简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is Solitaire PRIME Legit? Complete Safety Review : Is this fake broker or real

Abstract:If you're wondering, "Is Solitaire PRIME legit?", you're smart to be careful. The simple, honest answer is no. Based on our detailed review in 2026, Solitaire PRIME works without proper approval from trusted financial authorities. This isn't just a small problem - it's the biggest warning sign a broker can have.

Your Main Question Answered

If you're wondering, “Is Solitaire PRIME legit?”, you're smart to be careful. The simple, honest answer is no. Based on our detailed review in 2026, Solitaire PRIME works without proper approval from trusted financial authorities. This isn't just a small problem - it's the biggest warning sign a broker can have.

When there's no regulatory oversight, your money is in serious danger. There are no protections, no required safety measures, and no legal help through official financial channels if things go wrong. This lack of responsibility is what makes operations high-risk and possibly fraudulent. In the next sections, we'll explain the evidence step by step, showing you exactly why working with an unregulated company like Solitaire PRIME is a risk you shouldn't take.

A Regulatory Black Hole

The basis of trust in the financial world is regulation. Real brokers are watched by strict authorities that enforce rules to protect investors. Solitaire PRIME works completely outside of this system.

A Major Missing Piece

Good brokers clearly show their license numbers and regulatory credentials on their websites. It's an important selling point that shows safety and legitimacy. Our research found no such credentials for Solitaire PRIME. They are not authorized or licensed by any credible financial watchdog anywhere in the world. This is a deliberate choice to work in the shadows, away from oversight and responsibility.

Regulatory Status Check

To be sure, Is Solitaire PRIME Legit or not, we checked Solitaire PRIME against the databases of the world's top financial regulators. The results are clear and definite.

| Regulatory Body | Country/Region | Solitaire PRIME Authorization Status |

| FCA (Financial Conduct Authority) | United Kingdom | No Record of Authorization |

| ASIC (Australian Securities & Investments Commission) | Australia | No Record of Authorization |

| CySEC (Cyprus Securities and Exchange Commission) | European Union | No Record of Authorization |

| SEC / CFTC (Securities and Exchange Commission) | United States | No Record of Authorization |

Why Unregulated Brokers Are Dangerous

Choosing an unregulated broker means you give up the essential protections that regulation provides. Here's what you lose:

• Fund Protection: Regulated brokers must legally keep client funds in separate accounts, away from the company's operating funds. This protects your money if the brokerage fails. Unregulated brokers often mix funds together, meaning your money can be used for their expenses and isn't safe.

• Fair Practices: Regulators enforce rules against price manipulation and unfair trading conditions. Without this oversight, a broker can control the platform to make sure you lose.

• Dispute Resolution: If you have a problem with a regulated broker, you can appeal to an outside body or ombudsman for a fair and binding decision. With an unregulated broker, your only option is their customer service, which has no reason to help you.

• Accountability: Regulators can impose huge fines, stop operations, and cancel licenses. This threat keeps brokers honest. Unregulated companies face no such consequences for wrongdoing.

The Scam Playbook

Our research about Is Solitaire PRIME Legit or not shows a common and predictable playbook designed to take your money. Recognizing these tactics is your best defense. This is the typical process victims report.

1. The Aggressive Hook

It often starts with an unwanted, high-pressure phone call or a targeted online ad. The salesperson will make promises that are classic red flags: “We'll double your first deposit,” or “You can easily make hundreds of dollars per day.” They create urgency and exclusivity, pressuring you to deposit a “minimum” amount right away. They may also be connected with “automated trading software” scams that promise impossible returns. Remember, legitimate investment firms don't work this way.

2. The “Retention Agent” Upsell

Once you make an initial deposit, you're considered a qualified lead. You're then passed to a more experienced and convincing salesperson, often called a “retention agent.” Which will give you a Positive answer of the Question revolving in your mind that is Is Solitaire PRIME Legit?. Their only job is to build a relationship with you and convince you to deposit much larger amounts of money. They'll use advanced psychological tactics, pretending friendship and inside knowledge to gain your trust before pushing for a five or six-figure investment.

