简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ZarVista Regulatory Status: A Deep Look into Its Licenses and Warning Signs

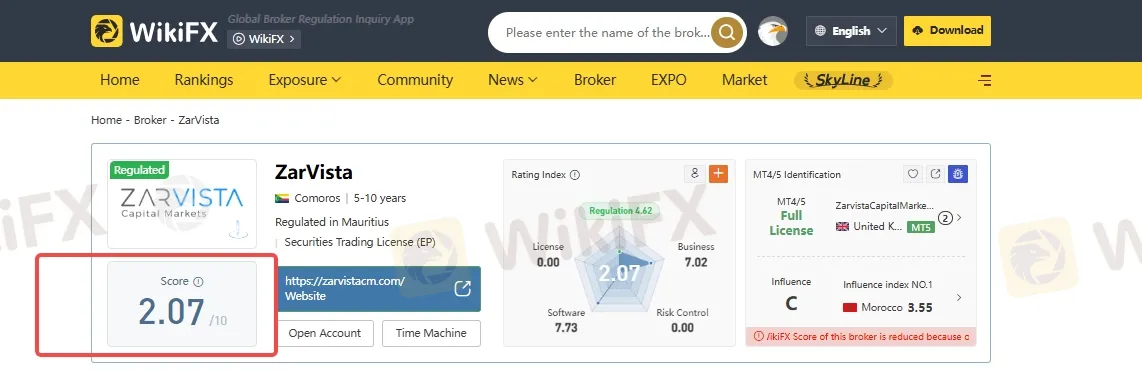

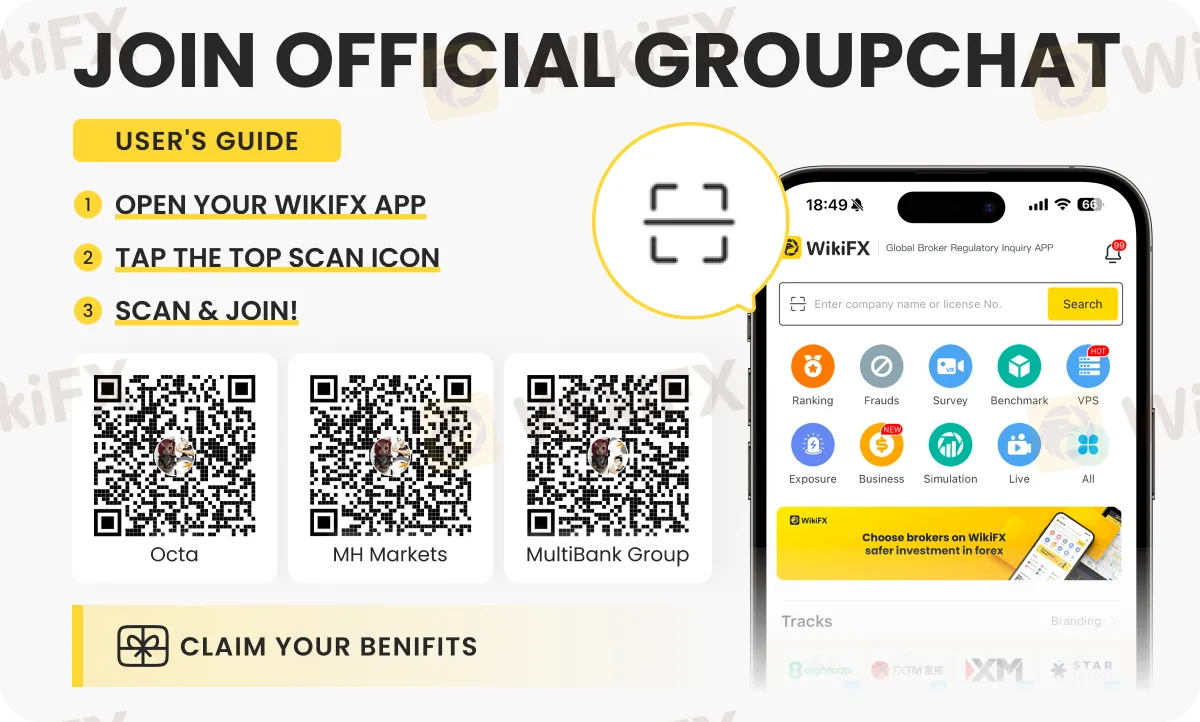

Abstract:When traders look at a broker, their biggest worry is safety. For ZarVista (previously called Zara FX), checking its regulation and license shows serious problems that make it very risky. This review is based on facts, not opinions. Regulatory checking websites like WikiFX give the broker a very low score of 2.07 out of 10, with a clear warning: "Low score, please stay away!"

