Abstract:Did your deposits in KEY TO MARKETS’ forex trading fail to reflect despite numerous follow-ups with the broker? Are you facing margin lock up and withdrawal issues due to stuck limit orders? Do you find losses due to wide spreads on the KEY TO MARKETS login? Similar issues have been expressed by many traders online. In this KEY TO MARKETS review article, we will take a close look at the complaints. Read on!

Did your deposits in KEY TO MARKETS forex trading fail to reflect despite numerous follow-ups with the broker? Are you facing margin lock up and withdrawal issues due to stuck limit orders? Do you find losses due to wide spreads on the KEY TO MARKETS login? Similar issues have been expressed by many traders online. In this KEY TO MARKETS review article, we will take a close look at the complaints. Read on!

Here are the Top Complaints Against KEY TO MARKETS

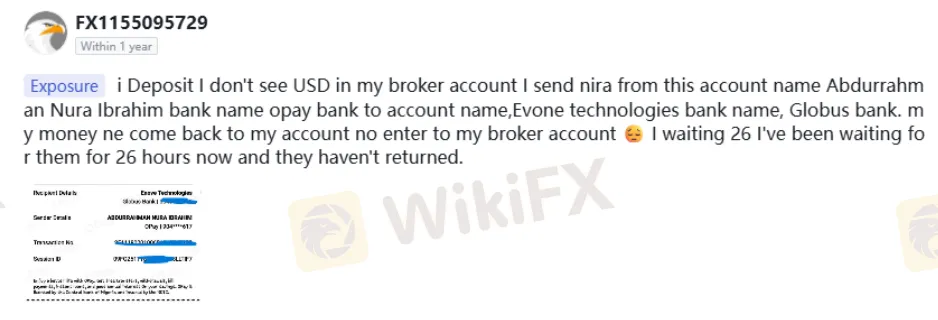

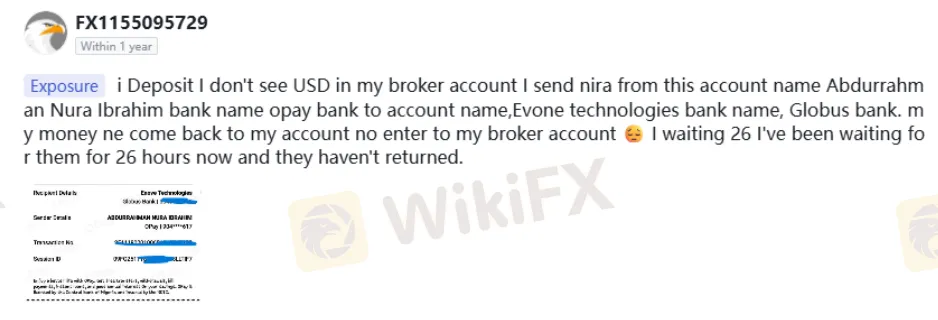

The Deposit Credit Failure

A trader recently reported about the hassles witnessed while depositing funds into the forex trading account at KEY TO MARKETS. The trader attempted to deposit through multiple bank accounts, but nothing reflected in his forex trading account—prompting this KEY TO MARKETS review.

