Basic Information

China

China

Score

China | 2-5 years |

China | 2-5 years |https://www.gwiqz.com/

Website

Rating Index

Forex License

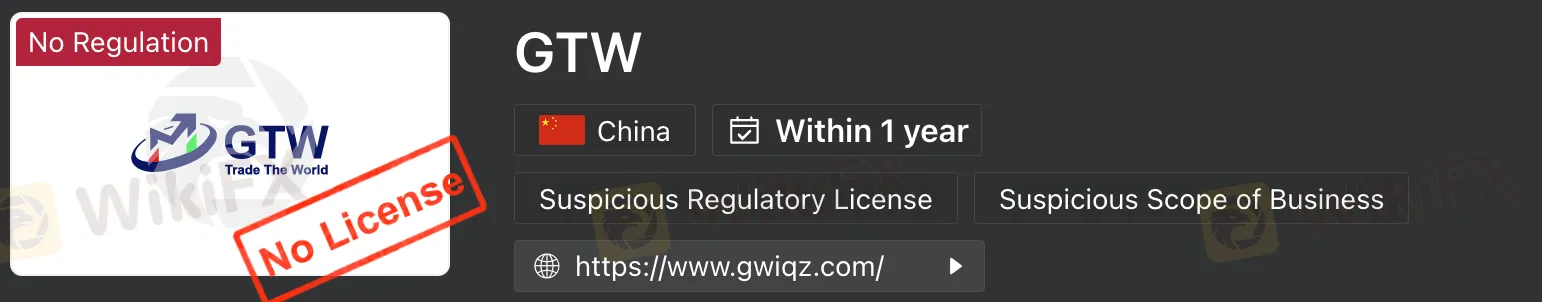

Forex License No forex trading license found. Please be aware of the risks.

China

China  gwiqz.com

gwiqz.com  United States

United States

| GTW | Basic Information |

| Company Name | GTW |

| Founded | 2023 |

| Headquarters | China |

| Regulations | Unlicensed |

| Tradable Assets | Forex, Stocks, Commodities, Indices, Cryptocurrencies |

| Account Types | Individual, Joint, Corporate, Professional, Islamic |

| Minimum Deposit | Not specified |

| Maximum Leverage | 1:200 |

| Spreads | Not specified |

| Commission | Not specified |

| Deposit Methods | Bank Wire Transfers, Electronic Payment Methods |

| Trading Platforms | Web-based, Mobile (Android, iOS) |

| Customer Support | E-mail, Phone |

| Education Resources | Not specified |

| Bonus Offerings | None |

GTW (Trade The World) is a trading platform that offers access to a diverse range of financial instruments, making it attractive to traders interested in various markets. Founded in 2023 and headquartered in China, GTW provides opportunities to trade in forex, stocks, commodities, indices, and cryptocurrencies. The platform offers multiple account types, including individual, joint, corporate, professional, and Islamic accounts, catering to different trading preferences.

However, it is essential to exercise caution when considering GTW as a trading platform, as it operates without proper regulatory oversight. Being an unlicensed broker raises concerns about the safety and security of funds, as regulatory authorities play a vital role in ensuring compliance with industry standards and safeguarding traders' interests. The lack of specified spreads, commissions, and educational resources also adds to the uncertainty and potential risks associated with trading on this platform. Moreover, limited customer support options may impact traders' ability to seek timely assistance when needed.

In conclusion, while GTW offers access to an array of tradable assets and account types, its unlicensed status and lack of transparency in trading conditions are significant drawbacks that traders should carefully consider. To ensure a safer trading experience, it is advisable to opt for regulated brokers that provide greater transparency and adherence to industry standards.

GTW is an unlicensed broker, and it is risky trading with it. Caution is advised when considering trading with GTW, as this broker operates without a license. Trading with an unlicensed broker carries inherent risks and raises concerns regarding the safety and security of funds. Regulatory authorities play a crucial role in overseeing and regulating the operations of brokers, ensuring compliance with industry standards and protecting the interests of traders.

Choosing to trade with an unlicensed broker such as GTW means there is a lack of regulatory oversight and accountability. This absence of oversight can result in potential issues such as inadequate client fund protection, unfair trading practices, and limited avenues for dispute resolution. In the event of any disputes or financial issues, traders may face challenges in seeking recourse or recovering their funds.

