مقدمة عن الشركة

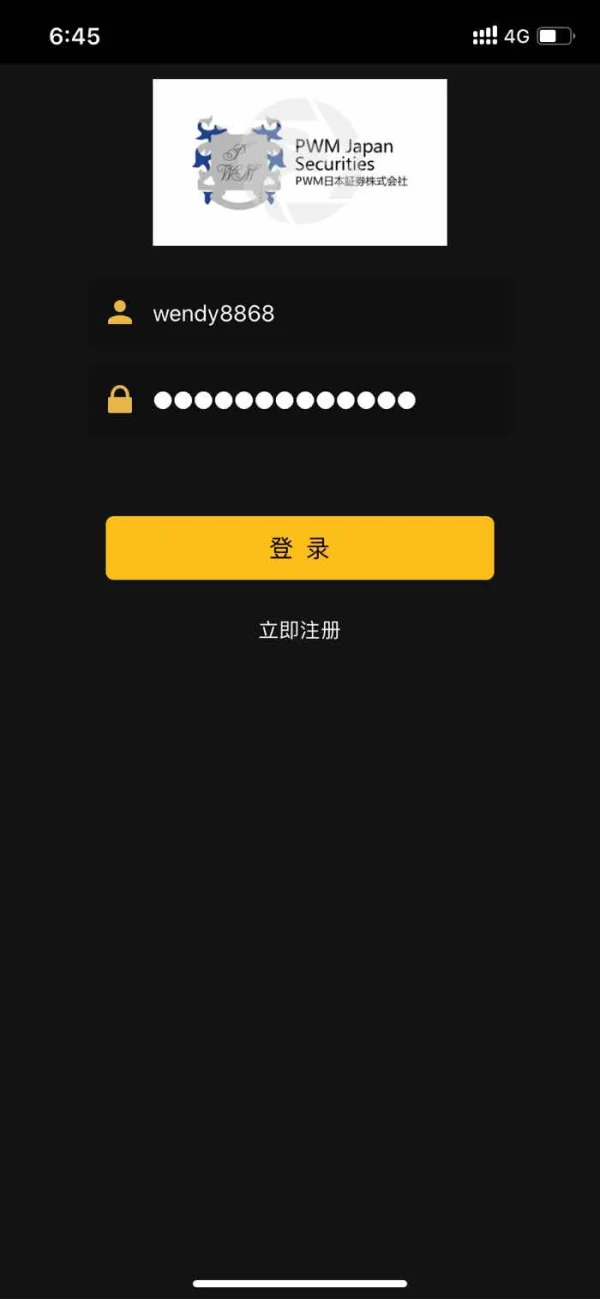

| PWM Japan Securities ملخص المراجعة | |

| تأسست | 1999 |

| البلد/المنطقة المسجلة | اليابان |

| التنظيم | منظم بواسطة FSA |

| أدوات السوق | منتجات استثمارية، سندات أجنبية |

| حساب تجريبي | / |

| منصة تداول | / |

| دعم العملاء | نموذج اتصال |

| هاتف: 03-6809-2388، 03-6809-2410 | |

معلومات PWM Japan Securities

PWM Japan Securities هي مؤسسة مالية يابانية تأسست في عام 1999 وتخضع لرقابة هيئة الخدمات المالية (FSA). تقدم مجموعة واسعة من المنتجات الاستثمارية، بما في ذلك الصناديق الاستثمارية، والسندات الأجنبية، وخطط التقاعد. ومع ذلك، ليست هناك تفاصيل واضحة حول الرسوم.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| منظم بواسطة FSA | نقص في معلومات الرسوم |

| وقت تشغيل طويل | تم ذكر نوع واحد فقط من الحسابات |

هل PWM Japan Securities شرعي؟

PWM Japan Securities مرخصة من قبل هيئة خدمات الأمور المالية في اليابان (FSA) بترخيص فوركس تجزئة، رقم الترخيص 関東財務局長(金商)第50号.

ما الذي يمكنني التداول به على PWM Japan Securities؟

PWM Japan Securities تقدم مجموعة متنوعة من المنتجات الاستثمارية، بما في ذلك الصناديق الاستثمارية التي تغطي مجموعة واسعة من الفئات مثل الأسهم الداخلية والدولية، والسندات، وصناديق الاستثمار العقاري، والصناديق المتوازنة، وصناديق السلع.

كما تقدم برنامج تسريع الأصول الذي يدعم الاستثمارات الدولية المتنوعة ابتداءً من 10,000 ين ياباني شهريًا. بالإضافة إلى ذلك، تقدم PWM سندات أجنبية بالإضافة إلى خطط التقاعد للمساهمة المحددة من قبل الشركات.

نوع الحساب

PWM Japan Securities تدعم حسابات NISA، مما يتيح للمستثمرين فتح حسابات خالية من الضرائب والتداول بأرباح خالية من الضرائب.