ZarVista's Main Regulation Question

When traders look at a broker, their biggest worry is safety. For ZarVista (previously called Zara FX), checking its regulation and license shows serious problems that make it very risky. This review is based on facts, not opinions. Regulatory checking websites like WikiFX give the broker a very low score of 2.07 out of 10, with a clear warning: “Low score, please stay away!”

This score comes from several major problems that every potential trader needs to know about. The main issues we will examine include its use of weak offshore regulation, many serious user complaints, and clear mistakes in its company information. These problems create a situation where trader money faces big risks. This low score results from multiple factors that every potential trader must understand. For a current view of ZarVista's score , ZarVista Regulation and latest user warnings, it's important to check their updated profile on a verification platform.

Breaking Down ZarVista's Licenses

ZarVista Regulation tells a story of two locations, a common strategy among high-risk brokers. The broker shows licenses from Mauritius and Comoros, but understanding the real protection these offer is important. Having a license doesn't automatically mean safety; the quality and location of the regulator are what truly matter. While ZarVista holds a license in Mauritius, it's labeled as 'Offshore Regulated.' Understanding the specific limits of this license is vital. You can view the full license details and regulatory status directly on the [ZarVista page on WikiFX](https://www.wikifx.com/en/dealer/3421558243.html).

To make the situation clear, we can compare the two claimed regulatory statuses side-by-side.

| Feature | Mauritius FSC License | Comoros MISA Registration |

| Licensed Entity | Zarvista Capital Markets (MU) Ltd | Zarvista Capital Markets Ltd |

| License Number | GB23202450 | T2023293 |

| License Type | Securities Trading License | International Brokerage License |

| Regulatory Standing | Offshore Regulator | Weak, Low-Reputation Regulator |

| Trader Protection | Limited; lower oversight | Minimal to non-existent |

| Legal Recourse | Difficult for international clients | Extremely difficult; offers little legal standing |

| WikiFX Tag | Offshore Regulated | N/A (Considered extremely weak) |

The Mauritius FSC License

ZarVista's main legitimate-looking license comes from the Financial Services Commission (FSC) of Mauritius. The licensed company is `Zarvista Capital Markets (MU) Ltd`, holding a Securities Trading License with number `GB23202450`. While the FSC is a formal regulatory body, Mauritius is widely known in the financial industry as an offshore location.

For traders, this “offshore” status has serious effects. Compared to top-level regulators like the UK's FCA or Australia's ASIC, offshore regulators typically have less strict oversight. Requirements for capital adequacy, client fund separation, and operational transparency are often lower. Furthermore, investor compensation schemes, which protect clients if a broker becomes bankrupt, may be limited or completely missing. If there's a dispute, taking legal action against a company based in an offshore location can be a complex and expensive process for an international client, with a lower chance of a good outcome. This is why platforms tag such brokers as “Offshore Regulated,” signaling a higher level of built-in risk.

The Comoros MISA Registration

The second part of ZarVista's regulatory puzzle involves a registration in Comoros. The entity `Zarvista Capital Markets Ltd` is registered with the Mwali International Services Authority (MISA) under license number `T2023293`. From an expert viewpoint, this registration adds no credibility and, in fact, increases the red flags.

Comoros is widely seen as one of the weakest and least reputable regulatory environments for forex and CFD brokers. A license from MISA is relatively easy and cheap to get, and it involves minimal ongoing supervision or compliance checks. For all practical purposes, a Comoros license offers no meaningful protection for traders' funds. It is often used by brokers to create a false appearance of regulation without submitting to the strict standards that protect consumers. Relying on this license for fund security is an extremely high-risk choice.

What “Offshore Regulation” Means

To summarize, the risks is associated with a broker because of ZarVistaRegulation like ZarVista, are substantial. Traders must be aware of the following potential dangers:

• Limited or Non-existent Investor Protection Funds: If the broker goes bankrupt, your funds are likely not insured and may be lost completely.

• Less Strict Compliance and Auditing: Offshore regulators are less likely to conduct surprise audits or enforce strict rules on how the broker operates and handles client money.

• Potential for Conflicts of Interest: Rules preventing a broker from trading against its clients may be weak or non-existent, creating a direct conflict of interest.

• Legal Challenges in Case of Disputes: If you have a problem, such as a withdrawal issue, your legal options are severely limited and often impractical to pursue.

