简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is VITTAVERSE Legit or a Scam? 5 Key Questions Answered (2026)

Abstract:VITTAVERSE is an offshore broker regulated by the Seychelles FSA with a concerningly low WikiFX score of 3.27. Despite offering popular platforms like MT5 and cTrader, a surge of recent complaints regarding denied withdrawals, profit deductions, and account blocking suggests a high-risk environment for your funds.

1. Executive Summary (TL;DR)

VITTAVERSE is a high-risk option currently holding a low WikiFX Score of 3.27. While it is legally registered in Seychelles, a recent flood of user reports alleges severe issues with fund withdrawals and unjustified profit removal.

If you are seeing ads for VITTAVERSE or have been approached by an “account manager,” you are likely feeling cautious. You should be. A broker established in 2022 with a “C” influence rank and offshore regulation requires careful scrutiny. Below, we break down the safety, costs, and real trader experiences to help you decide.

Question 1: Is my money safe with VITTAVERSE?

According to the regulatory database, VITTAVERSE (registered as Opal Markets Ltd) holds a license from the Seychelles Financial Services Authority (FSA).

What does this license mean for you?

The Seychelles FSA is an “offshore” regulator. While this is better than having no license at all, it does not offer the same level of protection as Tier-1 regulators like the FCA (UK) or ASIC (Australia).

- The Regulatory Gap: Offshore regulators typically have lower capital requirements and less strict auditing standards.

- The Risk: In Tier-1 jurisdictions, brokers must keep your money in “Segregated Accounts”—meaning they cannot use your cash to run their business. In many offshore setups, while segregation is encouraged, the enforcement mechanisms are weaker. If the broker faces bankruptcy, there is often no government-backed compensation scheme to reimburse international clients.

Verdict: Your funds carry Counterparty Risk. You are trusting the company's honesty more than government guarantees.

Question 2: Are the trading fees and leverage fair?

VITTAVERSE offers very high leverage, capping at 1:500, and provides three account types: VIP, Standard, and ECN PRO.

The “Double-Edged Sword” of 1:500 Leverage

Leverage of 1:500 allows you to control a position worth $50,000 with just $100 of your own money.

- The Trap: While this sounds great for profits, it works identically for losses. A market move of just 0.2% against your position could wipe out your entire deposit instantly. For beginners, high leverage is the fastest way to lose capital.

Account Structures

- Standard Account: Entry is low ($15), making it accessible, but spreads likely include a markup.

- VIP/ECN Accounts: Require higher deposits ($100 - $12,000) for spreads starting “from 0.0.”

Question 3: What are real traders complaining about?

This is the most critical section. In the last 3 months alone, WikiFX has received 9 serious complaints, with cases pouring in from Turkey, Australia, Pakistan, and Russia.

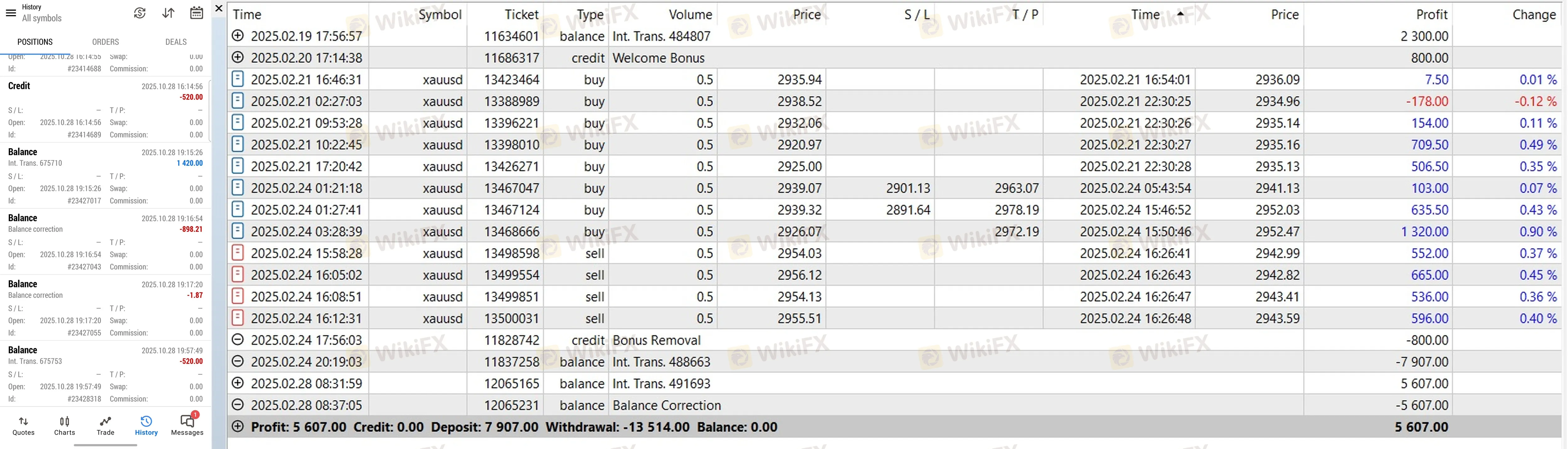

Theme 1: The “Balance Correction” Nightmare

Multiple traders report that their profits were retroactively deleted.

