简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trive Review 2026: Comprehensive Safety Assessment

Abstract:Trive holds a strong 7.84 WikiFX score with regulation from ASIC and MFSA, offering competitive trading conditions on MT4 and MT5 platforms. However, despite high regulatory marks, a recent surge in client complaints regarding withdrawal delays and profit deductions warrants caution.

Executive Summary

In this in-depth review, we analyze the key metrics defining Trive's current market standing to determine if its high safety score aligns with user reality. As a broker entity operating since 2013, Trive has expanded its global footprint with a multi-jurisdictional approach, serving clients across Europe, Asia, and Africa. Integrating a mix of established regulatory oversight and flexible offshore conditions, the firm attempts to cater to diverse trading styles.

While the WikiFX score of 7.84 suggests a high level of reliability, our review process uncovered significant disparities between the broker's theoretical framework and recent client experiences. The broker utilizes a hybrid model, offering services through both highly regulated entities and offshore branches, which directly impacts the level of protection afforded to retail clients.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation operates under. Trive presents a complex regulatory map that requires careful navigation by potential clients. On the positive side, the broker is regulated by top-tier and mid-tier authorities, including the Australian Securities and Investments Commission (ASIC) and the Malta Financial Services Authority (MFSA), along with the Financial Sector Conduct Authority (FSCA) in South Africa. These licenses generally ensure strict adherence to capital adequacy and operational standards.

However, the extensive global reach relies heavily on its British Virgin Islands (BVI) license, which is considered an offshore regulation standard. Offshore jurisdictions often provide less stringent oversight regarding client fund segregation compared to EU or Australian standards. Furthermore, WikiFX data flags the United Kingdom Financial Conduct Authority (FCA) and Indonesian BAPPEBTI licenses as “Unverified,” creating ambiguity regarding the firm's legal standing in those specific regions. This mix of high-tier and offshore oversight means the safety of your funds largely depends on which specific legal entity you contract with.

2. Forex Trading Conditions

For traders focusing on Forex instruments, Trive offers a highly competitive environment tailored to both scalpers and high-volume traders. The broker provides access to a wide range of assets, including major and minor currency pairs, commodities, indices, and cryptocurrencies. A standout feature is the leverage flexibility; while standard accounts often see caps at 1:500, the “Pro Leverage Account” pushes this boundary to 1:2000, offering immense exposure power but also significantly increasing risk.

Does Forex pricing compete with top-tier providers? Our analysis of the account types—ECN Zero, VIP, Standard, and Pro—reveals strong pricing structures. The ECN Zero account boasts spreads starting from raw 0.0 pips, suitable for algorithmic trading, while the Standard account offers floating spreads from 1.2 pips. These conditions make Trive an attractive option for experienced traders looking to maximize their strategy's efficiency.

3. User Feedback & Complaints

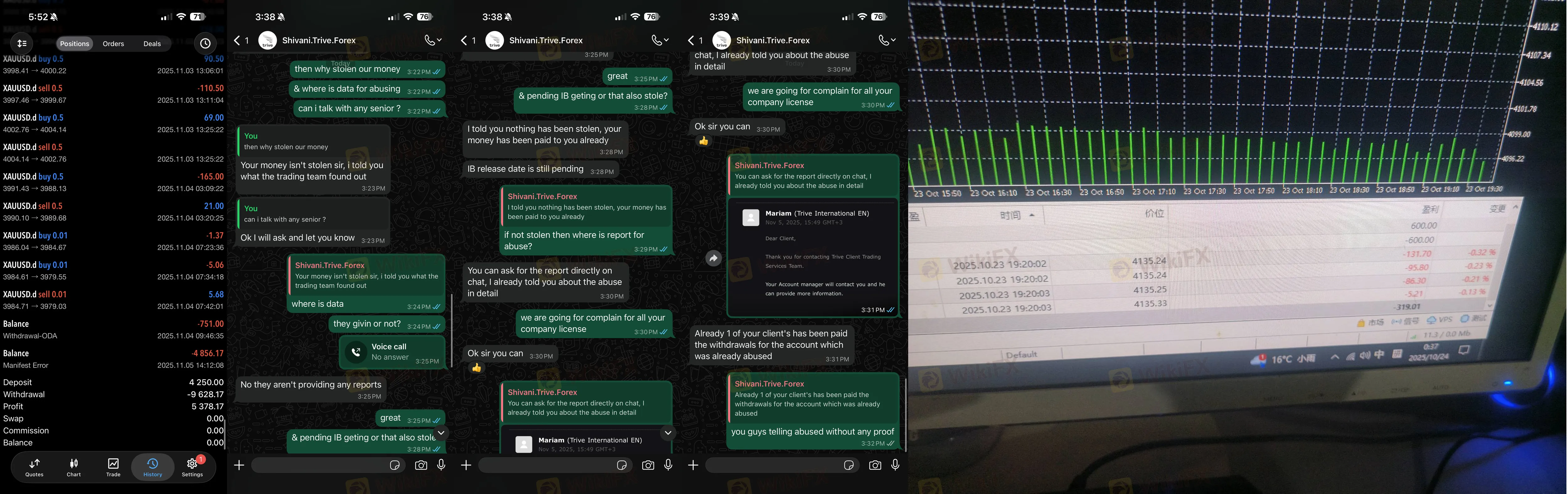

Despite the strong regulatory backing, the login to the client feedback section reveals concerning patterns. In the last three months alone, WikiFX has received 14 complaints, a high number for a broker with this safety rating. The primary grievances revolve around the withdrawal process and the negation of profits.

Multiple users have alleged that after generating significant profits, their requests for withdrawals were stalled or rejected. Specific cases cite the broker's risk management department deducting profits under claims of “abusive trading strategies” or non-compliance with bonus terms. For instance, traders reported that upon checking their account login, they found substantial sums (ranging from $5,000 to over $30,000) deducted or the account balance wiped. While the broker maintains policies against arbitrage and varied toxic flow, the volume of these reports suggests a strict, perhaps aggressive, enforcement of terms that traders must be wary of.

4. Software & Access

Regarding technology, Trive excels by offering the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside a proprietary mobile app. To access the platform, traders must complete the login security steps, which currently support standard encryption. However, the software review notes a lack of advanced biometric authentication or two-step verification in some versions, which is a missed opportunity for enhanced security.

Stability is generally rated as “Perfect” in software audits, but due to the complaint volume concerning account access restrictions, users have reported difficulties with their login stability in the context of account suspensions or freezes during withdrawal disputes. For the average user not involved in disputes, the platform provides a robust environment with custom charting, EA support, and copy trading capabilities.

Final Verdict

Trive presents a paradox in the financial markets: it is a highly regulated, high-scoring entity that simultaneously faces serious allegations regarding profit payouts. The technical offering is solid, with high leverage and low spreads appealing to professionals. However, the “Unverified” status of key licenses like the FCA and the volume of withdrawal complaints cannot be ignored.

For real-time updates on regulation status or to verify the official login page to avoid phishing clones, we strongly recommend consulting the WikiFX App before depositing funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

Bitget Review: A Regulatory Ghost Running a Phishing Playground

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Binomo Review: Is This Broker Safe or a High-Risk Trap?

South African Rand on Edge Ahead of Divisive Reserve Bank Meeting

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Currency Calculator