Company Summary

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | 2019 |

| Company Name | FXG.MARKET |

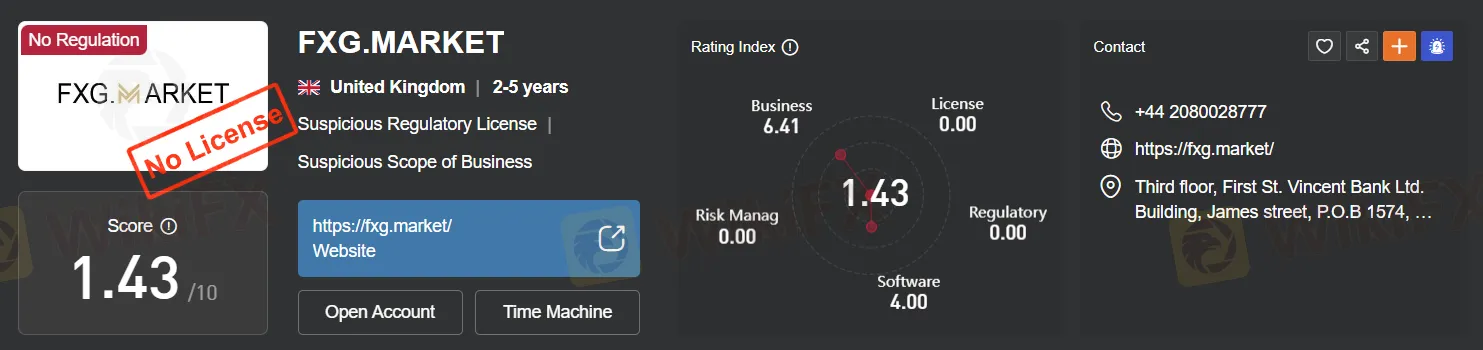

| Regulation | Doubts raised about regulatory authenticity |

| Minimum Deposit | €250 |

| Maximum Leverage | 1:10 |

| Spreads | Average spread of 2.5 pips for EUR/USD |

| Trading Platforms | Proprietary web-based platform |

| Tradable Assets | Cryptocurrencies, Forex pairs, Shares, Indices |

| Account Types | Live and Demo accounts |

| Demo Account | Available |

| Customer Support | Limited transparency and accessibility |

| Payment Methods | Information not provided |

| Educational Tools | Not available |

| Website Status | Reported as down and facing scam allegations |

| Reputation | Suspicions raised about legitimacy |

Overview

FXG.MARKET, a company claiming to operate from the United Kingdom, has been raising doubts and concerns in the financial industry. Founded in 2019, the broker's regulatory authenticity has come under scrutiny, casting significant shadows of doubt over its legitimacy and trustworthiness. With a minimum deposit requirement of €250 and a maximum leverage of 1:10, FXG.MARKET offers trading but imposes relatively high trading costs with an average spread of 2.5 pips for EUR/USD. While it provides a proprietary web-based trading platform for trading cryptocurrencies, forex pairs, shares, and indices, the lack of transparency and accessibility in its customer support is concerning. Moreover, FXG.MARKET's website being reported as down and facing scam allegations adds to its negative reputation, warranting extreme caution among potential investors. The absence of educational resources further diminishes its appeal, especially for traders seeking to enhance their knowledge and skills. Overall, FXG.MARKET's reputation is marred by uncertainties and suspicions, making it advisable for traders to explore more reputable alternatives in the market.

Regulation

FXG.MARKET has raised suspicions by purportedly using a cloned or questionable license as a broker. The review suggests that the broker operates under the laws of Cyprus, but doubts are cast on the authenticity of this claim. This situation is alarming because reputable regulatory authorities, like CySEC, are crucial for ensuring the safety and security of investors' funds in the financial industry. Operating with a questionable or cloned license raises significant concerns about the legitimacy and trustworthiness of FXG.MARKET as a brokerage platform. Investors are strongly advised to exercise caution and consider safer alternatives with clear and authentic regulatory oversight.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

FXG.MARKET presents a mix of advantages and disadvantages. On the positive side, it offers a range of market instruments, including cryptocurrencies, forex pairs, shares, and indices, giving traders diverse options. The availability of both live and demo accounts caters to traders at different experience levels. However, there are significant concerns surrounding its regulatory status and license authenticity, which raise doubts about the safety of investors' funds. Customer support appears to lack transparency and accessibility, and the offshore company address may present challenges for clients seeking physical contact or legal recourse. The absence of official social media presence and reported website issues add to the negative impression. Additionally, FXG.MARKET does not provide educational resources, which could be a drawback for traders looking to enhance their knowledge and skills. As such, potential investors are urged to exercise caution and explore more reputable alternatives in the market.

