Abstract:Warning: Zipphy Regulation is fake. Broker exposed for fraud and scams. Protect your funds and avoid risky platforms.

Is Zipphy Broker Legit or a Scam?

Zipphy presents itself as a modern trading platform offering MetaTrader 5 access, multiple account tiers, and promises of cashback and instant withdrawals. However, the evidence points to a troubling reality: Zipphy Regulation is non-existent. According to the brokers own disclosures and independent verification, Zipphy operates without a valid license. This raises immediate red flags about its legitimacy.

Customer complaints documented in the attached report reveal repeated withdrawal failures, aggressive upselling tactics, and suspiciously consistent “profitable trades” designed to lure investors. These patterns align with common hallmarks of fraudulent brokers.

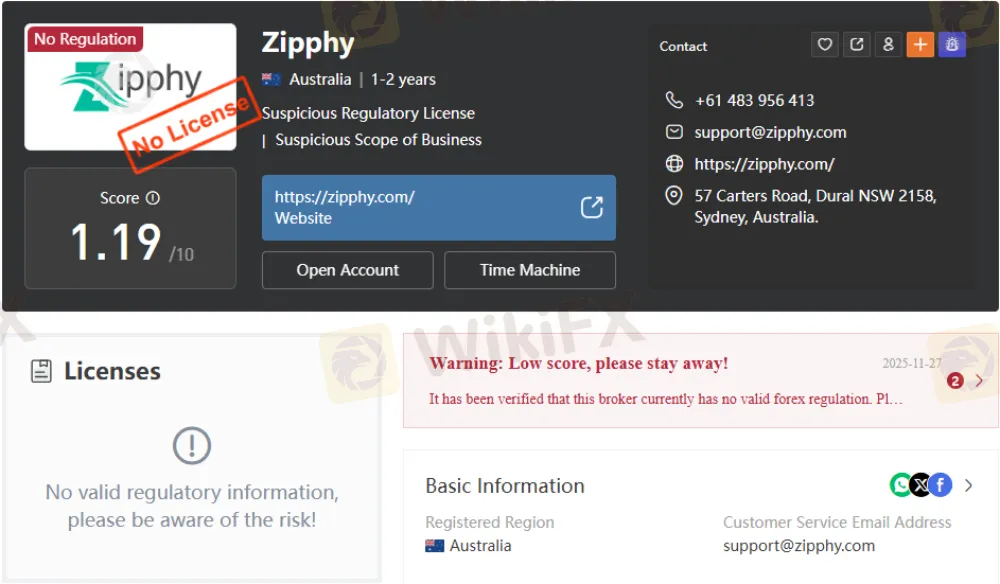

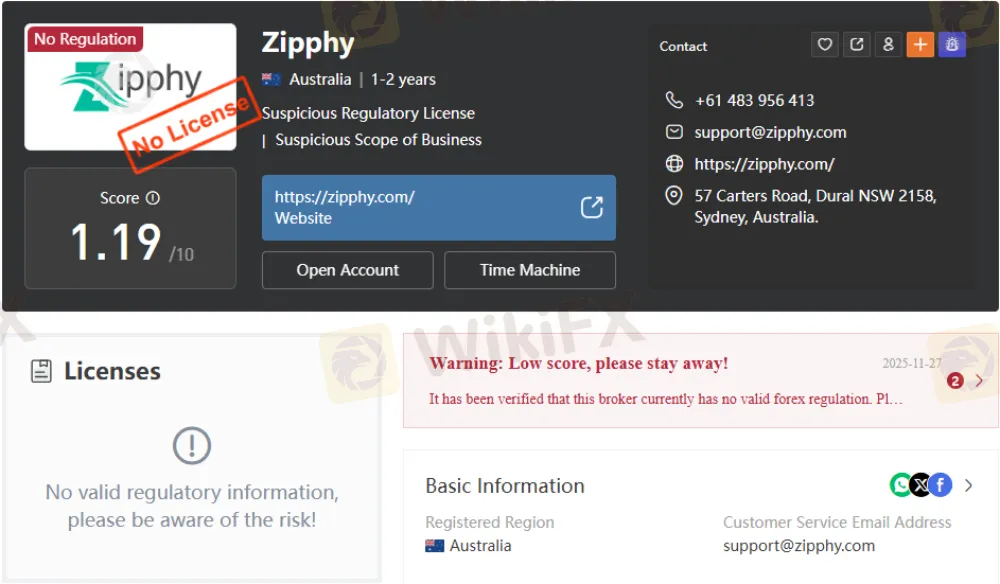

Zipphy Regulation and Licensing Explained

- Registered Region: Australia (Dural, NSW 2158, Sydney)

- License Status: No valid forex regulation, suspicious regulatory claims

- WikiFX Score: 1.19/10 — flagged as “No License” and “Suspicious Scope of Business”

- Contact Details: +61 483 956 413 | support@zipphy.com | zipphy.com

Despite marketing itself as a global broker, Zipphy Regulation is unverifiable. No recognized authority (ASIC, FCA, CySEC, or others) lists Zipphy as a licensed entity. This absence of oversight means traders have no legal protection if disputes arise.

Zipphy Review: Account Types & Fees

Zipphy offers a tiered account structure ranging from entry-level to premium packages.

Key Takeaway: The escalating deposit requirements and extreme leverage ratios (up to 1:1000) are highly risky. Legitimate brokers rarely offer such aggressive terms due to regulatory restrictions.

Zipphy Deposit and Withdrawal Methods

Zipphy claims to support:

- VISA / MasterCard

- Google Play

- Bank Transfer

- LIPI

However, multiple user reports highlight withdrawal failures. Cases include:

- Investors are pressured to purchase “AI systems” before accessing funds.