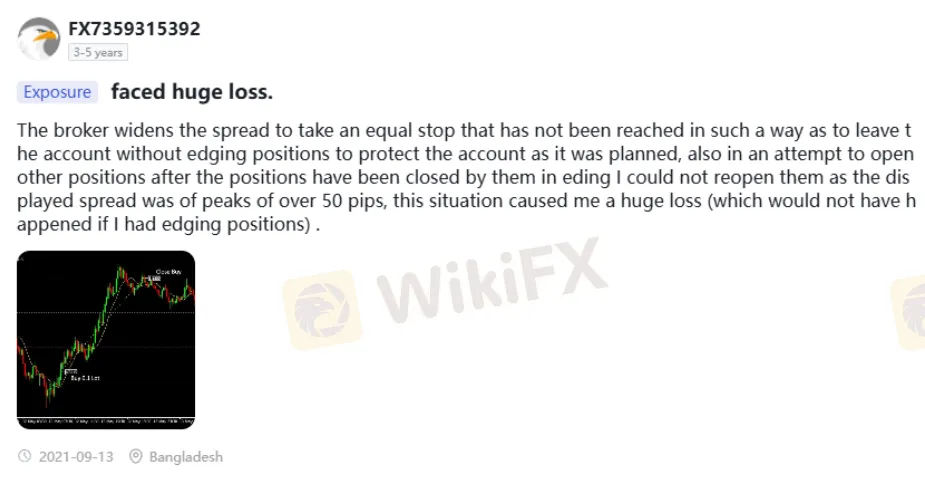

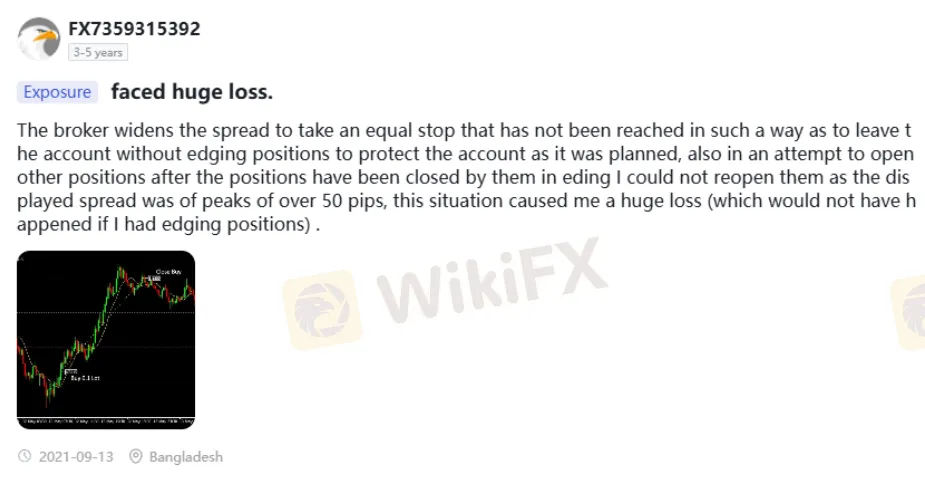

Wide Spreads and Losses for KEY TO MARKETS Traders

KEY TO MARKETS is accused of widening spreads to trigger stops even when the price remains far from the level set by the trader. Further, the broker reportedly closes the traders hedging positions and then raises spreads by more than 50 pips, disallowing re-entry. As per a trader, this has resulted in significant capital losses. The screenshot below further elaborates on the issue. Take a look!