杨芳30591

هونغ كونغ

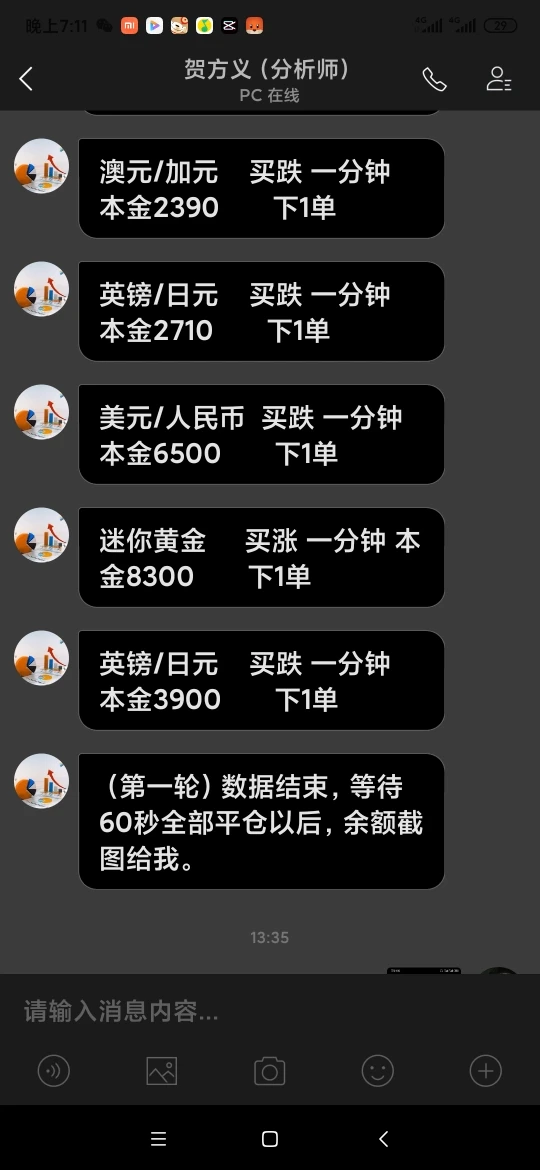

欺诈,分析师带着操作,说下错单了要补仓才能操作

البلاغات

摸一下

هونغ كونغ

所有的暴利,都不能相信,网络本身就是虚拟的,当你想赚钱的时候,还是在现实中的好,不懂的东西不要碰,不懂的东西不要投,这样至少不会被骗。

البلاغات

FX2812005723

هونغ كونغ

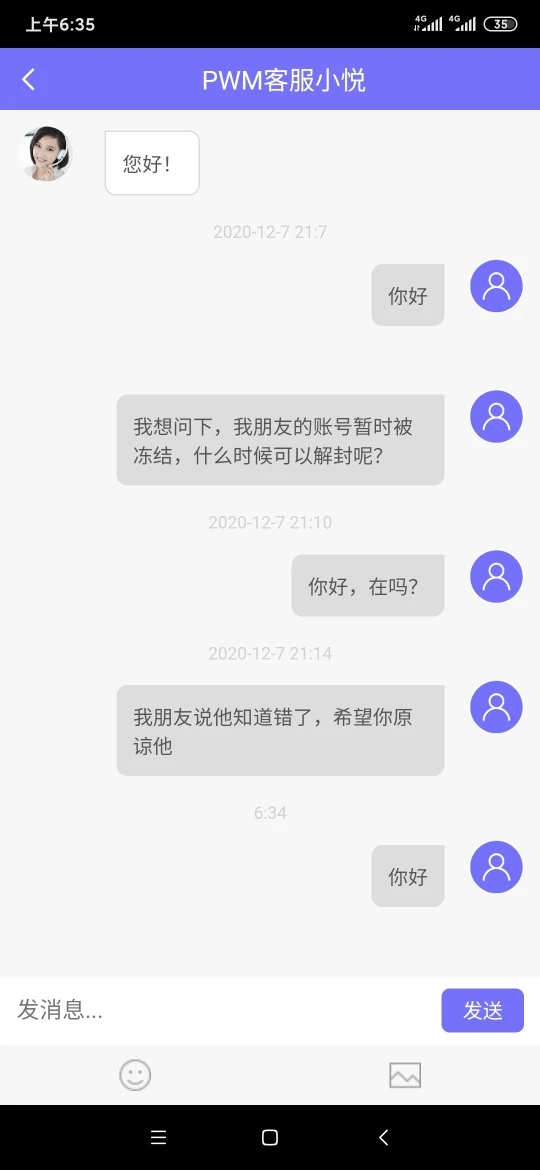

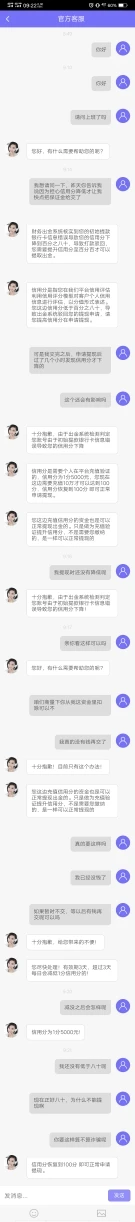

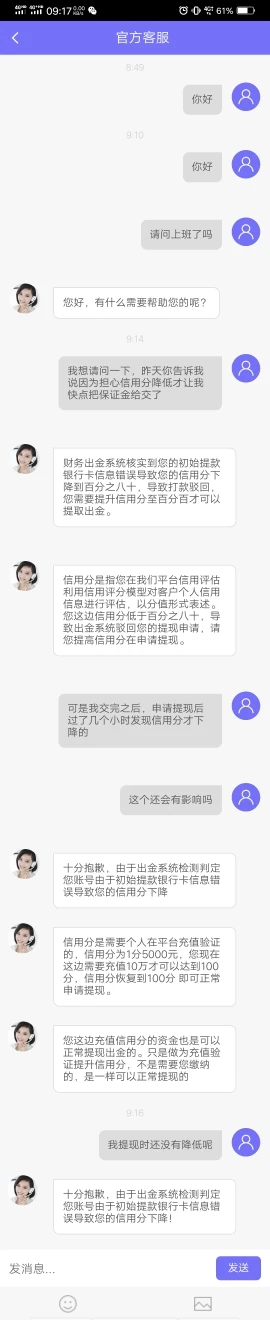

