Basic Information

United Kingdom

United Kingdom

Score

United Kingdom | 5-10 years |

United Kingdom | 5-10 years |http://www.blackhorseservice.com/

Website

Rating Index

Forex License

Forex License

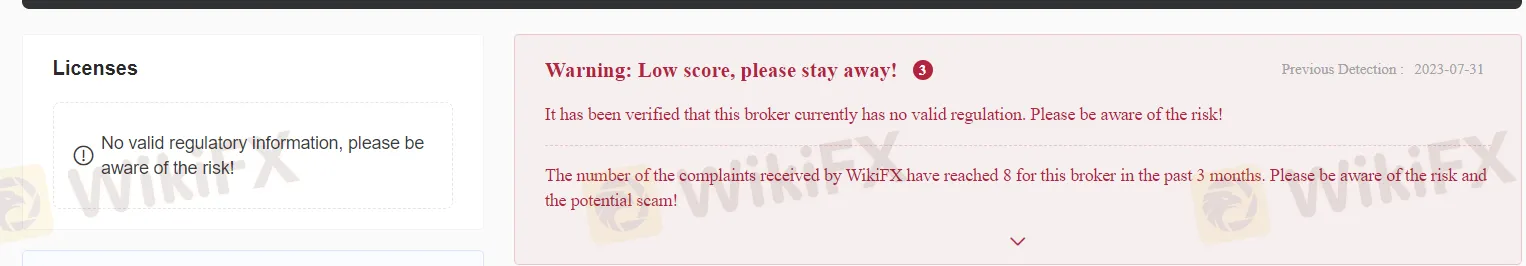

No forex trading license found. Please be aware of the risks.

United Kingdom

United Kingdom  blackhorseforex.com

blackhorseforex.com  China

China

CHAN LI

China

Director

Start date

Status

Employed

BLACK HORSE INVESTMENT SERVICES (UK) LIMITED(United Kingdom)

UK QILI INTERNATIONAL INVESTMENT ADVISER LTD

Secretary

Start date

Status

Employed

BLACK HORSE INVESTMENT SERVICES (UK) LIMITED(United Kingdom)

GOH CHENG XI CALVIN

Singapore

Director

Start date

Status

Employed

BLACK HORSE INVESTMENT SERVICES (UK) LIMITED(United Kingdom)

| Aspect | Information |

| Registered Country/Area | United Kingdom (UK) |

| Founded Year | Not specified |

| Company Name | Black Horse Service (Black Horse Investment Services (UK) Limited) |

| Regulation | None |

| Minimum Deposit | $200 |

| Maximum Leverage | Up to 1:500 on forex pairs, Up to 1:100 on other instruments |

| Spreads | Standard account: From 0.4 pips on major forex pairs |

| ECN account: Raw spreads starting from 0 pips | |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, Indices, Commodities, Cryptocurrencies, Shares, ETFs |

| Account Types | Standard Account, ECN Account |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Phone: +44 2084323088, 400 878 6006 |

| Email: info@blackhorseforex.com, admin@blackhorseservice.com | |

| Payment Methods | Wire Transfer, E-Wallets, Credit/Debit Cards |

| Educational Tools | Not specified |

Black Horse Service, also known as Black Horse Investment Services (UK) Limited, is a purportedly regulated broker based in the UK. It offers trading in forex, indices, commodities, cryptocurrencies, shares, and ETFs with high leverage of up to 1:500 on forex pairs and up to 1:100 on other instruments. The broker provides two account types, Standard and ECN, with different spreads and commissions. The ECN account offers raw spreads starting from 0 pips but charges commissions based on traded volumes. The company supports deposits through wire transfer, e-wallets, and credit/debit cards, with a minimum deposit requirement of $200. Traders can access the industry-standard MetaTrader 4 trading platform and receive customer support via live chat, email, and phone during market hours. However, due to limited available information and the unavailability of their official website, caution is advised before dealing with this broker.

As of now, BlackHorseService.com redirects to a poker site, indicating a potential change in its services or a possible rebranding.

None.

Black Horse Service operates without any regulatory oversight, which raises significant concerns about the company's transparency, accountability, and commitment to safeguarding clients' interests. The lack of regulation leaves traders exposed to potential risks and uncertainties, making it a risky choice for those seeking a reliable and trustworthy brokerage. Investors should exercise extreme caution and carefully consider the potential consequences of dealing with an unregulated entity like Black Horse Service.

