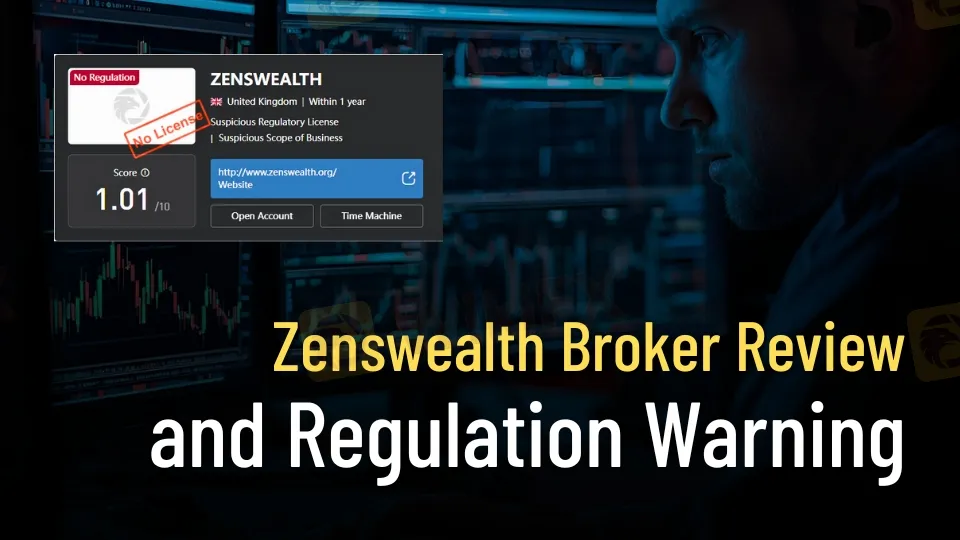

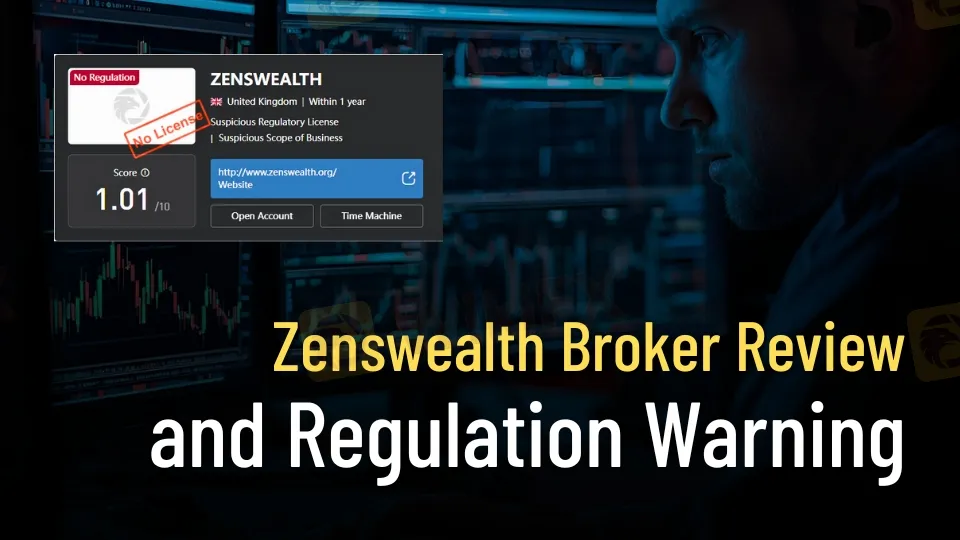

Abstract:Zenswealth Broker flagged as unregulated. FCA warns investors in latest review.

