简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

RockwellHalal Regulatory Status: Understanding Their Licenses and Company Information

Abstract:This analysis will directly and thoroughly examine the RockwellHalal regulation status. We will carefully look at the company's claims, search for a real RockwellHalal license, and explain what our findings mean for investor safety. For experienced traders, doing a quick check on verification platforms like WikiFX is standard practice to quickly evaluate a broker's background. This report will apply that same level of professional examination.

Introduction: Why Regulation Matters

Before putting your money into any investment platform, especially one like RockwellHalal that promises high returns, checking if they're properly regulated is the most important thing you can do. This isn't optional - it's essential research. A company's claims about being experts, having advanced technology, or operating worldwide don't mean anything without proper oversight from a trusted financial authority. Regulation is what separates real financial companies from risky, unclear operations. It creates rules that protect investors, ensure fair practices, and give you legal options if something goes wrong.

This analysis will directly and thoroughly examine the RockwellHalal regulation status. We will carefully look at the company's claims, search for a real RockwellHalal license, and explain what our findings mean for investor safety. For experienced traders, doing a quick check on verification platforms like WikiFX is standard practice to quickly evaluate a broker's background. This report will apply that same level of professional examination.

Our investigation will cover these key areas:

• Breaking down RockwellHalal's official claims about who they are and how they operate.

• Investigating their claimed licenses and company registration details.

• Analyzing the warning signs and contradictions in their provided information.

• Providing a clear conclusion about their regulatory standing and practical steps you should take to protect yourself.

Breaking Down Official Claims

To start our analysis, we must first understand how RockwellHalal presents itself. By listing their official statements, we create a starting point of claims that can be systematically checked. The following table organizes the key features RockwellHalal states on its public materials. We present this information objectively, without analysis, to create a factual foundation for our investigation.

| Claim Category | What RockwellHalal States |

| Origins & Expertise | “A global team of legal, technology, and cryptocurrency experts” since 2019. |

| Operational Base | “Operating digital asset exchanges in Switzerland,” with offices in Switzerland/Europe and a physical address in New York, USA. |

| Regulatory Compliance | Possesses a structure that “supports global payments and regulatory compliance.” |

| Security Guarantee | Has “installed strong Commodo License to ensure encrypted end-to-end communication.” |

| Contact Methods | Provides a UK phone number, a Gmail email address, and a New York street address. |

These claims create a picture of a sophisticated, secure, and globally compliant organization. The next step is to move beyond these statements and search for independent, verifiable evidence to support them.

The Main Investigation

This section forms the core of our report. We will now conduct a thorough, evidence-based analysis of the claims presented above. Our focus is to examine the RockwellHalal license status and its company details, comparing their statements against industry standards and public records.

What is a Financial License?

First, it's important to understand what makes up a legitimate financial license. It's not just a business registration. A financial services license is granted by a government-mandated regulatory body, such as the Swiss Financial Market Supervisory Authority (FINMA), the UK's Financial Conduct Authority (FCA), or the U.S. Securities and Exchange Commission (SEC).

These regulators enforce strict rules designed to protect consumers. Licensed firms must maintain minimum capital levels, keep client funds separate from company funds, follow fair marketing practices, and provide access to a dispute resolution service. A simple business registration allows a company to exist legally, but a financial license permits it to offer investment services legally and under strict supervision.

The Search for a License

Given RockwellHalal's claims of operating in Switzerland, Europe, and the USA, the logical step is to search the public registers of the relevant authorities. A licensed financial entity must be listed in these databases.

Our extensive search for “RockwellHalal” in the public online registers of FINMA (Switzerland), the FCA (UK), and the SEC (USA) found no results. We found no evidence of any entity named RockwellHalal holding a valid license to offer investment or brokerage services in these key jurisdictions. This absence is a critical finding. Legitimate global firms are proud of their regulatory status and are easily found on regulator websites.

The “Comodo License” Claim

This brings us to a unique and critical point in our analysis: the claim of having a “strong Commodo License.” This statement is a significant misdirection that requires careful explanation.

A “Comodo License,” now known as a Sectigo certificate, is an SSL/TLS certificate. Its only function is to provide a secure, encrypted connection between your web browser and the website's server. It's the technology that puts the padlock icon in your browser's address bar. It ensures that the data you send to the site (like passwords or personal information) is encrypted and cannot be easily intercepted by third parties during transit.

To be completely clear: an SSL certificate has absolutely nothing to do with financial regulation. It doesn't signify approval from any government body, nor does it guarantee the safety of your invested funds. It's a standard, inexpensive website security feature that almost all websites use. Presenting an SSL certificate as a form of regulatory license is a tactic designed to confuse and mislead users who don't understand the difference. It attempts to borrow the language of security to imply a level of financial legitimacy that doesn't exist.