Forex:

Description: Black Horse Service claims to provide trading in a wide range of forex currency pairs, including major, minor, and exotic pairs. These currency pairs represent the exchange rates between different global currencies and are popular choices for forex traders seeking to capitalize on currency movements.

Indices:

Description: The broker allegedly offers access to various indices, which are baskets of stocks representing specific markets or sectors. Trading indices allows investors to speculate on the overall performance of a group of companies rather than individual stocks, providing a broader perspective on market trends.

Commodities:

Description: Black Horse Service purports to provide opportunities to trade commodities such as gold, silver, oil, and other natural resources. Commodities are tangible assets and can serve as a hedge against inflation or geopolitical risks, making them attractive to certain investors.

Cryptocurrencies:

Description: The broker claims to offer trading in cryptocurrencies, including popular digital assets like Bitcoin, Ethereum, and other altcoins. Cryptocurrencies are known for their high volatility, attracting traders who seek potentially significant returns in this emerging market.

Shares:

Description: Black Horse Service allegedly provides access to individual company shares. Trading shares allows investors to take positions in specific companies they believe will perform well, offering an opportunity to participate in the growth of particular businesses.

ETFs (Exchange-Traded Funds):

Description: The broker purportedly offers trading in ETFs, which are investment funds that trade on stock exchanges and represent a diversified portfolio of assets. ETFs provide traders with exposure to a broad market or industry sector, promoting risk diversification.

Please note that the information provided about Black Horse Service and its offerings is limited and should be verified through more reliable sources. Additionally, given the lack of regulation mentioned earlier, caution is advised before engaging in any trading activities with this broker.

Standard Account:

The Standard account offered by Black Horse Service is tailored for traders who prefer a simple and commission-free trading experience. Traders using the Standard account allegedly benefit from competitive spreads, starting from 0.4 pips on major forex pairs. This account type provides access to a wide range of financial instruments, including forex, indices, commodities, cryptocurrencies, shares, and ETFs. It may be suitable for beginners or those who want to explore the financial markets without incurring additional charges, making it a user-friendly option for entry-level traders.

ECN Account:

The ECN (Electronic Communication Network) account is designed for more experienced traders seeking advanced trading conditions and tighter spreads. Black Horse Service's ECN account supposedly offers raw spreads starting from 0 pips, which could attract traders looking for lower transaction costs. However, it is important to note that this account type applies commissions based on traded volumes. The ECN account caters to active traders who require faster order execution and access to institutional liquidity for potentially improved trading performance.

Here is a simple table comparing the Standard and ECN account types offered by Black Horse Service:

| Account Type | Ideal For | Key Features | Spreads | Commission |

| Standard | Beginners and traders preferring a simple, commission-free experience | Access to forex, indices, commodities, cryptocurrencies, shares, and ETFs | Starts from 0.4 pips | No commission |

| ECN | More experienced traders seeking advanced trading conditions | Faster order execution, access to institutional liquidity, raw spreads | Starts from 0 pips | Based on traded volumes |

Black Horse Service allegedly provides leverage options for its clients, allowing them to trade with higher exposure than their deposited funds. According to the available information, the broker offers different maximum trading leverage depending on the type of financial instrument being traded.

For forex pairs, Black Horse Service supposedly offers a maximum trading leverage of up to 1:500. This means that traders can control positions up to 500 times the size of their account balance. Higher leverage allows for the potential of amplified gains from small price movements but also carries a higher level of risk, as losses can be equally magnified.

For other instruments such as indices, commodities, and shares, the maximum trading leverage offered by Black Horse Service is reportedly up to 1:100. While still providing increased market exposure, the leverage on these instruments is lower compared to forex pairs, which is common in the financial industry.

It is important to note that trading with leverage can be both rewarding and risky, and traders should exercise caution and adopt appropriate risk management strategies when using leverage to protect their capital. Different account types and financial instruments may have specific leverage limits, and it is essential for traders to be aware of the specific terms and conditions associated with their chosen trading accounts.

Spreads:

For the Standard account, the broker allegedly provides competitive spreads on major forex pairs, starting from 0.4 pips. These spreads may appeal to traders seeking cost-effective trading on widely traded currency pairs. However, the exact spreads on other financial instruments like indices, commodities, cryptocurrencies, shares, and ETFs are not specified in the available information.

On the other hand, the ECN account supposedly offers even tighter spreads with raw spreads starting from 0 pips. This feature caters to experienced traders who prioritize low-cost trading and require precise pricing for their trading strategies.

