简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Common Questions About MTRADING: Safety, Fees, and Risks (2025)

Abstract:Finding a broker that balances low costs with high security is the ultimate goal for any trader. MTRADING often catches the eye of beginners because of its very low entry barrier (just $10) and promises of high leverage. But does accessibility equal safety?

Finding a broker that balances low costs with high security is the ultimate goal for any trader. MTRADING often catches the eye of beginners because of its very low entry barrier (just $10) and promises of high leverage. But does accessibility equal safety?

When we analyzed the data on WikiFX, the results were concerning. With a WikiFX Score of just 2.34 out of 10, MTRADING sits firmly in the “high risk” category. Before you deposit your hard-earned capital, you need to understand exactly why their score is so low and what current users are experiencing regarding withdrawals.

Is MTRADING actually regulated?

No, MTRADING is not regulated.

This is the most critical factor in their low trust score. While the broker claims to be established since 2017 and operates out of Saint Vincent and the Grenadines, this status does not offer you, the trader, any protection.

The “Grey Area” License

Registering in Saint Vincent and the Grenadines is a common tactic for offshore brokers. It is important to understand that the local authority there does not police Forex trading. They do not require brokers to segregate client funds or provide negative balance protection. If MTRADING were to become insolvent tomorrow, your money would likely be lost with no legal recourse.

The Warning from Malaysia

Even more concerning than the lack of regulation is the active warning against them. According to the data, the Securities Commission Malaysia (SCM) has placed MTRADING on its Investor Alert List.

The SCM explicitly states that MTRADING is “carrying out capital market activities without a license.” When a government financial regulator officially flags a company as unauthorized, it implies they are operating illegally in that jurisdiction. This is a massive red flag that suggests the company does not adhere to standard international compliance rules regarding transparency and fair dealing.

What problems are users reporting?