GTW (Trade The World) offers a diverse range of trading instruments, including forex, stocks, commodities, indices, and cryptocurrencies, allowing traders to access various financial markets. However, it operates without regulation, which poses significant risks, and lacks transparency regarding spreads, commissions, and minimum deposit requirements. Customer support is limited to email and phone, and educational resources and bonus offerings are not clearly specified. Traders should exercise caution and conduct thorough research before considering GTW as a trading platform.

| Pros | Cons |

| Diverse Range of Trading Instruments: GTW offers a wide selection of tradable assets, including forex, stocks, commodities, indices, and cryptocurrencies, providing traders with various opportunities to diversify their portfolios. | Lack of Regulation: GTW operates as an unlicensed broker, which raises concerns about the safety and security of funds, as there is no regulatory oversight to protect traders' interests. |

| Multiple Account Types: Traders can choose from individual, joint, corporate, professional, and Islamic accounts, catering to different trading preferences and needs. | Unclear Spreads and Commissions: The exact spreads, commissions, and minimum deposit requirements are not specified, leaving traders uncertain about the overall trading costs. |

| Mobile Trading Platform: GTW provides a mobile trading app for Android and iOS devices, allowing traders to access their accounts and execute trades on the go. | Limited Customer Support: Customer support is available through email and phone only, and response times may be slower compared to brokers with live chat or dedicated account managers. |

| Leverage Options: The platform offers leverage of up to 1:200, enabling traders to control larger positions with a smaller amount of capital. | Absence of Educational Resources: GTW does not provide specific information about educational resources, which could be a drawback for traders seeking learning materials and market insights. |

| No Bonus Offerings: At the time of review, GTW does not offer any bonuses or promotional incentives for traders, potentially limiting opportunities for additional trading benefits. |

GTW (Trade The World) offers a diverse range of trading instruments, allowing traders to access various financial markets. The platform provides opportunities to trade in different asset classes, including forex, stocks, commodities, indices, and cryptocurrencies.

In terms of forex trading, GTW offers a wide selection of currency pairs, including major, minor, and exotic pairs. Traders can participate in the global currency market and take advantage of price movements in different currency pairs.

For stock trading, GTW provides access to a range of stocks from major exchanges around the world. Traders can invest in individual companies and potentially benefit from price fluctuations in the stock market.

Commodities trading is also available on the GTW platform, allowing traders to speculate on the prices of various commodities such as gold, silver, oil, natural gas, and agricultural products. This provides opportunities to diversify portfolios and potentially benefit from changes in commodity prices.

In addition, GTW offers trading in global indices, allowing traders to track and speculate on the performance of broader market trends. Popular indices such as the S&P 500, Dow Jones, NASDAQ, FTSE 100, and DAX are available for trading.

Cryptocurrencies have gained significant popularity, and GTW allows traders to participate in this market. Traders can access a range of popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Ripple, and more, enabling them to potentially benefit from the volatility and growth of the cryptocurrency market.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indices | Stock | ETF | Options |

| GTW | Yes | Yes | Yes | No | Yes | Yes | No | No |

| RoboForex | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| IC Markets | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

| Exness | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

GTW (Trade The World) offers different account types to cater to the varying needs and preferences of traders. These account types provide traders with flexibility and options based on their trading experience, risk tolerance, and trading volume.

1. Individual Account: The Individual account is designed for individual traders who want to trade on their own behalf. This account type is suitable for retail traders who are looking for a straightforward and personal trading experience. It typically offers standard features and trading conditions.

2. Joint Account: The Joint account allows multiple individuals to open and manage a single trading account together. This account type is suitable for partners, family members, or business partners who wish to pool their resources and trade collectively.

3. Corporate Account: The Corporate account is tailored for corporate entities, such as companies, institutions, or organizations. It provides the necessary features and tools for corporate entities to execute trading activities and manage their investments.

