简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

HEADWAY Exposure: Why "Profit" Means Nothing When You Can't Withdraw

Abstract:Our investigation into HEADWAY exposes a severe pattern of blocked withdrawals and 'bonus traps' that can instantly wipe client equity. With over 86 critical complaints logged in just three months, traders face a high risk of total capital loss disguised as technical glitches and bureaucratic stonewalling.

The 65 Million Rupiah Nightmare

For an Indonesian factory owner, trading on HEADWAY wasn't a hobby—it was a business strategy to upgrade failing equipment. “My factory was relying on this money to upgrade its equipment,” the user reported in a desperate plea. “Now the old machines keep breaking down... and the workers are about to quit.”

After weeks of trading, this user attempted to withdraw their principal. Instead of funds, they received silence, followed by absurd bureaucratic hurdles. Customer service demanded an “environmental impact assessment report” and equipment contracts—documents completely irrelevant to Forex trading.

This is not an isolated incident. It is the defining signature of HEADWAY, a broker that appears to rationalize withholding funds with increasingly bizarre excuses.

Regulatory Reality Audit: A Shield or a Mask?

HEADWAY claims legitimacy through a South African license. While the license exists, the sheer volume of international complaints suggests that for traders outside South Africa, this protection may be hollow.

| Regulator | License Type | REAL STATUS |

|---|---|---|

| South Africa FSCA | Financial Service Provider | Regulated (But High Risk Warning) |

WikiFX Investigator Note: Despite holding a license, HEADWAY has accumulated 86 severe complaints in just 90 days. A valid license does not physically prevent a broker from freezing international accounts, especially when they operate through offshore entities for global clients.