- Withdrawals are delayed or ignored despite promises of instant processing.

- Auto-withdrawals of small amounts while larger requests remain blocked.

This pattern strongly suggests systemic withdrawal obstruction — a hallmark of scam operations.

Zipphy Trading Platform Features

Zipphy advertises access to MetaTrader 5 (desktop, web, mobile) with:

- Real-time market data

- Algorithmic trading support

- Browser-based WebTrader

- Mobile apps for iOS and Android

While MT5 is a legitimate platform, its availability does not validate Zipphy Regulation. Fraudulent brokers often piggyback on trusted software to appear credible.

Zipphy Spreads and Leverage Explained

- Spreads: Fixed (Classic) or Variable (higher-tier accounts)

- Leverage: Ranges from 1:100 to 1:1000

Such high leverage magnifies risk. Regulated brokers typically cap leverage at 1:30 (EU/UK) or 1:50 (US). Zipphys extreme ratios are not only dangerous but also a clear indicator of its unregulated status.

Comparing Zipphy Broker vs Competitors

Observation: Competitors with valid regulations offer safer leverage limits, transparent fee structures, and proven withdrawal reliability. Zipphy fails across all these benchmarks.

Pros and Cons of Zipphy

Pros:

- Access to the MT5 platform

- Multiple account tiers

- Marketing promises of cashback and instant withdrawals

Cons:

- No valid regulation or license

- Extremely high leverage (up to 1:1000)

- Documented withdrawal failures

- Aggressive upselling and pressure tactics

- Low trust score (1.19/10 on WikiFX)

Bottom Line: Should You Trust Zipphy?

Zipphy Regulation is fake. The broker operates without oversight, exposes traders to extreme leverage risks, and has a track record of blocked withdrawals. While its polished website and MT5 integration may appear convincing, the absence of licensing and repeated fraud complaints make Zipphy a high-risk platform.

Final Verdict: Zipphy is not a legitimate broker. Traders should avoid depositing funds and instead choose regulated alternatives with proven transparency and investor protection.