Market Instruments

FXG.MARKET offers a range of market instruments for trading, including:

Cryptocurrencies: These are digital or virtual currencies like Bitcoin, Ethereum, and Litecoin. Cryptocurrency trading involves speculating on their price movements, and it's known for its high volatility.

Forex Pairs: Forex (foreign exchange) pairs involve trading one currency against another, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). Forex trading is one of the largest financial markets globally, and it's based on currency exchange rates.

Shares: Shares, also known as stocks or equities, represent ownership in a particular company. Trading shares involves buying and selling ownership stakes in companies listed on stock exchanges like the NYSE or NASDAQ.

Indices: Indices are a collection of stocks or other assets that represent the overall performance of a specific market or sector. Examples include the S&P 500, which tracks the performance of 500 large-cap U.S. stocks, and the NASDAQ Composite, which focuses on technology companies.

These market instruments provide traders with a diverse set of options for their investment and trading strategies. Each type of instrument comes with its own set of risks and opportunities, and traders often choose based on their preferences and market conditions.

Account Types

FXG.MARKET typically offers two types of accounts for traders: live accounts and demo accounts. Here's a description of each:

Live Account:

A live account is a real trading account where you use actual money to participate in financial markets.

Traders need to make an initial deposit, often a specified minimum amount, into the live account to start trading.

With a live account, traders can engage in real transactions and experience the actual financial risks and rewards of trading.

Profits earned in a live account can be withdrawn, but traders are also exposed to potential losses, which can exceed the initial deposit in leveraged trading.

Live accounts require identity verification and compliance with the broker's terms and conditions, including adherence to regulatory requirements if applicable.

A demo account, also known as a practice or paper trading account, is a simulated trading environment provided by the broker.

It allows traders to practice and familiarize themselves with the trading platform and market conditions without risking real money.

Traders are typically given virtual funds in the demo account to use for placing trades, making it a risk-free way to learn and refine trading strategies.

Demo accounts are valuable for beginners to gain experience and for experienced traders to test new strategies or evaluate a broker's platform.

Unlike live accounts, no actual monetary deposits or withdrawals are involved in demo accounts, and they do not require identity verification.

Demo Account:

In summary, a live account is for real trading with real money, while a demo account serves as a practice platform using virtual funds. Traders often use demo accounts to build confidence and skills before transitioning to live trading, where they face actual financial outcomes.

Leverage

The broker FXG.MARKET offers a maximum trading leverage of 1:10. This means that for every $1 of your own capital, you can control a trading position worth up to $10. Leverage can amplify both potential profits and losses in trading. In this case, a 1:10 leverage ratio suggests that trading positions can be magnified tenfold, but it also implies a higher level of risk as even small market movements can have a significant impact on the account balance. Traders should exercise caution when using high leverage and consider their risk tolerance and risk management strategies carefully. It's essential to be aware that higher leverage can lead to both substantial gains and substantial losses.

Spreads and Commissions

Spreads: FXG.MARKET offers a trading platform with an average spread of 2.5 pips for the EUR/USD currency pair. The spread represents the difference between the buying (ask) price and the selling (bid) price of a financial instrument. A spread of 2.5 pips implies that traders would need the market to move favorably by at least 2.5 pips to cover the cost of the spread before making a profit. Such a spread can be considered relatively high and may impact trading costs.

Commissions: FXG.MARKET is known to have commissions, but specific details about the size or structure of these commissions are not provided.

Deposit & Withdrawal

Minimum Deposit: FXG.MARKET specifies a minimum deposit requirement of €250 for traders to fund their trading accounts. This minimum deposit amount represents the initial capital that traders need to deposit to start trading with the broker.

