简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

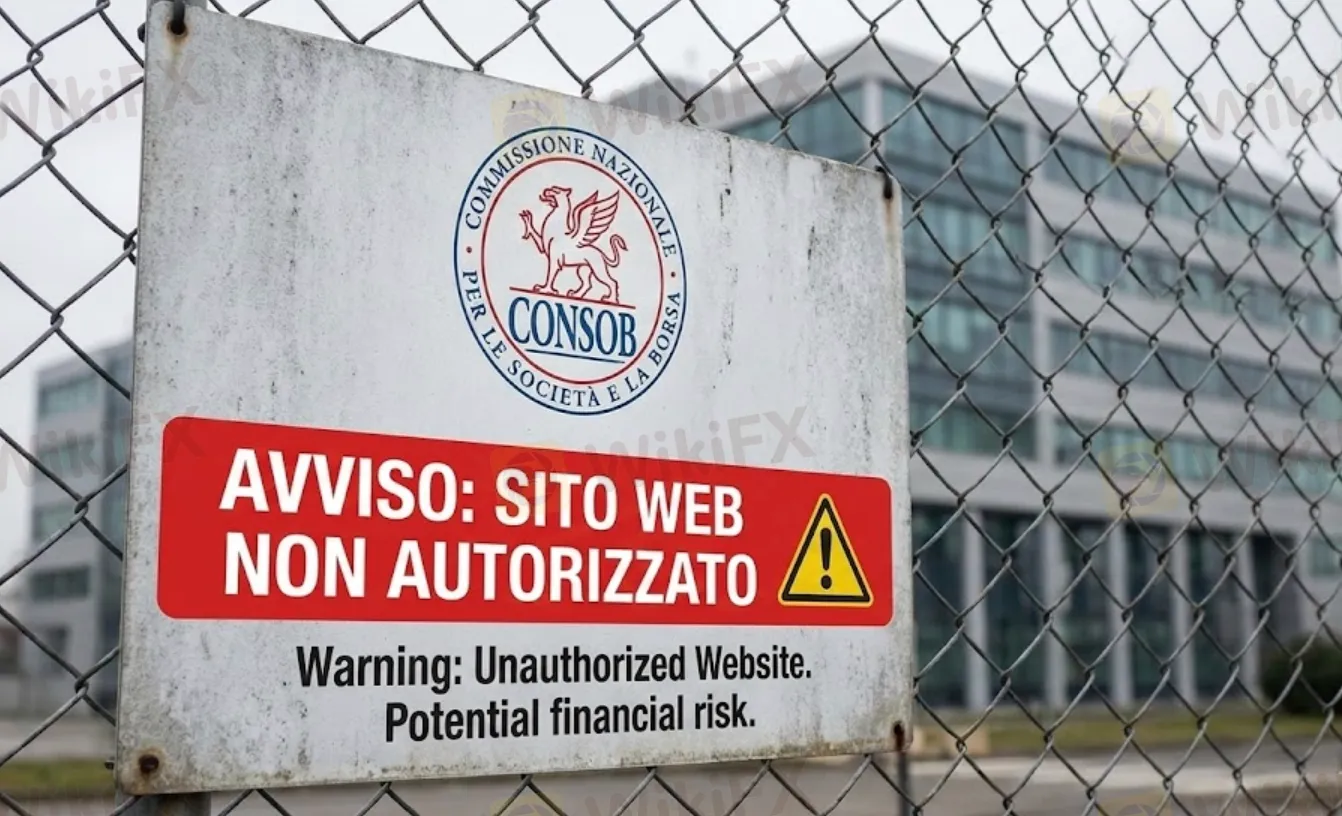

CONSOB Blackout: New Wave of Unauthorized Investment Scams Hidden Behind .it Domains

Abstract:CONSOB has blocked 11 new abusive financial websites, identifying a dangerous trend of unregulated schemes using .it domains to fool investors. See the full blacklist and learn how to protect your funds.

Italys financial watchdog, CONSOB, has struck another blow against online investment fraud. In its latest enforcement operation, the regulator ordered the blackout of 11 new websites that were illegally offering financial services and investment products to the public without authorization.

This latest action brings the total number of blocked domains to over 2,270 since the authority began its crackdown. However, this specific batch of shutdowns reveals a concerning new strategy employed by fraudsters: the mass usage of local .it domains to feign legitimacy.

The “.it” Trap: A Coordinated Network?

Analysis of the newly blacklisted sites reveals a striking pattern. Nearly all of the blocked platforms utilize the .it top-level domain (Italy's country code). By using a local domain extension, these unregulated entities attempt to create a false sense of security for Italian savers, appearing as “homegrown” or authorized local platforms.

The sites also share a suspicious similarity in naming conventions—often consisting of random alphanumeric codes (e.g., “RYE036”, “03WAKIH”)—and appear to rely on identical or highly similar web templates. This suggests they are likely part of a coordinated “clone” network, where fraudsters mass-produce cheap, identical websites to cast a wide net for victims seeking online trading opportunities.

The New Blacklist

Investors are urged to check their browser history and avoid the following domains immediately. These sites have been officially flagged for abusive financial activity:

- Praxiscarma s.a. (www.praxiscarma.com)

- “RYE036” (https://rye026.it)

- “RYE326” (https://rye326.it)

- “03WAKIH” (https://03wakih.it)

- “SJCJ11” (https://sjcj11.it)

- “01LUHAR” (https://01luhar.it)

- “GKJ159” (https://gkj159.it)

- “DSHS82” (https://dshs82.it)

- “GFJ123” (https://gfj123.it)

- “L88159” (https://l88159.it)

- “FGJ329” (https://fgj329.it)

Empowered by the “Growth Decree”

CONSOBs ability to act swiftly against these threats is bolstered by the “Growth Decree” (Decreto crescita). This legislation grants the authority the power to order internet service providers (ISPs) to completely restrict access to the websites of abusive financial intermediaries operating without proper licensing.

While ISPs work to implement these blocks, there may be a technical delay of a few days. During this window, the sites may remain visible, making individual vigilance critical.

How to Verify Before You Invest

The rise of “template scams”—where hundreds of sites look identical but carry different names—makes due diligence harder than ever.

CONSOB reminds investors that “common sense” is the first line of defense. Before transferring funds to any platform—especially those with nonsensical names or generic designs—verify their status.

Steps to Safety:

- Check the Authorization: Ensure the operator is listed on the official registers of authorized investment firms.

- Verify the Prospectus: For financial products, a valid prospectus must be published and approved by the regulator.

- Use Verification Tools: Platforms like WikiFX can help you instantly cross-reference a broker's regulatory status and view complaints from other users.

If you encounter a broker operating from a .it domain that is not on the official authorized list, it is highly likely a scam designed to exploit local trust.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Deriv Review: Is This Popular Broker Legit or Risky?

Libertex Investigation: When "Expert Advice" Leads to Total Ruin

Is CICC Broker Safe? CICC Regulation Check & In-Depth Review

A Collapse In Germany's Chemical Sector Is A Bad Omen

Change Review: The Broker Faces Massive Complaints on KYC Goof-ups and Fund Blocks

FINRA Imposes $150,000 Fine on Kingswood Capital Partners Over Supervisory Failures

Why Smart People Still Get Scammed | The Danger of Hope and Greed

IQ Option Review: Regulated Global Broker or Withdrawal Trap?

Inside the Elite Committee: Talk with Ayu Nur Permana

LQH Markets Broker and Regulation Review

Currency Calculator