multiple account options | Limited information on Islamic account availability |

| Access to MetaTrader 5 | Lack of detailed educational tools |

| Support for various payment methods | Lack of information on customer support response time |

| Wide range of tradable assets | Lack of information on leverage options |

| Demo account available | Limited information on spreads for each account type |

| Customizable trading platform | Limited information on fees for certain transactions |

| Copy trading feature | Limited information on withdrawal processing times |

Is Capitist Legit?

Capitist is regulated by the Financial Services Commission (FSC) of Mauritius. They hold a retail forex license with license number GB21026886. The regulation ensures that Capitist operates within the legal framework and complies with the necessary financial regulations and requirements.

It's important to note that the FSC regulation of Capitist is classified as an offshore regulation. This means that while the company is regulated, traders should be aware of the associated risks that may come with trading under offshore regulations.

Before engaging in any trading activities, it is recommended to conduct thorough research, review the terms and conditions, and consider the risks involved. It's also advisable to seek professional advice or consult relevant financial authorities to ensure a comprehensive understanding of the regulatory framework and the protection it provides to traders.

Market Instruments

Capitist provides access to a wide range of market instruments, allowing traders to invest in various financial assets. Here is a description of the market instruments available on Capitist:

1. CURRENCIES:

Capitist offers trading opportunities in the world's most popular currencies. This includes major currency pairs such as EUR/USD, GBP/USD, USD/JPY, and more. Traders can take advantage of fluctuations in exchange rates between different currencies to potentially profit from currency movements.

2. COMMODITIES:

Capitist allows traders to invest in commodities, which are physical or raw materials that can be traded on the market. This includes popular commodities such as gold, silver, crude oil, natural gas, and agricultural products like wheat or corn. Commodities can provide diversification and act as a hedge against inflation.

3. CRYPTOCURRENCIES:

Traders on Capitist can also participate in the growing market of cryptocurrencies. This includes popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and many others. Cryptocurrencies offer unique trading opportunities due to their high volatility and potential for significant price movements.

4. STOCKS:

Capitist enables traders to invest in stocks, allowing them to buy and sell shares of renowned companies. This includes stocks of companies like Facebook, Tesla, Amazon, and more. By trading stocks, traders can take part in the equity markets and potentially benefit from price fluctuations and dividend income.

| Pros | Cons |

| Access to a wide range of market instruments | Potential risk associated with market volatility |

| Opportunity to trade major currency pairs | Fluctuations in exchange rates may lead to potential losses |

| Investment diversification through commodities | Commodities can be influenced by unpredictable factors like weather or geopolitical events |

| Participation in the growing market of cryptocurrencies | High volatility in cryptocurrencies can lead to substantial gains or losses |

| Opportunity to invest in renowned companies through stocks | Stock prices can be influenced by various factors, including company performance and market conditions |

Account Types

Capitist offers different account types tailored to accommodate various trading styles and capital levels. Here is a description of the different account types:

1. MICRO ACCOUNT:

The Micro Account is designed for traders who are starting with a smaller capital base. The minimum deposit required for this account type is $100. It offers spreads starting from 2.0 pips. Spreads represent the difference between the buy and sell price of a financial instrument, and a lower spread can potentially result in reduced trading costs. The Micro Account is suitable for amateur traders or those who prefer to trade with lower volumes.

2. CAPITIST PREMIUM:

Capitist Premium account is aimed at traders who have a higher level of trading experience and are willing to invest a larger amount of capital. The minimum deposit for the Capitist Premium account is $5,000. This account type offers spreads starting from 1.6 pips. The lower spreads can provide traders with better trading conditions, potentially enhancing their profitability.

3. PROFESSIONAL ACCOUNT:

The Professional Account is designed for experienced traders with substantial trading capital. It requires a minimum deposit of $20,000. This account type offers even spreads starting from 0.8 pips. The Professional Account provides access to enhanced trading features, advanced tools, and personalized services. It caters to traders who have a high level of trading expertise and require more sophisticated trading conditions.

4. INSTITUTIONAL ACCOUNT:

The Institutional Account is tailored for institutional clients, such as hedge funds, asset managers, or large-scale investors. This account type requires a minimum deposit of $500,000. With an Institutional Account, traders can enjoy spreads starting from 0.0 pips, indicating that there may be no spread markup on certain instruments. The Institutional Account offers access to institutional-grade liquidity, advanced trading solutions, and customized services to meet the specific needs of institutional traders.

