简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

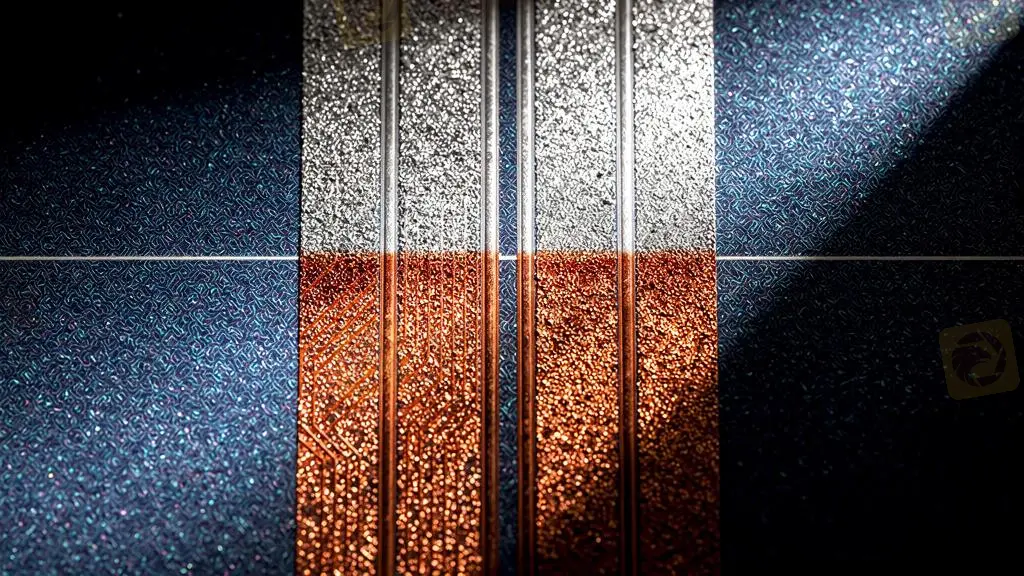

Silver at $94: Industrial Demand Collision Sparks Material Revolution

Abstract:Silver prices have surged to record highs over $94/oz, driving a structural shift in the solar industry as manufacturers aggressively substitute copper for silver to survive crippling costs.

Spot Silver (XAG/USD) has continued its historic ascent, trading up 1.61% at $94.14 per ounce, driven by a perfect storm of monetary debasement fears and an acute industrial supply squeeze. This price explosion is forcing an adapt or die moment in the photovoltaic (PV) sector.

The “Copper Era” in Solar

With Silver prices gaining over 200% since early 2024, the economics of solar panel manufacturing have been upended. Silver paste, once a manageable cost component (3.4%), now accounts for nearly 20% of a solar module's cost, surpassing polysilicon as the primary expense driver.

This has triggered an accelerated migration to Copper substitution.

- Silver-Coated Copper: Currently the fastest-growing solution for HJT and TOPCon cells, reducing metallization costs by roughly $0.15/watt.

- Pure Copper Plating: A more capital-intensive route endorsed by some trendsetting manufacturers, aimed at eliminating silver entirely.

Investment Implications

The structural deficit in Silver remains unresolved. Over 80% of supply comes from mining byproduct (copper, lead, zinc mines), meaning supply is inelastic to price surges.

For traders, the Gold/Silver Ratio continues to compress. However, the extreme volatility in Silver warrants caution; the price action is increasingly disconnected from traditional correlations (like the DXY) and is trading almost entirely on industrial panic buying and speculative squeeze dynamics.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Smashes Records: Poland Adds 150 Tons Amid Sovereign Buying Spree

"Sell America" Trade Intensifies as Transatlantic Rift Deepens

Japan’s ‘Truss Moment’: Bond Market Meltdown Forces BoJ Into a Corner

Fed Independence in Focus: Bessent Attacks Powell Ahead of Chair Nomination

From Scam Hub to Safe Bet? Cambodia Fights Back to Win Investors

PBOC Holds LPR Steady as Banks Guard Margins

Sterling Wavers as UK Payrolls Plunge and Wage Growth Slows

Trade War Escalates: Danish Fund Dumps Treasuries on Greenland Threats

Dollar Stumbles as 'Greenland Row' Sparks Tangible Capital Flight

Trans-Atlantic Fracture: EU Weighs 'Capital Option' as Tariff War Looms

Currency Calculator