Zenswealth Review: An Investigative Overview

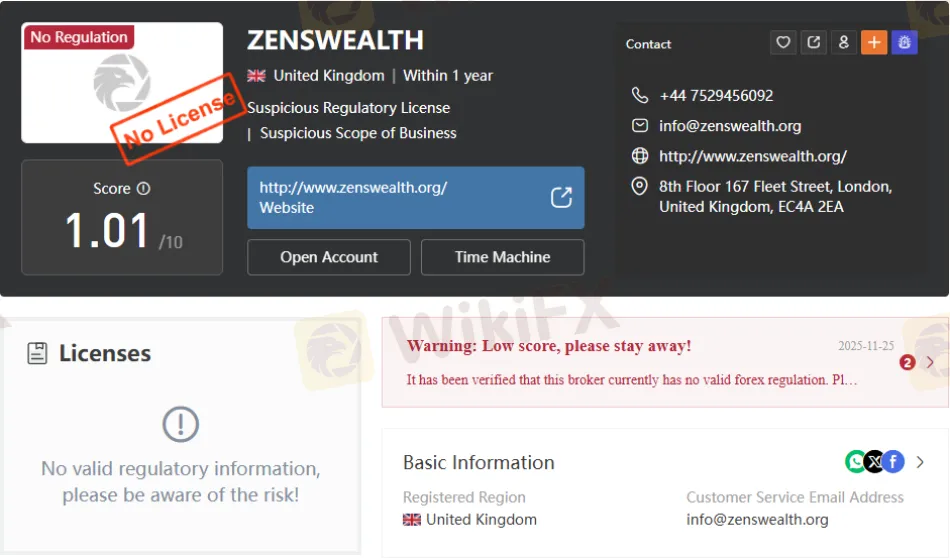

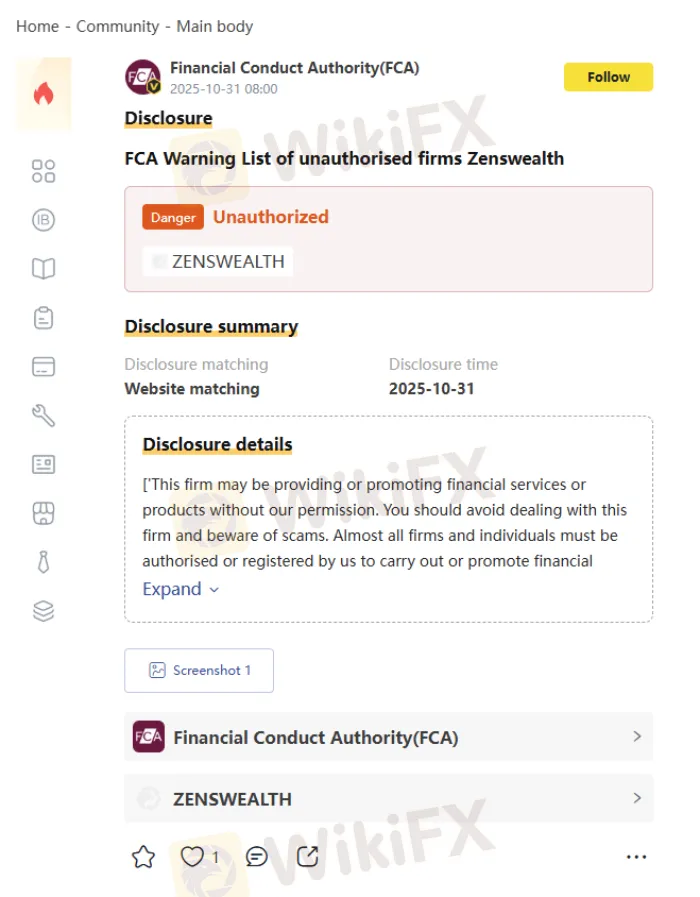

Zenswealth has recently drawn attention from regulators and traders alike. According to the Financial Conduct Authority (FCA), the broker is operating without authorization, placing it on the official warning list of unauthorised firms. This Zenswealth Review examines the brokers regulatory standing, investment plans, trading instruments, and overall credibility.

