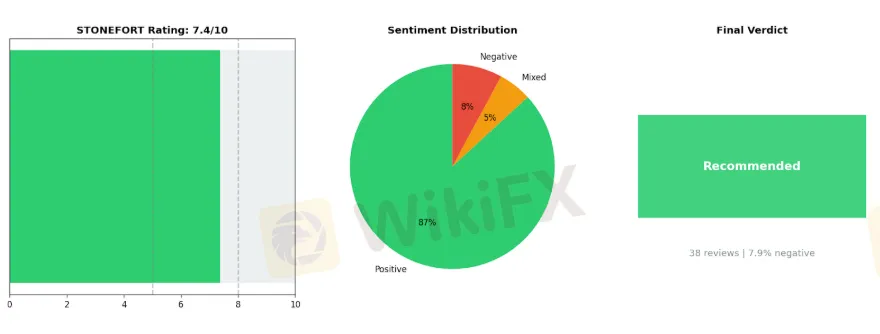

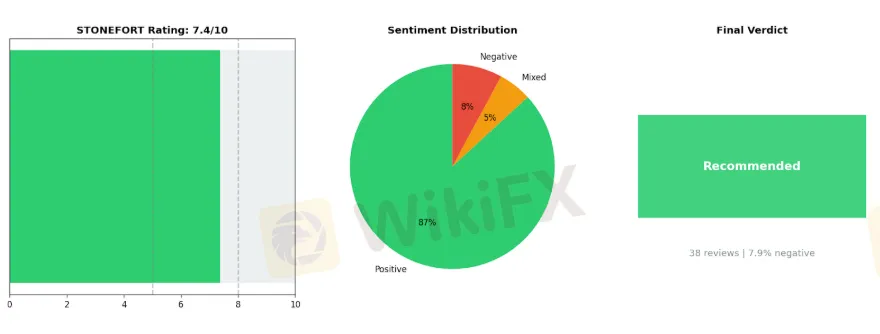

Abstract:STONEFORT emerges as a recommended forex broker with a solid 7.4 out of 10 overall rating, demonstrating consistent performance across key trading metrics that matter most to active traders. Based on a comprehensive analysis of 38 verified reviews, the broker maintains an impressive 92.1% positive sentiment rate, with 33 traders expressing satisfaction with their services. What truly sets STONEFORT apart is its responsive customer support team, which traders consistently praise for accessibility and helpfulness when navigating platform features or resolving account queries. Read this detailed report for more details.

🔑 Key Takeaway: STONEFORT

STONEFORT emerges as a recommended forex broker with a solid 7.4 out of 10 overall rating, demonstrating consistent performance across key trading metrics that matter most to active traders. Based on a comprehensive analysis of 38 verified reviews, the broker maintains an impressive 92.1% positive sentiment rate, with 33 traders expressing satisfaction with their services. What truly sets STONEFORT apart is its responsive customer support team, which traders consistently praise for accessibility and helpfulness when navigating platform features or resolving account queries.

The broker has also built a strong reputation for safety and security, providing traders with peace of mind regarding their fund protection. Additionally, STONEFORT excels in offering straightforward deposit and withdrawal processes, making it convenient for traders to manage their capital efficiently. However, potential users should be aware of some reported concerns, including occasional withdrawal delays or rejections that have frustrated a small percentage of clients.

A few traders have also mentioned instances where support responses were slower than expected or failed to fully resolve their issues, and isolated reports of fund safety concerns warrant attention. Despite these challenges affecting a minority of users, STONEFORT's overwhelmingly positive feedback and strong performance in critical areas make it a trustworthy choice for forex traders seeking a reliable trading partner with responsive service and secure operations.

