Company Summary

| Aspect | Information |

| Company Name | FORMAX |

| Registered Country/Area | United Kingdom |

| Founded Year | 2010 |

| Regulation | Unregulated |

| Minimum Deposit | 100 USD |

| Maximum Leverage | 1:1000 |

| Spreads | Floating |

| Trading Platforms | MetaTrader 4, MetaTrader 5, and ZuluTrade |

| Tradable Assets | Forex, CFDs on stocks, indices, commodities, and cryptocurrencies |

| Account Types | Standard, ECN |

| Demo Account | Yes |

| Customer Support | 24/5 live chat and email support |

| Deposit & Withdrawal | Credit/debit cards, bank transfers, e-wallets |

| Educational Resources | Webinars, e-books, trading tutorials |

Overview of FORMAX

FORMAX is a UK-based trading company founded in 2010. It operates without regulatory oversight. With a minimum deposit of $100 and leverage of up to 1:1000, it offers accessible trading opportunities. FORMAX provides traders with the MetaTrader 4, MetaTrader 5, and ZuluTrade platforms, flexible spreads, and a diverse range of tradable assets, including Forex, CFDs on stocks, indices, commodities, and cryptocurrencies.

Traders can choose between Standard and ECN account types, and a demo account is available for practice. Customer support is offered 24/5 through live chat and email. Deposits and withdrawals are convenient, with options such as credit/debit cards, bank transfers, and e-wallets.

FORMAX supports trader education through webinars, e-books, and trading tutorials. However, it's important to note that FORMAX is unregulated, so traders should exercise caution and conduct thorough research before trading with the company.

Regulatory Status

FORMAX operates in a unique space within the financial industry, as it stands apart from traditional regulated entities. Unlike conventional financial institutions such as banks or brokerage firms, FORMAX operates in an unregulated environment. This means that it does not fall under the oversight and stringent regulatory framework that governs these established financial entities. Instead, FORMAX operates with a degree of autonomy that can both offer certain freedoms and flexibility to its users but also presents a unique set of risks and considerations. Understanding this unregulated nature is crucial for anyone considering engaging with FORMAX's services, as it highlights the need for a heightened sense of personal responsibility and due diligence when navigating this particular financial landscape.

Pros and Cons

| Pros | Cons |

| Offers ECN trading environment | Limited educational resources |

| Diverse range of tradable assets | Limited base currencies |

| Competitive spreads and leverage | Potential withdrawal fees |

| Multiple trading platforms | High minimum deposit (£1,000) |

| Comprehensive customer support | Only one trading platform available (MT4) |

Pros:

ECN Trading Environment: FORMAX provides traders with access to an Electronic Communication Network (ECN) trading environment. This setup enables direct connectivity to liquidity providers, ensuring transparent and efficient trade execution, with real-time access to the best available prices.

Diverse Range of Tradable Assets: FORMAX offers a wide variety of tradable assets, including forex, commodities, indices, and cryptocurrencies. This diversity allows traders to create well-rounded portfolios and explore various market opportunities.

Competitive Spreads and Leverage: Traders can benefit from competitive spreads and leverage options when trading on FORMAX. These favorable trading conditions empower traders to optimize their profit potential while effectively managing risk.

Multiple Trading Platforms: FORMAX caters to different trading styles by offering a range of user-friendly trading platforms. Whether you prefer the simplicity of a web-based platform, the advanced features of a desktop application, or the mobility of a mobile app, FORMAX has a solution to suit your needs.

Comprehensive Customer Support: FORMAX places a strong emphasis on customer support. They offer comprehensive assistance through various channels, including live chat, email, and phone support. This commitment ensures that traders receive timely help with inquiries or issues throughout their trading journey.

Cons:

Limited Educational Resources: FORMAX falls short in terms of educational resources. Traders looking for comprehensive learning materials, tutorials, or webinars to enhance their trading knowledge may find the platform lacking in this aspect.

Limited Base Currencies: FORMAX offers a limited selection of base currencies for trading accounts. This limitation can be restrictive for traders who prefer to operate in a broader range of currencies.

Potential Withdrawal Fees: Traders should be aware of the possibility of withdrawal fees when using FORMAX. These fees can eat into profits and need to be factored into one's overall trading strategy.