3. The Withdrawal Trap

This is the most painful and inevitable part of the process. When you try to withdraw your funds - whether profits or your initial deposit - the problems start. Your requests will be ignored, delayed, or met with endless excuses and new conditions. A common tactic is to delay the process for months, specifically to run out the clock on the standard six-month window your bank gives you to file a credit card chargeback. They may also trick you into signing a “Managed Account Agreement” (MAA), which gives them permission to trade on your behalf, after which they'll quickly lose all your funds, leaving nothing to withdraw.

4. Reputation Laundering

If you search for reviews, you may find some positive ones. Be extremely skeptical. Unregulated operations frequently pay for fake reviews or use reputation management services to flood the internet with positive content. They do this to bury the real stories from victims and attract new targets. Trust the regulatory facts, not the paid-for praise.

Your Active Defense Checklist

To protect your money, you need a simple, repeatable checking process. Use this checklist for any broker you consider, not just Solitaire PRIME. It can save you from huge financial and emotional distress.

The Ultimate Broker Checking Checklist:

• [ ] Verifiable Regulation: Can you find their license number on their website? More importantly, can you independently verify that license number on the official website of a top-tier regulator like the FCA, ASIC, or CySEC? If not, stop.

• [ ] Unrealistic Profit Promises: Are they guaranteeing returns? Promising you'll get rich quick? This is the number one sign of a scam. Real investing involves risk.

• [ ] High-Pressure Tactics: Is a “senior account manager” calling you repeatedly, pushing you to deposit more money right now? Legitimate brokers give you space to make decisions.

• [ ] Unclear Withdrawal Policy: Is the process for getting your money out buried in fine print or intentionally confusing? It should be simple, clear, and easy to find.

• [ ] Association with “Auto-Trading” Software: Are they pushing you to use a specific “secret” trading bot that promises guaranteed wins? This is a common tactic to attract beginners.