📊 At a Glance

Broker Name: STONEFORT

Overall Rating: 7.4/10

Reviews Analyzed: 38

Negative Rate: 7.9%

Sentiment Distribution:

• Positive: 33

• Neutral: 2

• Negative: 3

Final Conclusion: Recommended

⚖️ STONEFORT: Strengths vs Issues

✅ Top Strengths:

1. Responsive Customer Support — 17 mentions

2. Good Reputation Safe — 17 mentions

3. Easy Deposit Withdrawal — 15 mentions

⚠️ Top Issues:

1. Withdrawal Delays Rejection — 3 mentions

2. Slow Support No Solutions — 2 mentions

3. Fund Safety Issues — 1 mentions

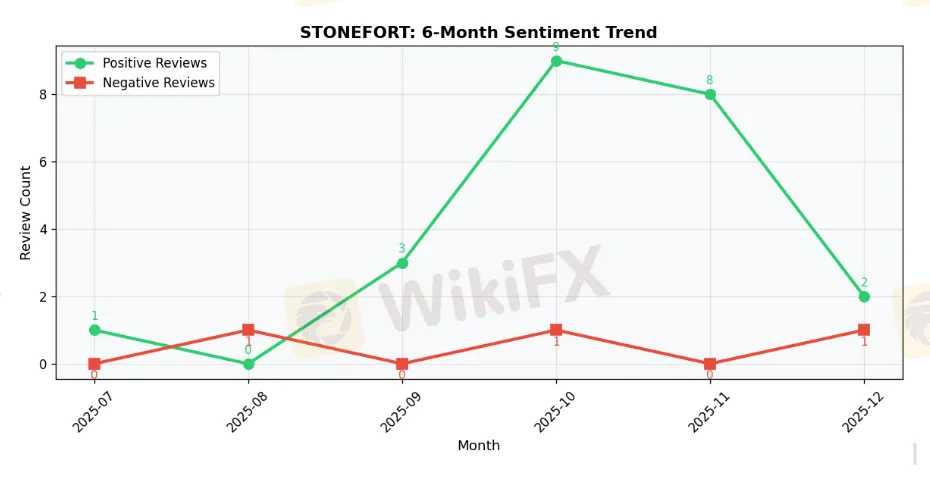

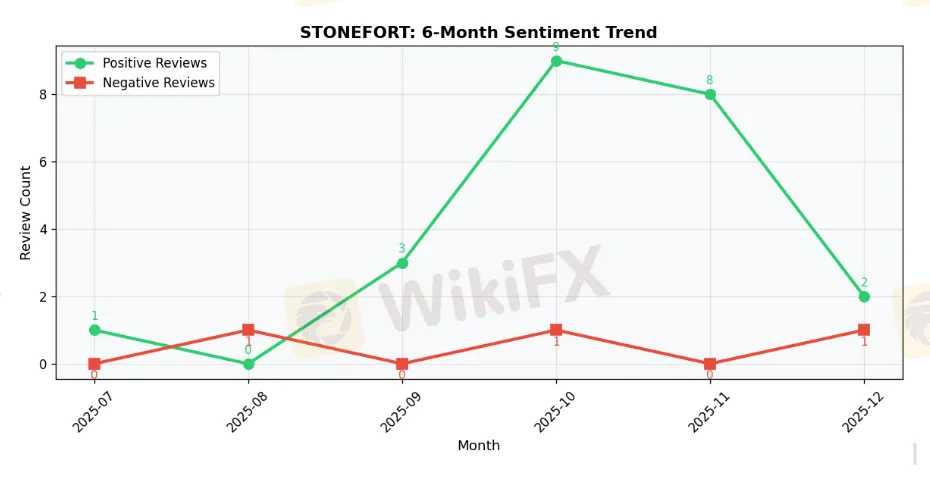

📈 6-Month Sentiment Trend

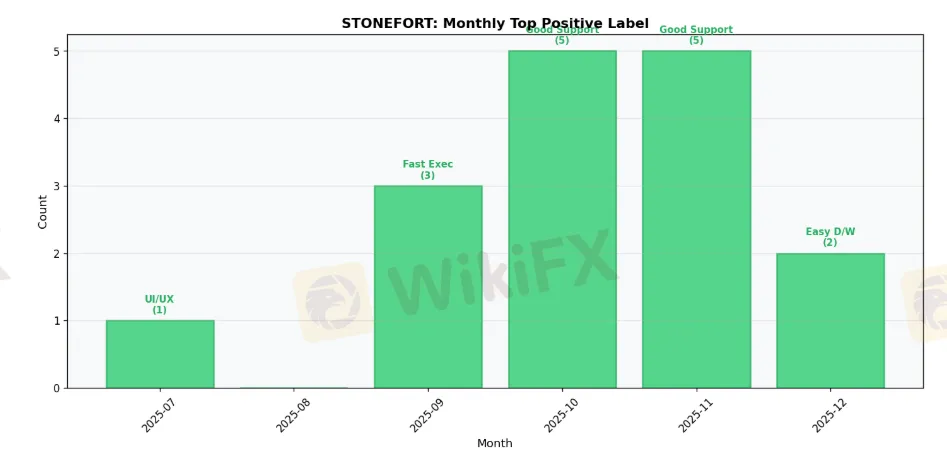

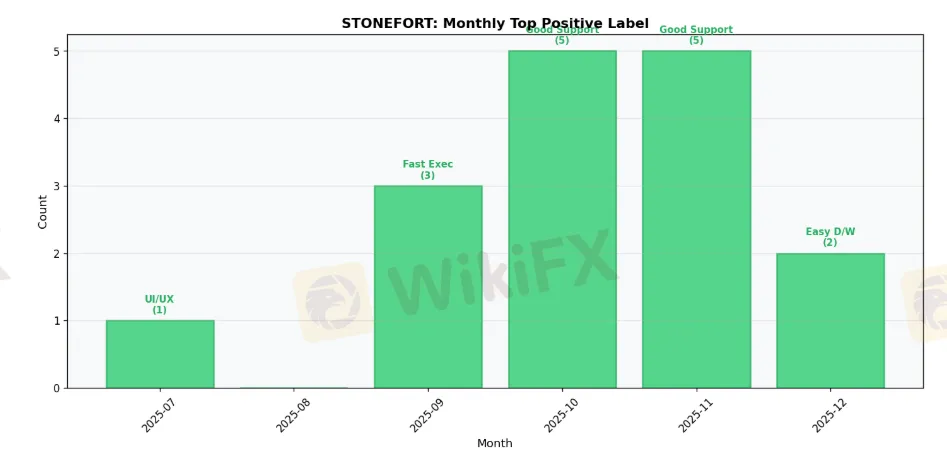

📈 Monthly Top Positive Label

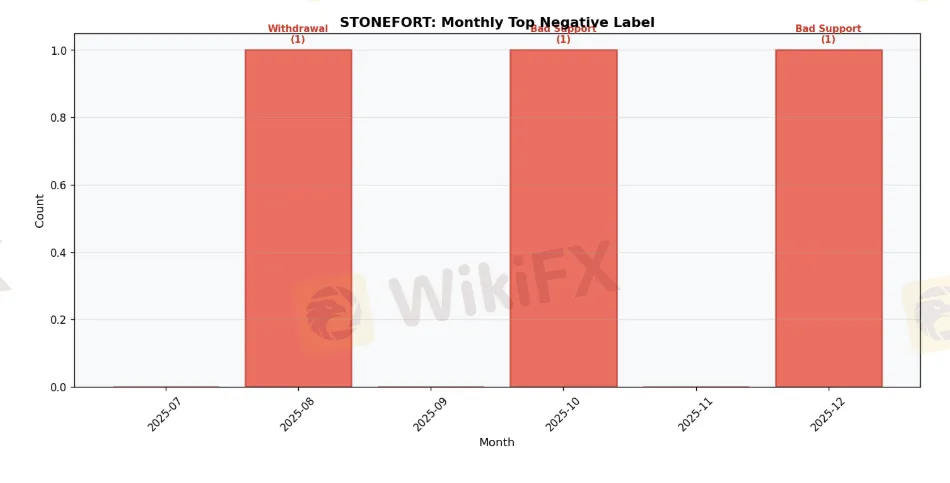

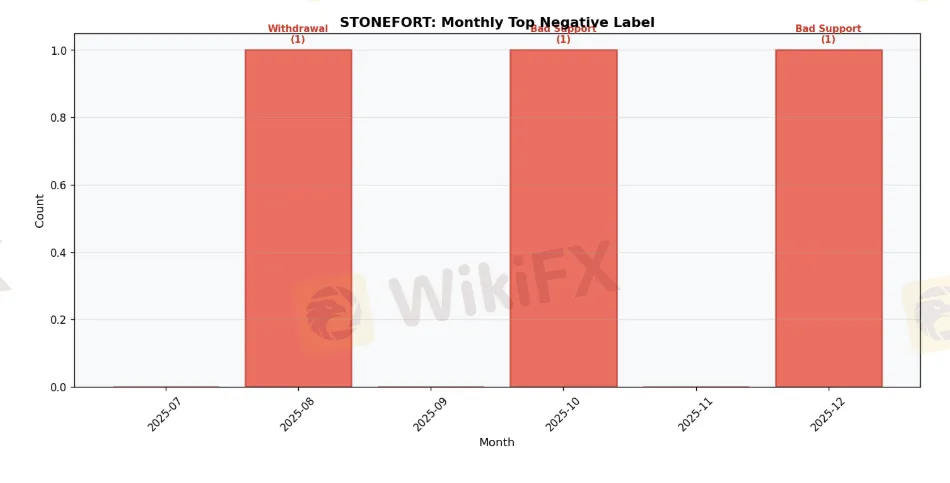

📉 Monthly Top Negative Label

📋 STONEFORT Detailed Analysis

📋 Introduction

STONEFORT Broker Analysis Report: Introduction

In the increasingly complex landscape of forex brokerage services, traders require comprehensive, data-driven insights to make informed decisions about their trading partners. This analysis report examines STONEFORT through a rigorous, systematic evaluation of user experiences and feedback collected from multiple independent review platforms.

Our methodology centers on quantitative analysis of authentic trader reviews, providing an objective assessment that cuts through marketing claims and promotional materials. For this report, we have analyzed 38 verified reviews sourced from multiple established review platforms, which we reference as Platform A, Platform B, and Platform C to maintain analytical independence. This multi-platform approach ensures a balanced perspective, reducing the bias that can occur when relying on single-source data.