Each account type provides varying features and benefits suited to different trading preferences and capital levels. Traders can choose the account type that aligns with their trading style, experience, and financial resources. It is important to carefully consider the features and requirements of each account type before selecting the most suitable option for your trading needs.

| Pros | Cons |

| Variety of account types to suit different trading styles and capital levels | Higher minimum deposit requirements for higher-tier accounts |

| Lower spreads for higher-tier accounts | Potential higher costs for lower-tier accounts due to wider spreads |

| Access to advanced tools and personalized services for higher-tier accounts | Limited benefits and features for lower-tier accounts |

| Institutional-grade liquidity for Institutional Account | High minimum deposit requirement for Institutional Account |

| Caters to traders with different levels of experience and expertise | Potential limitations on trading volume or position size for lower-tier accounts |

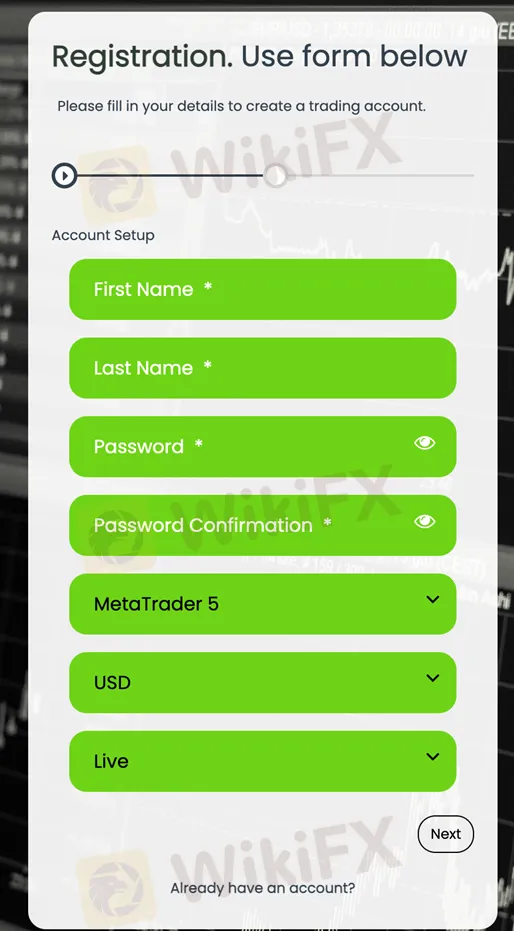

How to Open an Account?

To open an account with Capitist, follow these steps:

1. Visit the Capitist website and navigate to the “Accounts” section.

2. Click on the “Quick Registration” button or the registration form provided.

3. Fill in the required information in the account setup form. Provide your first name, last name, desired password, and confirm the password.

4. Select MetaTrader 5 as the preferred trading platform.

5. Choose the currency for your account, such as USD (United States Dollar).

6. Select the account type, such as “Live” for a real trading account.

Leverage

Leverage is a feature offered by Capitist that allows traders to amplify their trading positions and potentially increase their profits. Capitist offers leverage in various trading markets, including commodities, currencies, and stocks.

In commodities trading, leveraging enables traders to minimize their investment by using a fraction of the full amount. For example, with a 100:1 leverage, a trader would only need to pay a 100th of the total investment. This means that even with a small initial investment, traders can potentially earn significant profits if their predictions on price movements are correct.

In currency trading, leveraging allows traders to borrow money from Capitist, enabling them to trade larger positions in a currency pair. With leverage, a small amount of capital can control a much larger position. For instance, with a 100:1 leverage, a $1000 margin can enable a trader to trade up to $100,000 worth of currency. As a result, even small price movements can lead to substantial profits.

Similarly, in stock trading, leverage can be used to trade larger positions without investing the full amount. For example, if a trader buys 1 share of TSLA stock for $1000 with a 1:2 leverage, they would contribute $500 of their own money and borrow an additional $500 from Capitist. If the stock price reaches $1500 as predicted, the trader would earn a 100% return on their investment, effectively doubling their initial investment.

Spreads

Capitist offers different spreads depending on the account type chosen. The Micro Account has spreads starting from 2.0 pips, while the Capitist Premium account offers spreads starting from 1.6 pips. For experienced traders, the Professional Account provides even spreads starting from 0.8 pips. The Institutional Account, designed for institutional clients, offers spreads starting from 0.0 pips, indicating that there may be no spread markup on certain instruments.

