SogoTrade Fined $75K Amid Compliance Failures

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:INZO is a foreign exchange (Forex) and Contracts for Difference (CFD) brokerage company that started working in 2021. The company is registered in Saint Vincent and the Grenadines and regulated offshore. It focuses on serving clients around the world by giving them access to popular trading platforms, especially MetaTrader 5 (MT5) and cTrader. The company offers different types of trading instruments, from currency pairs to cryptocurrencies. It aims to help both new and experienced traders. Read on to know more about it.

INZO is a foreign exchange (Forex) and Contracts for Difference (CFD) brokerage company that started working in 2021. The company is registered in Saint Vincent and the Grenadines and regulated offshore. It focuses on serving clients around the world by giving them access to popular trading platforms, especially MetaTrader 5 (MT5) and cTrader. The company offers different types of trading instruments, from currency pairs to cryptocurrencies. It aims to help both new and experienced traders.

This review gives you a detailed guide to INZO's services in 2025. We will look at the company's background, regulatory status, platform technology, account types, and fees. Most importantly, we will examine the large number of mixed user reviews, showing both what the broker claims and the serious complaints reported by traders. Our goal is to give you a balanced view so you can weigh the potential benefits against the considerable risks.

Understanding a broker's company structure and regulatory oversight is the first and most important step when researching any broker. This information shows how trustworthy a broker is and how safe your capital will be.

Here are the basic facts about INZO's company identity based on public records:

· Company Name: INZO L.L.C

· Operating Period: 2-5 years (Started in 2021)

· Official Address: Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St. Vincent and the Grenadines

Being registered in St. Vincent and the Grenadines (SVG) is common for many online brokers. However, it's important to know that the SVG Financial Services Authority does not regulate or license Forex brokerage activities.

INZO's regulatory status is an important consideration. The broker's related company, INZO GROUP LTD, is regulated by the Seychelles Financial Services Authority (FSA) under license number SD163. This makes INZO an “Offshore Regulated” broker.

While this provides some basic oversight, offshore regulation generally does not offer strong investor protection systems, such as compensation programs or requirements to keep client funds separate, which are required by top-level regulatory bodies in places like the UK, Australia, or the European Union. This status is marked as a “High potential risk” and is an important factor for any potential client to consider. Traders should understand that they have limited options if they have a dispute with an offshore-regulated company.

INZO provides access to a wide selection of CFD markets, allowing traders to trade various asset types from one account. The instruments offered include:

· Forex: Major, minor, and exotic currency pairs.

· Indexes: A selection of global stock market indices.

· Metals: Precious metals such as gold and silver.

· Energy: Commodities such as crude oil and natural gas.

· Stocks: CFDs on stocks of various international companies.

· Cryptocurrencies: A range of popular digital currencies.

The trading platform is a trader's main tool. INZO has chosen not to use the older inzo broker mt4 platform and instead provides two powerful, modern alternatives: MetaTrader 5 and cTrader.

INZO offers a “Full License” for MetaTrader 5, which is a good sign of stable and strong platform integration. MT5 is the multi-asset successor to the popular MT4 platform and is highly respected for its advanced features. It is especially well-suited for experienced traders who need sophisticated analysis tools.

Key features of the MT5 platform include:

· Advanced Charting: More timeframes and technical indicators than its predecessor.

· Multi-Asset Trading: Built-in support for trading stocks and commodities alongside Forex.

· Algorithmic Trading: Powerful MQL5 programming language for developing and testing Expert Advisors (EAs) and custom indicators.

· Market Depth: Level II pricing provides insight into market liquidity.

· Accessibility: Available as a downloadable desktop client for PC, a web-based terminal, and mobile apps for iOS and Android.

For traders who want a clean, modern user interface and advanced order execution features, INZO also provides cTrader. This platform is known for its easy-to-use design and is often preferred by traders looking for a premium trading environment. Its strengths include its visual appeal, sophisticated order types (such as time-of-day orders), and detailed trade analysis reporting. Like MT5, cTrader is available on desktop, web, and mobile devices, ensuring a smooth trading experience.

INZO offers a tiered account system designed to accommodate traders with different capital levels, risk appetites, and trading styles. With six different account types, the structure provides flexibility but also requires careful consideration to choose the most cost-effective option.

INZO provides a wide range of accounts tailored to different needs. For a complete and always-updated breakdown of these account specifications, you can view the detailed profile. Below is a summary of the account types and their key features.

| Account Type | Minimum Deposit | Maximum Leverage | Spread | Commission | Swap-Free Option |

| Standard | $100 | 1:500 | From 0.8 pips | None | Yes |

| Zero Standard | $50 | 1:500 | From 0.0 pips | From $0.08 | Yes |

| Crypto | $50 | 1:100 | Raw LP Spread | From $0.085 | Yes |

| Stocks | $500 | 1:20 | From 5.00 points | None | No |

| Zero | $5,000 | 1:200 | From 0.0 pips | $8 per lot | Yes |

| INZO Vip | $50,000 | 1:50 | From 0.0 pips | $4 per lot | No |

This structure shows a clear trade-off. The Standard and Stocks accounts work on a spread-only model with no separate commission, which can be simpler for beginners. On the other hand, the Zero, Zero Standard, and INZO Vip accounts offer raw spreads starting from 0.0 pips but charge a commission per trade. This model is often preferred by scalpers and high-frequency traders. The low entry points for the Zero Standard and Crypto accounts ($50) make the broker accessible, while the INZO Vip account is clearly designed for wealthy individuals.

