Company Summary

| Next Capital Review Summary | |

| Region/Country | Pakistan |

| Founded | 2009 |

| Regulation | No regulation |

| Services | Investment Banking, Institutional Brokerage, Retail Investing, Equity Research |

| Trading Platforms | Eclipse Trading Terminal, NextCapital |

| Minimum Deposit | PKR 5,000 |

| Commission | Stock: 0.03 Paisa per share for share value ranging Rs. 0.01-20; 0.15% for share value over Rs. 20, etc. |

| Customer Support | Address, phone, email, social media, FAQ |

Next Capital Information

Next Capital, established in 2009 in Pakistan and listed since 2012, is a member of Pakistan Stock Exchange and Pakistan Mercantile Exchange. It is a full-service brokerage and investment banking advisory firm who offers a wide range of financial services to clients, including investment banking, institutional brokerage, retail investing, and equity research.

The firm provides multiple trading platforms and transparent fee structures to accommodate various investment needs. However, investors should be aware of concerns regarding its lack of regulatory oversight, which can pose significant risks and warrant careful consideration.

In the following article, we will analyse the characteristics of this company in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

Pros & Cons

| Pros | Cons |

| Comprehensive Financial Services | Lack of Regulatory Oversight |

| Multiple Trading Platforms | Uncertain MT5 Availability |

| Transparent Fee Structure | |

| Joint Account Option |

Pros:

Comprehensive Financial Services: Next Capital offers a wide range of financial services including investment banking, institutional brokerage, retail investing, and equity research.

Multiple Trading Platforms: They provide various trading platforms such as the Eclipse Trading Terminal for desktops and mobile apps for Android and iPhone.

Transparent Fee Structure: Next Capital maintains a transparent fee structure, detailing commissions for stock trading and other financial transactions.

Joint Account Option: Clients can open joint accounts for up to four individuals, facilitating shared investments and management.

Cons:

Lack of Regulatory Oversight: One of the significant concerns is the absence of regulatory oversight, which can pose risks regarding investor protection and financial transparency.

Uncertain MT5 Availability: Although claimed, the availability of the MT5 trading platform is not confirmed with a download link on their website, which inconveniences traders looking for this platforms.

Is Next Capital Legit?

When considering the safety of a brokerage like Next Capital or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

- Regulatory sight: The broker's current operation without legitimate regulatory oversight only fuels concerns about its legitimacy and trustworthiness. These worries are compounded by the broker's inaccessible website.

- User feedback: To get a deeper understanding of the exchange, it is suggested that traders explore reviews and feedbacks from existing clients. These shared insights and experiences from users can be accessed on reputable websites and discussion platforms.

- Security measures: So far we have not found any security measures from the company's website. It is recommended for you to seek for clarification before step into actual trading to ensure your assets are properly protected.

In the end, choosing whether or not to engage in trading with Next Capital is an individual decision. We advise you carefully balance the risks and returns before committing to any actual trading activities.