Analyzing Company Details

A professional analyst looks for patterns, and the company details provided by RockwellHalal reveal a pattern of inconsistencies that are highly unusual for a legitimate global financial firm.

• Geographic Mismatch: The contact information presents a puzzle. The company provides a UK phone number (`+44` country code), an address in New York, USA, and claims its primary base of operations is in Switzerland. Legitimate financial institutions have clear, consistent, and verifiable contact information for each region they operate in. This mix-and-match approach is a common red flag.

• Unprofessional Email: The use of a generic `gmail.com` address is perhaps the most obvious warning sign. A credible financial institution of any size will always operate using a corporate domain email (e.g., `support@rockwellhalal.com`). Using a free public email service for official client communication demonstrates a serious lack of professionalism and infrastructure, and it's a hallmark of unregulated operations.

• Vague Partnerships: The mention of “strategic partnerships with major retail networks” without naming a single partner is an empty claim. Legitimate firms publicize their partnerships as a mark of credibility. Vague, unverifiable claims are used to create an illusion of substance.

These details are not minor oversights. They are precisely the kind of data points that verification tools are designed to flag. We strongly advise investors to cross-reference all broker details on a platform like WikiFX to see if addresses, phone numbers, and regulatory claims align with verified records.

Evaluating Investment Risk

The lack of verifiable regulation directly impacts the risk associated with RockwellHalal's investment offerings. The structure of their investment packages, combined with the absence of oversight, creates a high-risk environment for any potential investor.

Promised Returns vs. Reality

Let's examine the “Pro” and “Elite” investment packages, which promise a “Maximum return” of 20% and 25%, respectively. While the term “maximum” is used, presenting such high and specific return figures is a classic characteristic of high-risk investment schemes.

Legitimate investment firms are legally required to be careful about returns. They talk about historical performance, potential growth, and, most importantly, they provide prominent risk disclaimers warning that capital is at risk and past performance doesn't indicate future results. The promise of high, seemingly easy returns without corresponding risk warnings is designed to appeal to emotion rather than financial prudence. Since their founding in 2019, and as we approach the end of 2025, a track record of six years should be verifiable, yet the focus remains on promises, not proven, audited performance.

Consequence of No Regulation

Dealing with an unregulated entity means an investor willingly gives up a suite of critical protections that are standard in regulated markets. The difference isn't trivial; it's the difference between a structured market and a financial wilderness.

Here's what you lose by operating outside the regulatory framework:

• Segregated Funds: Regulated brokers are legally required to keep client funds in separate bank accounts, segregated from the company's own operational funds. This ensures that if the broker becomes insolvent, client money isn't used to pay the company's creditors. With an unregulated entity, your funds are likely mixed together, meaning they can be used for any purpose, including paying salaries or marketing costs.

• Compensation Schemes: Many major regulatory jurisdictions have investor compensation funds (e.g., the FSCS in the UK or SIPC in the USA). If a regulated broker fails, these schemes can compensate investors up to a certain limit. With an unregulated broker like RockwellHalal, if the firm disappears, your money disappears with it. There's no safety net.

• Dispute Resolution: If you have a dispute with a regulated broker—regarding a trade execution, a withdrawal, or any other issue—you can appeal to an independent ombudsman or a financial dispute resolution service. This body can make a legally binding ruling. With an unregulated entity, your only option is to try and contact their support (via a Gmail address), and you have no independent legal body to turn to.

Verdict and The Safe Path

After a thorough examination of RockwellHalal's claims and a search for verifiable evidence, our investigation reaches a clear and definitive conclusion.

Summary of Findings

Our analysis reveals a critical lack of evidence to support the claims of a legitimate, regulated financial operation. The key findings are:

• There's no verifiable `RockwellHalal License` found in the public databases of major financial regulators in Switzerland, the UK, or the USA.

• The company makes misleading use of a website security certificate (an SSL/TLS “Comodo License”) as a substitute for financial regulation.

• There are significant red flags in the company details, including mismatched geographic information and the use of an unprofessional Gmail address for contact.

• The investment packages promise high, specific returns characteristic of high-risk schemes, without the required risk disclaimers of legitimate firms.

The Golden Rule of Investing

The findings on RockwellHalal highlight the single most important rule for any modern investor: verify before you transfer. Never send money to any broker or investment platform before you have independently and conclusively verified their regulatory claims with a trusted, third-party source. A polished website and bold promises are not substitutes for genuine regulatory oversight.