A broker's reputation is ultimately defined by the experiences of its clients. In the case of INZO, the user feedback presents a sharply divided and concerning picture. While some users report positive experiences, there is a significant and growing number of serious complaints that cast doubt on the broker's operations.

On one side of the story, some users have praised INZO for several aspects of its service. Common themes in positive reviews include:

· Helpful Customer Support: Mentions of a responsive 24/6 live chat and a helpful support team.

· Beginner-Friendly Services: Praise for features like copy trading, which can be useful for new traders.

· Smooth Transactions: Some users report easy and smooth deposit and withdrawal processes.

· Professional Environment: Compliments on the availability of advanced platforms such as MT5 and cTrader.

It is important to add a disclaimer here: a large portion of this positive feedback is marked as “Unverified” on review platforms and often lacks specific details, consisting of general praise.

In contrast, there are numerous detailed, specific, and alarming “Exposure” reports from users. These complaints are not minor issues; they describe a pattern of alleged behavior that raises major red flags for any potential trader.

· Severe Withdrawal Issues: This is the most common and serious complaint. Multiple users report that their withdrawal requests are blocked. The alleged tactic involves the broker demanding repeated video selfies or live video conferences for verification, which are then systematically rejected without a clear reason, effectively holding funds captive.

· Manipulation of Trading Conditions: A disturbing number of reports allege a “bait-and-switch” practice. Users claim that after successfully depositing funds, the broker arbitrarily changes their account terms without notice. These changes include:

· Drastic Leverage Reduction: Leverage being advertised at 1:500 is allegedly cut to as low as 1:20 post-deposit, with the broker falsely citing new “regulatory requirements.”

· Spreads and Slippage: Reports of sudden, significant widening of spreads and increased slippage, making profitable trading nearly impossible.

· Available Pairs Reduced: One detailed account claims that after a deposit, the number of tradable pairs on their MT5 account was suddenly reduced from over 125 to just 35, severely limiting their trading strategy.

· Unauthorized Trade Closure: At least one trader has reported that INZO closed its open positions without any authorization or prior warning, again citing unexplained “new policy and rules.”

· Deceptive and Useless Support: In direct contradiction to positive reviews, users filing complaints describe the live chat support as “useless” and accuse the staff of repeatedly lying about the company's own terms and conditions to justify the manipulative changes.

These reports raise significant concerns about the broker's practices. Traders are strongly encouraged to review all recent user feedback and exposure reports for themselves to assess the current situation. For the most up-to-date collection of user experiences and regulatory information, we advise traders to check the detailed INZO profile on WikiFX.

The process of funding and withdrawing from a trading account is a practical concern for every trader. INZO offers a modern mix of payment methods, but, as highlighted above, the reality of withdrawals appears to be a major point of contention.

INZO supports a variety of deposit and withdrawal channels, catering to both traditional and crypto-native clients. The methods listed include:

· Credit/Debit Cards: VISA, MasterCard

· Cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Tether (USDT)

· E-wallets/Vouchers: Payeer, Voucherry

The broker does not publicly share specific details regarding processing times or potential fees associated with these methods, which is a lack of transparency.

To attract new clients, INZO offers several promotions. These include a $30 welcome bonus for new accounts and a 30% deposit bonus. While bonuses can be attractive, traders should always read the terms and conditions carefully. These promotions often come with strict volume requirements or other clauses that can complicate or prevent the withdrawal of funds until specific conditions are met.

This is where the broker's advertised services collide with the user-reported reality. While INZO lists multiple modern and convenient withdrawal methods, the large number of complaints centered on blocked funds cannot be ignored. The contrast is stark: a broker that accepts deposits via crypto and credit cards but is then alleged to create impossible verification hurdles when clients attempt to retrieve their money. This disconnect is perhaps the single most critical risk factor to consider.

After a comprehensive review of its services, regulatory status, and user feedback, the question remains: should you trade with INZO? We will not provide a simple “yes” or “no.” Instead, we will summarize the key arguments for and against, allowing you to make a well-informed decision based on your own risk tolerance.

On the surface, INZO presents an appealing package with several distinct advantages:

· Low Entry Point: With minimum deposits as low as $50, the broker is accessible to traders with limited capital.

· Modern Platforms: Offering both MT5 and cTrader provides access to top-tier trading technology.