4. Professional Account: The Professional account is designed for experienced and professional traders who meet specific criteria set by the broker. This account type may offer enhanced features, lower trading costs, and higher leverage compared to other account types. Professional accounts are typically subject to certain regulatory requirements, such as meeting minimum trading volume or demonstrating extensive trading experience.

5. Islamic Account: GTW also offers an Islamic account, adhering to the principles of Islamic finance. Islamic accounts are designed for traders who follow Islamic law and require trading conditions that comply with Shariah principles. These accounts are interest-free (swap-free) and do not involve any overnight interest charges.

It's important for traders to carefully consider their trading goals, risk tolerance, and specific requirements when selecting an account type. Each account type may have its own set of benefits and features tailored to different trading preferences. Traders should review the details and conditions of each account type offered by GTW to choose the one that aligns with their trading needs and objectives.

GTW (Trade The World) provides leverage options to traders, allowing them to amplify their trading positions and potentially increase their trading opportunities. Leverage is a tool that enables traders to control larger positions in the market with a smaller amount of capital. It is important to note that leverage can significantly enhance both potential profits and losses, and therefore, it should be used with caution and proper risk management.

The specific leverage levels offered by GTW may vary depending on the trading instrument and regulatory requirements. Leverage ratios typically differ between different asset classes and can be subject to regulatory restrictions imposed by financial authorities. Higher leverage ratios are generally available for major currency pairs, while lower leverage ratios may apply to more volatile or exotic instruments.

Leverage ratios are usually expressed as a ratio, such as 1:50 or 1:200. A leverage ratio of 1:50 means that for every dollar (or base currency unit) in the trading account, the trader can control a position equivalent to $50 in the market. Similarly, a leverage ratio of 1:200 allows traders to control a position that is 200 times larger than the amount of capital in their trading account.

While leverage can potentially amplify profits, traders should be aware of the associated risks. Higher leverage increases the exposure to market fluctuations and can lead to substantial losses if the market moves against the trader's position. It is important for traders to assess their risk tolerance, set appropriate stop-loss orders, and implement risk management strategies when utilizing leverage.

It's also worth noting that leverage requirements and regulations may vary depending on the jurisdiction and the regulatory framework governing GTW. Traders should familiarize themselves with the specific leverage options and requirements applicable to their trading accounts to make informed decisions and manage their trading risks effectively.

GTW (Trade The World) charges spreads and commissions to traders as part of their trading costs. Spreads refer to the difference between the bid and ask price of a financial instrument, and they represent the broker's profit on each trade. Generally, lower spreads are considered more favorable for traders, as they reduce the cost of trading and allow for better execution of trades.

However, the exact spreads offered by GTW may vary depending on the specific trading instrument, market conditions, and the type of trading account. Traders should be aware that spreads can fluctuate during periods of high market volatility, leading to potentially wider spreads and increased trading costs.

In addition to spreads, GTW may charge commissions on certain types of accounts or for specific trading products. Commissions are separate fees that traders pay on top of the spreads. These commissions can vary based on the trading volume and the type of account. It's crucial for traders to understand the commission structure and any additional fees that may apply to their trades.

Traders should carefully consider the impact of spreads and commissions on their overall trading profitability. Higher spreads and commissions can reduce potential profits and may require a higher level of market movement to cover trading costs. As such, traders should factor in these costs when formulating their trading strategies and risk management plans.

It's important to note that the exact details of GTW's spreads and commission structure may be available on their website or through their customer support. Traders are encouraged to seek transparency in fee disclosures and to compare GTW's pricing with other brokers to make informed decisions that align with their trading objectives and preferences.

GTW (Trade The World) offers various deposit and withdrawal methods to facilitate funding and accessing funds from trading accounts. Traders can use different payment options to deposit money into their accounts, but it's important to note that the available deposit methods may vary depending on the region and the specific regulatory requirements.

Commonly, GTW accepts deposits through bank wire transfers, which allow traders to transfer funds directly from their bank accounts to their trading accounts. However, the processing time for bank wire transfers can vary, and it may take several business days for the funds to appear in the trading account.

Additionally, GTW may offer electronic payment methods, such as e-wallets or online payment systems, as a convenient way to fund accounts. These methods usually provide faster processing times compared to bank transfers, allowing traders to start trading more quickly.