Commissions:

The commission structure also varies based on the trading accounts. The Standard account, as mentioned, does not charge any commissions on trades. This could be advantageous for traders who prefer not to pay additional fees and have their trading costs solely covered by the spreads.

In contrast, the ECN account applies commissions based on traded volumes. Unfortunately, the specific commission rates are not provided in the available information. Traders using the ECN account should be aware that they will be subject to additional charges on top of the spreads, which may affect their overall trading costs.

Overall, traders considering Black Horse Service should carefully assess the spreads and commissions associated with their preferred account type to determine the most suitable option based on their trading preferences and strategies. As the spreads and commission rates are vital factors affecting trading costs, investors must have a clear understanding of these aspects before initiating any transactions with the broker.

Based on the information provided, Black Horse Service offers deposit and withdrawal options to facilitate funding and transferring funds for trading activities.

Deposits:

The broker requires a minimum deposit of $200 to open an account. Traders can choose from various deposit methods, including:

Wire Transfer: Clients can transfer funds directly from their bank accounts to their trading accounts via wire transfer. Wire transfers are commonly used for larger deposits and may take a few business days to complete.

E-Wallets: Black Horse Service supposedly supports e-wallets as a deposit method. E-wallets are online payment systems that allow users to store and transfer funds securely. Popular e-wallet options may include PayPal, Skrill, Neteller, or other similar services.

Credit/Debit Cards: The broker allegedly accepts deposits through credit and debit cards. This provides a convenient and widely used method for clients to fund their trading accounts instantly.

Withdrawals:

Specific details about the withdrawal process, including available methods, processing times, and potential fees, are not mentioned in the available information. Traders should verify the withdrawal options and policies directly with Black Horse Service to ensure a smooth and transparent withdrawal process.

It's important for traders to be aware of any withdrawal limitations or requirements set by the broker, such as minimum withdrawal amounts or potential verification procedures to comply with anti-money laundering regulations.

As with any financial transactions, investors should exercise caution and ensure that they have a clear understanding of the deposit and withdrawal procedures, as well as the associated costs, before conducting any financial activities with Black Horse Service.

Black Horse Service relies on the widely used MetaTrader 4 (MT4) trading platform as its primary offering, which may be perceived by some traders as lacking innovation and falling behind current industry trends. While MT4 is known for its stability, its dated interface and limited functionalities compared to more modern platforms could deter traders seeking cutting-edge tools and features for their trading activities.

The platform's heavy reliance on Expert Advisors (EAs) for automated trading might also raise concerns about over-reliance on pre-defined strategies, potentially limiting traders' ability to adapt to dynamic market conditions. Some experienced traders may find MT4's capabilities lacking when compared to more sophisticated platforms that offer a wider array of advanced indicators and charting tools for conducting in-depth technical analysis.

Despite claims of offering over 10,000 trading apps on the MetaTrader marketplace, the quality and reliability of these apps may be questionable, leaving traders skeptical about their usefulness in enhancing trading performance. Without comprehensive details and vetting measures from the broker, traders might be hesitant to trust these third-party apps, raising doubts about their effectiveness.

Furthermore, the mention of a possible option for MetaTrader 5 (MT5) without providing concrete details or benefits about its implementation may be seen as a lack of transparency. Traders seeking information on this alternative platform could be left uncertain about its advantages and whether it addresses the limitations of MT4.

In conclusion, Black Horse Service's decision to prioritize MetaTrader 4 (MT4) as its primary trading platform might be seen as a missed opportunity to provide traders with a more cutting-edge and robust trading experience. The platform's limitations, combined with the lack of clarity regarding MetaTrader 5, could leave traders feeling dissatisfied and seeking alternative brokers that offer more innovative and advanced trading solutions.

Black Horse Service's customer support, as gleaned from the limited information available, can be reached through telephone contact numbers, namely +44 2084323088 and 400 878 6006. While the provision of phone support seems favorable for immediate assistance, the absence of an alternative means of contact such as a toll-free number might leave traders concerned about potential call charges and accessibility issues.

The email support options, info@blackhorseforex.com and admin@blackhorseservice.com, may raise doubts regarding the responsiveness and efficiency of the broker's support team. With only email as a communication channel, traders might fear delayed responses and inadequate assistance during critical trading situations.

Although Black Horse Service indicates that customer support is available during market hours, the specific hours of operation are not provided, leaving traders uncertain about the availability and responsiveness of the support team outside standard market hours. This lack of transparency could lead to frustration and anxiety for clients requiring timely resolutions to their queries or issues beyond regular trading hours.