High Minimum Deposit (£1,000): FORMAX imposes a relatively high minimum deposit requirement of £1,000. This could be a barrier to entry for traders with smaller budgets or those who wish to start with lower capital.

Only One Trading Platform Available (MT4): FORMAX provides only one trading platform option, the popular MetaTrader 4 (MT4). While MT4 is favored by many traders for its features, some individuals may prefer alternative platforms, and FORMAX's limited platform selection may not cater to their specific preferences.

Market Instruments

Formax distinguishes itself by offering a diverse array of trading products, catering to the diverse needs and preferences of traders.

In the realm of Forex, Formax presents a comprehensive selection of currency pairs, encompassing both major, minor, and exotic pairs. Whether you're interested in the well-trodden path of EUR/USD or seek to explore the intriguing territories of exotic pairs like USD/ZAR, Formax's Forex offerings provide ample choices for traders.

Commodities enthusiasts will find Formax's offerings equally enticing. The platform extends trading opportunities across precious metals such as Gold and Silver, energy resources like Oil and Natural Gas, as well as a range of agricultural and industrial commodities. From the volatility of energy markets to the stability of precious metals, Formax's commodity options offer diversity.

Indices traders can access prominent global indices, including the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite, among others. Additionally, Formax provides access to emerging market indices and sector-specific indices, allowing traders to tailor their strategies to specific economic themes or geographic regions.

The cryptocurrency arena is not left unexplored by Formax, as it offers a variety of digital currencies, including pioneering Bitcoin and Ethereum, as well as altcoins like Litecoin and Ripple. The platform caters to crypto enthusiasts looking to harness the potential of this innovative asset class.

Beyond these traditional trading products, Formax takes a step further by offering additional features such as Copy Trading, allowing traders to emulate the strategies of experienced counterparts, and Social Trading, which fosters collaboration and idea-sharing among traders. Moreover, Formax prioritizes trader education, offering a range of resources to facilitate the learning journey of both novice and seasoned traders.

Account Types

-

Standard account: This is the most basic account type. It has a minimum deposit of £1,000, variable spreads from 0.1 pips, and a maximum leverage of 1:500. It offers all of Formax's trading products, including forex, commodities, indices, and cryptocurrencies.

ECN Zero account: This account type offers ECN trading and zero spreads on major currency pairs. It has a minimum deposit of £10,000 and a maximum leverage of 1:200. It offers all of Formax's trading products, except for cryptocurrencies.

ECN Pro account: This account type offers ECN trading and spreads from 0.0 pips on major currency pairs. It has a minimum deposit of £50,000 and a maximum leverage of 1:100. It offers all of Formax's trading products, except for cryptocurrencies.

| Account type | Minimum deposit | Spreads | Leverage | Trading products |

| Standard | £1,000 | Variable, from 0.1 pips | 1:500 | All |

| ECN Zero | £10,000 | Zero on major pairs | 1:200 | All, except cryptocurrencies |

| ECN Pro | £50,000 | From 0.0 pips on major pairs | 1:100 | All, except cryptocurrencies |

How to Open an Account?

-

Go to the Formax website and click on the “Open Account” button.

You can find the “Open Account” button in the top right corner of the Formax website.

Fill out the account registration form with your personal information.

The account registration form will ask for your personal information, such as your name, address, email address, and phone number. You will also need to create a password for your account.

Choose an account type and make a deposit.

Formax offers three account types: Standard, ECN Zero, and ECN Pro. Choose the account type that is right for you and make a deposit using one of Formax's accepted payment methods.

Verify your account by providing proof of identity and address.

Formax is required to verify the identity of all of its customers. You can verify your account by providing a copy of your government-issued ID and a copy of a recent utility bill or bank statement.

Once your account has been verified, you can start trading.

Leverage

Formax offers a maximum leverage of 1:500. However, the different account types on Formax have different leverage limits.

The maximum leverage for a Standard account is 1:500.

The maximum leverage for an ECN Zero account is 1:200.

The maximum leverage for an ECN Pro account is 1:100.

In addition, Formax also sets lower leverage limits for certain trading products.

The maximum leverage for cryptocurrencies is 1:20.

The maximum leverage for precious metals is 1:200.