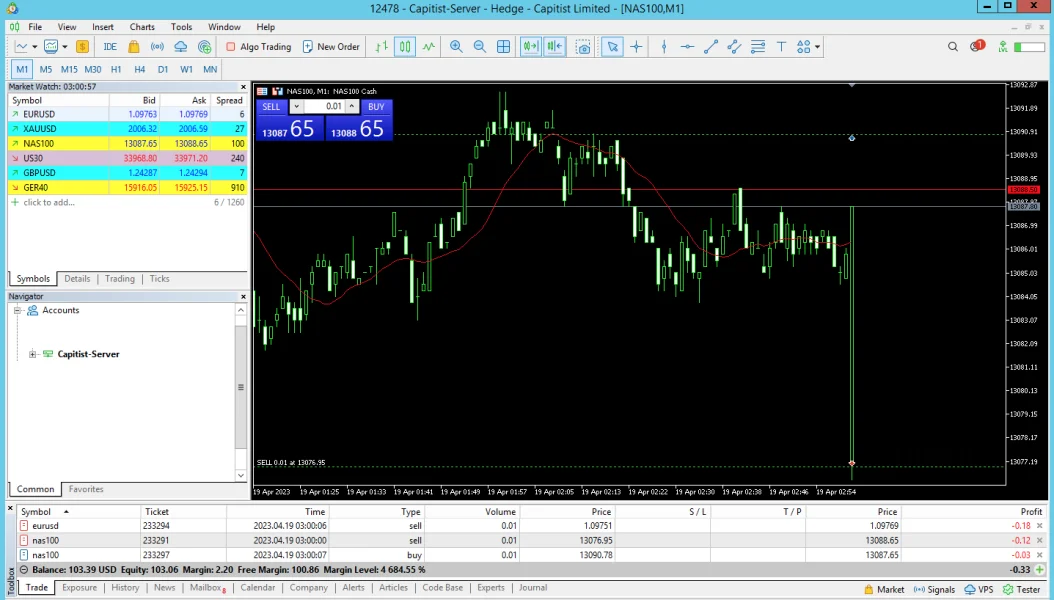

TRADING PLATFORM AVAILABLE

Capitist utilizes MetaTrader 5 as its trading platform, catering to both beginner and experienced traders. MetaTrader 5 offers advanced electronic trading platforms and innovative mobile apps, providing traders with a comprehensive set of tools to meet their trading needs. Here are some key features of the MetaTrader 5 trading platform:

1.Technical Analysis: MetaTrader 5 is equipped with the latest technical analysis tools, including over 80 technical indicators and 21 different time frames. Traders can perform detailed analysis of price movements, utilize charts, and apply a wide range of technical indicators to make informed trading decisions.

2. Customization Options: The platform allows traders to customize their trading environment to suit their specific preferences. Traders can personalize the platform, choose their preferred chart layouts, and create customized trading templates to streamline their trading activities.

3. Access to Multiple Markets: MetaTrader 5 provides access to a broad range of financial markets, including currencies, commodities, cryptocurrencies, and stocks. Traders can trade various instruments from a single platform, enabling diversification and the opportunity to capitalize on different market trends.

4. Trading Systems: MetaTrader 5 supports advanced algorithmic trading, enabling traders to automate their trading strategies and implement expert advisors (EAs).

5. Mobile Trading: MetaTrader 5's mobile apps enable traders to access the platform and trade on the go. Traders can monitor the markets, execute trades, and manage their portfolios directly from their smartphones or tablets, ensuring they stay connected and responsive to market movements.

6. Copy Trading: MetaTrader 5 facilitates copy trading, allowing traders to copy and execute trades of successful traders. This feature enables novice traders to learn from experienced traders and potentially replicate their success.

