Top Forex Brokers Offering Free Demo Accounts

Access demo accounts from top forex brokers. Practice trading risk‑free and explore platforms before investing.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Financial scams have grown more deceptive across digital platforms. Learn to recognize key scam types, detect warning signs, and protect your money confidently.

Financial scams are deliberate acts of deceit designed to steal money, personal data, or both, often disguised as legitimate financial opportunities. With the expansion of digital platforms, scammers now exploit social media, email, and instant messaging to reach a global audience. They craft professional websites, impersonate licensed advisors, and manipulate trust using persuasive language, fake success stories, and emotional pressure.

Understanding exactly how these scams work is your best protection. The sections below detail the most common scam types, their inner workings, and the subtle warning signs professionals use to identify them early.

A financial scam involves any fraudulent scheme in which an individual or organization deceives others to secure money or confidential information. These scams often mimic legitimate financial services—using convincing visuals, technical jargon, and falsified documentation—to appear trustworthy.

They thrive on three psychological levers:

Scammers succeed when potential victims react emotionally rather than rationally. Public awareness shifts control back to the consumer by instilling cautious, informed decision-making. The more you recognize patterns of fraud, the less likely you are to fall victim to them—and the more capable you become of protecting others through shared knowledge.

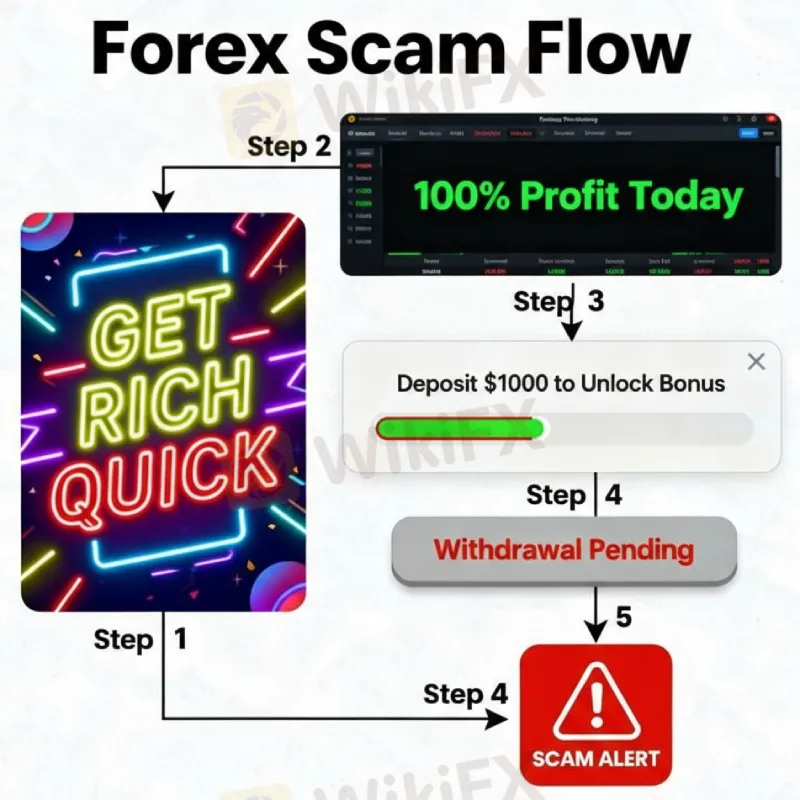

Foreign exchange markets are legitimate, but scammers exploit their technical nature to disguise false investment platforms. These operators often advertise “guaranteed daily profits” or use automated trading bots to feign legitimacy. Victims typically deposit money into controlled accounts, see simulated “profits” appear on dashboards, and are then asked to deposit even more. When withdrawal requests are made, access is suddenly restricted, or fees are demanded before funds can be released.

Common Tricks:

Warning Signs: Overly confident profit promises, cryptic contract terms, and vague contact details.