Company Identity vs. Reality

A trustworthy broker maintains a transparent and verifiable company presence. Investigating ZarVista's company structure and physical addresses reveals significant differences between their official claims and ground reality. This lack of transparency is a major red flag and a key indicator of a high-risk operation. This section provides a critical analysis by connecting the broker's registered addresses with third-party verification efforts, revealing a major difference that points to a lack of trustworthiness.

The Official Company Trail

On paper, ZarVista's company structure appears to span multiple countries, a tactic that can create a misleading impression of being a large, global entity. The known company information includes:

• `Zarvista Capital Markets Ltd`: Registered in Comoros with an address at Moheli Corporate Services Ltd, P.B. 1257 Bonovo Road, Fomboni. This is a common registered agent address, not a functional office.

• `Zarvista Capital Markets (MU) Ltd`: The entity licensed in Mauritius. Again, such registrations often use administrative addresses rather than true operational headquarters.

This scattered company trail, with a primary registration in a weak location like Comoros, already raises questions about the company's core operational base and accountability.

The On-the-Ground Investigation

To present facts to you in this ZarVista Regulation. The evidence comes from independent field surveys conducted to verify the broker's physical presence. These investigations, which represent a form of firsthand due diligence, yielded alarming results. The findings from WikiFX's field survey team were clear:

• A visit to Zara FX in Canada – No Office Found.

• A visit to ZARA FX in Cyprus – No Office Found.

The significance of these findings cannot be overstated. A broker that claims to have a global presence but lacks a verifiable physical office in key locations like Canada or a related-entity location like Cyprus is operating with a severe lack of transparency. A regulated broker with a Legitimate License always have an office. A physical office is a sign of operational substance, accountability, and a long-term commitment to the business. The inability to find any trace of the company at its supposed locations raises serious doubts about the ZarVista Regulation. It suggests that the addresses provided are merely for registration purposes and that the company may not have the substantial, professional operation it projects. For traders, this is a critical warning sign that the company may be difficult to locate or hold accountable if problems arise.

The Voice of the User

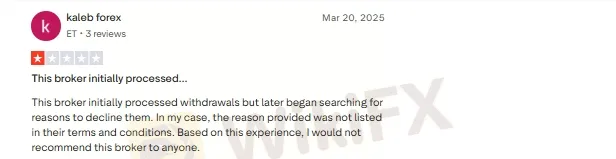

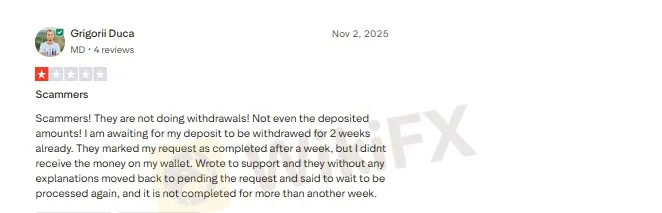

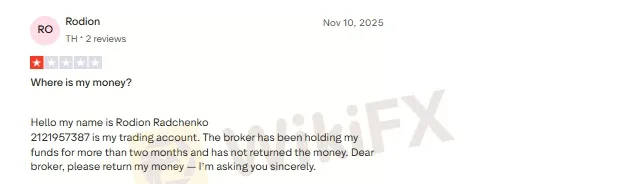

Beyond ZarVista Regulation, the direct experiences of clients provide the most powerful insight into a broker's true nature. In the case of ZarVista, its low score is heavily influenced by a high volume of severe user complaints. While a few positive reviews exist, they are overwhelmingly overshadowed by a consistent pattern of serious allegations, particularly concerning financial transactions. These firsthand accounts paint a concerning picture. To read these user exposure reports in full and see if new ones have been submitted, you should visit the [comprehensive ZarVista review on WikiFX https://www.wikifx.com/en/dealer/3421558243.html

Main Complaint: Withdrawal Issues

The most frequent and alarming theme among user complaints is the inability to withdraw funds. This is the ultimate red flag for any financial service. Reports detail a range of obstructive tactics:

• Outright Withdrawal Rejections: One user reported that their withdrawal was “declined by the bank,” with the broker deflecting responsibility back to the client's card issuer, a common tactic to delay or avoid payment.

• Blocked Access After Withdrawal Requests: A particularly worrying complaint comes from a user who, after experiencing withdrawal issues, found they were completely unable to access the broker's website, receiving only an error message. This effectively locks them out of their account and funds.

