Company Summary

| Aspect | Information |

| Company Name | BINS Markets |

| Registered Country/Area | Marshall Islands |

| Founded Year | 2023 |

| Regulation | Unregulated |

| Market Instruments | Forex, Commodities, Indices, Stocks, ETFs |

| Account Types | Basic, Silver, Gold, Black |

| Minimum Deposit | $250 |

| Maximum Leverage | Up to x9 |

| Trading Platforms | cTrader |

| Customer Support | Phone at +52 55 4172 6262 or via email at customer@binsmarkets.com |

| Deposit & Withdrawal | Bank transfers, credit/debit cards, and popular electronic wallets like Skrill or Neteller |

| Educational Resources | E-books, blog, FAQ |

Overview of BINS Markets

BINS Markets, established in 2023 and headquartered in the Marshall Islands, operates as an unregulated trading platform. It offers a variety of market instruments including Forex, commodities, indices, stocks, and ETFs.

The platform utilizes cTrader, providing traders with advanced tools for technical analysis, order management, and customizable trading options. BINS Markets serves various investor levels with account types such as Basic, Silver, Gold, and Black, each offering different bonuses and leverage options up to x9.

Regulatory Status

BINS Markets operates without regulatory oversight. This lack of regulation means there is no governing body ensuring the platform follows industry standards or protects traders' interests. As a result, users can face higher risks, including potential issues with fund security, fair trading practices, and dispute resolution.

Pros and Cons

| Pros | Cons |

| Wide range of trading assets | Leverage options limited (x9) |

| Advanced cTrader platform with various tools and customization options | Unclear fee structures |

| Bonus incentives for account types | Unregulated |

| Various account types |

Pros:

- Wide Range of Trading Assets: BINS Markets offers a wide selection of trading assets including Forex pairs, commodities like gold and oil, indices, stocks, and ETFs. This variety allows traders to diversify their portfolios and capitalize on different market opportunities.

- Advanced cTrader Platform: The platform provides advanced tools and customization options through cTrader. Traders benefit from various technical analysis tools, various order types, Price Alerts, and Symbol Watchlists. This enhances flexibility and precision in trading strategies.

- Bonus Incentives: BINS Markets offers bonus incentives for different account types, encouraging higher deposits with increased trading capital. These bonuses can range from 10% to 50% depending on the account tier, providing additional funds to potentially boost trading profits.

- Various Account Types: Traders can choose from multiple account types tailored to different trading preferences and capital levels. Options include Basic, Silver, Gold, and Black accounts, each offering varying bonuses, leverage, and additional features like educational packages and daily trading signals.

Cons:

- Limited Leverage Options (Up to x9): While BINS Markets provides leverage up to x9, this maximum limit can be restrictive for traders accustomed to higher leverage ratios offered by some competitors. Higher leverage can amplify potential profits but also increases risk, and the capped leverage can not suit all trading strategies.

- Unclear Fee Structures: The platform's fee structure is not clearly outlined, which can lead to uncertainty for traders regarding transaction costs, spreads, and other fees associated with trading. Clarity on fee transparency is crucial for traders to accurately calculate potential costs and evaluate profitability.

- Unregulated: BINS Markets operates without regulatory oversight, which means there is no external authority ensuring adherence to industry standards, fund protection measures, or dispute resolution mechanisms. Traders should consider the risks associated with trading on an unregulated platform, including potential lack of consumer protection.

Market Instruments

BINS Markets provides access to global assets on Forex, Metals, Oil, Indices, Stocks, ETFs.

Forex: BINS Markets offers a variety of currency pairs for trading, providing opportunities to trade on global foreign exchange markets.

Metals: The platform includes precious metals like gold and silver, allowing traders to invest in these valuable commodities.

Oil: Traders can buy and sell oil, taking advantage of the fluctuating prices in the global energy market.

Indices: BINS Markets provides access to major global indices, enabling traders to speculate on the performance of entire markets.

Stocks: The platform includes individual stocks, giving traders the ability to invest in specific companies.

ETFs: Exchange-Traded Funds are available, allowing traders to diversify their portfolios with a range of assets.

Account Types

BINS Markets offers a range of account types to suit different trader needs and investment levels.

The BASIC account type requires a minimum investment of $250 and offers a 10% bonus. It comes with leverage of x2 and includes three weekly business sessions. This account type is suitable for beginners or those with limited investment capital, as it provides a straightforward introduction to trading with lower financial risk.