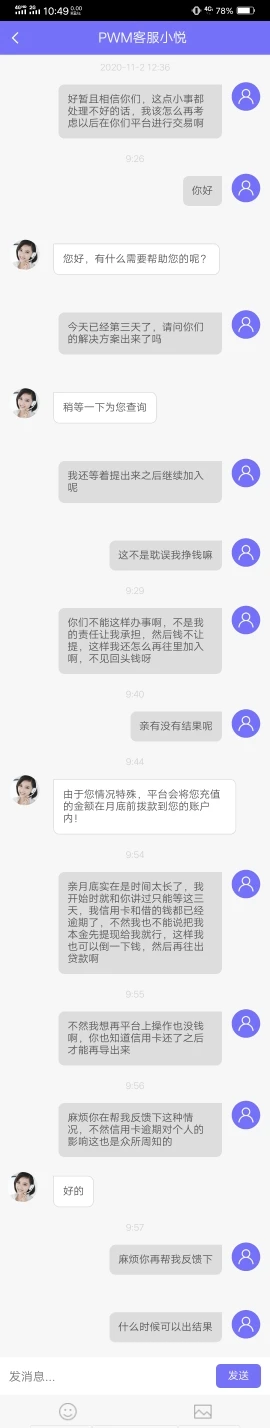

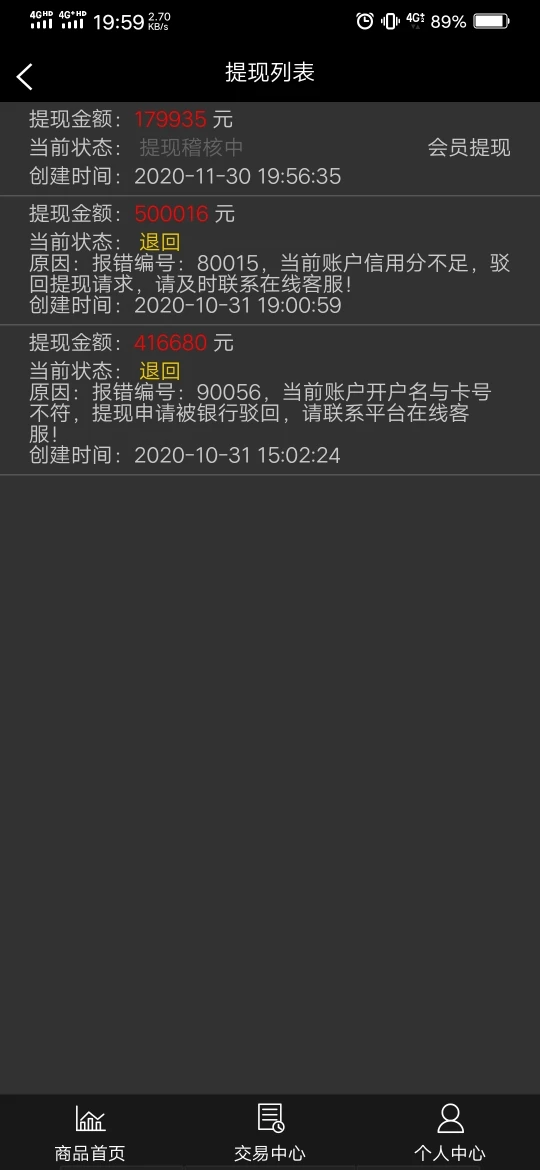

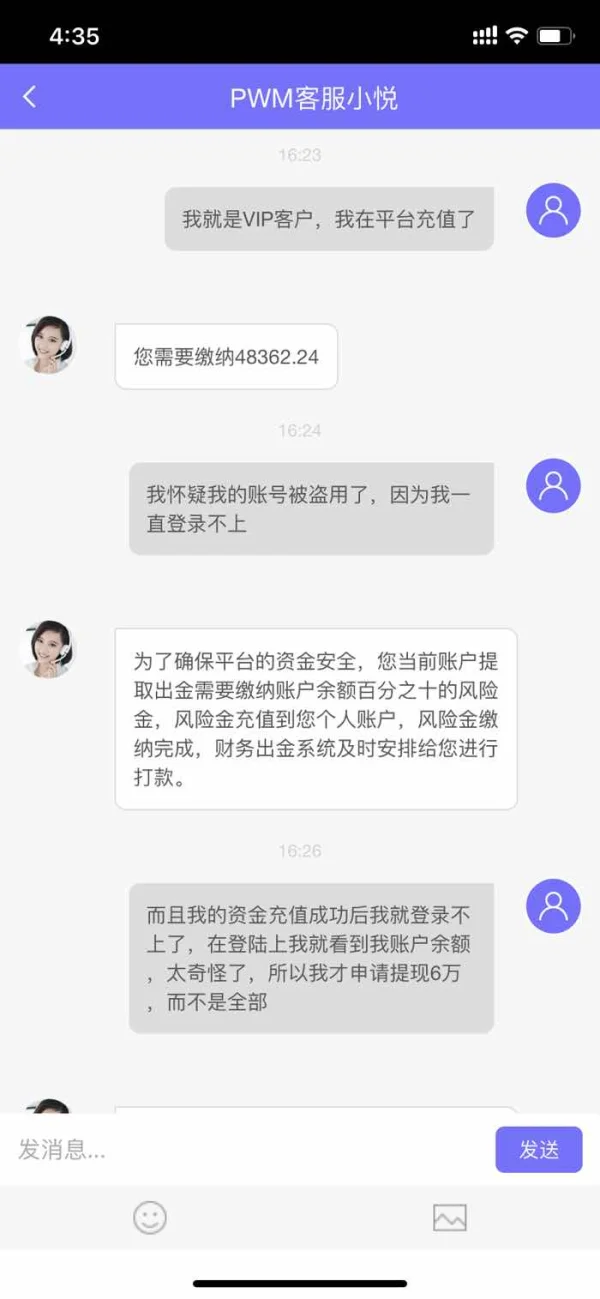

在2020.10.30日联系客服入金,10.31正式在PWM平台进行操作,最后在交易完要提现时客服以我银行卡号错误为由让我交保证金还有身份证和银行卡照片,客服说可以帮我改正银行卡号信息,交了保证金后还是提现不成功,客服又告诉我信用分下降等理由阻止我提现,但我是在交了保证金后并且信用分百分时申请提现的,平台没理由也没道理不给我提现到账的,于是我要求客服给处理我的出金问题,但最后客服告诉我要等11月末平台结算时才可以,直到11月19日客服还在说让我等月末,但是当我11月22日再与客服联系时,直到今天12月8日,客服也都没有任何回复,我的本金17万多就这样销声匿迹,被他们骗走了,本以为可以改善家里的生活质量,结果现在还要还信用卡还贷款是雪上加霜,请看到我消息的友人们帮忙转发,不要让其她人再受其害,同时也请相关部门能够帮忙严查PWM JAPAN PWM日本证券这个平台,可以帮我们讨回公道,让他们还我们血汗钱,让中国的国民再免受这些平台的欺害!

البلاغات

慧46668

هونغ كونغ

根本无法出金,骗人的专人带操作,没有天上掉馅饼,高收益全身骗人的

البلاغات

___Mr. Lonely"

هونغ كونغ

这些骗人的东西,不会有好下场的,呼吁和我有着同样遭遇的人儿,大家都要主动不公安部门报案立案,不要怕麻烦也不要怕丢人,这不是什么可耻的事情,尽早抓到这帮骗子,好让我们的血汗钱早早归还。