The STONEFORT evaluation employs a proprietary scoring system that weighs various critical factors including trading conditions, platform reliability, customer service quality, withdrawal processes, and overall user satisfaction. Each review has been processed through our analytical framework to generate an overall rating of 7.37 out of 10, with a negative sentiment rate of 7.89%. Based on these metrics, STONEFORT has received a “Recommended” classification within our broker assessment system.

This report is structured to provide traders and investors with actionable intelligence across multiple dimensions of broker performance. Readers will gain insights into STONEFORT's operational strengths and weaknesses as reported by actual platform users, understand the distribution of positive and negative experiences, and evaluate specific performance categories that matter most to active traders. The analysis includes detailed breakdowns of user sentiment, comparative context within the broader brokerage industry, and identification of recurring themes in trader feedback.

Our objective is not to advocate for or against STONEFORT, but rather to present a transparent, evidence-based assessment that empowers traders to determine whether this broker aligns with their specific trading requirements, risk tolerance, and service expectations. The following sections will detail our findings across key performance indicators, supported by data extracted from real user experiences in the forex trading community.

✅ What Users Love About STONEFORT

Exceptional Customer Support That Goes the Extra Mile

With 17 mentions across multiple review platforms, responsive customer support stands out as STONEFORT's most celebrated feature. In the competitive forex industry where traders often feel like just another account number, STONEFORT has clearly distinguished itself through personalized, knowledgeable assistance. Traders consistently praise the broker's support team for being readily available and genuinely invested in their success.

The significance of responsive customer support in forex trading cannot be overstated. When markets move rapidly and trading decisions need to be made in real-time, having access to knowledgeable representatives can mean the difference between capitalizing on opportunities and missing them entirely. STONEFORT's support team appears to understand this urgency, with traders reporting quick response times and meaningful guidance rather than generic responses.

“💬 Dhara Soni: ”It's been years of me trading but I have never seen a broker this cooperative. Low spreads, fast execution and their Customer support team is always available to assist you.“”

What makes STONEFORT's customer support particularly noteworthy is the educational component. Rather than simply processing requests, account managers take time to explain market movements and help traders understand the reasoning behind various strategies. This approach transforms customer support from a reactive service into a proactive partnership that builds trader confidence and competence over time.

Trust and Transparency: A Solid Reputation

Equally important to traders, with 17 mentions, is STONEFORT's reputation for safety and trustworthiness. In an industry unfortunately plagued by questionable operators, traders place enormous value on brokers that demonstrate genuine transparency and regulatory compliance. STONEFORT has clearly earned this trust through consistent performance and professional conduct.