The SILVER account type requires an investment of $2,500 and provides a 20% bonus. It offers leverage of x3 and includes access to a Senior Analysts Account Principal, two weekly trading sessions, and a complete education package. This account type is ideal for intermediate traders who are looking to enhance their trading knowledge and receive guidance from experienced analysts.

The GOLD account type requires a minimum investment of $10,000 and offers a 40% bonus. It comes with leverage of x7 and includes the services of a Senior Account Principal Analyst, a complete education package, and daily trading signals. This account type is suitable for advanced traders who are looking for more significant leverage and additional resources to make informed trading decisions.

The BLACK account type requires an investment of $25,000 and offers a 50% bonus. It provides leverage of x9 and includes the services of a Senior Account Principal Analyst, a complete education package, and daily trading signals. This account type is designed for professional traders or those with substantial capital, seeking high leverage and support to maximize their trading potential.

| Plan | Investment Amount | Bonus | Leverage | Sessions | Additional Features |

| BASIC | $250 | 10% | x2 | 3 Weekly Business Sessions | |

| SILVER | $2,500 | 20% | x3 | Senior Analysts Account PrincipalComplete Education Package | 2 Weekly Trading Sessions |

| GOLD | $10,000 | 40% | x7 | Senior Account Principal AnalystDaily Signal | Complete Education Package |

| BLACK | $25,000 | 50% | x9 | Senior Account Principal AnalystDaily Signal | Complete Education Package |

Leverage

BINS Markets offers maximum leverage up to x9, depending on the account type chosen.