البلاغات

霞23898

هونغ كونغ

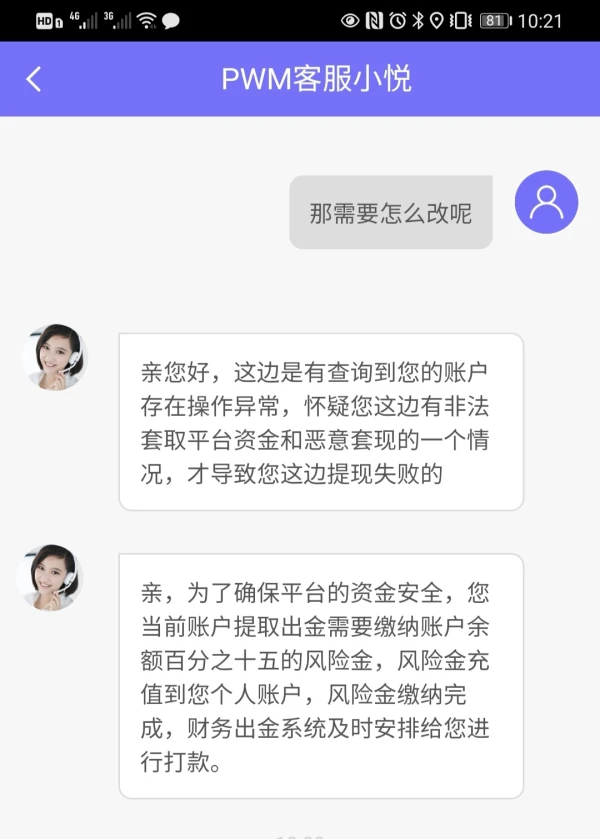

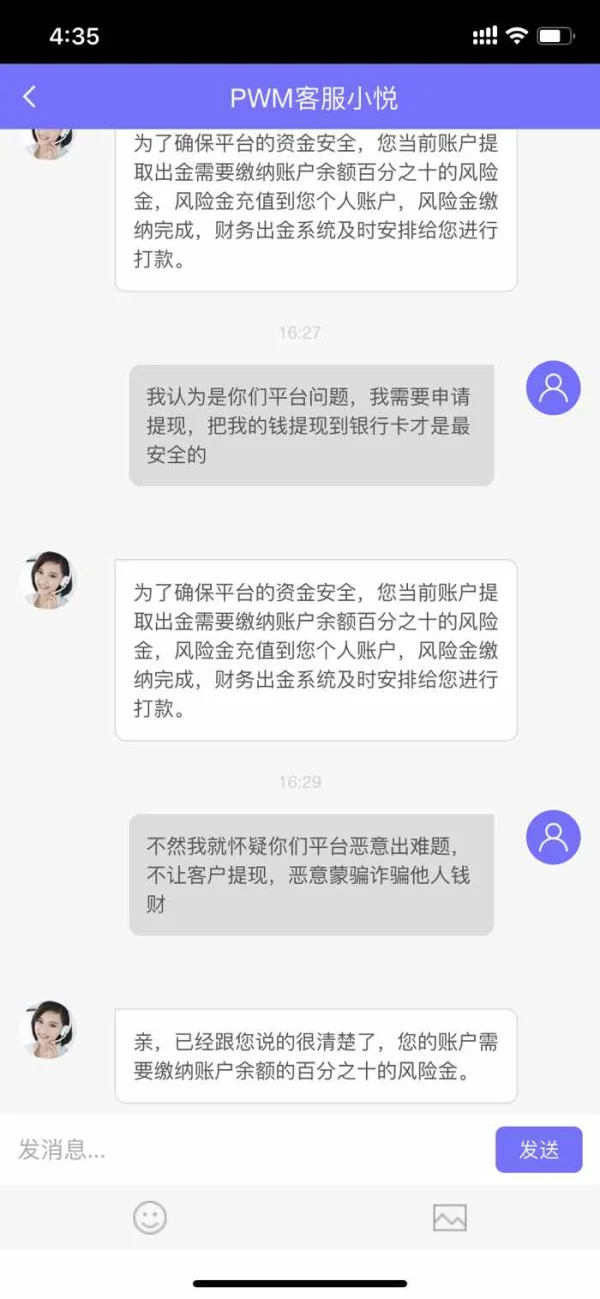

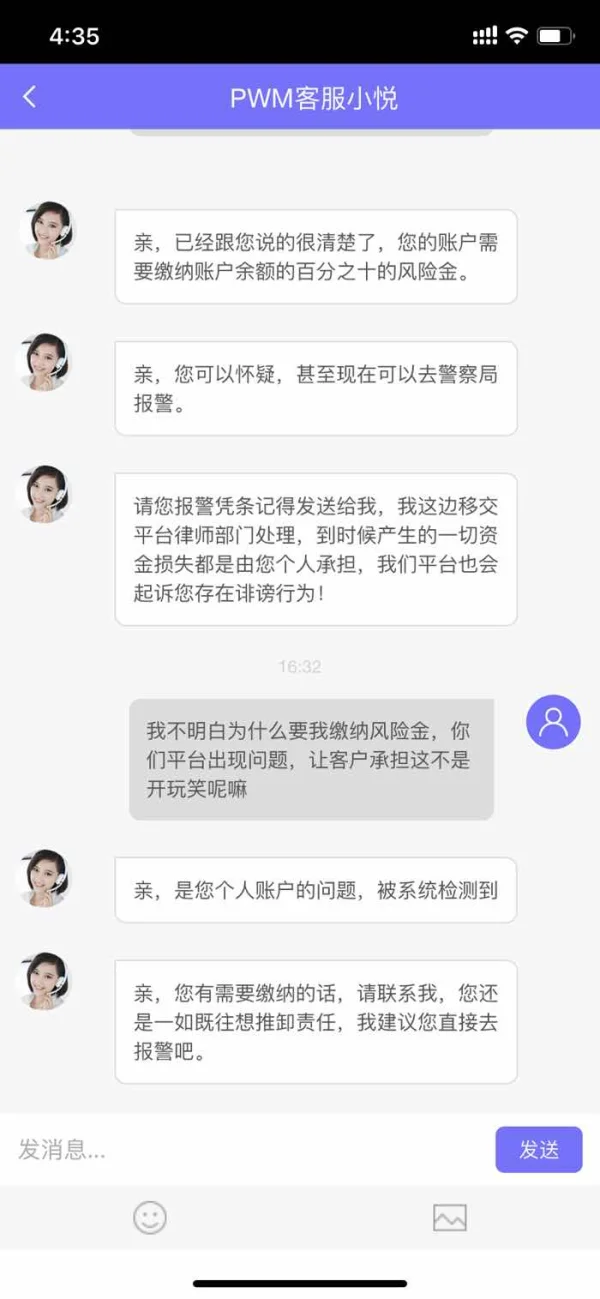

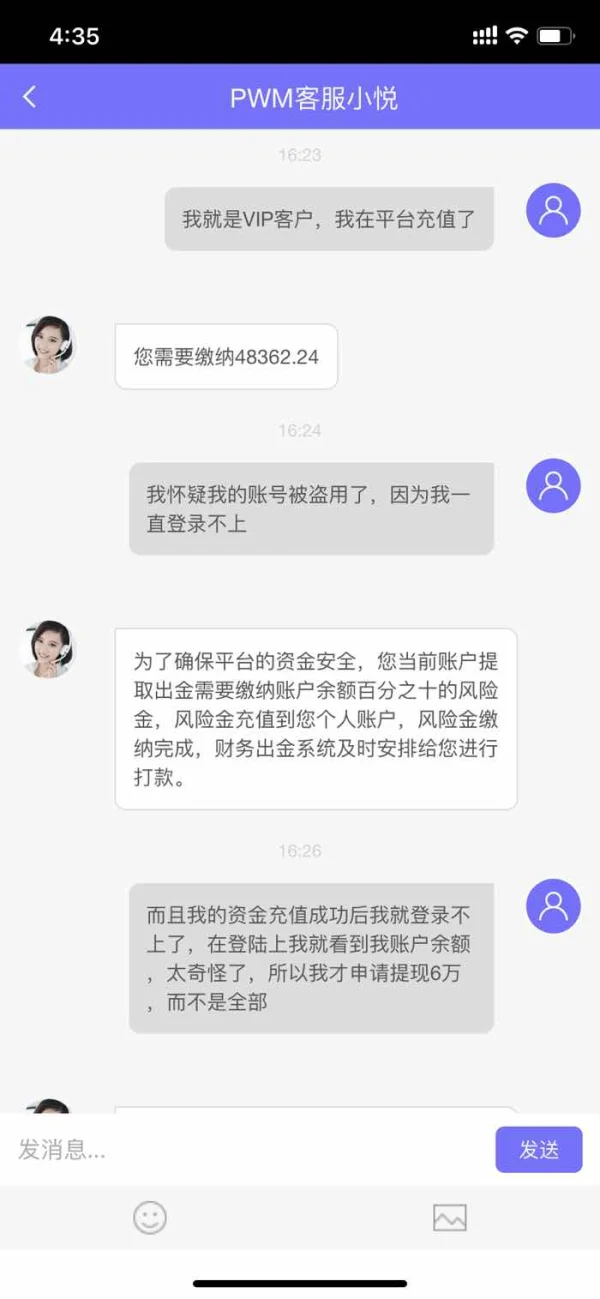