Here is a table summarizing the leverage limits for each trading product on Formax:

| Trading product | Standard account | ECN Zero account | ECN Pro account |

| Forex | 1:500 | 1:200 | 1:100 |

| Cryptocurrencies | 1:20 | 1:20 | 1:20 |

| Precious metals | 1:200 | 1:200 | 1:200 |

| Indices | 1:500 | 1:200 | 1:100 |

| Commodities | 1:500 | 1:200 | 1:100 |

Spreads & Commissions

Formax offers variable spreads on all of its trading accounts. The spreads on the Standard account start from 0.1 pips, while the spreads on the ECN Zero and ECN Pro accounts start from zero pips on major currency pairs.

Formax also charges commissions on its ECN Zero and ECN Pro accounts. The commission on the ECN Zero account is £3 per lot, while the commission on the ECN Pro account is £12 per lot.

Other transaction costs

FORMAX adopts a transparent fee structure, with commissions and overnight interest being key components that traders should be aware of when using their platform.

For traders opting for the ECN Zero and ECN Pro accounts, commissions come into play. On the ECN Zero account, a commission of £3 per lot is levied. Meanwhile, for those choosing the ECN Pro account, the commission is slightly higher at £12 per lot. This commission-based model ensures that traders are aware of the costs associated with their trades upfront, allowing for clear and predictable fee calculations.

Additionally, traders who decide to hold positions overnight should be mindful of Formax's overnight interest charges. The specific amount of overnight interest incurred depends on two factors: the size of the position and the currency pair involved. This variable rate ensures that traders are charged in a manner commensurate with the duration and specific market conditions of their positions. It is essential for traders to consider these overnight interest charges when devising their trading strategies, as they can impact the overall cost and profitability of their trades.

Trading Platform

FORMAX offers a variety of trading platforms, including:

MetaTrader 4 (MT4): MT4 is the most popular forex trading platform in the world. It is a powerful and versatile platform that offers a wide range of features, including:

A user-friendly interface

A variety of technical analysis tools

Automated trading capabilities

MetaTrader 5 (MT5): MT5 is the next generation of the MetaTrader platform. It offers all of the features of MT4, plus a number of additional features, such as:

A built-in economic calendar

A wider range of order types

Support for hedging

ZuluTrade: ZuluTrade is a social trading platform that allows traders to copy the trades of other, more experienced traders. It is a good option for beginners who are still learning how to trade forex.

Deposit & Withdrawal

FORMAX makes it simple to move your money from place to place. They provide a range of account funding and account withdrawal options in multiple base currencies.

| Payment methods | Credit/debit cards (Visa, Mastercard, Maestro), bank transfers, e-wallets (Skrill, Neteller, WebMoney, FasaPay, Perfect Money) |

| Accepted currencies | USD, EUR, GBP, AUD, CAD, CHF, JPY, SGD, HKD, MYR, IDR, THB |

| Deposit processing time | A few minutes to 24 hours |

| Withdrawal processing time | 1-2 business days to 5 business days |

| Deposit fees | None |

| Withdrawal fees | Credit/debit cards: 2.5%, bank transfers: 2%, e-wallets: 1% |

Customer Support

FORMAX takes pride in offering robust customer support services that are designed to assist traders effectively and promptly. The platform understands the importance of accessible and responsive customer support in the dynamic world of online trading. Here's a description of FORMAX's customer support:

24/5 Availability: FORMAX's customer support operates round the clock during trading days, which means you can reach out for assistance at any time from Monday to Friday. This extended availability aligns with the global nature of the financial markets, ensuring that traders can access help when they need it most, regardless of their time zone.

Email Support: For more complex inquiries or issues that require documentation or detailed explanations, FORMAX offers email support. This method allows traders to communicate their concerns or questions in writing and receive thorough responses from the support team. It's an excellent option for those who prefer a written record of their interactions with customer support.

Educational Resources

FORMAX takes a proactive approach to trader education by offering a comprehensive suite of educational resources designed to empower traders at all levels of expertise. These resources encompass webinars, e-books, and trading tutorials, providing a well-rounded learning experience:

Webinars: FORMAX regularly hosts live webinars conducted by industry experts and seasoned traders. These webinars cover a wide range of topics, from fundamental analysis and technical strategies to risk management and trading psychology. Attendees have the opportunity to interact with the presenters, ask questions, and gain valuable insights in real time.