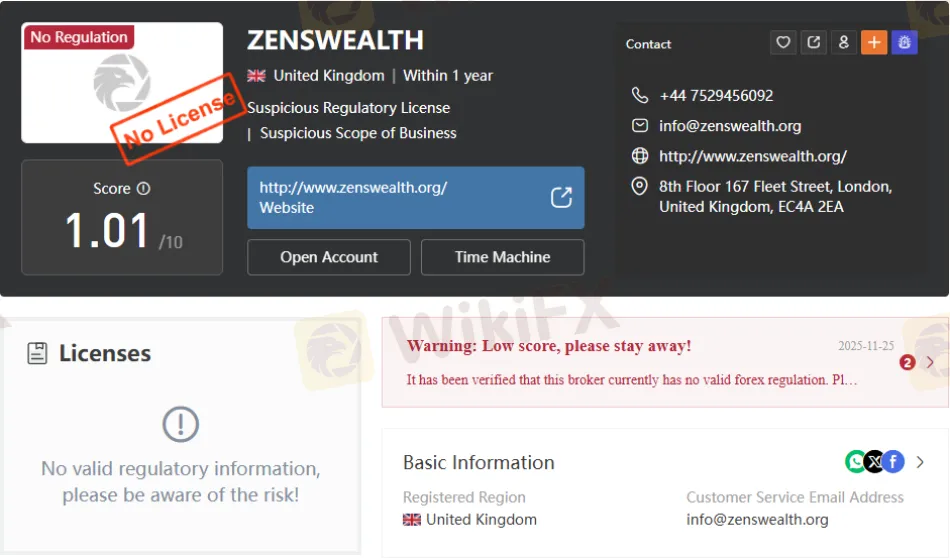

Zenswealth Broker Regulatory Status

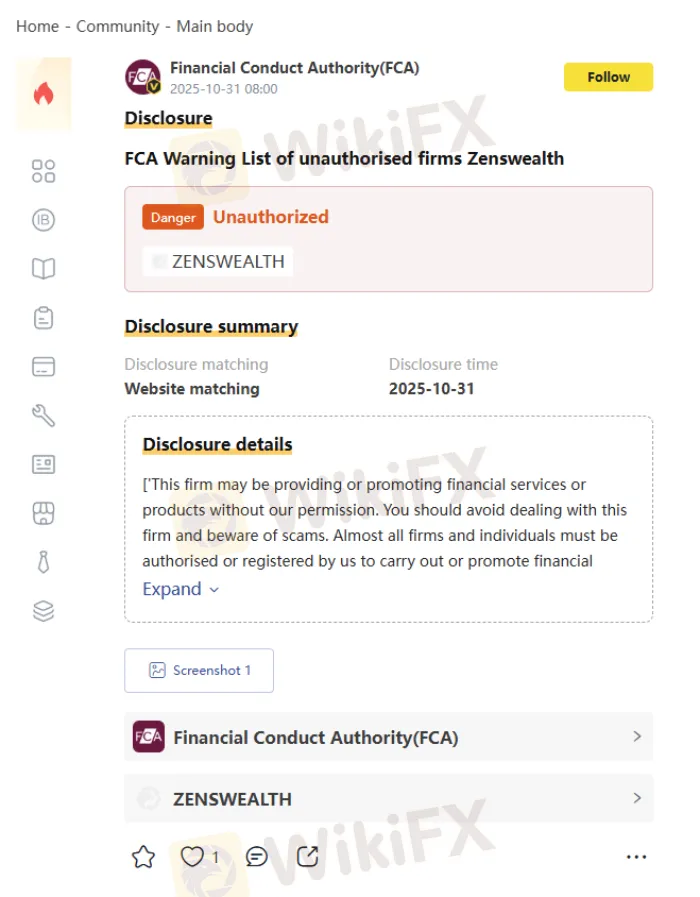

The most pressing issue surrounding Zenswealth is its regulatory absence. The FCA explicitly warns that the firm may be providing or promoting financial services without permission. Almost all brokers must be registered or licensed to operate legally in the UK.

- Regulatory Authority: Financial Conduct Authority (FCA)

- Status: Unregulated, no valid license

- Disclosure Date: October 31, 2025

- Website: zenswealth.org

- Registered Address: 8th Floor, 167 Fleet Street, London, EC4A 2EA

This lack of oversight raises serious concerns about Zenswealth Regulation and investor safety.

