Abstract:AMarkets Review 2026 shows no regulation, hidden risks, and unsafe trading conditions. Don’t risk your funds—choose a regulated broker today.

AMarkets Review 2026 reveals a broker operating without proper oversight, exposing traders to hidden risks and unsafe conditions. AMarkets, based in Saint Vincent and the Grenadines, offers high leverage up to 1:3000 and 500 instruments, but lacks valid forex regulation, raising serious red flags for investor safety. This investigative piece uncovers the absence of licenses, regional blocks, and other pitfalls that make AMarkets a risky choice. Traders seeking AMarkets review insights should know that unregulated operations could lead to fund losses—opt for regulated alternatives today.

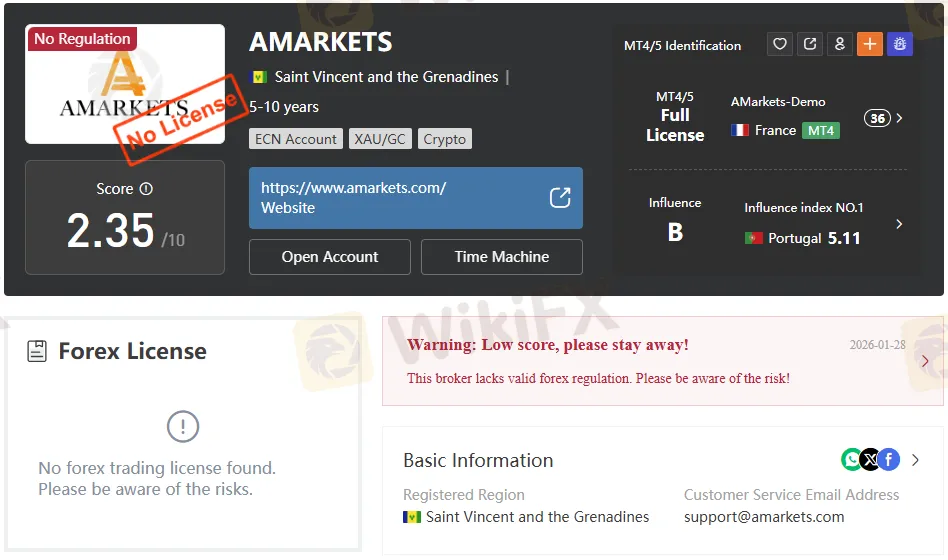

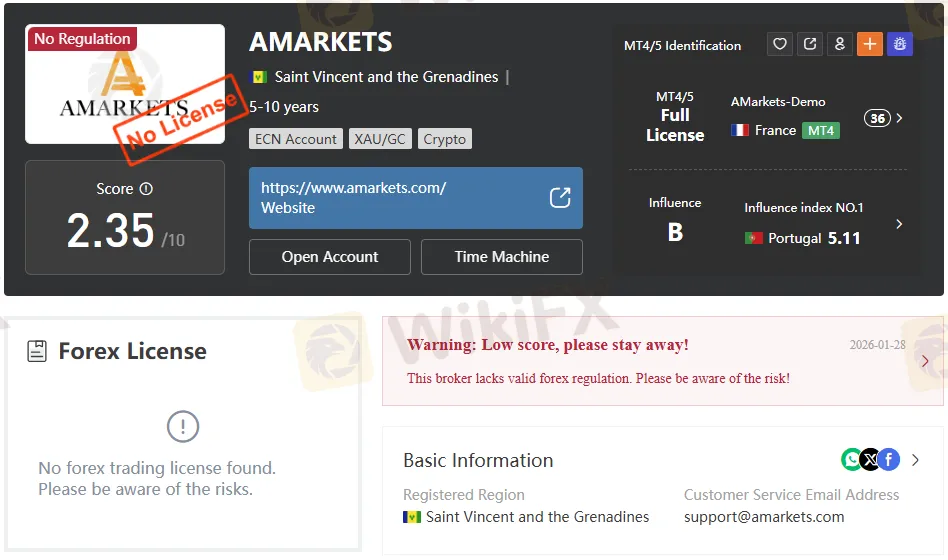

Unregulated Status Exposed

AMarkets holds no forex trading license from recognised authorities, a critical flaw in an industry demanding strict oversight. Registered only in Saint Vincent and the Grenadines, a known offshore haven with lax rules, the broker scores a mere 2.35 out of 10 on reliability metrics. Without regulatory backing, theres no guarantee of fair practices or fund protection, leaving traders vulnerable to potential misconduct.

Experts warn that unregulated entities like this often prioritise operations over client security. Saint Vincent registrations rarely involve audits or compensation schemes like those found in the UK or Australia. For anyone eyeing AMarkets review for legitimacy, this setup screams caution—funds deposited here lack the safeguards of tier-1 regulated firms.