E-books: FORMAX provides a library of e-books that delve into various aspects of trading. These digital resources offer in-depth explanations of trading concepts, strategies, and market dynamics. Whether you're a beginner looking to grasp the fundamentals or an advanced trader seeking advanced insights, FORMAX's e-books cater to diverse learning needs.

Trading Tutorials: FORMAX offers step-by-step trading tutorials that guide traders through the process of using the platform's features and tools effectively. These tutorials are especially beneficial for those who are new to online trading or the specific platform and want to familiarize themselves with its functionalities.

Conclusion

In conclusion, FORMAX presents a mixed picture for traders, with distinct strengths and areas for improvement. On the positive side, it offers an enticing ECN trading environment, ensuring transparent and efficient trade execution. The diverse range of tradable assets, competitive spreads, and leverage options further enhance its appeal. Additionally, the availability of multiple trading platforms and comprehensive customer support demonstrates its commitment to catering to diverse trader needs.

However, there are notable drawbacks to consider. FORMAX's educational resources are limited, which could pose challenges for traders seeking to expand their knowledge base. The selection of base currencies is also constrained, potentially limiting the flexibility of traders. Potential withdrawal fees can impact overall trading costs, and the high minimum deposit requirement of £1,000 may deter traders with smaller budgets. Moreover, the platform provides only one trading platform option (MT4), which may not align with the preferences of all traders.

Ultimately, FORMAX offers a platform with strengths that may resonate with certain traders, particularly those who value a diverse range of assets and advanced trading features. However, it is essential for traders to carefully weigh these advantages against the platform's limitations and determine whether FORMAX aligns with their specific trading goals and preferences.

FAQs

Q: What are the spreads on FORMAX?

A: The spreads on FORMAX vary depending on the account type and the currency pair being traded. However, the spreads on Formax are generally considered to be competitive.

Q: What is the leverage of FORMAX?

A: The leverage on FORMAX varies depending on the account type and the currency pair being traded. However, the maximum leverage on Formax is 1:500.

Q: Does FORMAX offer hedging?

A: Yes, FORMAX offers hedging. Hedging is a risk management strategy that allows traders to offset losses on one trade with gains on another trade.

Q: Does FORMAX offer social trading?

A: Yes, FORMAX offers social trading through its ZuluTrade platform. ZuluTrade is a platform that allows traders to copy the trades of other, more experienced traders.

Q: Is FORMAX a good broker for beginners?

A: Yes, FORMAX is a good broker for beginners. FORMAX offers a variety of educational resources and tools to help beginners learn how to trade forex. FORMAX also offers a demo account that allows beginners to practice trading with virtual money before they risk any real money.

FX3145782912

Hong Kong

Can’t log in to the web or APP. I just want my remaining funds back

Exposure

运营01

Hong Kong

Is it?

