Abstract:While NAGA markets itself as a comprehensive "communal trading ecosystem" backed by European regulation, recent distressing reports from mid-2025 suggest a darker reality for profitable traders. With allegations of high-value accounts being wiped under the guise of "expired bonuses" and senior executives blocking distressed clients, we investigate whether this FinTech giant is currently safe for your capital.

Abstract: While NAGA markets itself as a comprehensive “communal trading ecosystem” backed by European regulation, recent distressing reports from mid-2025 suggest a darker reality for profitable traders. With allegations of high-value accounts being wiped under the guise of “expired bonuses” and senior executives blocking distressed clients, we investigate whether this FinTech giant is currently safe for your capital.

Disclaimer: All cases cited in this article are based on real user complaints and regulatory records lodged with WikiFX. To protect the privacy of the individuals involved, specific identities have been anonymized.

The “Phantom Bonus” Mechanism

For many traders, the allure of NAGA lies in its reputation as a publicly listed, regulated entity. However, our investigation into recent complaints lodged in June 2025 reveals a disturbing pattern that targets high-net-worth accounts: the weaponization of “bonus terms.”

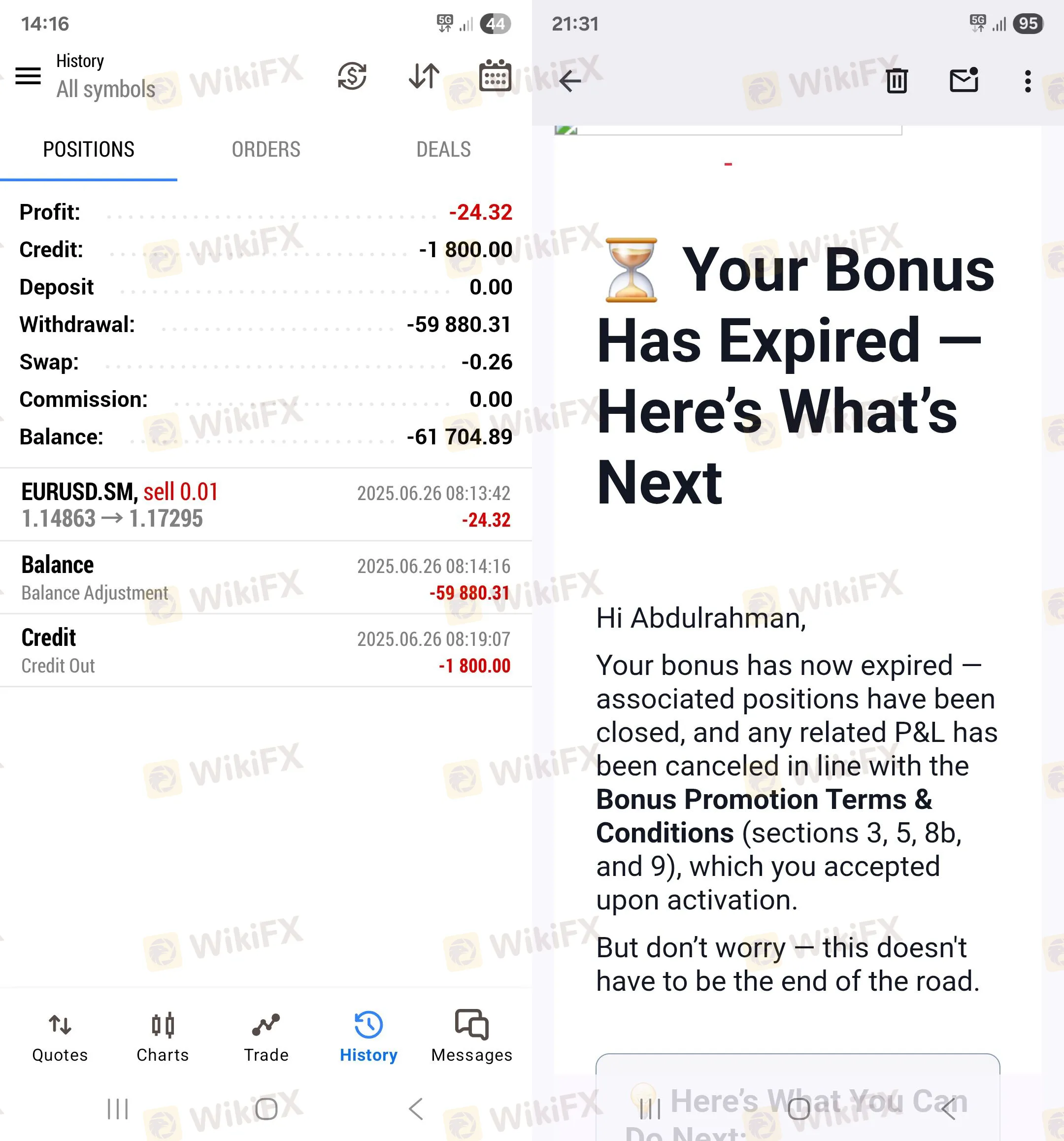

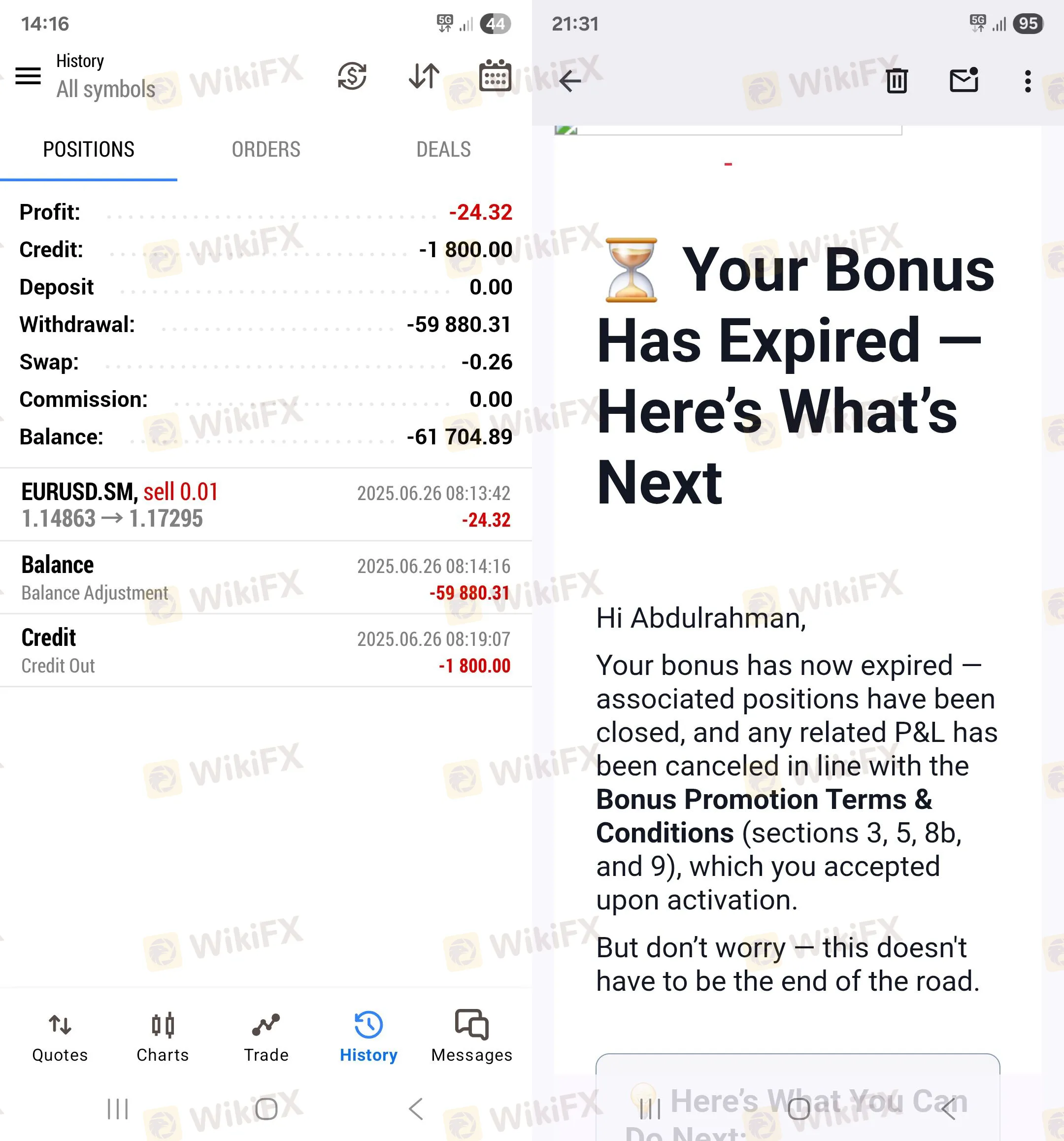

In a harrowing case reported from Kuwait, a trader witnessed a staggering $59,800 USD vanish from their balance. The justification provided by the broker? The expiration of a bonus worth merely $1,800. The disparity between the bonus amount and the penalized funds is alarming enough, but the traders testimony points to a more systemic issue. The user explicitly states they never requested a bonus, nor were they presented with Terms and Conditions regarding such a scheme during registration.

This suggests a mechanism where “phantom bonuses” might be applied to accounts without clear consent, acting as a dormant “kill switch” for the broker to reclaim funds—including the trader's principal and profits—under the pretext of technical expiration.

The Silent Treatment: Executive Evasion

When a standard support ticket fails, high-value clients often seek escalation to management. However, the response received by another NAGA client raises serious questions about the company's governance culture.

