简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

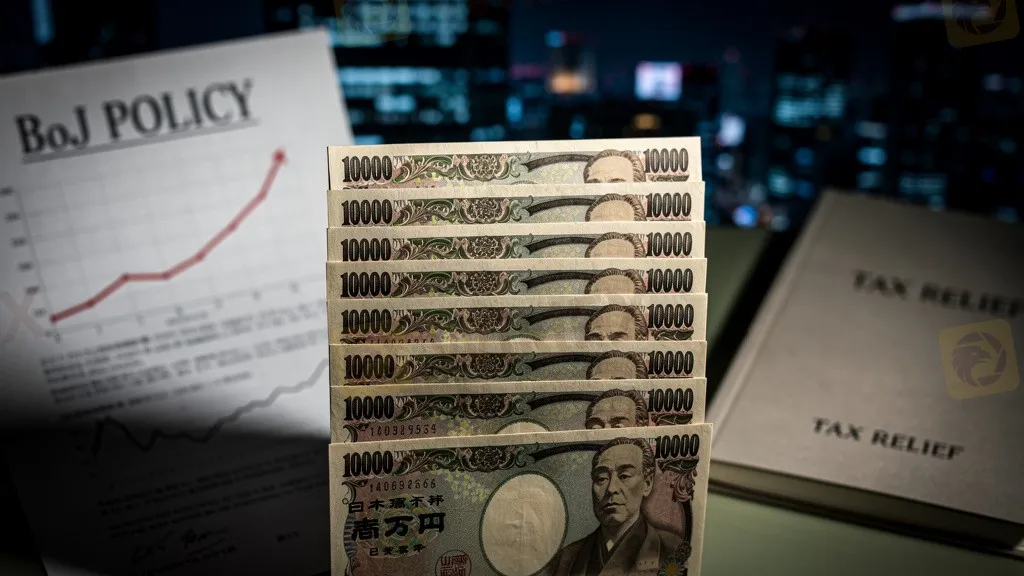

BoJ Hawks vs. Fiscal Doves: Japan's Policy Rift Leaves Yen in Limbo

Abstract:The Bank of Japan faces a policy deadlock as hawkish meeting minutes clash with the Prime Minister's push for tax cuts, creating volatility for the Yen.

Tokyo — The Japanese Yen (JPY) is caught in a turbulent tug-of-war between monetary tightening and fiscal expansion, as a rift widens between the Bank of Japan (BoJ) and the political administration.

Hawk Talk in Minutes

Minutes from the BoJ's December policy meeting, released this morning, reveal a growing consensus among policymakers that conditions for rate hikes are maturing.

- Inflation Overshoot: Board members noted that core inflation is tracking above the 3.0% forecast for fiscal 2025.

- FX Passthrough: Several members warned that the weak Yen is feeding into domestic prices faster than before, arguing that “waiting too long to hike carries significant risk.”

Political Headwinds

Directly countering the central bank's hawkish tilt, Prime Minister Sanae Takaichi is reportedly considering a suspension of the grocery consumption tax. While popular, the measure would slash tax revenue by an estimated 5 trillion yen, raising alarms about Japan's fiscal discipline.

Market Verdict

The contradictory signals have left the Yen volatile but lacking clear direction.

- USD/JPY: While the pair has softened due to broad USD weakness (trading near 152.00), the Yen's gains are capped by fears that the BoJ may be politically strong-armed into delaying normalization.

- Yields: JGB yields remain elevated as traders bet that, regardless of political pressure, the inflation reality will eventually force the BoJ's hand.

Analysts at Tokyo-based banks suggest that without a coordinated message from the Ministry of Finance and the BoJ, the Yen will remain highly sensitive to external factors, particularly US Treasury yields and carry-trade dynamics.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Currency Calculator