Your Essential Due Diligence Tool

Before you consider creating an account with any broker, perform this simple 60-second check on WikiFX. It's a small investment of time that could save you from significant financial loss and distress.

Here's a simple, repeatable process for evaluating any broker:

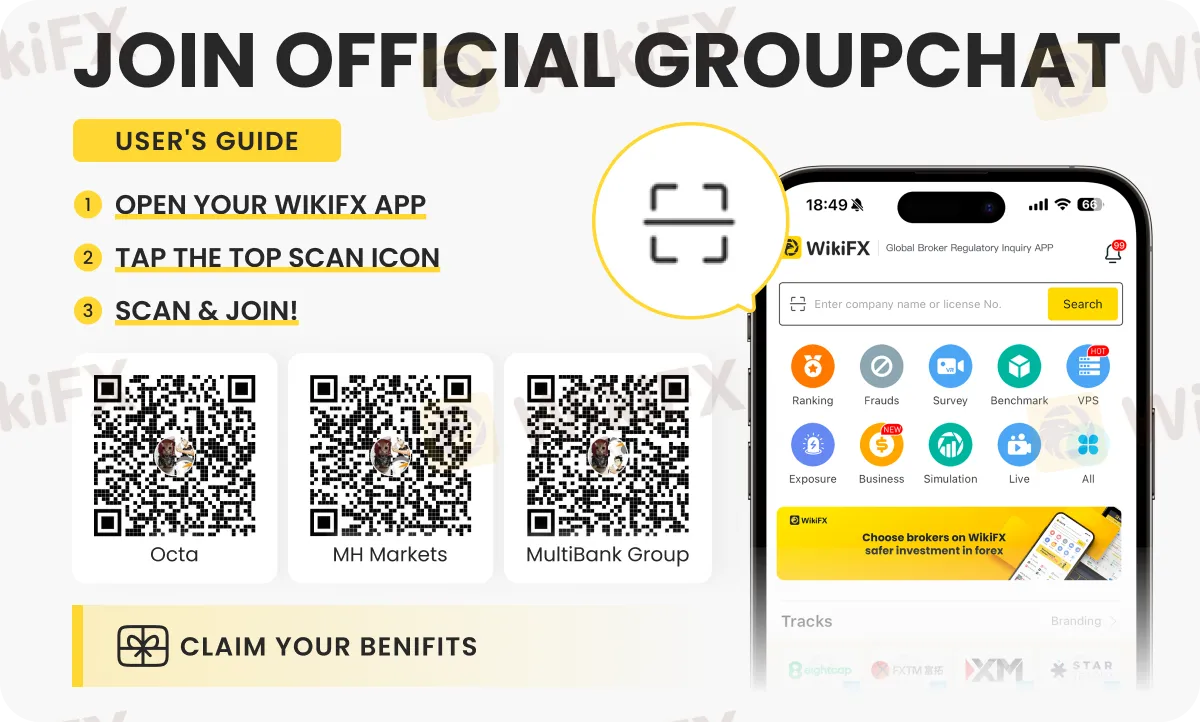

1. Navigate to the WikiFX website or open the mobile app.

2. Use the search bar, which is prominently displayed, to type in the full name of the broker you're considering (e.g., “RockwellHalal”).

3. Carefully examine the search results. Look for an official, verified profile. An absence of a detailed profile is, in itself, a warning.

4. If a profile exists, click on it and immediately go to the “Regulatory Information” section. WikiFX independently verifies licenses with regulators and will clearly state whether a broker's license is valid, cloned, or non-existent.

5. Pay close attention to the overall score, user reviews, and especially any “Exposure” warnings. These are real complaints from other traders, providing invaluable insight into a broker's operational practices, particularly regarding withdrawals.

By integrating this simple check into your process, you empower yourself with the data needed to make safe and informed investment decisions, steering clear of unregulated entities and protecting your capital.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

TP ICAP Expands Global Reach with Acquisition of Vantage Capital Markets

RM2.95 Million Gone: Terengganu Director Falls for ‘High-Return’ Scam

Trade War Crossroads: Supreme Court Ruling and Tariff Maze Threaten Economic Stability

Dollar Reigns Supreme: Economic Resilience Eclipses Political Noise Ahead of

Dollar Dives and Metals Surge: Powell Investigation Sparks Institutional Crisis

The 'Just-in-Case' Era: Strategic Hoarding Ignites Commodity Supercycle

Silver Markets Face 'Liquidity Squeeze' Risk, Warns Goldman Sachs

Top Forex Brokers Offering Free Demo Accounts

Global Central Bank Policy Fractures: The End of "Synchronized Action"

Dollar on Edge: Supreme Court Tariff Ruling and Deficit Warnings Collide

Currency Calculator