مقدمة عن الشركة

| Nittan Capital Group ملخص المراجعة | |

| تأسست | 2014 |

| البلد/المنطقة المسجلة | اليابان |

| التنظيم | FSS |

| الخدمات | معاملات الفوركس، معاملات سوق العملات الأجنبية، وساطة مشتقات |

| دعم العملاء | هاتف: +81-3-3271-8450 |

معلومات Nittan Capital Group

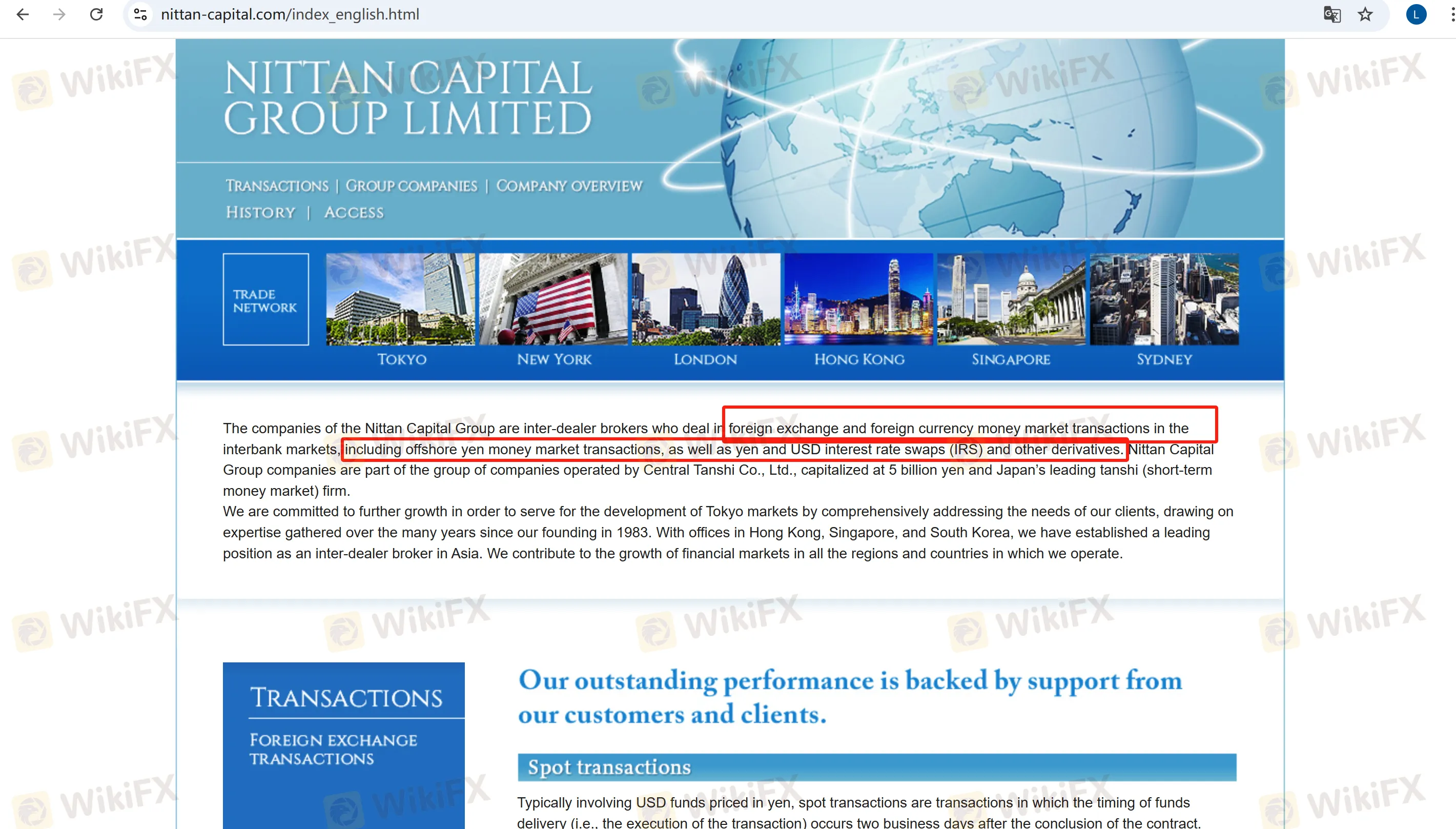

Nittan Capital Group Limited هي مجموعة خدمات مالية تابعة لشركة سنترال تانشي المحدودة (برأس مال قدره 5 مليار ين ياباني)، وهي شركة يابانية لسوق النقود على المدى القصير، مقرها في منطقة تشوو-كو، طوكيو.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| / | تنظيمها بواسطة FSS |