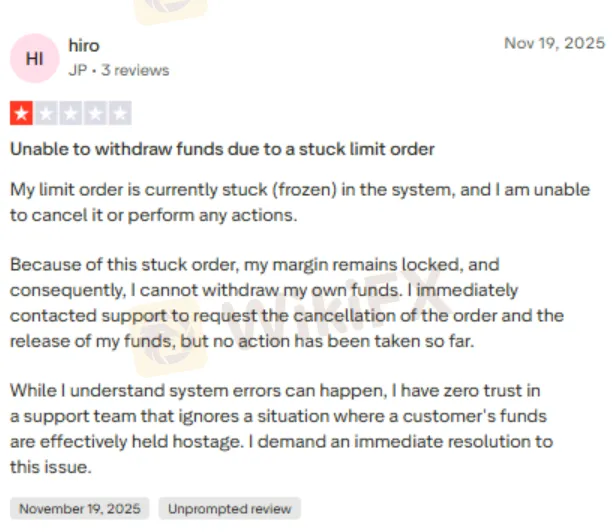

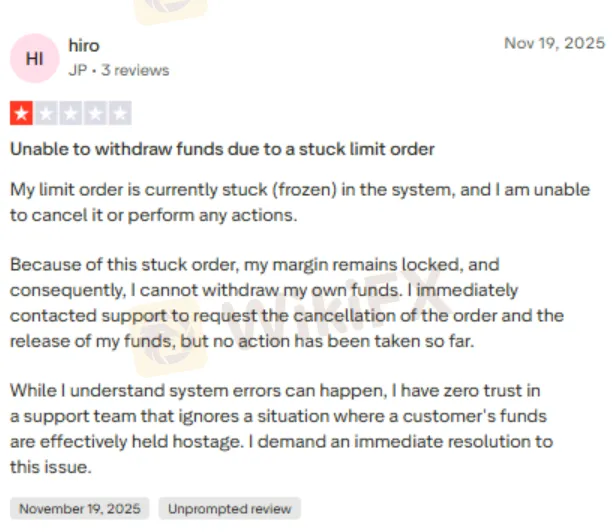

KEY TO MARKETS Withdrawal Issues Due to Stuck Limit Orders

Traders also report an increasing number of stuck limit orders causing a margin lock up. A trader recently reported about his multiple attempts to contact the KEY TO MARKETS customer support service executives to cancel the orders and release his funds. However, the trader did not receive any response to this matter. As a result, the trader shared this review of KEY TO MARKETS.

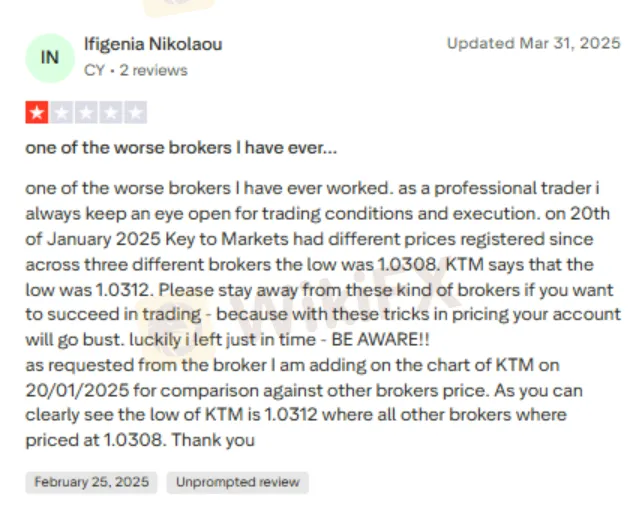

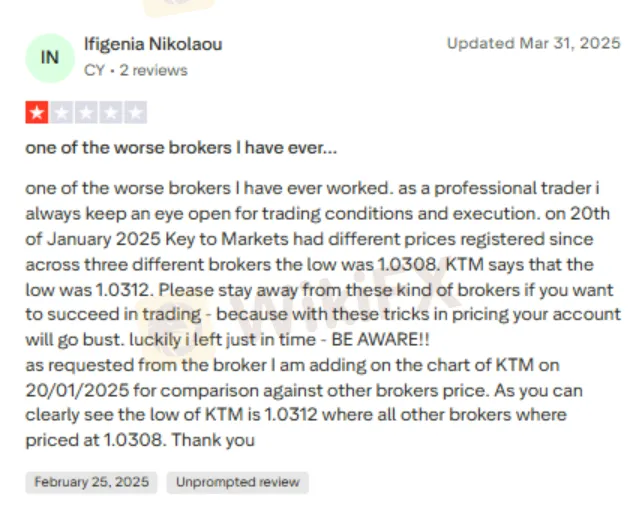

The Looming KEY TO MARKETS Account Blowup Threat

The broker is accused of displaying different prices for the same security simultaneously, causing chaos and increasing the likelihood of incorrect trade order executions. Recently, a trader highlighted that due to price manipulations, the scope for account blowups rose on a particular day. Since the trader did not trade, he was saved from the danger. Check out this KEY TO MARKETS review to understand things better.

KEY TO MARKETS Review: Score & Regulation Status

The complaints mentioned above reflect a lack of transparency and trust in KEY TO MARKETS, which is allegedly involved in suspicious forex trading activities. To detect the reason behind all these trading issues, the WikiFX team conducted a detailed inquiry into its regulatory status. The inquiry revealed that the Mauritius-based forex broker is an unregulated entity, raising significant investment risks for traders. The team thus gave KEY TO MARKETS a score of 2.40 out of 10.

Want to know the latest about the forex market? Be part of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.