”New Traders Launch Pad” Initiative

Bravely Share Your First Trade

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:BitDelta Pro Review: No valid regulation, risky spreads, and hidden broker issues. Traders should proceed with caution.

BitDelta Pro positions itself as a multi-asset broker offering access to over 5,000 CFDs across forex, commodities, indices, shares, ETFs, and crypto. On paper, this looks impressive. However, a closer investigation reveals that BitDelta Pro Broker operates without valid regulation.

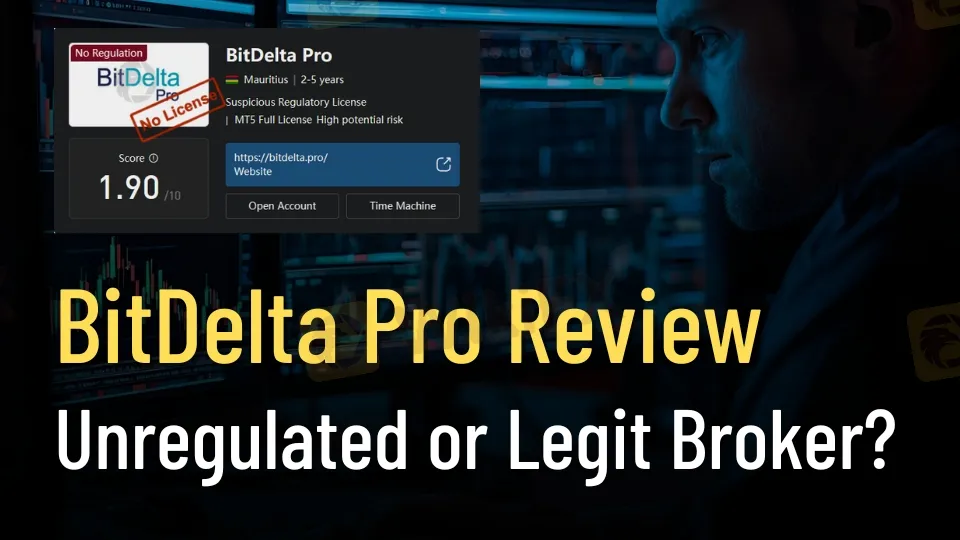

The company claims to hold a license from the Financial Services Commission (FSC) in Mauritius, but official records show no such authorization. WikiFX rates the broker at 1.90/10, explicitly warning traders to stay away due to suspicious licensing and lack of transparency.

This raises the critical question: Is BitDelta Pro a scam or legit? Evidence strongly suggests that BitDelta Pro is unregulated, exposing traders to significant risks.

Without proper oversight, BitDelta Pro Regulation is essentially non-existent. Traders should note that unregulated brokers can change terms, manipulate spreads, or even restrict withdrawals without accountability.

For comparison, trusted online broker reviews of regulated firms (e.g., IG, Pepperstone, or Saxo Bank) highlight transparent licensing, audited financials, and investor protection schemes. BitDelta Pro offers none of these safeguards.

BitDelta Pro provides three main account tiers: Standard, VIP, and Institutional.

| Account Type | Spreads (EURUSD/XAUUSD/WTI) | Leverage | Commission | Minimum Deposit | Bonus |

| Standard | 0.00008 / 0.27 / 0.028 | 1:200 | $0 | $10 | None |

| VIP | 0.00007 / 0.24 / 0.028 | 1:200 | $0 | $50 | 20% |

| Institutional | 0.00003 / 0.15 / 0.025 | 1:200 | $5 Commodities / $3 Forex | $5,000 | None |

Key takeaways:

Compared to regulated brokers, these spreads and commissions are inconsistent and often higher than industry averages.

BitDelta Pro advertises dynamic leverage up to 1:500, but most accounts cap at 1:200. While high leverage can amplify profits, it also magnifies losses.

Spreads are problematic:

This means traders face slippage and inflated costs, eroding profitability. In contrast, leading brokers typically offer EURUSD spreads below 1 pip with transparent commission structures.

BitDelta Pro supports MetaTrader 5 (MT5) alongside its proprietary platform and CQG.

While MT5 is a respected platform, the broker‘s infrastructure raises concerns. Reports of severe slippage and inconsistent execution suggest that BitDelta Pro’s servers may not meet professional standards.

For traders comparing options, regulated brokers like Pepperstone or IC Markets deliver faster execution and audited performance metrics.

The broker advertises flexible deposits starting at $10. However, transparency around withdrawal methods is limited.

The lack of clear withdrawal terms is a red flag. In trusted online broker reviews, withdrawal speed and reliability are critical benchmarks. BitDelta Pro fails to provide sufficient assurance.

Pros

Cons

When placed against regulated competitors, BitDelta Pro falls short:

| Feature | BitDelta Pro | Regulated Broker (e.g. IG, Pepperstone) |

| Regulation | None | FCA, ASIC, CySEC, BaFin |

| Minimum Deposit | $10 | $100–$250 |

| Spreads (EURUSD) | 20 points | <1 pip |

| Leverage | Up to 1:500 | Typically capped at 1:30 (EU/UK) |

| Transparency | Low | High – audited, investor protection |

This comparison underscores why the best forex broker comparison consistently favors regulated firms over unregulated entities like BitDelta Pro.

BitDelta Pro markets itself as a modern broker with diverse instruments and MT5 support. Yet, beneath the surface, the lack of regulation, suspicious licensing claims, and high spreads make it a high-risk choice.

Traders seeking security should prioritize brokers with verifiable licenses, transparent fee structures, and proven track records. BitDelta Pro does not meet these standards.

Final Verdict: BitDelta Pro is not a trusted broker. Its unregulated status, hidden costs, and questionable transparency place traders at risk. Those looking for reliable trading should consult trusted online broker reviews and choose regulated alternatives.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Bravely Share Your First Trade

Do you have to constantly witness trade delays on the EO Broker trading platform? Have you encountered cases of unfair trade executions where you have recorded heavy losses? Are inconsistent spreads eating into your trading gains? Is the EO Broker withdrawal process too slow? Is the customer support team incompetent in resolving all these trading queries? You are not alone! Many traders have vehemently opposed the broker’s tactics on review platforms. We have highlighted different EO Broker reviews in this article. Read on!

Achiever FX has been receiving flak for numerous reasons, including slow-paced trade execution, lack of transparency, and, importantly, alleged attempts to defraud traders. With its customer support team not able to resolve these issues, traders have allegedly been left alone! They have rightly reviewed the Saint Lucia-based forex broker negatively online. In this Achiever FX review article, we have explored complaints against the forex broker. Keep reading to know the same.

Alpari艾福瑞's notably low overall rating of 2.52 out of 10 raises immediate red flags for traders seeking a reliable forex broker. While the broker has generated sufficient market presence to accumulate 218 documented reviews, the available data presents an unusually opaque picture of their operational strengths and weaknesses. This lack of clear performance metrics across key service areas makes it challenging to provide specific insights into their trading conditions, platform reliability, or customer service quality. Read on for more information.