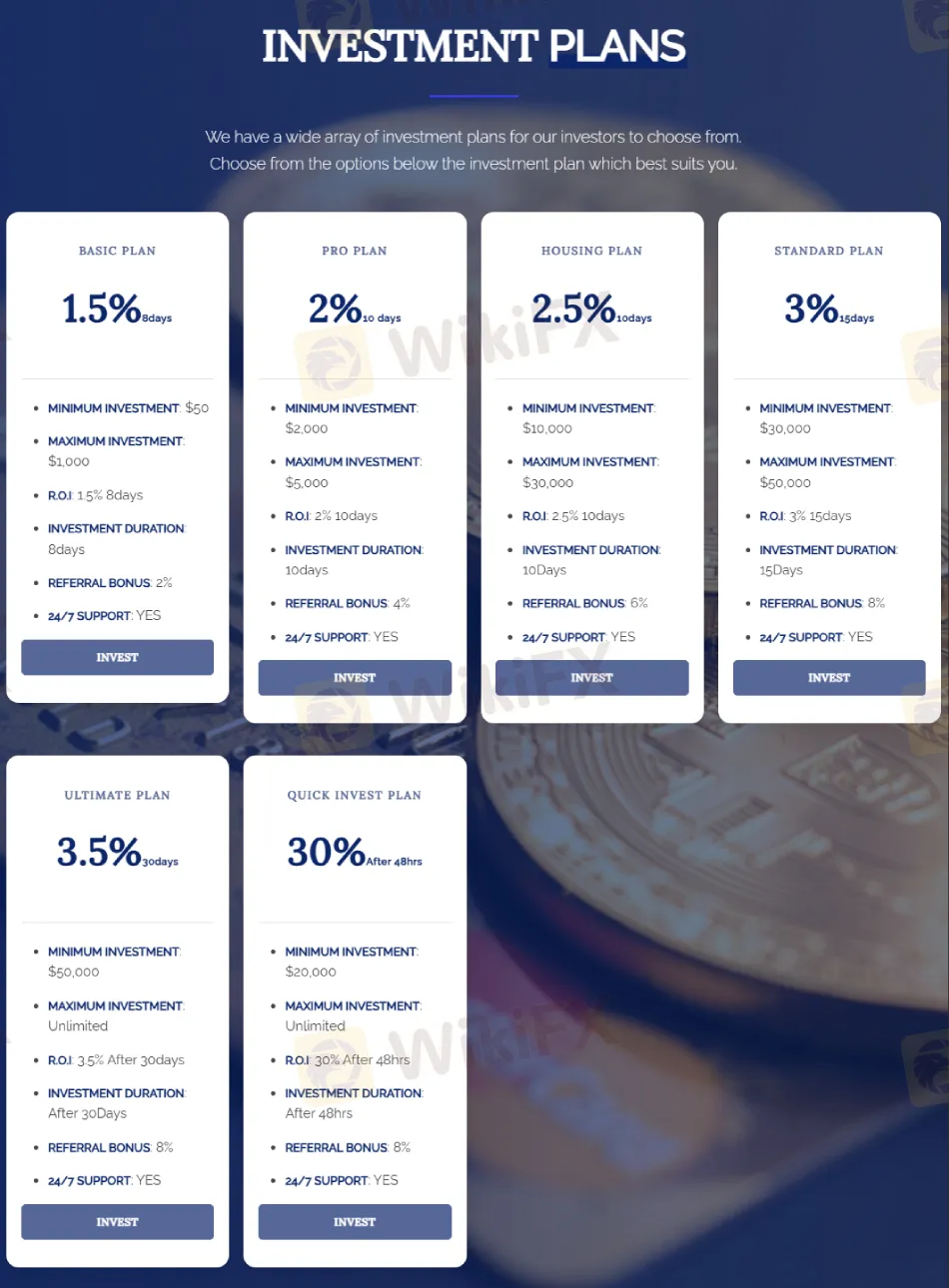

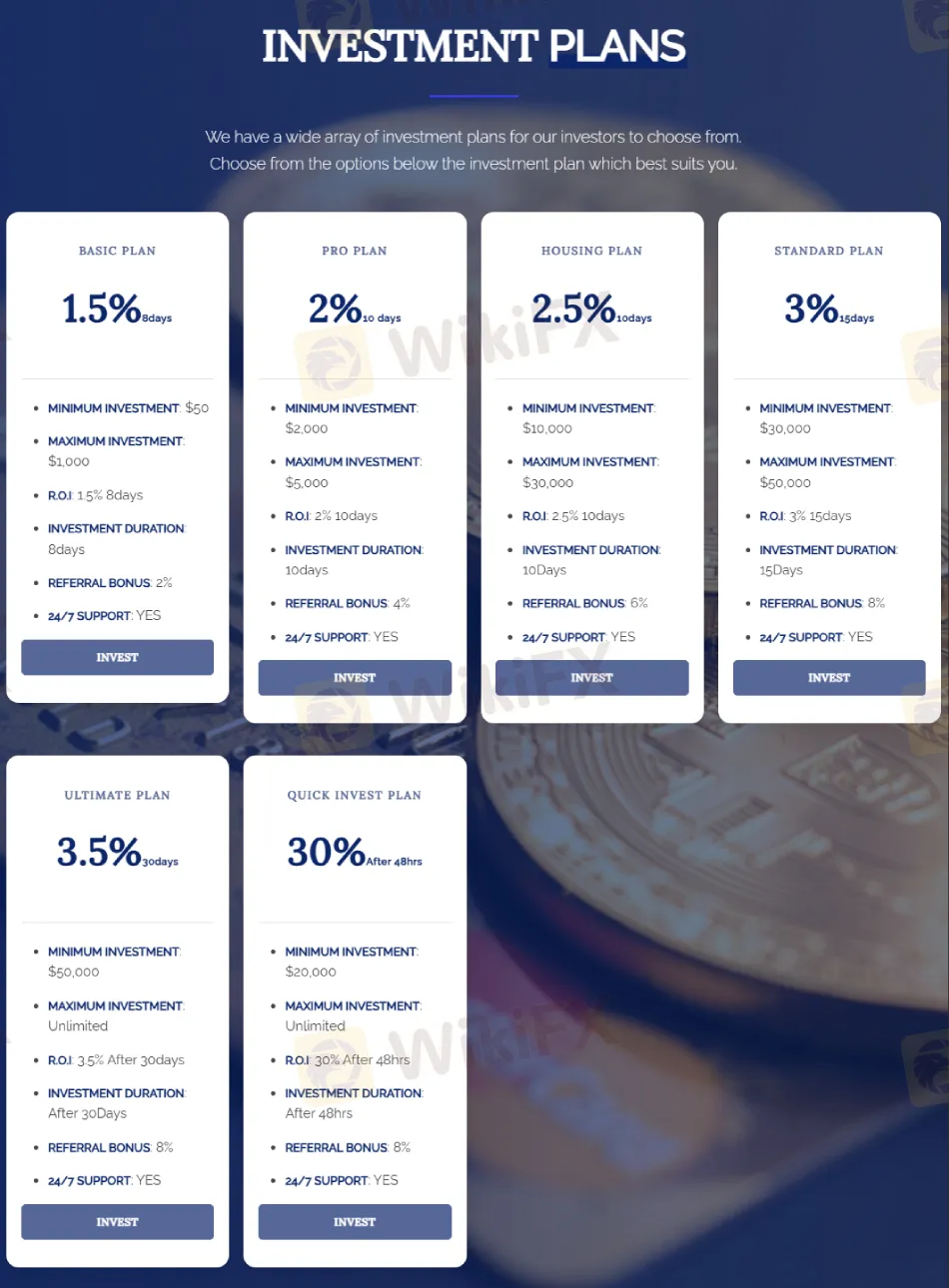

Zenswealth Broker Investment Plans

Zenswealth promotes a wide array of investment schemes with unusually high returns. These include short-term plans promising daily percentages and quick-invest options with extreme ROI claims.

Such aggressive ROI promises are red flags in the brokerage industry, often associated with high-risk or fraudulent schemes.

Zenswealth Trading Instruments

Zenswealth advertises access to multiple asset classes:

- Cryptocurrency

- Forex Trading

- Real Estate

- Stock Market

- Bonds

While this range appears diverse, the absence of regulatory oversight makes it impossible to verify execution quality, spreads, leverage, or platform reliability.

Zenswealth Broker Website and Security

The brokers website, zenswealth.org, is flagged as not secure. This compromises user data protection and raises questions about the legitimacy of its operations.

- Domain: zenswealth.org

- Security Status: Not secure (SSL absent)

- Customer Service Email: info@zenswealth.org

- Phone Contact: +44 7529456092

Pros and Cons of Zenswealth Broker

✅ Pros

- Multiple investment plans advertised

- Wide range of trading instruments listed

- 24/7 customer support claims

❌ Cons

- Unregulated broker flagged by FCA

- Website lacks security protocols

- Unrealistic ROI promises (up to 30% in 48 hours)

- No transparency on spreads, leverage, or fees

- High minimum deposits for advanced plans

Zenswealth Regulation vs Competitors

Compared to regulated brokers in the UK, Zenswealth falls short in every critical category:

- Competitor brokers typically disclose FCA license numbers, audited financials, and transparent fee structures.

- Zenswealth Broker provides none of these assurances, relying instead on aggressive marketing of high-yield investment plans.

This stark contrast underscores the importance of verifying broker regulation before committing funds.

Bottom Line: Zenswealth Review

The Zenswealth Review reveals a broker flagged by the FCA as unauthorised and unregulated. Despite offering multiple investment plans and trading instruments, the absence of valid regulation, insecure website infrastructure, and unrealistic ROI claims make Zenswealth a high-risk choice for investors.

Final Verdict: Traders should exercise extreme caution. The lack of Zenswealth Regulation and the FCAs explicit warning strongly suggest avoiding this broker.