· Variety of Assets: A good range of instruments across Forex, stocks, and crypto allows for portfolio diversification.

· Account Flexibility: Multiple account types, including swap-free options and copy trading, cater to different needs.

However, these advantages are heavily outweighed by a number of severe and well-documented risks:

· Offshore Regulation: The Seychelles FSA license provides only a minimal level of investor protection, leaving traders vulnerable in case of disputes.

· Severe User Complaints: There is a clear and consistent pattern of serious complaints. Allegations of withdrawal blocks and the manipulation of trading conditions are too numerous and specific to be dismissed.

· Discrepancy Between Claims and Reality: The most concerning aspect is the reported gap between the trading conditions advertised to attract deposits and the conditions allegedly imposed once funds are committed.

While INZO's marketing and on-paper offerings—low deposits, high leverage, and modern platforms—are designed to be attractive, they are overshadowed by the high level of risk highlighted by its offshore regulation and, more importantly, the troubling pattern of user-reported issues. The allegations of withdrawal obstruction and post-deposit manipulation of trading terms suggest a business practice that is fundamentally at odds with a fair and transparent trading environment.

The decision to trade with any broker ultimately rests with the individual. Given the conflicting information, we strongly advise traders to conduct thorough research. You can check the latest regulatory updates, company details, and verified user reviews for INZO on WikiFX to form a complete picture before committing any funds.

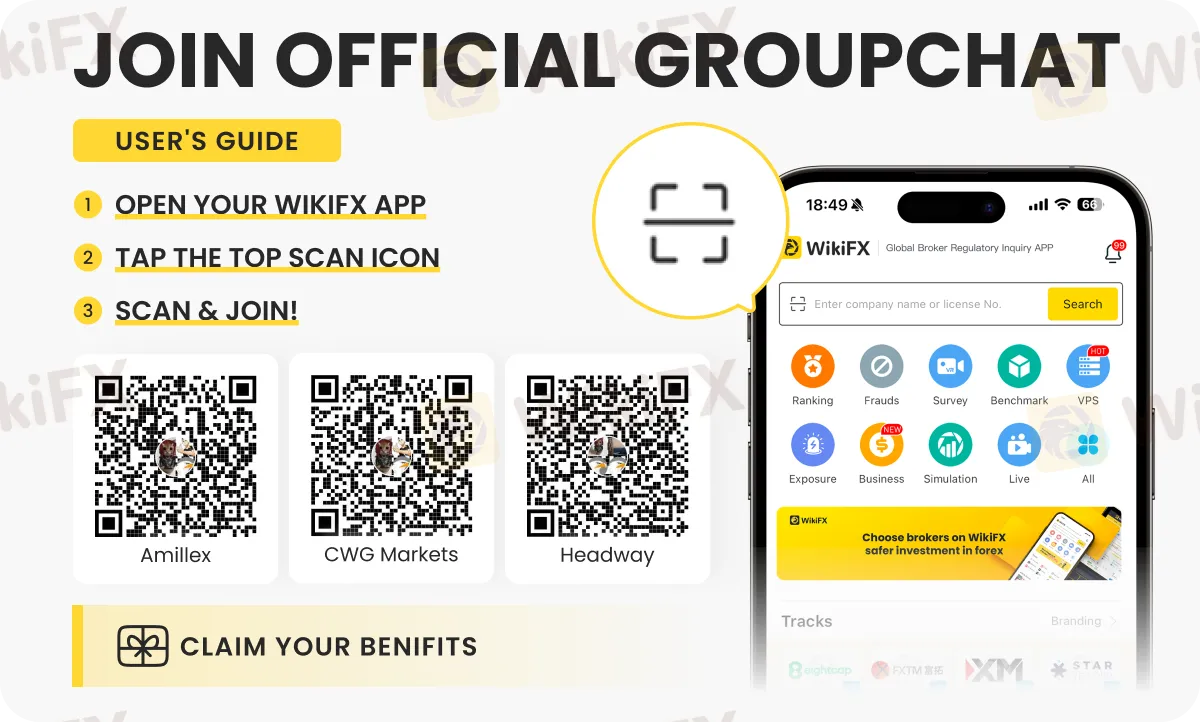

To know more about forex brokers and their product offerings, join any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions below.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

A WikiFX review of Zeven Global reveals the absence of regulatory licensing, a low safety rating, and potential risks to investor protection.

As the new year begins, WikiFX extends our sincere gratitude to traders worldwide, our industry partners, and all users who have consistently supported us.

Dear Forex Traders, When choosing a forex broker, have you ever faced these dilemmas? Dozens of broker advertisements, but unsure which one is truly reliable? Online reviews are either promotional content or outdated/incomplete? Want to learn about real users’ deposit/withdrawal experiences but can’t find firsthand accounts? Now, your experience can help thousands of traders and earn you generous rewards! The campaign is long-term and you can join anytime.