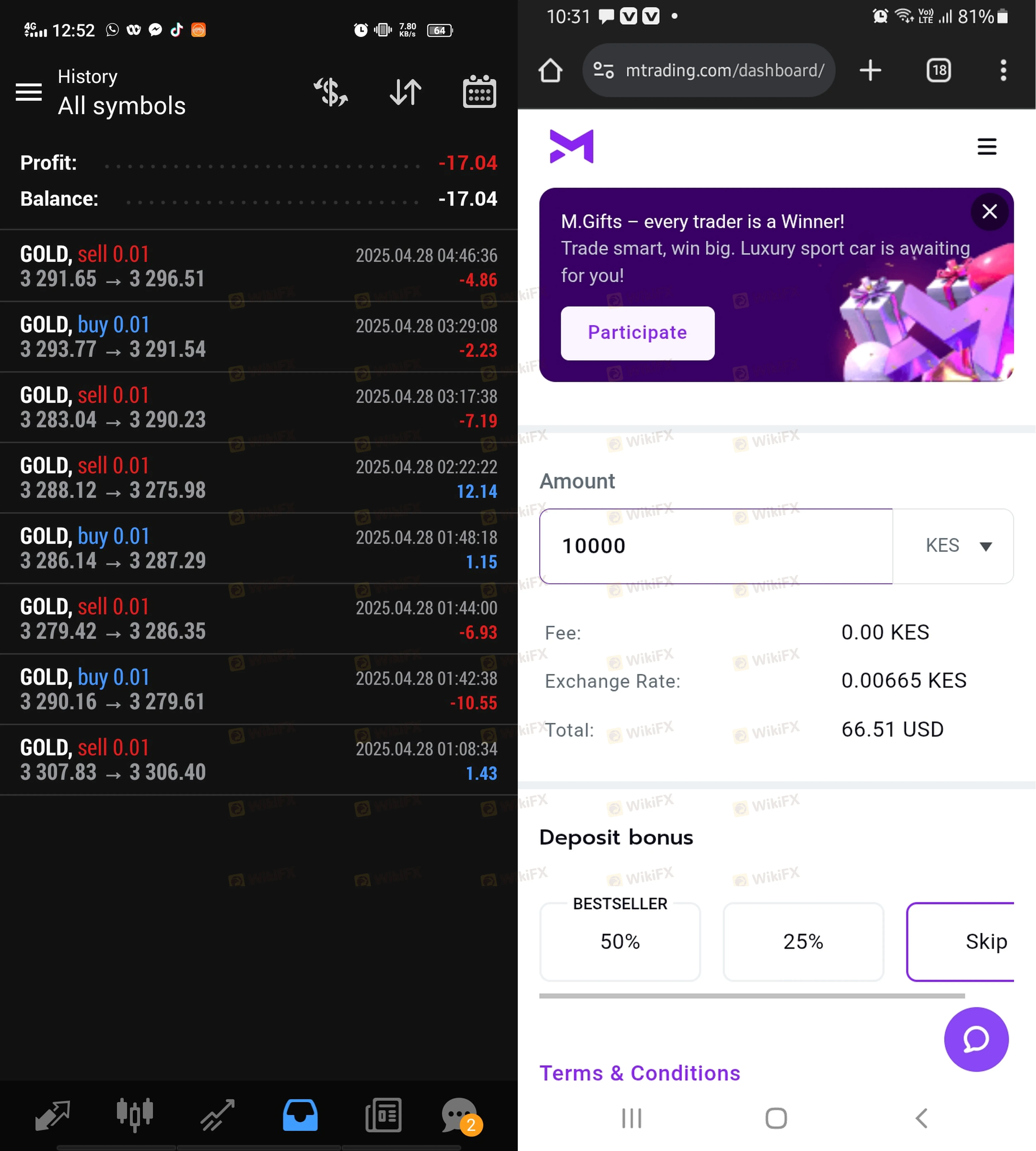

While marketing materials promise easy profits, the feedback from actual users tells a different, more frustrating story. Over the last three months alone, there have been 7 serious complaints lodged, and the recurring theme is the inability to get money out of the platform.

The Withdrawal Trap

A very specific and dangerous pattern has emerged from user reports in Thailand. One user detailed a scenario where the broker refused a withdrawal request, stating that the trader needed to “deposit more” to meet a minimum threshold before they could withdraw their existing funds.

This is a classic friction tactic used by bad actors. In a legitimate trading environment, you should be able to withdraw your available equity without needing to inject new capital. If a broker asks for more money to release your old money, it is almost always a sign of trouble.

Market Manipulation and Hidden Fees

Traders in Malaysia and Kenya have reported issues regarding trade execution and costs. One user accused the platform of “market manipulation,” suggesting that price feeds may be tweaked to force trades into losses.

Another user from Kenya pointed out that while the trading fees might look low on paper, the backend costs are high. They reported excessive charges on deposits and very poor exchange rates when trying to withdraw, which eats into any potential profits made during trading.

What trading conditions does MTRADING offer?

If you look past the safety risks, MTRADING offers conditions that are designed to be attractive to high-risk speculators, but these conditions come with their own set of dangers.

Leverage Rules

MTRADING offers massive leverage of up to 1:1000. While this allows you to control large positions with a small deposit (like their $10 minimum), it is financially lethal for most beginners.

Regulated brokers (like those in the UK or Australia) are usually capped at 1:30 leverage for a reason. With 1:1000 leverage, a market move of just 0.1% against your position could wipe out your entire account instantly. Without negative balance protection (which is not guaranteed here), you could legally owe the broker money.

Spreads & Costs

The data shows MTRADING has a “Cost Grade” of AA, meaning their raw spreads are competitive. They offer accounts like M.Pro and M.Premium, with spreads starting from 0 pips on the Pro account.

However, cheap spreads are often the bait used by unregulated brokers. You might save a few dollars on the spread, but if the “Slip Grade” is D (which it is for MTRADING), you will lose money on trade execution. Slippage occurs when the broker fills your order at a worse price than you clicked. A D-grade implies this happens frequently, negating the benefit of “low spreads.”

Software and Execution

The broker provides access to MT4 and MT5, which are the industry standards. However, the software layout is only as good as the server execution behind it. The test data rates their Trading Environment as “Poor” (Grade D).

Specific metrics show poor transaction speeds and frequent disconnects (Average reconnect time is high). In fast-moving markets like Gold or Forex, a slow connection means you cannot exit a losing trade quickly, leading to larger losses than planned.

Bottom Line: Should you trust MTRADING?

Based on the evidence, we cannot recommend trading with MTRADING.

The combination of a 2.34 WikiFX Score, a complete lack of valid regulation, and an active Investor Warning from the Malaysian Securities Commission makes this broker a dangerous choice. The user reports of withdrawal blocks particularly the “deposit more to withdraw” tactic—are severe warning signs that your capital is at risk the moment you transfer it.

There are many brokers who offer MT5 and competitive spreads while also holding licenses from top-tier regulators like the FCA or ASIC. There is simply no reason to take the risk with an unregulated entity.

Markets change fast. To verify their current license status or see if new complaints have surfaced before depositing, search for MTRADING on the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

TP ICAP Expands Global Reach with Acquisition of Vantage Capital Markets

RM2.95 Million Gone: Terengganu Director Falls for ‘High-Return’ Scam

Trade War Crossroads: Supreme Court Ruling and Tariff Maze Threaten Economic Stability

Dollar Reigns Supreme: Economic Resilience Eclipses Political Noise Ahead of

Dollar Dives and Metals Surge: Powell Investigation Sparks Institutional Crisis

The 'Just-in-Case' Era: Strategic Hoarding Ignites Commodity Supercycle

Silver Markets Face 'Liquidity Squeeze' Risk, Warns Goldman Sachs

Top Forex Brokers Offering Free Demo Accounts

Global Central Bank Policy Fractures: The End of "Synchronized Action"

Dollar on Edge: Supreme Court Tariff Ruling and Deficit Warnings Collide

Currency Calculator