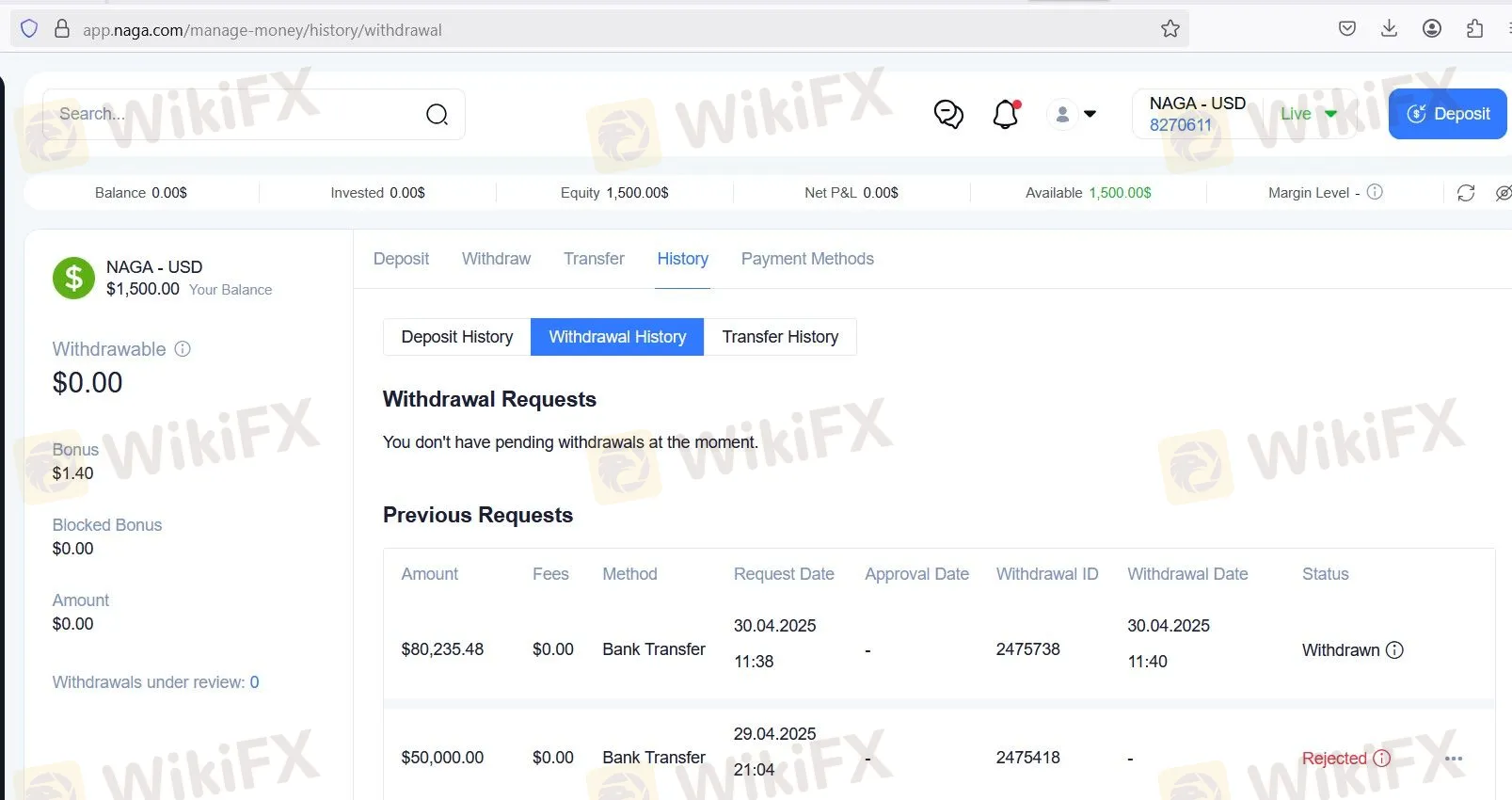

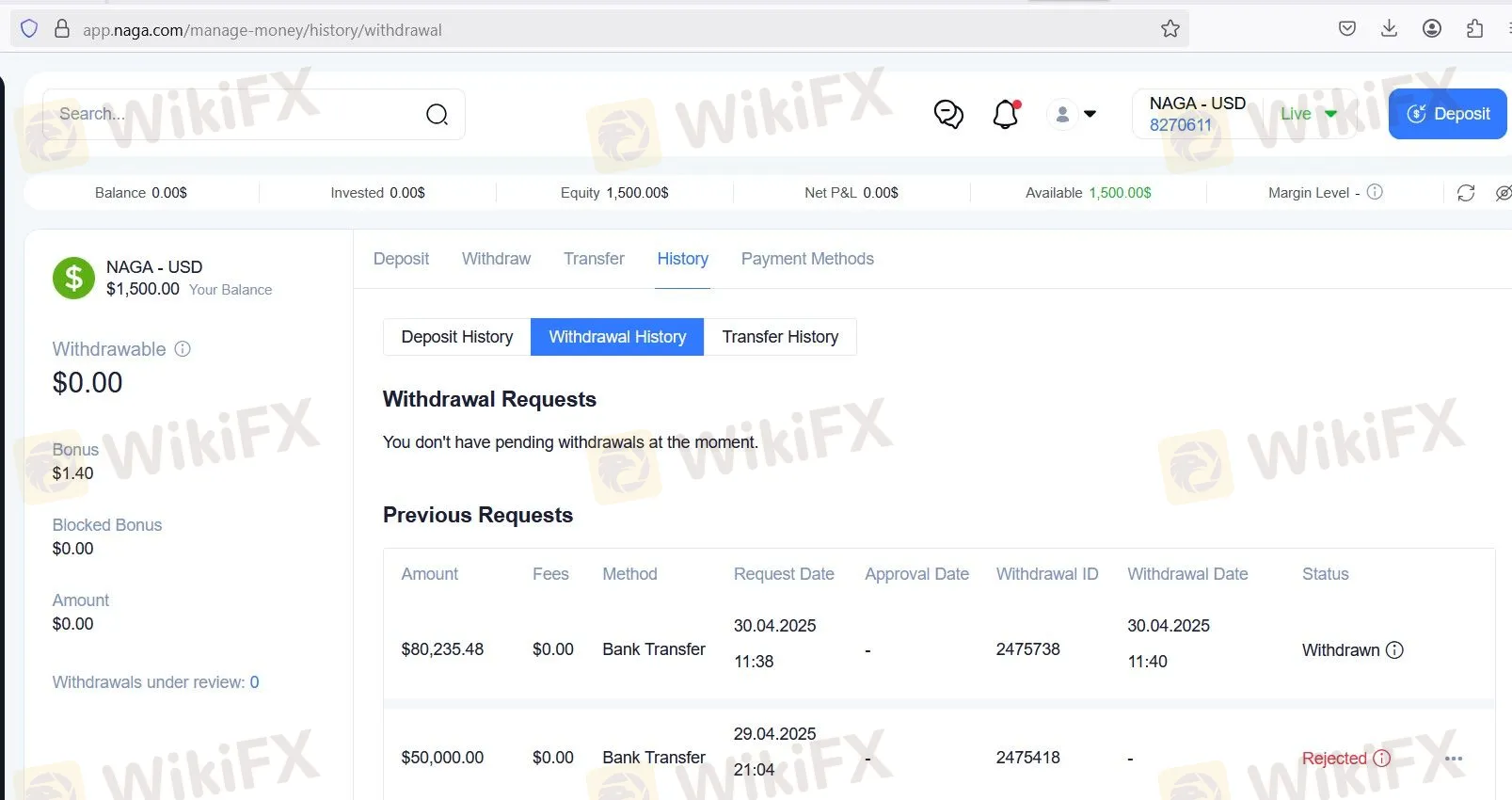

After accumulating profits exceeding $80,000, this verified account holder found their access restricted without clear explanation—a classic symptom of liquidity withholding. Desperate for a resolution, the trader bypassed standard support to contact NAGAs CEO, Octavian Patrascu, directly to explain the situation.

Instead of an investigation or a professional rebuttal, the trader reports that they were simply blocked.

This action sends a chilling message to the trading community. When the leadership of a “transparent” social trading network chooses to silence complaints rather than address them, “is NAGA safe?” becomes a rhetorical question. The support team subsequently acknowledged the withholding of profits, again citing vague bonus terms that the user claims never to have seen or signed.

A Drastic Shift in Sentiment: From “Ecosystem” to “Enigma”

To provide a balanced NAGA review, we analyzed the broker's historical performance. Throughout 2024, the sentiment surrounding NAGA was predominantly positive. Users from Germany, Spain, and Thailand praised the platforms “versatile trading ecosystem,” highlighting the convenience of having copy trading, news, and market execution in one place.