The “Bonus” Trap: How Equity Disappears

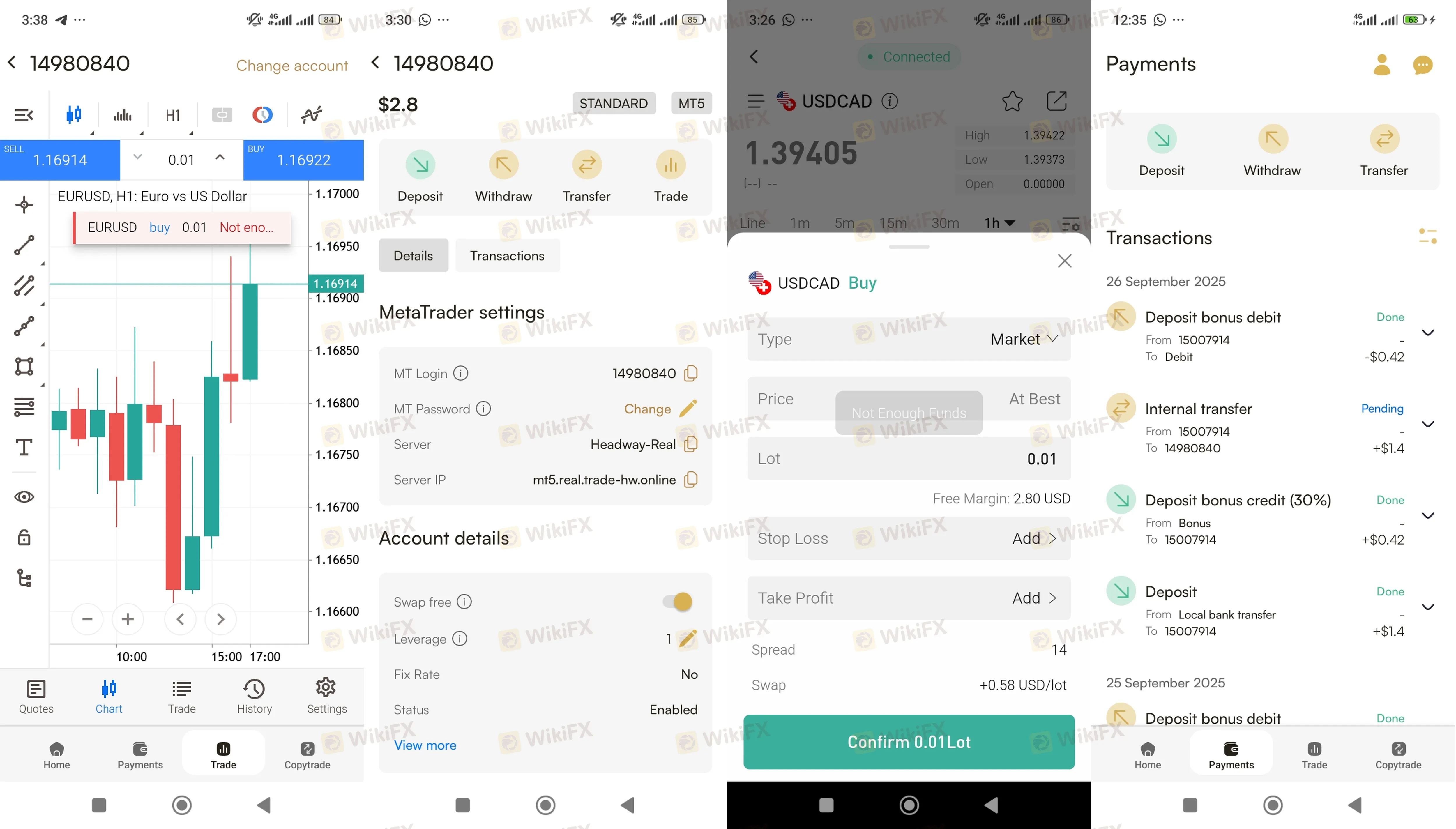

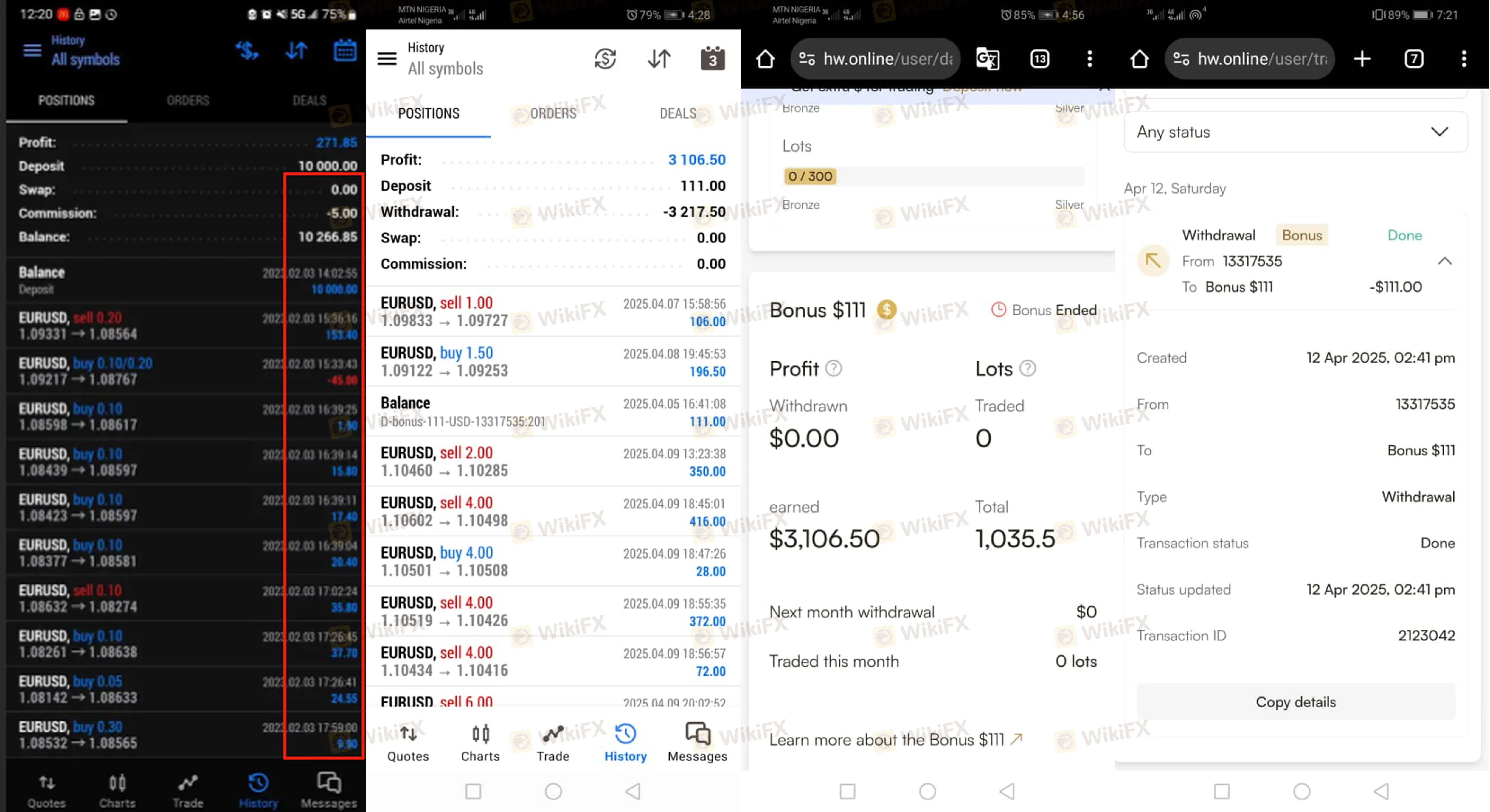

Our analysis of multiple complaints reveals a predatory mechanism involving deposit bonuses. Traders are lured in by offers like “111$ No Deposit Bonus” or deposit matching, only to find these bonuses act as a self-destruct button for their accounts.