Services

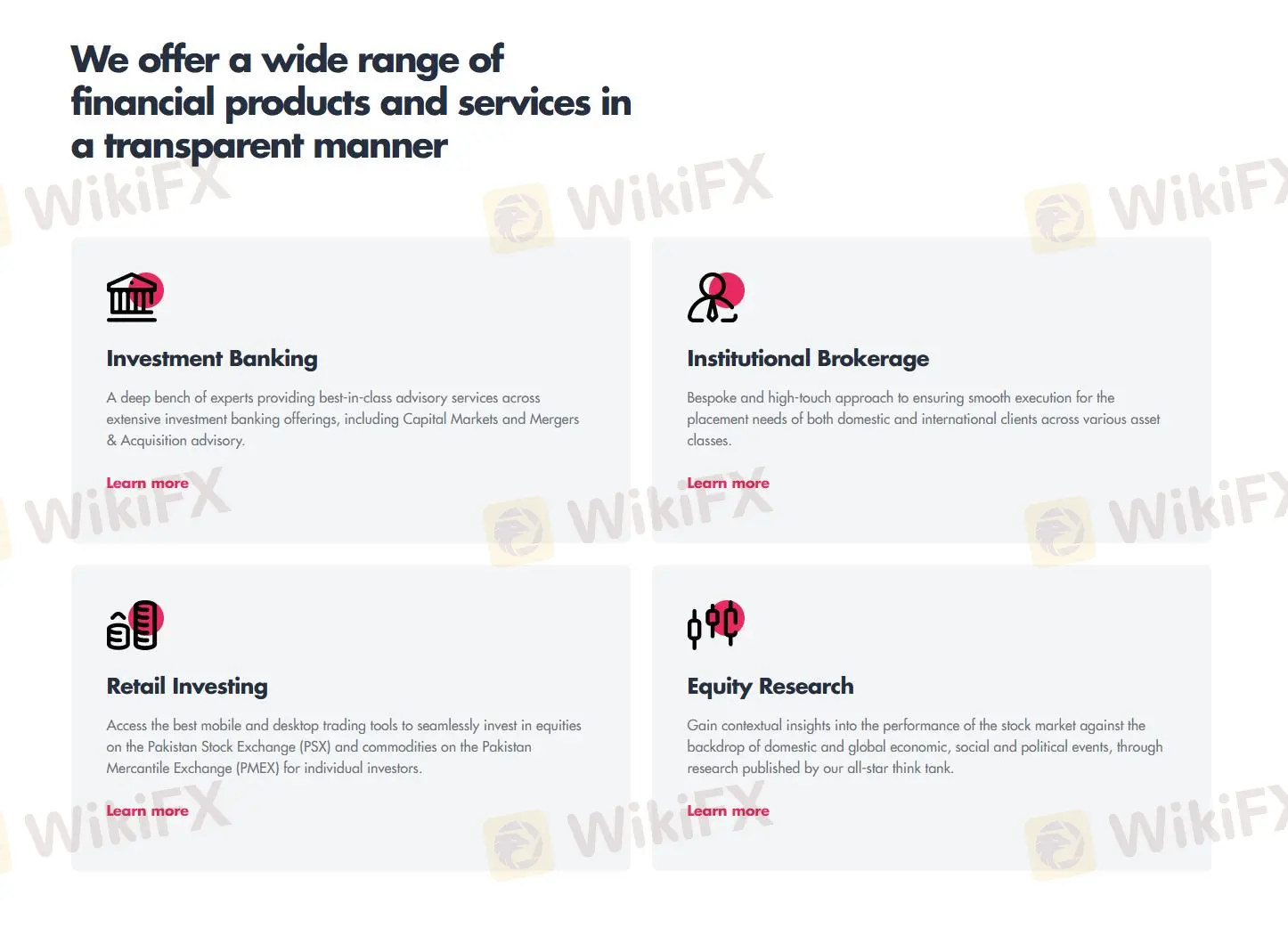

Next Capital offers a diverse range of services.

Retail Investing: The service provides access to a wide range of asset classes, including precious metals, oil, third currencies, agricultural commodities, and selected international indices offered on the PMEX, ensuring a broad spectrum of investment opportunities.

Investment Banking: Their services encompass business and financial advisory, M&A advisory, equity capital raising, debt capital raising, and financial restructuring, offering comprehensive support for corporate financial needs and strategic growth.

Institutional Brokerage: This category includes international equity sales, institutional equity sales, and fixed income sales, catering to the sophisticated requirements of institutional investors with a focus on maximizing returns and managing risks.

Equity Research: The division delivers in-depth analyses through various reports, including economy reports by Dr. Hafiz Pasha, strategy/economy reports, sector/company reports, weekly reports, market wrap-ups, and morning briefings, providing valuable insights and market intelligence to support informed investment decisions.

Account Types

Next Capital offers a range of account types to suit various client needs, including individual and corporate accounts, with a minimum deposit requirement of PKR 5,000.