Moreover, while a registered address is listed, the absence of other contact options such as live chat or a dedicated customer support portal may be seen as a limitation in offering prompt and convenient support. Traders who value immediate assistance and efficient problem-solving may view this as a missed opportunity to provide a more comprehensive and user-friendly support experience.

In conclusion, Black Horse Service's customer support, though offering telephone contact options, may be perceived as inadequate in terms of alternative communication channels and operational transparency. Traders seeking accessible and responsive support for their trading needs might be hesitant to fully rely on the broker's current support framework.

Black Horse Service, also known as Black Horse Investment Services (UK) Limited, is a purportedly regulated broker based in the UK. The company offers a diverse range of trading instruments, including forex, indices, commodities, cryptocurrencies, shares, and ETFs. With leverage of up to 1:500 on forex pairs and up to 1:100 on other instruments, traders can access high market exposure. The broker provides two account types - Standard and ECN - catering to traders with different trading preferences. The Standard account offers competitive spreads and no commissions, while the ECN account boasts tight raw spreads but applies commissions based on traded volumes.

While the availability of the industry-standard MetaTrader 4 (MT4) trading platform is a positive aspect, the reliance on MT4 might deter traders seeking more advanced and innovative platforms. Additionally, the mention of a potential MetaTrader 5 (MT5) option without elaborating on its features leaves traders uncertain about its suitability for their trading needs.

The absence of regulation raises significant concerns about the broker's transparency and accountability, making it a risky choice for traders who prioritize regulatory oversight and investor protection.

Customer support can be reached via telephone and email during market hours. However, the lack of alternative communication channels, such as live chat, may be seen as a limitation in providing prompt and efficient support.

On the positive side, Black Horse Service's diverse range of trading instruments and high leverage options may attract traders seeking exposure to various financial markets and the potential for amplified gains. The availability of competitive spreads on the Standard account and tight raw spreads on the ECN account could be appealing to traders looking for cost-effective trading conditions.

In conclusion, while Black Horse Service offers a diverse range of trading instruments and competitive spreads, the absence of regulation and limited customer support channels may be significant drawbacks for traders. The reliance on the dated MT4 platform without substantial information on the potential MT5 alternative might lead traders to explore other brokerage options that offer more advanced platforms and regulatory protection. Investors should exercise caution and conduct thorough research before engaging in any trading activities with this broker.

Q1: Is Black Horse Service a regulated broker?

A1: No, Black Horse Service operates without any regulatory oversight, which may raise concerns about transparency and client protection.

Q2: What is the minimum deposit required to open an account with Black Horse Service?

A2: The minimum deposit required is $200, allowing traders to start with a relatively small investment.

Q3: Does Black Horse Service charge commissions on trades?

A3: Yes, commissions are applicable on the ECN account based on traded volumes, while the Standard account has no commission charges.

Q4: What is the maximum leverage offered by Black Horse Service?

A4: The broker provides up to 1:500 leverage on forex pairs and up to 1:100 leverage on other instruments.

Q5: What trading platforms are available at Black Horse Service?

A5: Black Horse Service offers the widely used MetaTrader 4 (MT4) trading platform for desktop and mobile trading, with a possibility of MetaTrader 5 (MT5) but limited information about its implementation.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

大明94349

Hong Kong

The scam platform noticed us to withdraw funds last week with the reason of ceased service in China. But the fund is yet to be received.

Exposure

军辰

Hong Kong

My request for withdrawal is approved in last June. The platform transferred 2000 RMB each time on and off during 2 months. There are still 20000 RMB yet to be received. The salesman told me to wait for another 2 months since there was a tight budget and, craving for my understanding. But, after 6 months, the platform kept shirking, giving no access to fund. Manager Lu of BlackHorse , didn’t respond on phone or WeChat. BlackHorse talks no about integrity and only wants to shirk. How can you conduct business in Chinese market in the run-up? Let us get united and report it to take back our money.

Exposure

FX6599653802

Hong Kong

Actually, the platform never be the appointed representative by FCA.There is fund security risk in it.I checked it and revealed them.One can see the interpretation shifted from the English version

Exposure

橄榄树

Hong Kong

I applied for the withdrawal in BlackHorse in February.It has been more than 8 months,only half of the withdrawal was received,with 120000 RMB or so haven’t be received.In recent 2 months,I haven’t received a penny.

Exposure

人生(成功没有偶然)

Hong Kong

This fraud platform,where I only get a small portion of my withdrawal,with 30000 unavailable.The customer service was out of contact.Help,the money was hard-earned money I borrowed.