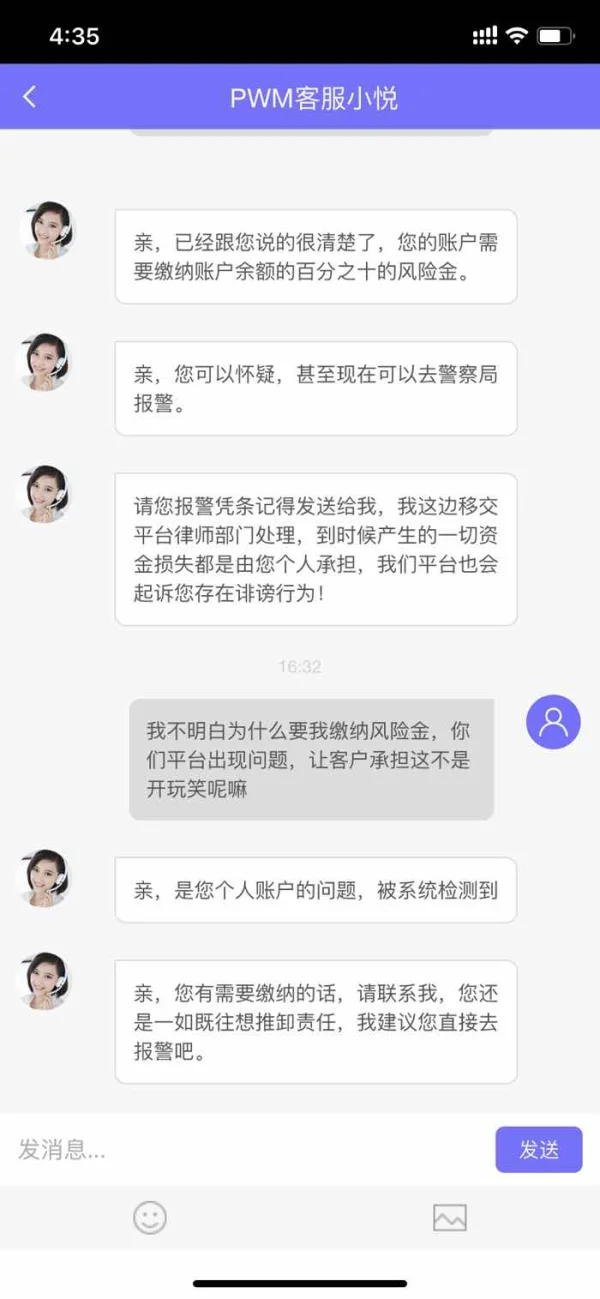

客服说银行卡信息不对,需要缴纳百分之十五风险金方可更改信息,否则没法出金,骗子公司,纯属诈骗

البلاغات

___Mr. Lonely"

هونغ كونغ

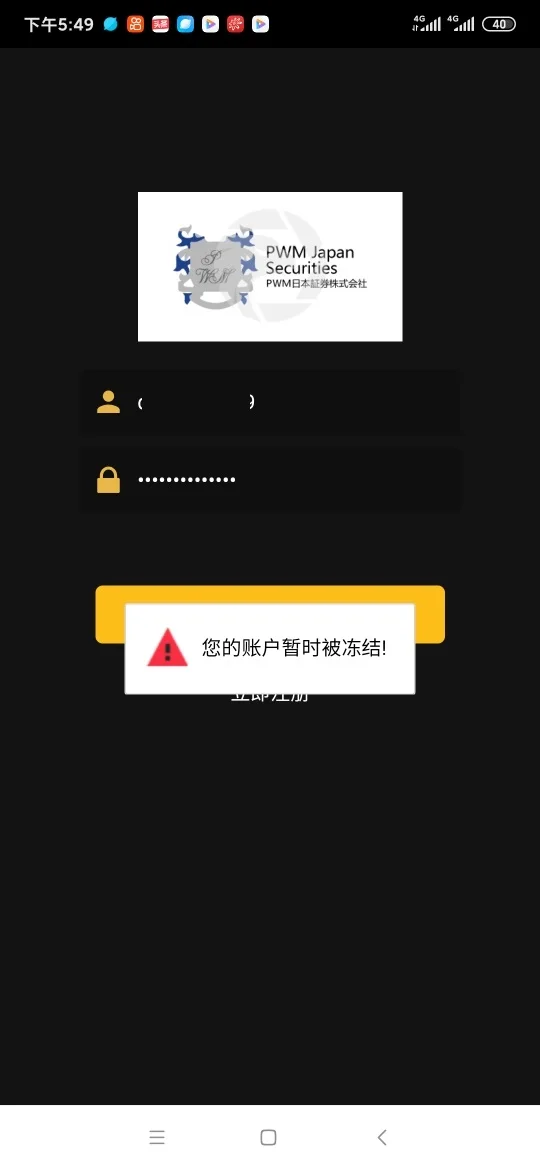