As for withdrawals, GTW typically processes withdrawals back to the original deposit method. For example, if a trader deposited funds via a bank wire transfer, the withdrawal would be sent back to the same bank account. Withdrawals via electronic payment methods might be processed faster than bank transfers.

Traders should be aware that certain withdrawal methods may involve fees or minimum withdrawal amounts. It's essential for traders to review GTW's withdrawal policy to understand any potential costs or limitations associated with accessing their funds.

It's important to note that while GTW may offer multiple deposit and withdrawal options, the specific methods available to traders may depend on their geographical location and the applicable regulations. Traders should carefully review the available options and ensure that their chosen method aligns with their needs and preferences. Additionally, it's crucial to verify the accuracy of the provided account details when initiating any fund transfers to avoid any potential complications or delays in processing.

GTW (Trade The World) offers trading platforms that allow traders to access and execute trades in various financial markets. The web-based trading platform provides a user-friendly interface accessible through web browsers. Traders can log in to their accounts via the GTW website and access the platform without the need for any software download or installation. The web platform typically provides essential trading functionalities, including real-time market quotes, charting tools, and order execution capabilities. However, it's important to note that web-based platforms may have limitations compared to downloadable trading software in terms of advanced features and customizability.

For traders who prefer to trade on the go, GTW may offer a mobile trading platform for both Android and iOS devices. The mobile app allows traders to access their accounts and trade from their smartphones or tablets. Mobile platforms often provide real-time market updates, trading alerts, and order management features, enabling traders to monitor and execute trades while away from their computers. However, mobile platforms may have some limitations compared to desktop versions, such as reduced screen space and limited access to certain advanced tools.

As with any trading platform, it's essential for traders to evaluate the features, functionalities, and user experience of the provided platforms to determine whether they meet their trading needs. Traders should also consider any potential risks associated with trading on web or mobile platforms, such as internet connectivity issues and device compatibility. Additionally, it's advisable to ensure that the trading platforms offered by GTW are reliable, secure, and stable to support a seamless trading experience.

The customer support of GTW (Trade The World) may provide assistance through email and phone channels. Traders can reach out to the customer support team via email for inquiries or support-related issues. While email communication can be convenient for sending detailed messages and documents, it may not offer real-time responses, and the resolution of inquiries may take time.

The availability of phone support allows traders to directly speak with a customer support representative. However, it's important to consider the working hours and time zone differences, as phone support may only be available during specific hours of the day. Traders may need to be patient if they encounter long waiting times or delays in connecting with a support agent.

It's important to note that the effectiveness of customer support can vary based on the responsiveness and efficiency of the support team. Additionally, GTW's customer support may have limitations compared to larger and more established brokers, which often offer additional support channels such as live chat or dedicated account managers.

In conclusion, GTW (Trade The World) offers a diverse range of tradable assets and account types, making it appealing to traders interested in various financial markets. However, its unlicensed status poses inherent risks, raising concerns about fund safety and regulatory oversight. The lack of specified spreads, commissions, and educational resources further adds to the uncertainty surrounding trading conditions. Additionally, limited customer support options may hinder traders' ability to seek timely assistance. While GTW may present opportunities for trading, its unregulated nature and lack of transparency make it a less secure option compared to regulated brokers that provide greater accountability and protection for traders. Traders should approach GTW with caution and carefully weigh the potential benefits against the associated risks before making their trading decisions.

Q: Is GTW a regulated broker?

A: No, GTW is an unlicensed broker, which means it operates without regulatory oversight.

Q: What are the tradable assets offered by GTW?

A: GTW provides access to a variety of tradable assets, including forex, stocks, commodities, indices, and cryptocurrencies.

Q: What types of accounts does GTW offer?

A: GTW offers different account types, such as Individual, Joint, Corporate, Professional, and Islamic accounts, catering to various trading preferences.

Q: Are the spreads and commissions specified on the GTW platform?

A: No, GTW does not provide specific details about its spreads and commissions, leaving traders uncertain about trading costs.

Q: What deposit and withdrawal methods are available with GTW?

A: GTW allows deposits through bank wire transfers and electronic payment methods. However, the specific methods may vary based on traders' geographical locations.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now