Withdrawal Processing: The broker mentions that withdrawal requests are processed within 7 days, which equates to seven working days. This suggests that it may take up to a week for traders to receive their requested withdrawal amounts. However, the review does not provide detailed information about the withdrawal methods available or any associated fees.

Fees: While the review indicates that there are some fees associated with using the broker's services, it does not provide specific details about the nature or amount of these fees. The review also suggests that these fees may be applicable to both deposits and withdrawals, but the exact fee structure remains undisclosed.

Inactivity Fee: FXG.MARKET includes a clause stating that if there has been no trading activity in a user's account for six consecutive months, the broker will charge a 5% commission on the amount in the account. This implies that traders who maintain inactive accounts may be subject to additional fees.

Trading Platforms

FXG.MARKET provides a web-based trading platform, distinct from the widely used MetaTrader 4 (MT4), for its clients. This platform offers convenient access through a web browser without requiring any additional software installation. Traders using FXG.MARKET's platform can access a diverse range of financial instruments, including cryptocurrencies, forex pairs, shares, and indices. However, it's important to note that the review mentioned limitations in chart customization options and described the EUR/USD spread as relatively high at 2.5 pips on average. Additionally, FXG.MARKET offers a maximum trading leverage of 1:10, which is relatively low compared to some other brokers. Traders should consider these platform features and limitations when evaluating FXG.MARKET for their trading needs.

Customer Support

FXG.MARKET's customer support appears to be lacking in transparency and accessibility. The absence of official social media profiles on platforms like Twitter, Facebook, Instagram, and YouTube raises concerns about the broker's commitment to engaging with its clients and providing updates or assistance through popular online channels.

Furthermore, the provided company address in St. Vincent and the Grenadines may pose challenges for clients seeking physical contact or legal recourse, as offshore locations often have less stringent regulatory oversight. The absence of clear and easily accessible contact information on social media and the reliance on an offshore address can create an impression of limited accountability and support for traders.

Educational Resources

FXG.MARKET does not appear to offer educational resources or materials to assist traders in enhancing their knowledge and skills in the field of online trading. The absence of educational content could be a drawback for traders, especially those who are new to the financial markets and would benefit from access to educational resources such as articles, tutorials, webinars, or video lessons. Traders seeking to improve their trading strategies or deepen their understanding of the markets may need to look elsewhere for comprehensive educational support.

Summary

FXG.MARKET operates under a cloud of suspicion due to concerns about the legitimacy of its license and regulatory status. The broker's claim to be regulated under the laws of Cyprus is met with skepticism, casting doubt on the authenticity of its regulatory compliance. This lack of transparency in regulatory matters raises significant red flags regarding the safety of investors' funds. Additionally, the absence of official social media presence and the reliance on an offshore address in St. Vincent and the Grenadines for contact information indicate a lack of transparency and accessibility in customer support. The reported absence of educational resources further diminishes the broker's appeal, particularly for traders seeking to enhance their knowledge and skills. Moreover, FXG.MARKET's website being down and facing reports of being a scam adds to the negative impression, making it imperative for potential investors to exercise extreme caution and consider more reputable alternatives in the market.

FAQs

Q1: Is FXG.MARKET a regulated broker?

A1: FXG.MARKET claims to operate under the laws of Cyprus, but there are doubts about its regulatory status. Caution is advised due to the lack of clear regulatory oversight.

Q2: What is the minimum deposit required to open an account with FXG.MARKET?

A2: FXG.MARKET specifies a minimum deposit of €250 for traders to fund their accounts.

Q3: How long does it take for withdrawal requests to be processed by FXG.MARKET?

A3: Withdrawal requests are mentioned to be processed within 7 working days, suggesting it may take up to a week for traders to receive their requested withdrawals.

Q4: What is the maximum leverage offered by FXG.MARKET?

A4: FXG.MARKET offers a maximum trading leverage of 1:10, which can magnify both profits and losses.

Q5: Does FXG.MARKET provide educational resources?

A5: No, FXG.MARKET does not appear to offer educational resources or materials to assist traders in improving their trading knowledge and skills.