They also provide the option to open joint accounts for up to four people. To open a joint account, each holder must fill out the online account opening form separately. Once completed, decide on the principal account holder and inform customer support of your intention to open a joint account. The customer support team will then handle the rest of the process, ensuring a smooth and efficient setup.

Trading Platform

Next Capital offers a variety of trading platforms.

The Eclipse Trading Terminal is available for both Windows and Mac, providing a robust and versatile desktop trading experience.

For mobile users, Next Capital offers apps for both Android and iPhone, allowing traders to manage their investments on the go with ease.

They also feature the popular stock tracking app “i-invest,” available on both Android and iOS, for monitoring stock performance and market trends.

Although the company claims to offer the popular MT5 platform, there is currently no download link available on their website, so it is recommended to contact them directly for more information on accessing this platform.

Fees

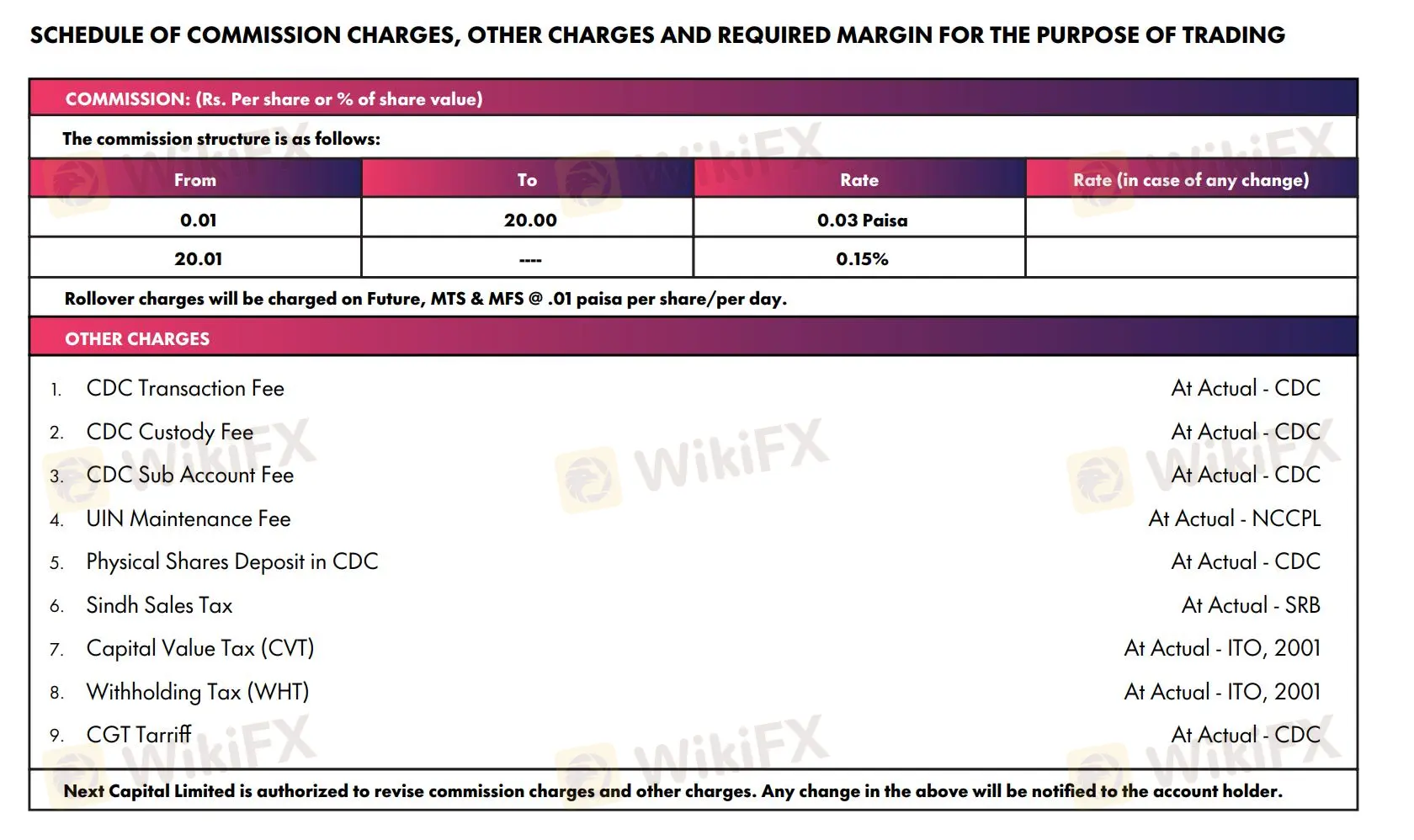

Next Capital has a comprehensive fee structure for trading stocks and other financial instruments.

For example, for stock trading, the commission rates are as follows: from Rs. 0.01 to Rs. 20.00, the rate is 0.03 paisa per share; for trades above Rs. 20.01, the rate is 0.15% of the share value.

Additionally, rollover charges of 0.01 paisa per share per day apply to Futures, MTS, and MFS.

Other charges include CDC transaction, custody, and sub-account fees, UIN maintenance, physical shares deposit, Sindh sales tax, capital value tax (CVT), withholding tax (WHT), and CGT tariff, all billed at actual costs.

The commission and other charges are subject to revision by Next Capital Limited, with any changes being notified to account holders.

For detailed information on commodities commissions, you can visit their website at https://cdn.prod.website-files.com/62135fdbd85a60c2f528095e/628b48851faf052d642de2bc_COMMISSION%20STRUCTURE.pdf.