| هيكل رسوم غير واضح |

هل Nittan Capital Group شرعية؟

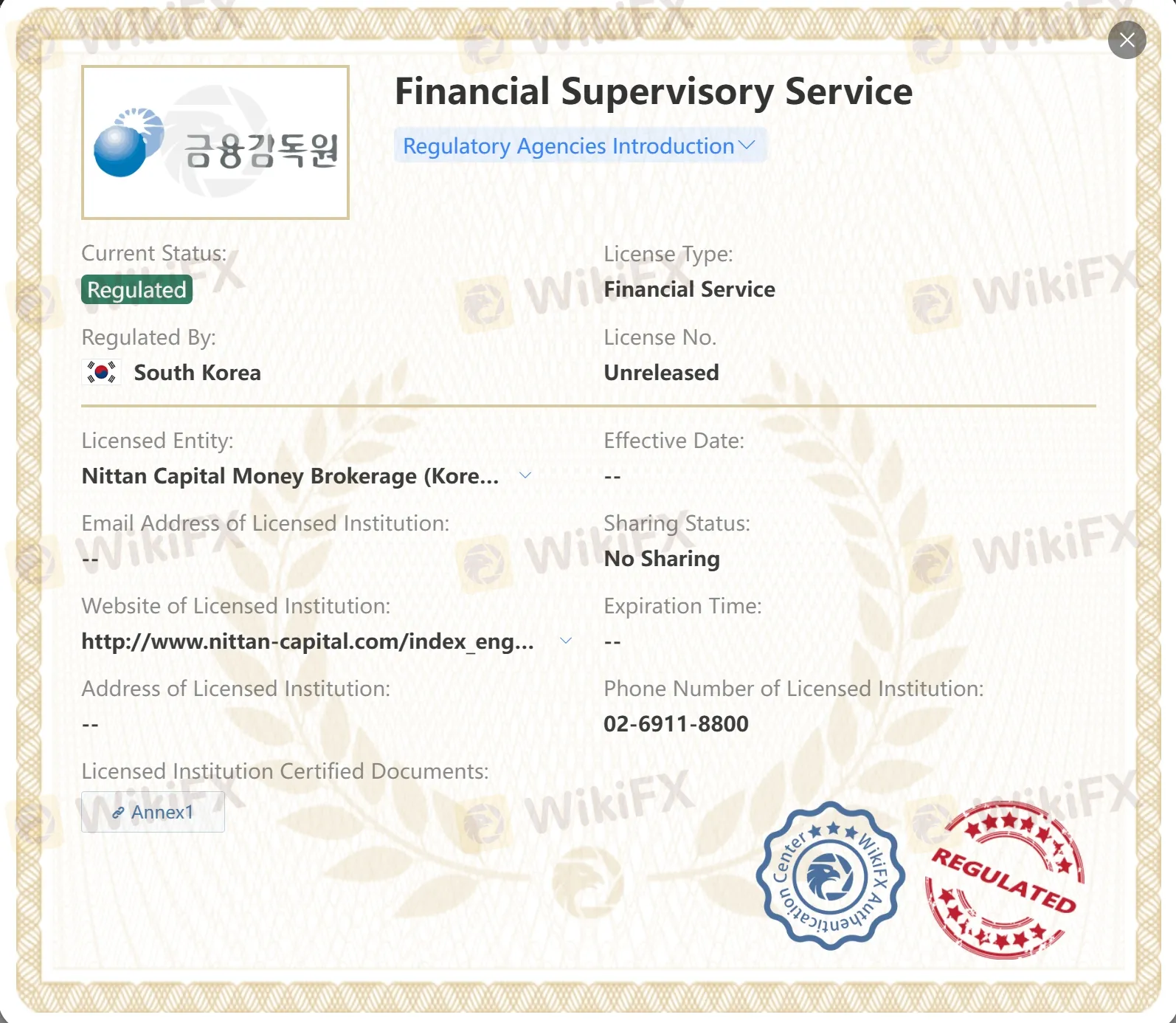

| السلطة التنظيمية | الحالة الحالية | الكيان المرخص | البلد المنظم | نوع الترخيص | رقم الترخيص |

| هيئة الرقابة المالية (FSS) | منظم | شركة نيتان كابيتال لوساطة النقود (كوريا) المحدودة | كوريا الجنوبية | خدمة مالية | غير مصدر |

الخدمات

كوسيط تداول في سوق البنوك الدولية، تقدم Nittan Capital Group خدمات لـ معاملات صرف العملات الأجنبية، معاملات سوق العملات الأجنبية (مثل معاملات الدعوة بالدولار الأمريكي ومعاملات سوق الين الخارجي)، وخدمات وساطة مشتقات تشمل مبادلات أسعار الفائدة (IRS)، وما إلى ذلك.