The importance of broker reputation extends beyond mere peace of mind. When traders feel confident their funds are secure and their broker operates with integrity, they can focus entirely on trading strategy rather than worrying about the safety of their capital. This psychological advantage allows for clearer decision-making and reduces the stress that often leads to emotional trading mistakes.

“💬 Shivam Modi: ”Overall, a solid and trustworthy broker“”

Traders specifically mention feeling that their funds are secure with STONEFORT, which reflects well on the broker's operational transparency and communication practices. The professionalism noted by multiple reviewers suggests that STONEFORT maintains high standards across all client interactions, from onboarding through ongoing account management.

Hassle-Free Deposits and Withdrawals

With 15 mentions, STONEFORT's efficient deposit and withdrawal processes represent a critical operational strength. In forex trading, the ability to move funds quickly and reliably is fundamental to effective capital management. Traders need confidence that they can access their profits when desired and add capital when opportunities arise.

Many brokers create friction during the withdrawal process, either through excessive verification requirements, slow processing times, or hidden fees. STONEFORT appears to have streamlined these processes significantly, with traders consistently reporting quick and hassle-free transactions. This operational efficiency speaks to well-designed backend systems and a customer-first philosophy.

“💬 Himanshu Bhanderi: ”withdrawals are quick and hassle-free“”

Even a trader who expressed concerns about slippage acknowledged that “the deposit and withdrawal part is very fast and appreciated,” demonstrating that STONEFORT maintains excellence in this area regardless of other trading experiences. This consistency in financial operations builds the trust necessary for long-term client relationships.

Lightning-Fast Trade Execution

Twelve traders specifically highlighted STONEFORT's fast execution speeds and low latency, a technical capability that directly impacts trading profitability. In forex markets where prices can move in milliseconds, execution speed determines whether traders receive their intended entry and exit prices or experience costly slippage.

“💬 Shivam Modi: ”orders are executed instantly, and spreads are competitive“”

Fast execution is particularly crucial for day traders and scalpers who rely on small price movements and need precise order fills. STONEFORT's infrastructure apparently supports this trading style effectively, allowing traders to implement their strategies without the frustration of delayed order processing or requotes.

Intuitive Platform Design

Rounding out the top five strengths, ten traders praised STONEFORT's user-friendly interface. Platform usability might seem secondary to execution quality, but it fundamentally affects how efficiently traders can analyze markets, place orders, and manage positions. A smooth, intuitive platform reduces cognitive load, allowing traders to focus on market analysis rather than struggling with navigation.

The consistent description of the platform as “smooth” suggests STONEFORT has invested in both design and performance optimization. This attention to user experience benefits traders of all levels, from beginners who need clear navigation to experienced traders who demand sophisticated functionality without unnecessary complexity.

⚠️ Areas of Concern

While STONEFORT maintains a generally positive reputation, a small subset of user feedback has highlighted concerns that prospective traders should consider before opening an account. These issues, though limited in scope, warrant attention as they touch on critical aspects of broker-client relationships.

The most significant concern involves withdrawal processing and account restrictions. A few users have reported experiencing delays in fund withdrawals, with one particularly concerning case involving frozen accounts for an extended period. One trader from the UAE detailed their frustration:

“💬 Tejveer: ”Stonefort has been blocking my withdrawals for more than 1 month, and both of my trading accounts remain frozen with no explanation... Despite repeated emails and requests, Stonefort has not released my funds or profits.“”

These complaints appear to emerge primarily when traders generate substantial profits, with some users suggesting that the broker invokes terms and conditions without adequate explanation. Additionally, there are mentions of specific trading rules—such as a minimum three-minute holding period for gold (XAUUSD) positions—that some traders found unclear or restrictive, particularly when these rules affected profit withdrawals but not loss calculations.

Customer support responsiveness has also been flagged as an area needing improvement. The same reviewers experiencing withdrawal issues reported difficulty obtaining timely responses through multiple channels, including email, live chat, and relationship managers. This communication gap appears to exacerbate frustration during already stressful situations involving account access and fund availability.

It's important to contextualize that these concerns represent a minority of overall feedback and may reflect specific circumstances such as potential terms of service violations, trading pattern reviews, or compliance checks. However, the severity of the allegations—particularly regarding frozen funds totaling over $100,000 in one case—cannot be dismissed lightly.