Overall, MetaTrader 5 provides a user-friendly and feature-rich trading platform that empowers traders with advanced tools and flexibility to trade in various markets. With its technical analysis capabilities, customization options, and mobile accessibility, MetaTrader 5 offers a comprehensive trading experience for traders of all levels.

| Pros | Cons |

| Technical analysis tools | Potential learning curve for beginners |

| Customization options for personalized trading | May require additional software installation |

| Access to multiple financial markets | Relatively high system requirements |

| Support for algorithmic trading and expert advisors | Limited information on additional platform features |

| Mobile trading for on-the-go accessibility | Possible dependency on stable internet connection |

| Copy trading feature to learn from successful traders |

Deposit and Withdrawal

Deposits and withdrawals are important aspects of the Capitist trading platform. Here is a description of the deposit and withdrawal process:

Deposits:

To start trading on Capitist, you need to make a deposit. You can add the desired amount you wish to deposit using your preferred payment method. Capitist accepts deposits in various currencies such as USD, EUR, and GBP. The minimum deposit amount is $20. You can choose from different payment methods including Bitcoin, Ethereum, bank transfer, Visa, Mastercard, and USDT. Once you have made the deposit, you can begin investing and expanding your portfolio.

Withdrawals:

Capitist provides quick and easy withdrawal options for traders. When you want to make a withdrawal, you need to select the trading account from which you wish to withdraw funds. Then, specify the amount you want to withdraw. Capitist offers various methods for withdrawals, including Bitcoin, Ethereum, bank transfer, Visa, Mastercard, and USDT. The withdrawal processing time may vary depending on the method chosen. Bitcoin, Ethereum, Visa, Mastercard, and USDT withdrawals are usually processed within 24 hours, while bank transfers may take 3 to 5 business days for processing. Capitist does not charge any fees for withdrawals.

Withdrawal Process:

Once you have requested a withdrawal, the funds will be returned to your designated bank account, which you can set up in your Client Portal. It's important to note that Capitist generally does not accept joint bank accounts for deposits and withdrawals, unless a joint trading account is registered with them. This ensures the security and integrity of the withdrawal process.

| Pros | Cons |

| Multiple payment methods | Potential delays for bank transfers |

| Accepts various currencies | Limited information on withdrawal processing times |

| Quick and easy withdrawals | No support for joint bank accounts |

| No withdrawal fees | Limited information on withdrawal limits |

| Limited information on supported cryptocurrencies |

Trading Tools

Capitist provides two trading tools to assist traders in their decision-making process:

1. TRADING IDEAS: Capitist offers trading ideas that provide insights and analysis on specific assets. These trading ideas present information about recent market movements and indicators that may impact the asset's price. For example, the NIO trading idea states that shares of NIO experienced a 3.7% decline in the last session, and the Stochastic indicator is giving a negative signal. This information can help traders assess the current market sentiment and make informed trading decisions. The trading ideas also include support and resistance levels, which indicate price ranges where the asset is expected to encounter buying or selling pressure.

2. ECONOMIC CALENDAR: Capitist provides an economic calendar that offers a schedule of important economic events and data releases. These events can have a significant impact on the financial markets, including currencies, commodities, and stocks. Traders can refer to the economic calendar to stay informed about upcoming events such as central bank announcements, economic reports, and geopolitical developments. By staying aware of these events, traders can anticipate market volatility and adjust their trading strategies accordingly.

Educational Resources

VIDEO URL: https://client.capitist.com/beginner-videos

Capitist provides an Education Center with educational resources for traders. It includes beginner, intermediate, and advanced videos. The beginner videos cover fundamental trading concepts, while intermediate videos delve into strategies and techniques. Advanced videos focus on complex strategies and market analysis. These resources aim to enhance traders' knowledge and skills at different stages of their trading journey.