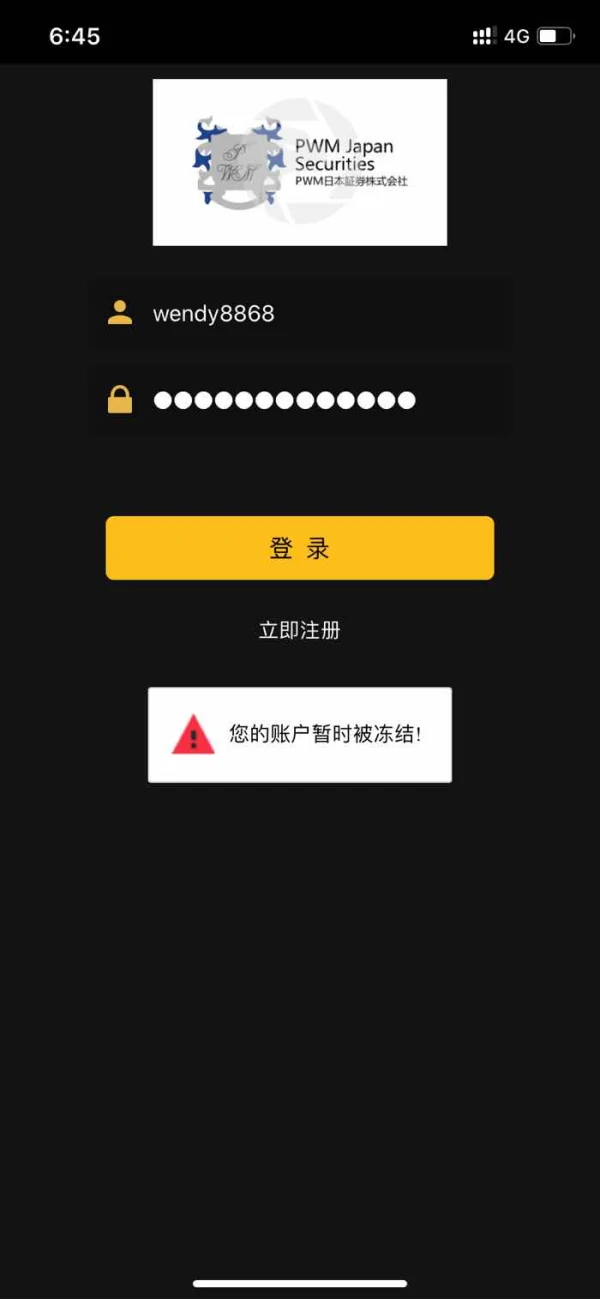

投资外汇10万元血本无归,找各种各样借口不让提现,这还不算还要缴纳风险金才能提现,但是能不能提现还是未知的,现在连本金都没了踪影,账号被冻结了,报案无果,不知道能不能追回,心脏病发作了都,呼吁广大群众和我有同样遭遇的朋友们,大家一起去报案,金额越大越好,让有关部门尽快重视起来,别让这些没良心的诈骗犯逍遥法外,我的血汗钱也不是大风刮来的