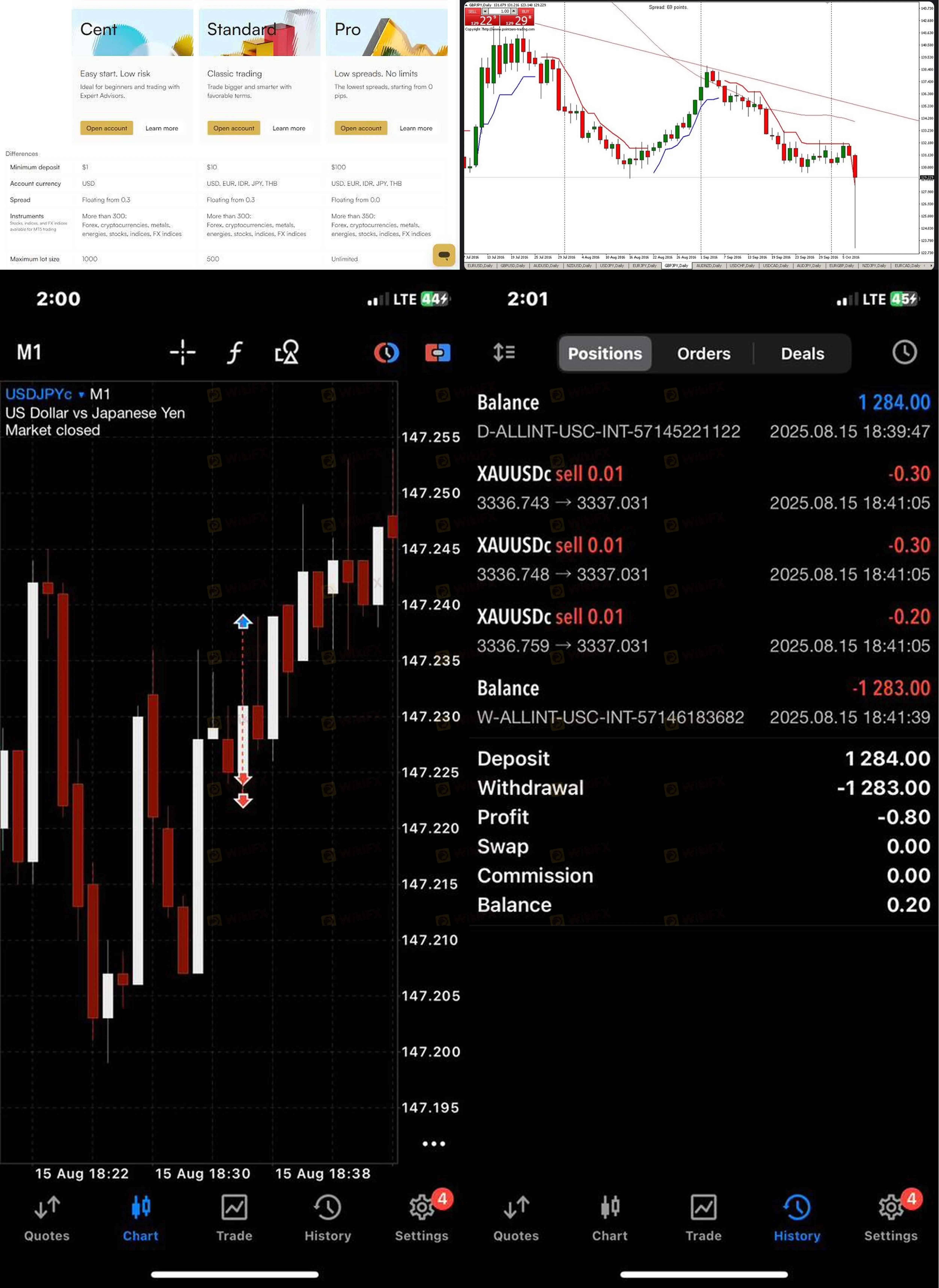

- The Mid-Trade Wipeout: Users report that bonuses are removed during open trades. Because the bonus counts towards margin, removing it instantly triggers a margin call, liquidating the user's own real money.

- The Phantom Negative Balance: Users like the one in Case 58 report that when accounts hit a negative balance (which should be zeroed out by “Negative Balance Protection”), the broker instead deducts that negative amount from new deposits, effectively stealing fresh capital to cover old, system-generated losses.

> “The deposit bonus they offer you will disappear in seconds... they can remove your bonus mid-trade and blow up your entire account.” — Victim Report, Case 4

“Ghost Prices” and Data Manipulation

High slippage is common in volatile markets, but HEADWAY users report anomalies that defy market logic.

- The 6x Spread Hike: A Thai trader (Case 42) documented that HEADWAY's spreads on USD/THB were six times higher than local competitors, costing them an extra 93,000 THB in fees.

- The Stop-Loss Hunter: Multiple verified users (Case 24, Case 39) reported “ghost prices”—price spikes that triggered stop-losses but never appeared on the official charts. One Malaysian trader noted, “The stop-loss was executed at a price that didn't even appear on the chart.”

Visual Evidence: The Discrepancy

(See recent user submissions below showing price gaps and frozen withdrawals)

The Verdict: Community Leaders Speak Out

Perhaps the most damning evidence comes from those who once trusted the platform. The founder of the “Hausa Forex Trading community” (Case 84), who previously introduced students to HEADWAY, has publicly issued a “Scam Alert.”

> “It pains me deeply... Headway Broker has turned out to be a complete scam. They lured many of us... only to later manipulate trades, block withdrawals, and close accounts without explanation.”

Key Red Flags

- Withdrawal Blockade: 86 complaints currently logged, with the majority citing “Unable to withdraw” or “Endless processing.”

- Bureaucratic Stonewalling: Demanding irrelevant documents (like factory environmental reports) to process withdrawals.

- Bonus Weaponization: Bonuses are revoked at critical moments to force liquidation of real funds.

- Severe Slippage: Execution prices that deviate significantly from market constants, specifically targeting stop-losses.

WikiFX Recommendation: The data indicates HEADWAY creates a “roach motel” environment: funds check in easily via instant deposits and bonuses, but they rarely check out. We strongly advise global traders to avoid depositing capital until these severe anomalies are resolved.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Currency Calculator