Exposure

习习

Hong Kong

The backstage approved my apply for $1400 withdrawal on the 6th ,2019,and promised to transfer into my account within three working days.But the withdrawal hasn’t been to the account yet for 3 months.While the customer service help you feedback to the related department,no reply anymore.With exposing this fraud platform,I hope you avoid being cheated!

Exposure

橄榄树

Hong Kong

I have withdrawn more than 37,000 dollars from February 10 to February 22 this year. Parts of them were credited in the first two months. However, from April 13th to now, my card only received RMB 5,000 once on May 14th. So far, a total of RMB100,000 has been received, and about 150,000 yuan has not been received. I call the platform customer service personnel every working day, and they always told me that the problem has been reported to the superior and would be processed as soon as possible. I send an email to the platform every day, but the platform has never replied to me. I don't know what to do now, so I decided to expose the platform, hoping that no more customers will be deceived by such a platform!

Exposure

FX9079864194

Hong Kong

The gold position even could be closed during Christmas while there was no time potion on the chart.The client's order was manipulated by others for no reason, and could not be found causing losses of several hundred thousand yuan.The withdrawal is slow because of channel problem. The internal staff said that the boss had no money to pay and was ready to run away.

Exposure

FX1849853128

Hong Kong

I withdrew money from BlackHorse in August, but the money has not yet arrived. They said that the payment channel was complained against, so the funds were frozen. At the beginning, they said that I could only withdraw 20,000 yuan a day. Ok, OK. no problem. Wait, wait, wait...., later they said that the problem was very serious, not as simple as I thought So I kept waiting... After that, they said that was because there were a lot of client in the company, and the funds can not be transferred. And they added that 5K RMB was remitted every day, and all money would be done in a month. But after money arrived for two days, and there was no more. I asked them again and they let me to wait again... 2k RMB arrived my card every day for three consecutive days last last week. There was a total of ten thousand yuan in the balance, and now only 20,000 yuan more was withdrawn. There are more than 70,000 left. Is the payment channel reported? ? ? it has nothing to do with me? Doesn’t it make sense that you are reported since it took long time for you to remit money? In a word, the platform is not strong, and the flow of funds is not enough. The account manager told me that many people have the same problem. I just want to ask, how the platform run under such conditions? New investors have no such withdrawing problem but the old clients have. Is the platform deliberately stuck with funds of the old clients, or is there no money on the platform to pay? Also don't talk about the problem of payment channels. The money was remitted by a personal card.

Exposure

FX1849853128

Hong Kong

I withdrew money from BlackHorse in August, but the money has not yet arrived. They said that the payment channel was complained against, so the funds were frozen. At the beginning, they said that I could only withdraw 20,000 yuan a day. Ok, OK. no problem. Wait, wait, wait...., later they said that the problem was very serious, not as simple as I thought So I kept waiting... After that, they said that was because there were a lot of client in the company, and the funds can not be transferred. And they added that 5K RMB was remitted every day, and all money would be done in a month. But after money arrived for two days, and there was no more. I asked them again and they let me to wait again... 2k RMB arrived my card every day for three consecutive days last last week. There was a total of ten thousand yuan in the balance, and now only 20,000 yuan more was withdrawn. There are more than 70,000 left. Is the payment channel reported? ? ? it has nothing to do with me? Doesn’t it make sense that you are reported since it took long time for you to remit money? In a word, the platform is not strong, and the flow of funds is not enough. The account manager told me that many people have the same problem. I just want to ask, how the platform run under such conditions? New investors have no such withdrawing problem but the old clients have. Is the platform deliberately stuck with funds of the old clients, or is there no money on the platform to pay? Also don't talk about the problem of payment channels. The money was remitted by a personal card.

Exposure

FX6129232876

Hong Kong

The withdrawal applied on August 20th was approved was said to be received in 3 workdays.I kept waiting and inquired the customer service,who just said”The feedback has been made.” The client manager said that it will be processed in a while.But I only received 2000 RMB.

Exposure

FX6469208016

Hong Kong

I was induced to open an account in BlackHorse in this May.With the agent giving wrong order recommendation,I made a loss of more than $10000.Now the agent is still going unpunished!!! When they induced me,they said the small fund is OK.Now they blamed my losses on small fund.Liar!

Exposure

逗比

Hong Kong

I deposited $60000 on x and traded 2 days. I wanted to withdraw but they rejected it saying some third-party channel problems.

Exposure