Customer Service

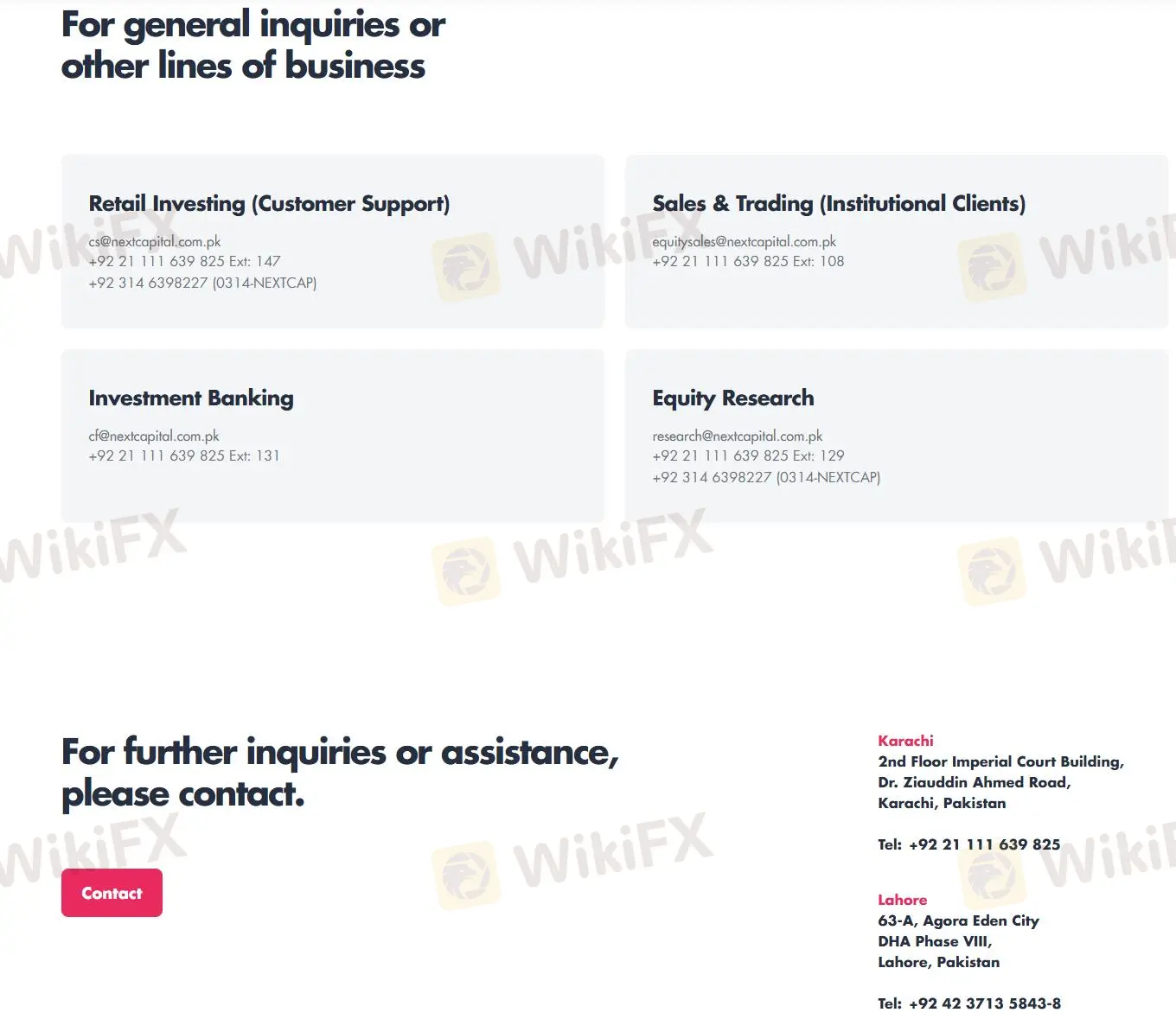

Next Capital offers customer service via multiple channels. Customers can contact them by visiting their offices, phone, email, and social media platforms such as Twitter, Instagram, LinkedIn and Facebook. Additionally, they provide an FAQ section on their website to address common queries and concerns.

- Karachi: 2nd Floor Imperial Court Building, Dr. Ziauddin Ahmed Road, Karachi, Pakistan.

Tel: +92 21 111 639 825

- Lahore: 63-A, Agora Eden City, DHA Phase VIII, Lahore, Pakistan.

Tel: +92 42 3713 5843-8

- Retail Investing (Customer Support)

Email: cs@nextcapital.com.pk; tel: +92 21 111 639 825 Ext: 147, +92 314 6398227 (0314-NEXTCAP)

- Sales & Trading (Institutional Clients)

Email: equitysales@nextcapital.com.pk; tel: +92 21 111 639 825 Ext: 108

- Investment Banking

Email: cf@nextcapital.com.pk; tel: +92 21 111 639 825 Ext: 131

- Equity Research

Email: research@nextcapital.com.pk; tel: +92 21 111 639 825 Ext: 129, +92 314 6398227 (0314-NEXTCAP)

Conclusion

In conclusion, Next Capital, a Pakistan-based brokerage firm, provides comprehensive financial services such as investment banking, institutional brokerage, retail investing, and equity research. However, the absence of regulatory oversight raises concerns for some investors.

Therefore, investors should proceed with caution, undertake their own research on the company, and consider alternative partners that offer stronger regulatory assurances, especially if regulatory oversight is a critical factor in their investment criteria.

Frequently Asked Questions (FAQs)

Is Next Capital regulated?

No. The broker is currently under no valid regulation.

Is Next Capital a good broker for beginners?

No, the company is not regulated by any authorities, which means it lacks the official oversight that typically provides investor protection, which is crucial for beginners and seasoned investors alike.

What is the minimum transfer amount does Next Capital request?

PKR 5,000.

What trading platforms does Next Capital offer?

Next Capital provides various trading platforms including the Eclipse Trading Terminal for Windows and Mac, as well as mobile apps for Android and iPhone. However, the availability of MT5 should be confirmed directly with them.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.