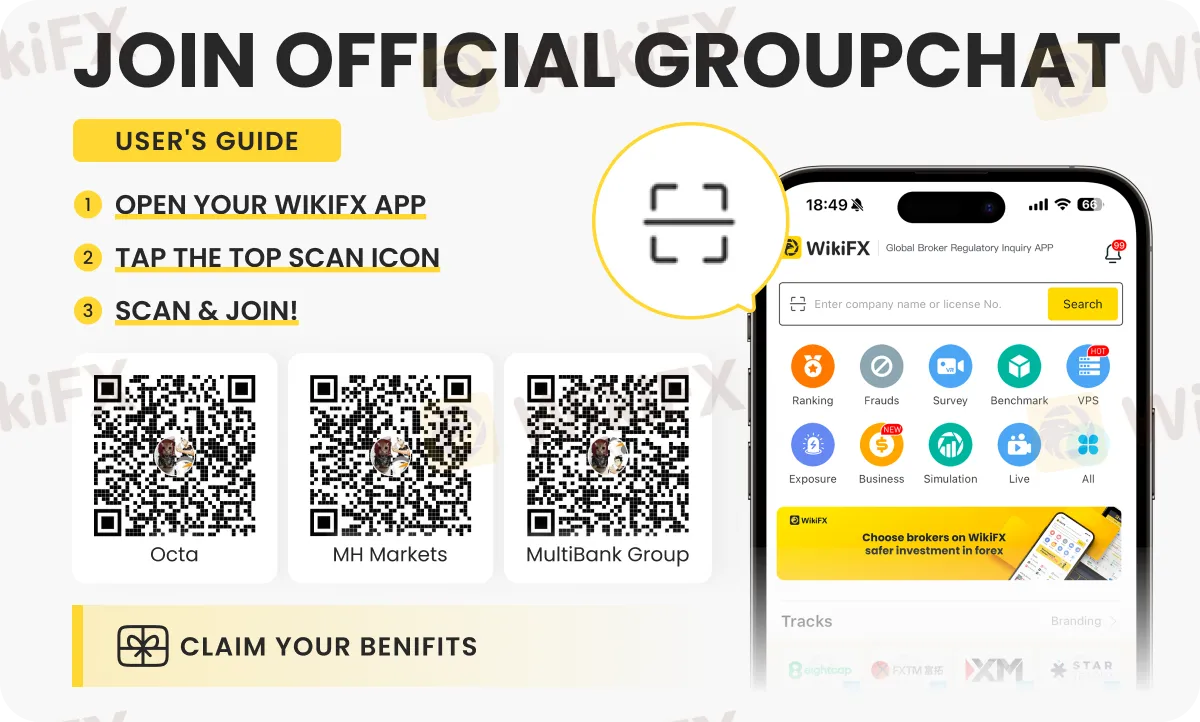

• [ ] The First Step to Safety: Cross-Verification. Before you do anything else, the most important step is to use an independent third-party verification service. We strongly recommend checking every potential broker on a platform like [WikiFX](https://www.wikifx.com). It combines regulatory status, user-reported issues, and risk analysis in one place, giving you a clear picture of who you're dealing with.

Already Invested? A Recovery Guide

If you've already put money with broker and are thinking Is Solitaire PRIME Legit to trade with. The situation is serious but not completely hopeless. You must act quickly and systematically.

Step 1: Document Everything

Immediately save all communication. This includes every email, chat log, and record of phone calls (dates, times, who you spoke to). Take screenshots of your account balance and your withdrawal requests. This documentation is your proof that you've been deceived and that they're refusing to return your funds.

Step 2: Start a Chargeback Immediately

If you deposited money using a credit or debit card, this is your most powerful tool. Contact your bank or credit card provider immediately. Don't delay. State clearly that you were deceived by an unregulated online trading company that is refusing to return your funds. Provide them with the documentation from Step 1. You typically have a six-month window from the transaction date to file a chargeback, and scam brokers know this. They'll intentionally delay you to run out this clock. Act now.

Step 3: Increase the Pressure for Wire Transfers

If you paid by wire transfer, a chargeback isn't possible. Your leverage comes from credible threats of legal and regulatory reporting. Send the broker a formal email stating that if your funds aren't returned within a specified, short timeframe (e.g., 48 hours), you'll be filing official fraud complaints with the financial authorities in your country and their supposed jurisdiction. This can sometimes prompt them to return your funds to avoid attracting more attention.

Step 4: Share Your Experience

Warn others. Leave factual, detailed reviews on consumer sites and forums describing your experience. This helps disrupt their “reputation laundering” efforts and prevents others from falling into the same trap. Mentioning names, dates, and specific tactics is highly effective.

Final Verdict and Safe Trading

To conclude, the answer to the question “Is Solitaire PRIME legit?” is a definite no. The complete absence of regulation, combined with operational tactics that mirror a classic scam playbook, makes it an unacceptably high-risk entity for any investor. Investing with them isn't trading; it's a blind gamble with the odds stacked against you.

The most important lesson from this analysis is simple but powerful: never, ever invest with an unregulated broker. No promised return is worth the risk of losing your entire investment with no recourse.

Your Golden Rule for Investing: Before you even consider creating an account or depositing a single dollar, do your research. Make it a habit to verify every broker using the comprehensive database and risk analysis on [WikiFX](https://www.wikifx.com). It's a simple, free step that can save you from financial disaster.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is Forex Still Worth It in 2026? Global Central Banks Are Splitting

JPY Volatility Ahead: PM Takaichi Calls Snap Election Amid Rate Hike Speculation

China Holds Rates Steady After Hitting 5% Growth Target, Easing Expected in Q1

The Fed on Trial: Markets Brace for Supreme Court Showdown Over Central Bank Independence

Trade War 2.0: Trump’s Greenland Ultimatum Rattles Transatlantic Alliance

Euro Stabilizes as France Forces 2026 Budget; Bond Spreads Narrow

JPY Volatility Spikes as PM Takaichi Calls Snap Election and Fiscal Gamble

AI in Medicine: Diagnostics, Privacy, and Ethical Challenges

TSMC Earnings Confirm AI "Supercycle," But Capacity Wall Looms

China Macro: Liquidity Trap Signals Persist Despite Credit Bump

Currency Calculator