Exposure

FX5879251264

Hong Kong

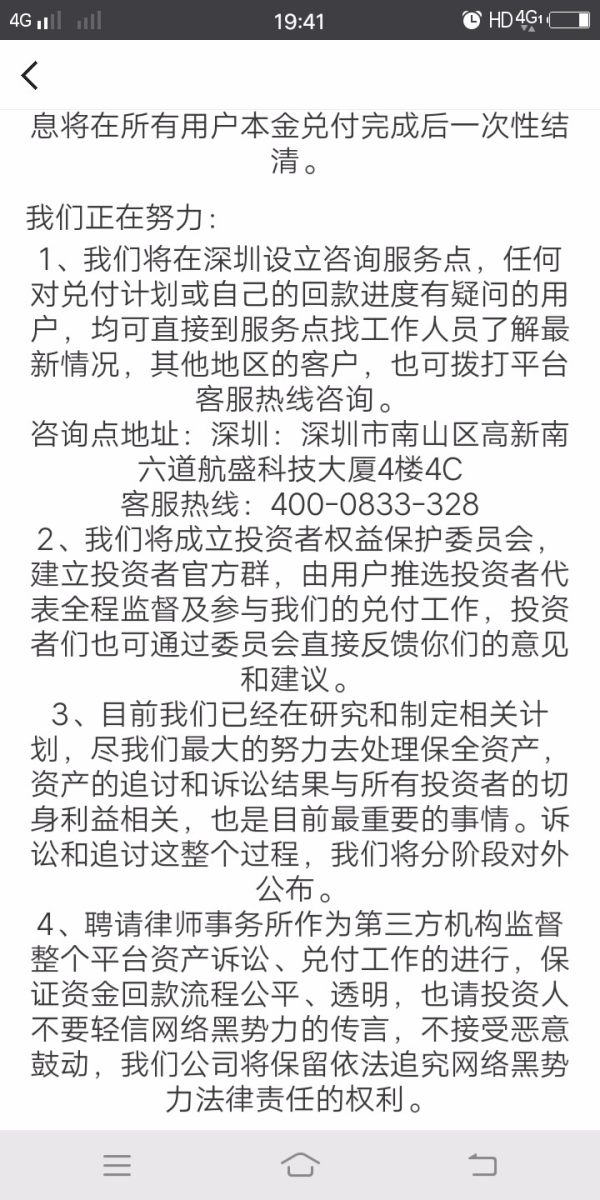

I’ve just been trading on FORMAX for half a month and found their system was under maintenance. I contacted their service, who told me they would quit Chinese market on July 10th and would settle all the withdrawals down on August 10th. Then they were all missing. I found myself scammed. They told us they would pay us all in September. However, everything was gone on their app on September 8th. Somebody helps me!

Exposure

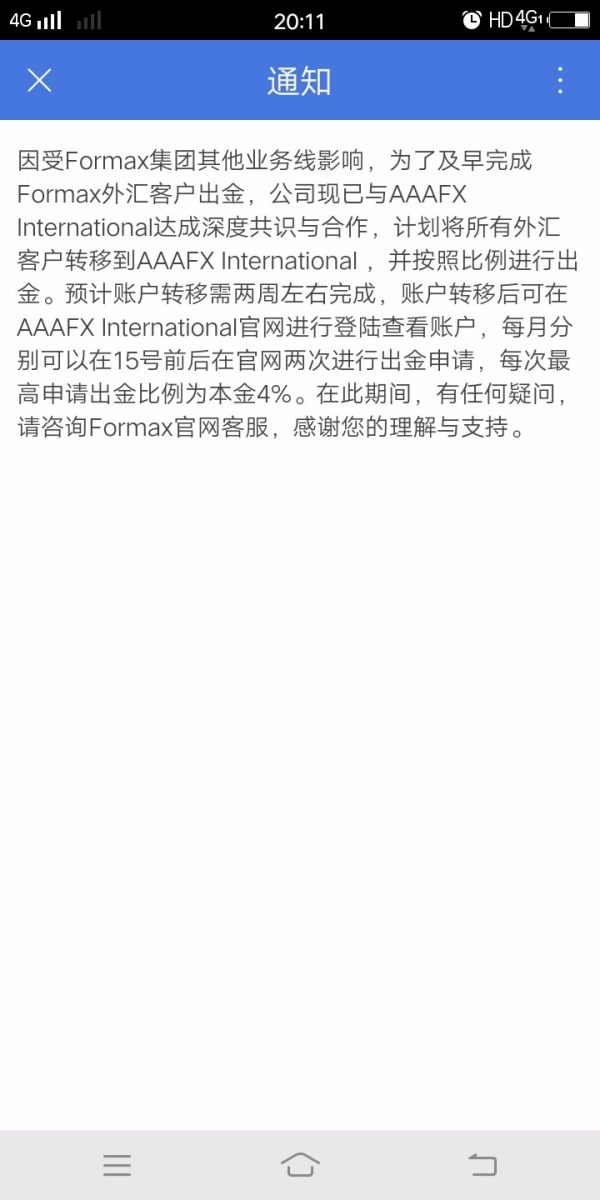

FX9819300941

Hong Kong

I can’t withdraw on FORMAX. They promised us to let us withdraw on August 10th. But now they said they are cooperating with AAAFX, who would give us 4% our money each time.

Exposure

FX3089772123

Hong Kong

They promised me they would give us money on August 10th 2018. However, until today, September 5th, they still gave us no money. God damned scammers!

Exposure