However, even amidst this praise, early warning signs were visible. In March 2024, a user from Indonesia noted unexpected withdrawal fees. While they described the fee as small at the time, this points to a tightening of liquidity conditions that appears to have escalated significantly by 2025.

The contrast is stark: specifically, the timeline shifts from users praising a “Role Model” broker in early 2024 to allegations of five-figure fund removals in 2025. This rapid deterioration in user experience allows us to infer that internal policies regarding withdrawals and profitability may have undergone a quiet, yet aggressive, overhaul.

Regulatory Disconnect: Why Licensed Brokers Can Still Fail You

It is crucial for traders to understand that a valid license does not physically prevent a broker from freezing an account; it merely provides a legal framework for recourse. NAGA holds a Tier-1 license, yet the withdrawal problems persist.

Below is the complete regulatory data extracted from WikiFX database regarding NAGA's current standing:

While the “Regulated” status is valid, the complaints regarding the “Bonus Abuse” clause often fall into a grey area of compliance. Brokers often use the Terms and Conditions (T&C) of bonuses to legally bypass standard regulatory protections regarding client funds. If a trader inadvertently accepts a bonus (or one is auto-applied), they may legally waive their right to withdraw until impossible volume requirements are met.

Conclusion

The trajectory of NAGA is concerning. A broker that once garnered praise for its innovative social trading tools is now facing serious accusations of withholding significant sums—$59,800 and $80,000 in just two recent cases. The shift from “unexpected small fees” in 2024 to “total account restriction” in 2025 indicates a potential liquidity crisis or a predatory policy shift.

For traders, especially those in Africa and emerging markets where legal recourse against Cypriot entities is difficult, extreme caution is advised.

WikiFX Risk Warning:

The number of complaints against NAGA has reached 10 within the past 3 months. Despite its valid regulatory status with CySEC, the severity of recent fund withholding allegations poses a significant risk. We strongly advise users to avoid accepting any bonuses, thoroughly read all Terms & Conditions, and consider the high risk before depositing large capital.

Score: 6.01 (Declining due to recent complaints)

Status: Regulated, but High User Complaint Volume.