Trading Platform

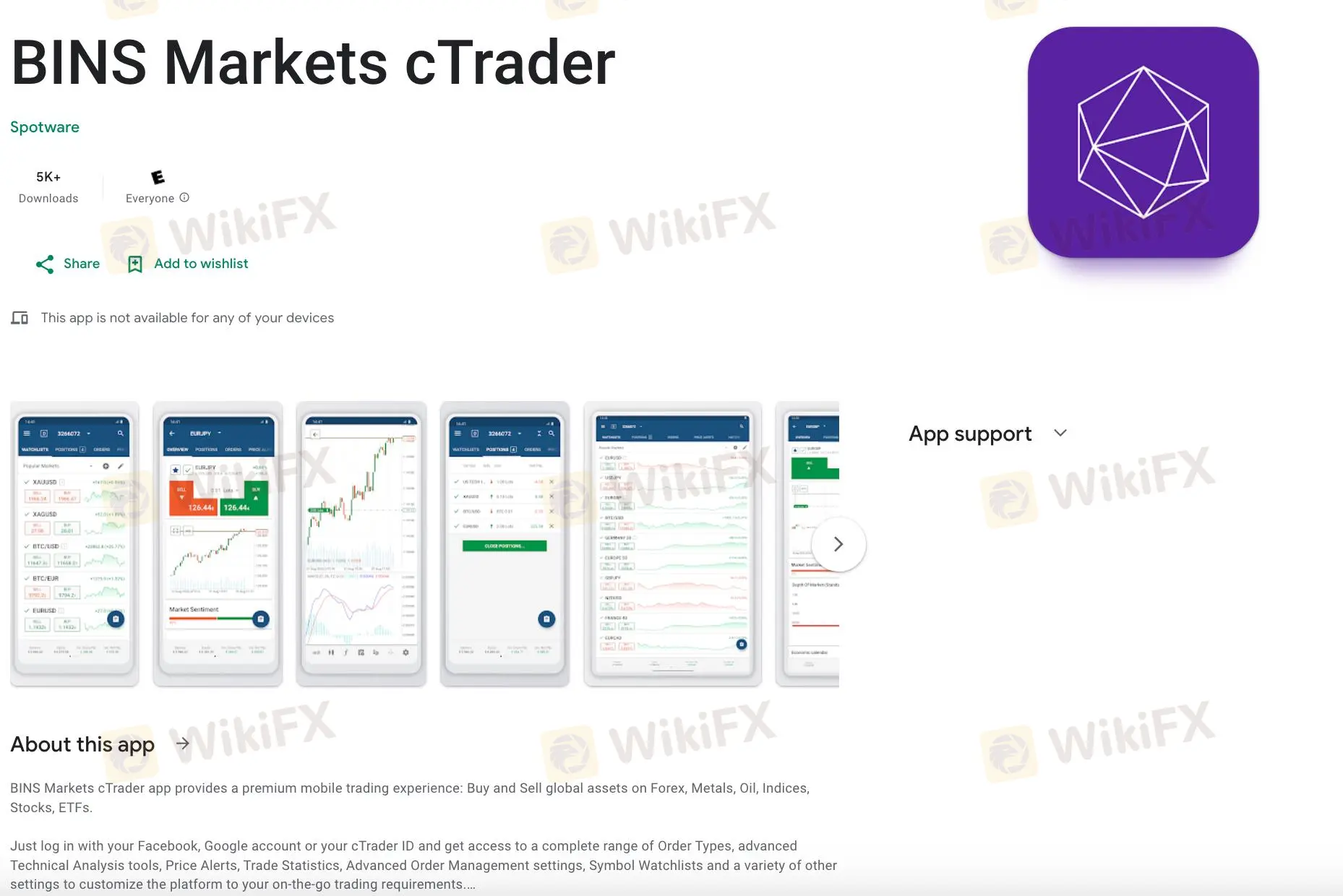

BINS Markets utilizes the cTrader trading platform, which offers a suite of features tailored for active traders. Users can seamlessly log in using Facebook, Google accounts, or their cTrader ID, providing convenient access to a wide array of Order Types, advanced Technical Analysis tools, Price Alerts, and customizable Trade Statistics. The platform operates on a Direct Processing (STP) and No Dealing Desk (NDD) model, ensuring transparent execution.

Key features include detailed Symbol Information and Trading Schedules, essential for understanding market dynamics and trading opportunities. Links to News Sources keep traders informed about events impacting markets. The platform's fluid and responsive charts, coupled with QuickTrade Mode, facilitate rapid execution with one-click trading. Additionally, sophisticated Technical Analysis tools offer extensive customization options for indicators and chart settings, supporting in-depth market analysis.

Deposit & Withdrawal

BINS Markets offers a variety of payment methods to accommodate various trader preferences. These typically include bank transfers, credit/debit cards, and popular electronic wallets like Skrill or Neteller.

The minimum deposit requirement at BINS Markets varies depending on the chosen account type, starting from $250 for the BASIC account. This allows entry for traders with different financial capacities, facilitating accessibility to their trading platform.

Regarding payment fees, BINS Markets typically does not charge deposit fees.

Customer Support

BINS Markets provides customer support from Monday to Friday, 9:00 am to 6:00 pm GMT-6. You can reach them by phone at +52 55 4172 6262 or via email at customer@binsmarkets.com.

Educational Resources

BINS Markets provides an Educational Center featuring e-books, a blog, and an FAQ section to support traders' learning and skill development.

These resources offer foundational knowledge on market analysis, trading strategies, and platform navigation. However, compared to leading brokers, BINS Markets' educational offerings can be more basic and lack interactive elements such as webinars or advanced courses.

For beginners, the e-books and FAQs can provide a solid starting point.

Conclusion

In conclusion, BINS Markets presents itself as a trading platform offering a wide range of trading assets including Forex, commodities, indices, stocks, and ETFs. Operating without regulatory oversight, it provides traders access to the advanced cTrader platform for technical analysis and customizable trading strategies.

While it offers various account types with differing leverage options and bonuses, potential users should consider the platform's unregulated status and limited transparency regarding fee structures.

FAQ

- What trading assets does BINS Markets offer?

- BINS Markets provides a range of trading assets including Forex pairs, commodities, global indices, individual stocks, and Exchange-Traded Funds (ETFs).

- How can funds be deposited into a BINS Markets account?

- Deposits can be made via bank transfers, credit/debit cards, and popular electronic wallets like Skrill and Neteller.

- Is BINS Markets a regulated platform?

- No, BINS Markets operates without regulatory oversight.

- Which trading platform does BINS Markets use?

- BINS Markets utilizes the cTrader platform.

- What are the minimum deposit requirements for opening an account?

- Minimum deposits start from $250.

- Does BINS Markets offer educational resources for traders?

- Yes, BINS Markets provides basic educational resources such as e-books, a blog, and an FAQ section to assist traders in understanding the platform and improving their trading knowledge.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.