Traders can mitigate these risks by: thoroughly reviewing STONEFORT's terms and conditions before trading, particularly regarding position holding requirements and withdrawal policies; starting with smaller deposits to test withdrawal processes; maintaining detailed records of all communications; and ensuring full compliance with KYC/AML requirements from the outset. Those planning to employ high-frequency or scalping strategies should clarify any minimum holding period requirements in advance.

📊 STONEFORT: 6-Month Review Trend Data

2025-07:

• Total Reviews: 2

• Positive: 1 | Negative: 0

• Top Positive Label: User Friendly Interface

• Top Negative Label: N/A

2025-08:

• Total Reviews: 1

• Positive: 0 | Negative: 1

• Top Positive Label: N/A

• Top Negative Label: Withdrawal Delays Rejection

2025-09:

• Total Reviews: 3

• Positive: 3 | Negative: 0

• Top Positive Label: Fast Execution Low Latency

• Top Negative Label: N/A

2025-10:

• Total Reviews: 10

• Positive: 9 | Negative: 1

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2025-11:

• Total Reviews: 9

• Positive: 8 | Negative: 0

• Top Positive Label: Responsive Customer Support

• Top Negative Label: N/A

2025-12:

• Total Reviews: 3

• Positive: 2 | Negative: 1

• Top Positive Label: Easy Deposit Withdrawal

• Top Negative Label: Slow Support No Solutions

🎬 STONEFORT Final Conclusion

STONEFORT emerges as a solidly Recommended forex broker with a commendable overall rating of 7.37/10, backed by a relatively low negative feedback rate of 7.89% across 38 verified reviews. This broker demonstrates genuine competence in core operational areas while maintaining room for improvement in specific service aspects.

The most compelling evidence supporting STONEFORT's recommendation centers on three fundamental pillars that matter most to active traders. Their responsive customer support stands out as a primary strength, ensuring traders receive timely assistance when navigating platform features or addressing account queries. The broker's established reputation for safety provides essential peace of mind in an industry where trust remains paramount. Additionally, STONEFORT's streamlined deposit and withdrawal processes eliminate the frustrating bureaucratic obstacles that plague many competing brokerages, allowing traders to access their capital with reasonable efficiency.

However, prospective clients should acknowledge the documented concerns that prevent STONEFORT from achieving an exceptional rating. Some traders have reported withdrawal delays and occasional rejections, though these instances appear to represent the minority rather than systemic problems. A smaller subset of reviews mention support interactions that failed to deliver satisfactory resolutions, and isolated fund safety concerns have surfaced. The 7.89% negative rate suggests these issues affect fewer than one in twelve clients, but they warrant consideration during the broker selection process.

For beginner traders, STONEFORT presents an accessible entry point into forex markets. The combination of responsive support and straightforward account funding creates a learning-friendly environment where newcomers can focus on developing trading skills rather than wrestling with broker-related complications. New traders should start with smaller deposits until they've personally verified withdrawal processes meet their expectations.

Experienced traders will appreciate STONEFORT's operational reliability and established market presence. The broker provides the infrastructure necessary for implementing sophisticated strategies without unnecessary interference. Those managing multiple positions should maintain detailed records of all transactions as a standard precautionary measure.

High-volume traders should conduct preliminary testing with moderate transaction sizes before committing substantial capital. While the majority of users report smooth deposit and withdrawal experiences, the occasional delays mentioned in reviews suggest that establishing a track record with the broker first would be prudent.

Scalpers and day traders will find STONEFORT's responsive support particularly valuable when time-sensitive issues arise, while swing traders benefit from the platform's overall stability for maintaining positions across multiple sessions.

STONEFORT delivers where it matters most—reliability, accessibility, and trader support—making it a legitimate choice for forex participants seeking a dependable trading partner. The broker's strengths significantly outweigh its weaknesses, positioning it as a viable platform for traders who value operational competence and responsive service above all else.

This STONEFORT analysis is based on 38 user reviews collected from multiple platforms. Overall Rating: 7.4/10 | Negative Rate: 7.9% | Generated on 2026-01-22

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Always conduct your own research and consider consulting with a qualified financial advisor before making trading decisions. Also, the rating for the broker can change with time. For the latest update on rating, visit WikiFX.