Company Summary

| Okasan Niigata Review Summary | |

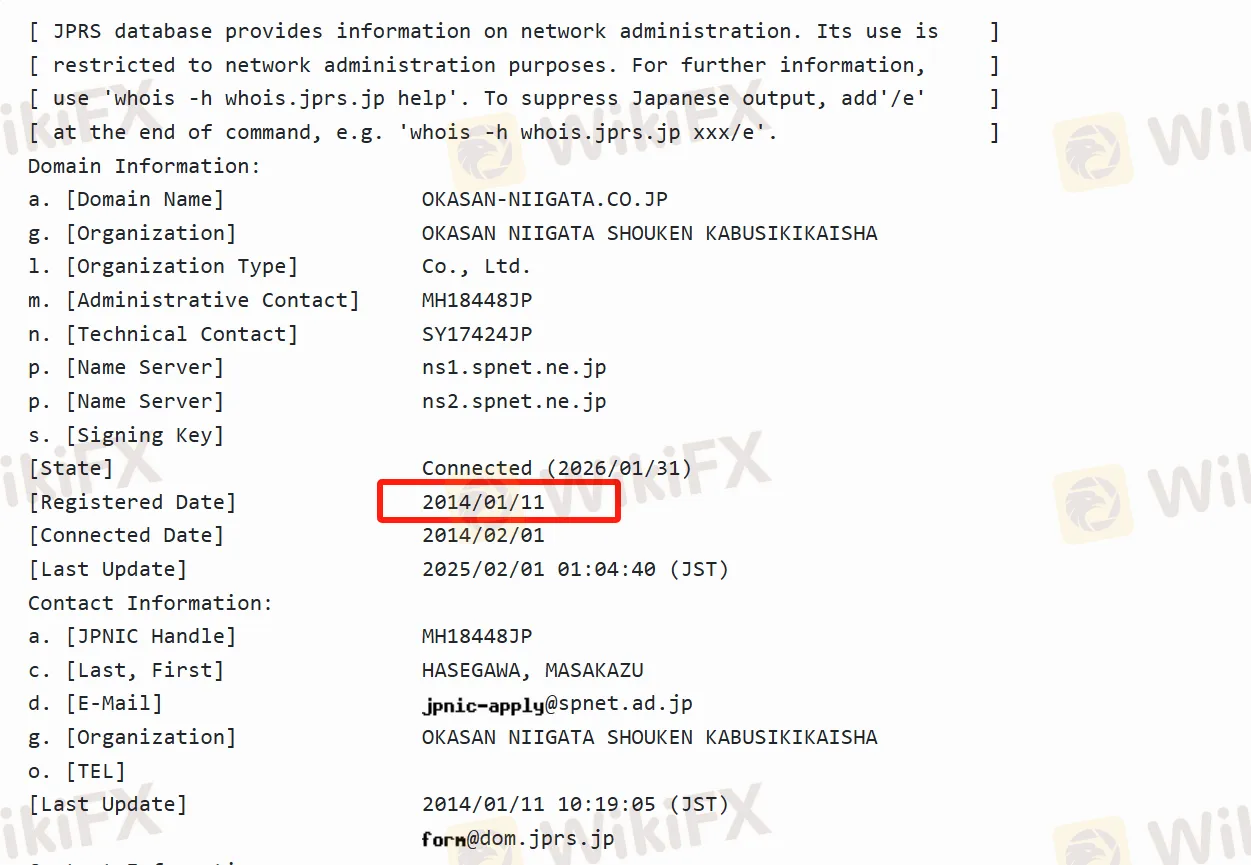

| Founded | 2014/01/11 |

| Registered Country/Region | Japan |

| Regulation | Regulated |

| Products and Services | Stocks, Investment Trusts, Bonds, and NISA -Eligible Products |

| Customer Support | 0258-35-0290 |

| 1-5-5 Ote-dori, Nagaoka City, Niigata Prefecture, Postal Code 940-0062 | |

Okasan Niigata Information

Okasan Niigata is a well-established financial institution in Japan, with a long-standing history dating back to 1899 when it was founded as the Hank 町新作商店. Over the years, it has evolved, and in 2014, it became Okasan Niigata Securities. As a part of the Okasan Securities Group, it offers a wide range of investment and financial services, mainly focusing on the local market in Niigata Prefecture while also having a connection to the broader financial landscape.

Pros and Cons

| Pros | Cons |

| Regulated | Limited international perspective |

| Various investment products | Language barrier (Japanese) |

| Abundant educational resources |

Is Okasan Niigata Legit?

Okasan Niigata Securities is a legitimate financial institution and is affiliated with the Okasan Securities Group. It is regulated by the Financial Services Agency, and its license number is No. 169 issued by the Commissioner of the Kanto Local Finance Bureau (Financial Merchants).

Products and Services

Okasan Niigata offers various trading products. Investors can trade stocks of local companies in Niigata, stocks in the broader market, various investment trust products, as well as domestic and foreign bonds.

In addition, for investors who wish to take advantage of Japan's Nippon Individual Savings Account (NISA) program, the company provides eligible products, and investors can enjoy the preferential treatment of tax-free investment.

| Services | Supported |

| Stocks | ✔ |

| Investment Trusts | ✔ |

| Bonds | ✔ |

| NISA - Eligible Products | ✔ |