Hidden Risks in Operations

High leverage up to 1:3000 sounds attractive, but it amplifies risks without regulatory caps, turning small losses into wipeouts. The brokers execution speeds average 212 ms, with pings around 159 ms on MT4 servers, which can lag during volatile markets. Combined with a lack of oversight, these technical specs fail to inspire confidence in high-stakes trading.

Regional restrictions block clients from over 70 countries, including the US, UK, and much of the EU, signalling awareness of regulatory scrutiny. Countries like Portugal rank high on their influence index at 5.11, yet even there, the lack of local compliance heightens exposure. Traders in allowed regions face unclear dispute-resolution paths, a hallmark of risky brokers.

Account Types Lack Safety

AMarkets offers four accounts: Crypto (min $10 MBT), Fixed, Standard ($100 min), and ECN ($200 min), all with floating or fixed spreads from 0 pips. Islamic swap-free options are available for Fixed, Standard, and ECN accounts, but not for Crypto accounts, and they exclude certain assets, such as stocks. Demo accounts start with $10,000 virtual funds, useful for testing but no substitute for real protections.

ECN suits scalpers with direct prime-broker access, but commissions and a 40% stop-out add costs without safety nets. Negative balance protection is available across accounts, yet the lack of regulation undermines its value.

Trading Instruments Tempt

Over 500 instruments span forex (44 pairs on Standard), metals, cryptos, bonds, commodities, indices, and stocks. This breadth appeals to diversified traders, covering majors like EURUSD from 0.2 pips. However, without audits, price feeds, and order fills, there is a risk of manipulation.

Crypto account uses MBT (0.001 BTC units), limiting leverage to 1:100 versus 1:3000 elsewhere. Copy trading exists, letting users mirror pros for commissions, but unregulated environments breed opacity around strategies. Bonuses like 15% on first deposits lure newcomers, often with strings attached in fine print.

Platforms Hide Flaws Well

MT4 and MT5 servers (2 each) support full licenses, with MT5 edging out for advanced features like market depth and hedging. The AMarkets App for iOS/Android offers 7 asset classes, 24/7 chat, and multi-language support (English, Russian, etc.). Average execution at 212 ms suits most, but pings (159-165 ms) lag for Asia-Pacific users.

Platforms boast 30+ indicators on MT4, economic calendars on MT5, yet no regulation means no verified fairness in backtesting or live trades. Mobile deposits/withdrawals integrate seamlessly, masking deeper trust issues.

Deposits Easy, Withdrawals?

Deposits via Visa/Mastercard, crypto (BTC, ETH, LTC, USDT), and e-wallets (Advcash, Neteller, Perfect Money) incur no fees, with processing times of minutes to hours. Minimums align with accounts, from $10 MBT equivalents. Withdrawals may incur broker fees, with no publicly guaranteed timelines.

Crypto options attract high-risk traders, but an unregulated status heightens reversal risks. No deposit fees hook users, but withdrawal hurdles emerge in practice.

Regional Blocks Signal Danger

Bans in the US, UK, EU nations (Austria to Switzerland), Japan, and many African/Latin American countries indicate avoidance of strict regulators. Top markets: Uzbekistan, Iran, Portugal (influence 5.11), Russia (4.21). The Philippines scores low at 2.52, yet it is accessible—traders there face additional vulnerability.

Multiple domains (amarkets.com, amarkets.trading, etc.) with IPs in Germany/US suggest proxy setups to evade blocks. This web of sites indirectly targets restricted zones, amplifying the potential for scams.

High Leverage Amplifies Losses

1:3000 leverage on major accounts dwarfs industry norms, boosting profits but exploding losses on minor moves. Crypto caps at 1:100, still aggressive without caps from bodies like CySEC. Stop-outs at 20-40% offer slim buffers in volatile swings.

Unregulated high leverage often leads to overtrading, wiping out novices. Pros might exploit it, but average users suffer most without mandatory risk warnings.

Support Promises, Delivers?

24/7 live chat, Telegram, email (support@amarkets.com), phone (+44 330 777 22 22) sound robust. Multi-language app support aids global reach. Yet, without regulation, there are no enforceable response standards or escalation paths.

In disputes, offshore brokers like this often delay or deny, leaving traders stranded.

Pros Mask Serious Cons

Wide instruments, MT4/5, no deposit fees, and copy trading shine superficially. But cons outweigh the pros: no regulation, ECN commissions, regional bans, and high-risk leverage. A low score (2.35/10) starkly reflects these imbalances.

Founded in 2007, 5-10 years of experience claims maturity, but the offshore base erodes trust.

Bottom Line

AMarkets lacks regulation, hides risks behind flashy leverage (1:3000), 500 instruments, and MT4/5 platforms, scoring just 2.35/10. Offshore in Saint Vincent, it blocks regulated markets while targeting vulnerable markets such as Uzbekistan and Portugal. Deposits flow easily, but withdrawals and fund safety remain dicey without oversight.

Steer clear—verify any brokers licenses via FCA, ASIC, or CySEC sites before depositing. Choose regulated firms with proven track records to protect your capital. Demand transparency; your funds depend on it.