• Allegations of Fund Seizure: The most severe accusations involve claims of outright theft. One trader alleges that ZarVista stole “$50k usd” from their social trading account. Another user claims a balance of over “$75k usd” was taken, after which the broker “delete My account details from their own platform and MT4.” These are not minor disputes; they are allegations of large-scale fund confiscation.

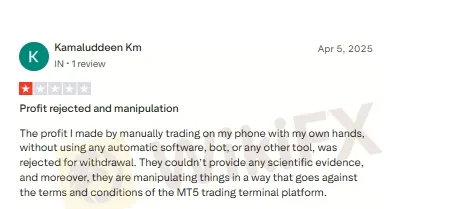

Allegations of Trading Manipulation

Beyond withdrawal problems, ZarVista Regulation , some users have accused ZarVista of unfair trading practices. One trader complained that profits made from manual trading were rejected without any “scientific evidence.” This user further alleged that the broker was “manipulating things in a way that goes against the terms and conditions of the MT5 trading terminal platform.” Such claims suggest that even if a trader is profitable, the broker may interfere to prevent them from realizing those profits. This undermines the very foundation of fair trading and points to a potential conflict of interest where the broker profits from client losses.

Acknowledging Other Feedback

To provide a balanced view, it is important to acknowledge the positive and neutral feedback that has been posted. Some users have praised ZarVista for a few operational aspects:

• Low spreads and competitive pricing on some accounts.

• The availability of useful tools and customizable charts on the MT5 platform.

• Reports of fast platform speed and, in some isolated instances, good customer service that resolved an issue quickly.

However, these operational positives do not and cannot outweigh the critical financial risks highlighted in the “Exposure” reports. Fast execution and useful charts are meaningless if a trader cannot withdraw their capital and profits. The sheer volume and severity of complaints related to fund safety and withdrawal denials form a clear pattern of behavior that defines ZarVista as a high-risk entity and raises Question on ZarVista Regulation.

The Final Judgment on ZarVista

After a deep look into ZarVista regulation, company structure, and user feedback, the evidence points to an unavoidable conclusion. The broker presents a high-risk profile for any trader, and engaging with it carries a significant potential for financial loss. The marketing claims of a global, sophisticated brokerage do not hold up under scrutiny.

The analysis reveals a collection of critical red flags that, when combined, paint a picture of an untrustworthy operation. The key takeaways are:

• Weak Offshore Regulation: The broker's reliance on ZarVista license from Mauritius and Comoros offers minimal to no meaningful trader protection. These locations lack the stringent oversight and compensation schemes found with top-tier regulators.

• Severe User Complaints: There is a clear and disturbing pattern of user complaints centered on the most critical issue: the inability to withdraw funds. Allegations of rejected withdrawals, blocked accounts, and outright fund seizure are widespread.

• Lack of Verifiable Presence: Independent field surveys failed to locate any physical offices in Canada and Cyprus. This lack of a tangible, verifiable presence casts serious doubt on the company's transparency, substance, and accountability.

• Clear Warnings: Third-party verification services like WikiFX issue a very low score and a direct warning to “please stay away,” consolidating the evidence into a clear risk assessment.

In the world of online trading, due diligence is non-negotiable. The safety of your capital is the first and most important consideration. Based on the extensive evidence, entrusting funds to ZarVista is a gamble against heavily stacked odds.

Before engaging with any broker, including ZarVista, it is essential to perform your own thorough check. Verify their latest regulatory status, read current user reviews, and pay close attention to any active warnings. We strongly recommend you visit the [ZarVista page on WikiFX](https://www.wikifx.com/en/dealer/3421558243.html) to verify all the information in this article and check for the most up-to-date alerts before making any financial decisions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

China Holds Rates Steady After Hitting 5% Growth Target, Easing Expected in Q1

JPY Volatility Ahead: PM Takaichi Calls Snap Election Amid Rate Hike Speculation

Is Forex Still Worth It in 2026? Global Central Banks Are Splitting

The Fed on Trial: Markets Brace for Supreme Court Showdown Over Central Bank Independence

Trade War 2.0: Trump’s Greenland Ultimatum Rattles Transatlantic Alliance

Euro Stabilizes as France Forces 2026 Budget; Bond Spreads Narrow

JPY Volatility Spikes as PM Takaichi Calls Snap Election and Fiscal Gamble

JGB Yields Breach 4% as PM Takaichi's Fiscal Gambit Triggers 'Sell-Off'

Scrolled, Clicked, Lost RM166,000: Factory Worker Trapped by Online Investment Scam

China Macro: Liquidity Trap Signals Persist Despite Credit Bump

Currency Calculator