البلاغات

___Mr. Lonely"

هونغ كونغ

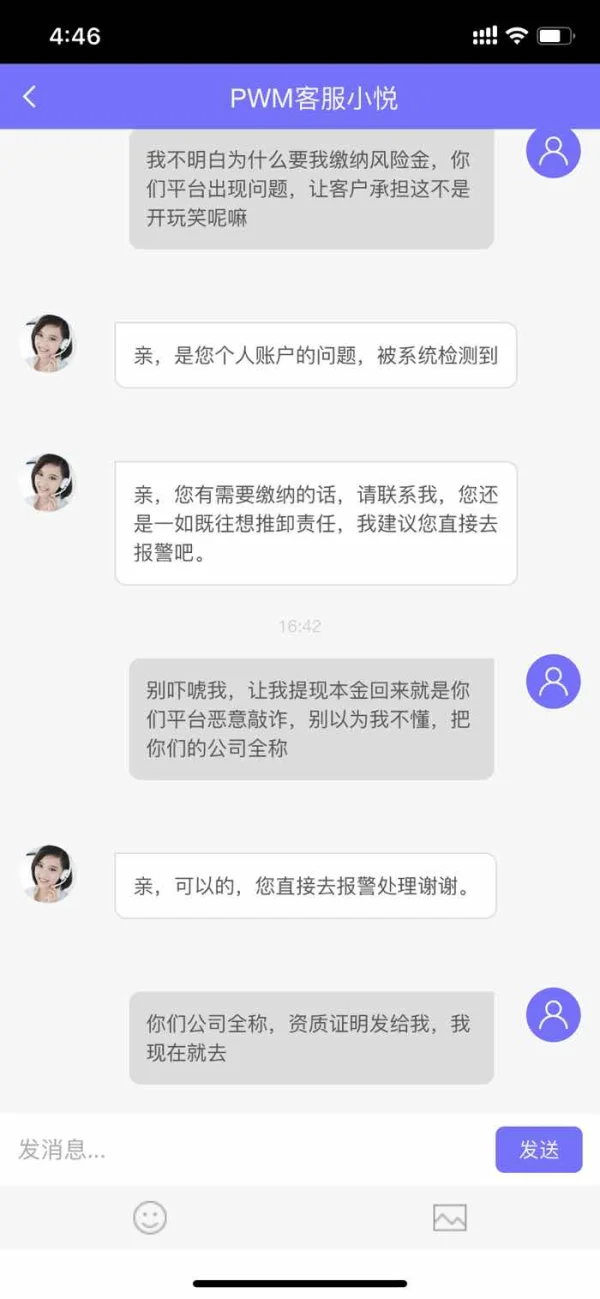

现在更狠,直接给我冻结了,太气人了,天理何在,就是骗子,想多骗点

البلاغات

FX2812005723

هونغ كونغ

在我申请出金时,PWM平台上的客服以银行卡信息有误,让我缴纳保证金,后又以信用分降低不予我出金,之后又讲要11月末给我出金,但之后我再与客服联系,也不回复我任何信息,我再次提交申请出金时也不给通过,也没有任何变动,客服也不再讲信用分降低的事了,就是完全不理睬,这不就是赤裸裸的诈骗勒索,黑平台吗?期望更多部门能够重视起来,更多好心人能够帮忙曝光它们这样的平台.

البلاغات

___Mr. Lonely"

هونغ كونغ

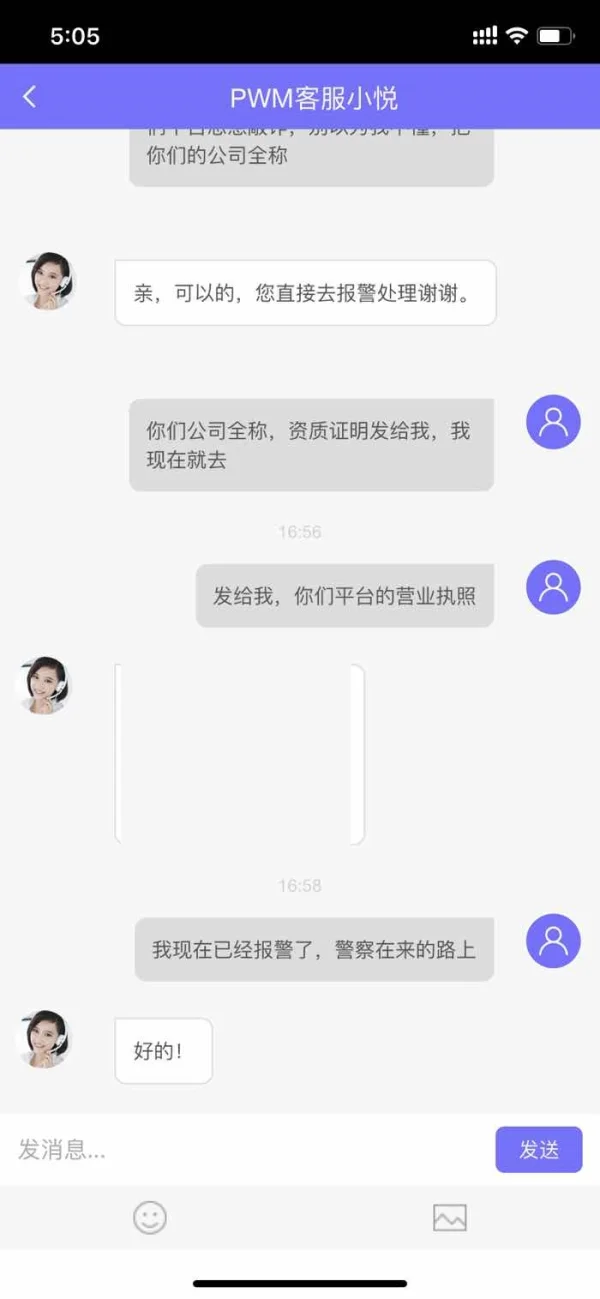

客服说账户存在风险,让交风险金才能提现,还骗人呢,说报警也不怕,好你等着吧,已经报警处理

البلاغات

___Mr. Lonely"

هونغ كونغ

通过一个人的微信朋友圈了解到,外汇交易,说他们公司有技术能一对一带你赚钱,说是赚取平台的钱,我抱着侥幸心理想说投资点试试,结果分析师说投资金额太少操作空间有限,让我追加投资。本来我只想先投三万元试试,结果追加投资后本金就是七万五千元了。充值完开始操作结束说我有漏单,让我交上162700让我补仓才能进行下两轮操作,三轮都操作完就可以提现了。我就觉得不对劲,骗人,我被骗了。后期又充值2万5千元,也不能提现,平台说我存在异常,也是让我缴纳风险金,总金额的百分之十,总金额是483622.4,百分之十那就是48362.24。越想越不对劲,马上打电话报警,去派出所报案立案。

البلاغات

FX2812005723

هونغ كونغ

2020.11.1日在此平台中进行买卖外汇交易,等到我账户余额上数目增长后,我想要申请提现,之后平台客服以我填写银行卡号有误,不给提现通过,让我继续缴纳保证金,还承诺最后保证金会一起退还的,之后我交完保证金和银行卡、身份证照片后再申请出金,客服又将我信用分降低,以信用分低为由再次将我提现申请驳回,后又告诉我月底结算才可以给我出金,但后来再联系客服,客服不再回复我任何消息,我再次申请了提现,也一直不给处理处理,都是在审核中,前后共以这种诱导方式骗取我17万多本金,恳请相关部门可以介入调查,严查他们这些行为恶劣的平台,让他们还我们血汗钱!

البلاغات