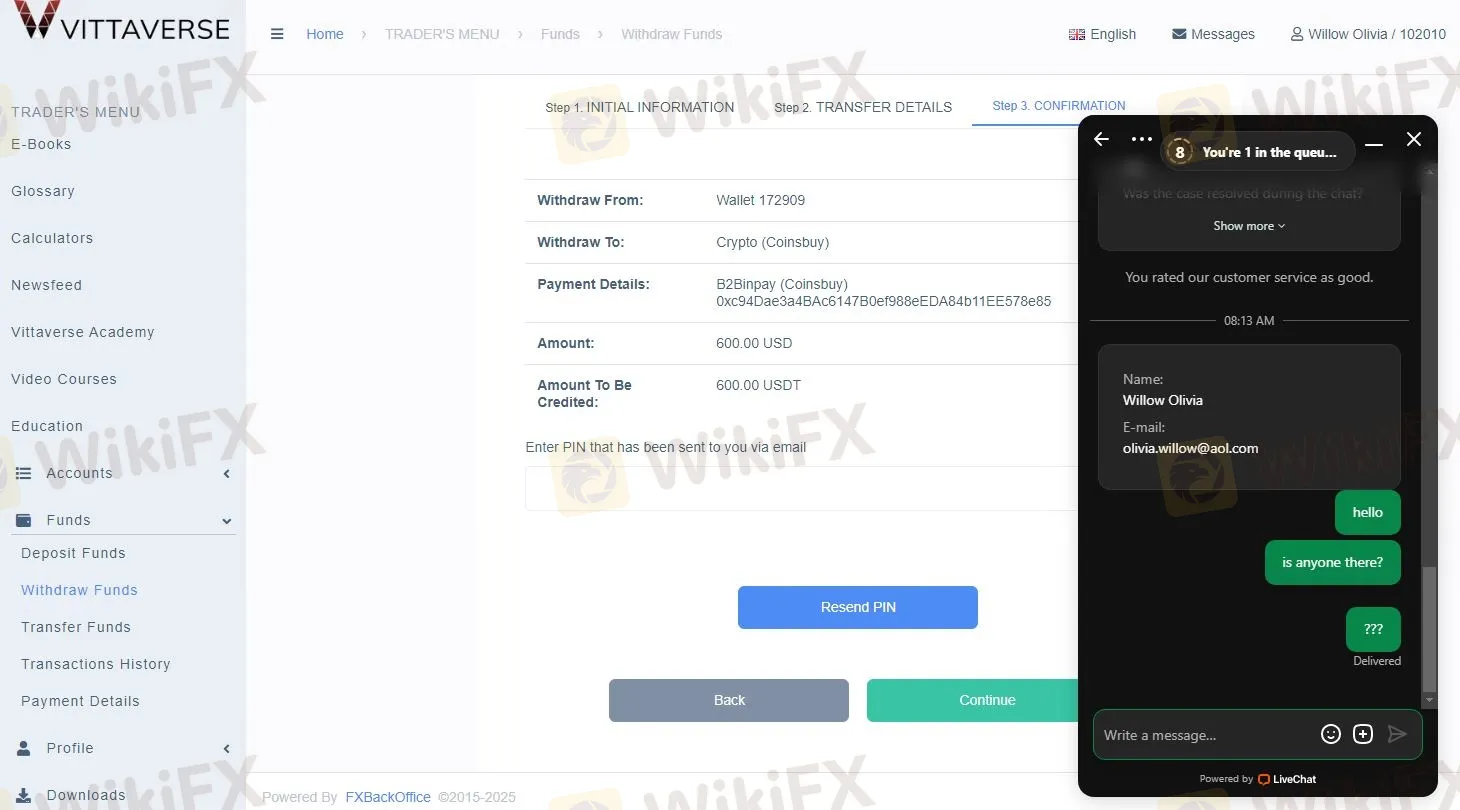

Theme 2: Withdrawal Blocks

- Evidence: A user from Pakistan showing a balance of over $12,000 reported, “They declined my withdrawal... and now they removed my total balance.”

Pro Tip: “Balance Correction” is a term often abused by unethical brokers. They may claim your trading style violated obscure terms and conditions (like “abusive scalping”) to justify confiscating winnings while keeping your losses.

Question 4: What software will I use?

VITTAVERSE provides MetaTrader 5 (MT5) and cTrader.

The Software Reality

These are excellent, industry-standard platforms known for speed and charting capabilities.

- The Warning: However, having good software does not guarantee safety. The trading platform is hosted on the broker's server. As seen in the complaints above (Case 1), if the broker decides to disable your access or manipulate the back-end to freeze your login, the quality of the software does not matter. Use the software to test execution speed, but do not assume it protects your funds from administrative interference.

Final Verdict: Should I open an account?

Based on the live data and case history, we advise extreme caution regarding VITTAVERSE.

While they hold a valid offshore license, the pattern of complaints—specifically regarding profit confiscation and withdrawal denials—is a major red flag. A score of 3.27 indicates that the broker's risk factors currently outweigh its benefits.

Your Action Plan:

1. Prioritize Safety: Look for brokers with a score above 7.0 and regulation from a Tier-1 agency (UK, Australia, USA).

2. Test Withdrawals: If you are already trading here, attempt a withdrawal immediately to verify access to your funds.

Status changes daily. Before depositing, check the WikiFX App for the latest real-time certificate and score updates.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Labuan Forex Scam Costs Investors RM104 Million | Authorities Pressed to Act

TopWealth Trading User Reviews: A Complete Look at Real Feedback and Warning Signs

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Fed Holds Firm: January Rate Cut Hopes Fade Despite Cooling CPI

A Complete 2026 Review: Is RockwellHalal Legit or a Scam to Stay Away From?

One Message, RM600K Gone: WhatsApp Investment Scam Exposed

Fed

War Risk Premium Explosions: Gold Hits

TrioMarkets Launches TrioFunded as Brokers Continue to Expand Into Prop Trading

Geopolitical Risk Returns: Iran Threatens 'Unforgettable Lesson' as Tensions Mount

Currency Calculator