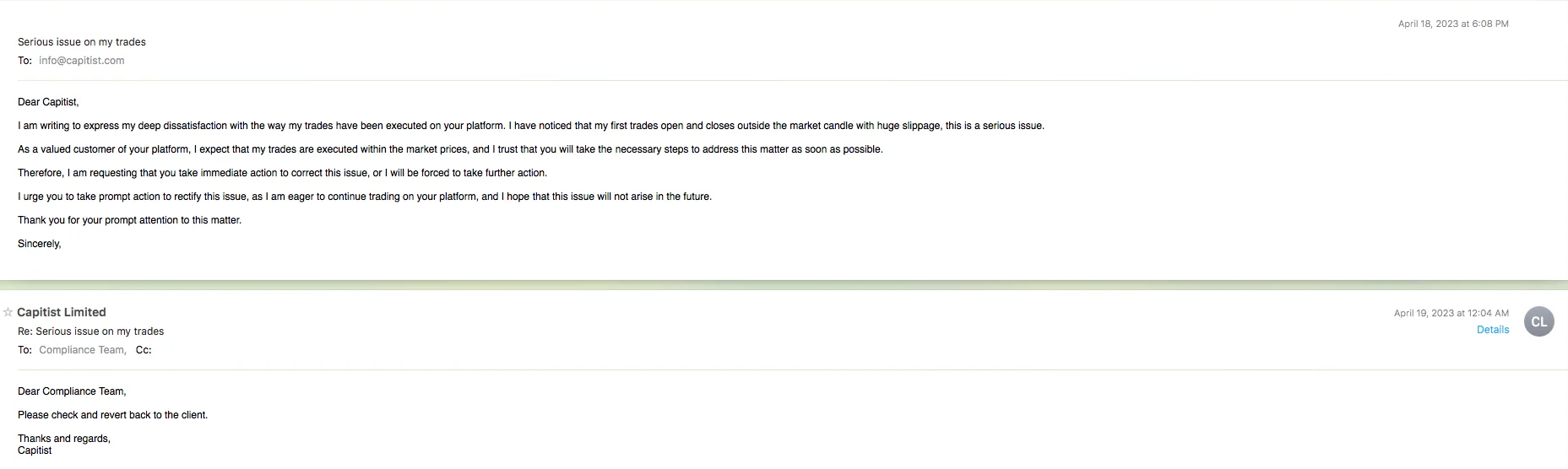

Customer Support

Capitist offers a customer support team that is available 24/5 to assist users with any inquiries or requests they may have. Traders can reach out to the customer support team through various channels, including phone calls, email, and live chat. This allows for timely communication with the support team.

For email inquiries, users can contact Capitist's customer support team at info@capitist.com. Additionally, phone numbers are provided for different regions, including the UK (+44 20 4520 0288), UAE (+971 4 341 0033), and SA (+27 105004000). These contact options enable traders to reach out to customer support in their preferred manner, ensuring efficient and personalized assistance.

Conclusion

In conclusion, Capitist is a regulated trading platform based in Mauritius, authorized by the Financial Services Commission (FSC). It offers a variety of account types, including Micro Account, Capitist Premium, Professional Account, and Institutional Account, catering to traders with different levels of experience and capital. The platform provides access to a wide range of tradable assets, including currencies, commodities, cryptocurrencies, and stocks, allowing traders to diversify their portfolios. Capitist utilizes the MetaTrader 5 trading platform, which offers advanced technical analysis tools, customization options, and mobile trading capabilities. The platform also provides trading ideas and an economic calendar to assist traders in their decision-making process. While Capitist offers several advantages, such as regulatory oversight and a comprehensive trading platform, traders should be aware of the associated risks of trading under offshore regulation and conduct thorough research before engaging in trading activities.

FAQs

Q: Is Capitist regulated?

A: Yes, Capitist is regulated by the Financial Services Commission (FSC) of Mauritius. They hold a retail forex license with license number GB21026886.

Q: What market instruments are available on Capitist?

A: Capitist provides access to various market instruments, including currencies, commodities, cryptocurrencies, and stocks.

Q: What are the different account types offered by Capitist?

A: Capitist offers Micro, Capitist Premium, Professional, and Institutional accounts, each catering to different trading styles and capital levels.

Q: How can I open an account with Capitist?

A: To open an account, visit the Capitist website, navigate to the “Accounts” section, and complete the registration process by providing the necessary information and selecting the desired account type.

Q: What is leverage, and how does it work on Capitist?

A: Leverage allows traders to amplify their trading positions. Capitist offers leverage in various markets, enabling traders to trade larger positions with a smaller initial investment. However, leverage also increases the potential risks and losses.

Q: What is the deposit and withdrawal process on Capitist?

A: Traders can deposit funds into their Capitist account using various payment methods, including cryptocurrencies, bank transfers, and card payments. Withdrawals can be made using the same methods, and Capitist generally processes them within a specific timeframe.

Q: Which trading platform does Capitist use?

A: Capitist uses the MetaTrader 5 trading platform, which offers advanced features, customization options, and mobile trading capabilities.

Q: What trading tools are available on Capitist?

A: Capitist provides trading ideas and an economic calendar to assist traders in making informed decisions based on market analysis and upcoming economic events.

Q: Does Capitist offer educational resources?

A: Yes, Capitist provides an Education Center with beginner, intermediate, and advanced videos covering various trading topics and strategies.

Q: How can I contact Capitist's customer support?

A: Capitist's customer support team can be reached 24/5 via phone, email (info@capitist.com), and live chat for assistance and inquiries. Regional phone numbers are available for different locations.