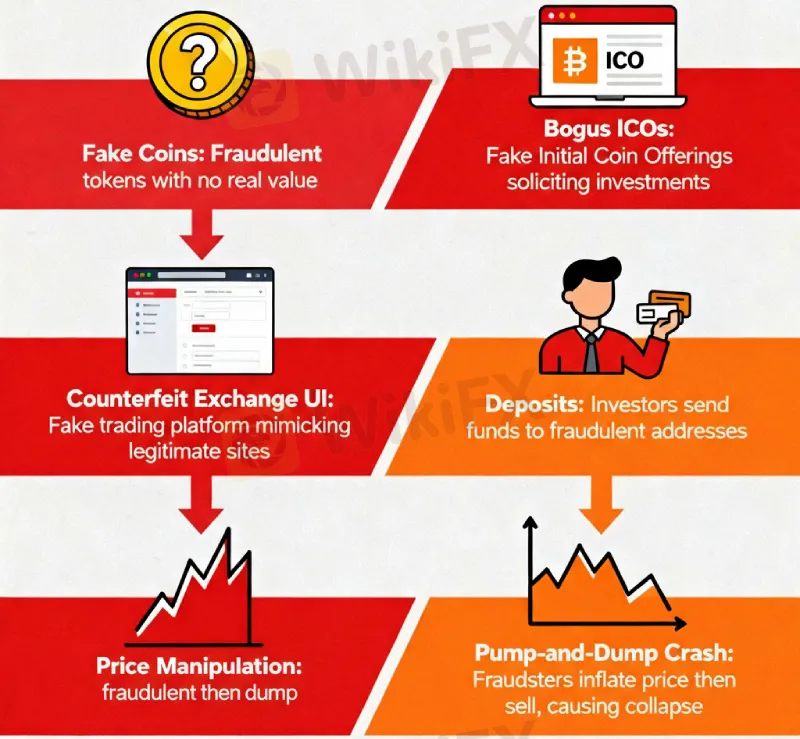

The digital asset boom has become fertile ground for innovative scams. Criminals create fake coins, bogus Initial Coin Offerings? (ICOs), or counterfeit crypto trading exchanges. Some even replicate the interface of real platforms, convincing users to deposit genuine funds. Others conduct “pump and dump” schemes, manipulating hype to raise a coins value before selling off their own holdings, leaving investors with worthless tokens.

Common Variants:

Warning Signs: Anonymous developers, grammatical errors in whitepapers, or unsolicited offers emphasizing exclusivity.

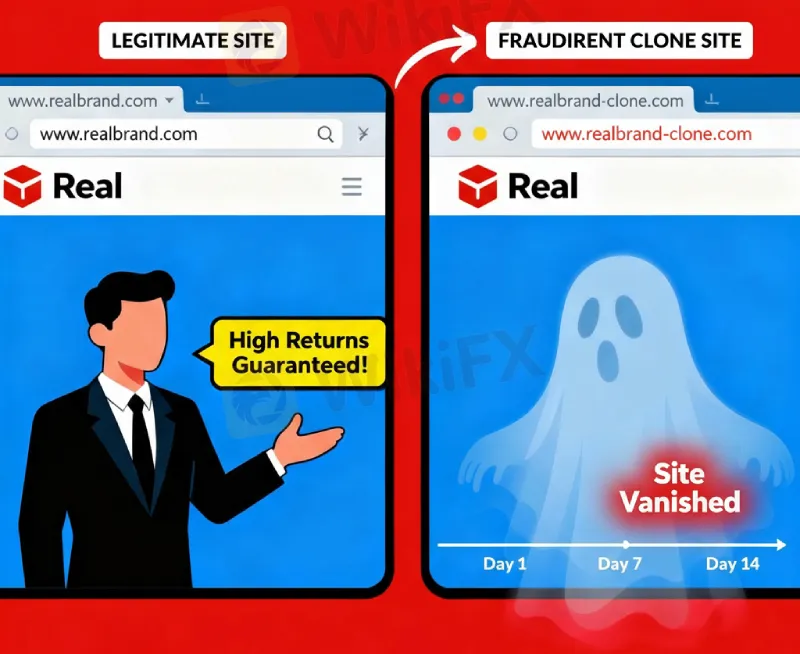

Clone scams impersonate real companies by duplicating their branding, website design, and registration details. The resemblance is often meticulous—logos, disclaimers, and even customer service chat interfaces look identical. The fraudster contacts investors pretending to be legitimate representatives, offering high-return packages or “private trading access.”

What exposes these scams are subtle inconsistencies: slightly altered email domains, missing terms of service links, and untraceable telephone numbers. In many cases, these impostor sites exist only for a few weeks before disappearing completely, leaving victims with empty accounts.

Warning Signs: Website URLs with minor spelling changes (for example, “.co” instead of “.com”), calls discouraging direct company contact, or representatives pushing confidential “executive access” offers.

These emotionally charged scams combine social engineering with financial deception. The con artist builds comfort and trust through dating apps or social platforms, often over weeks or months. Once emotional dependence is established, the scammer introduces an investment “opportunity” — commonly in crypto or foreign exchange — promising shared financial success. They may even allow small returns initially, reinforcing the illusion. Eventually, the victim is persuaded to invest more substantial amounts, after which all communication ceases.

Psychological Triggers: Flattery, empathy, and shared long-term visions. The fraudster operationalizes affection as financial leverage.

Warning Signs: Quick emotional attachment, reluctance to meet in person, and investment discussions framed as “our future together.”

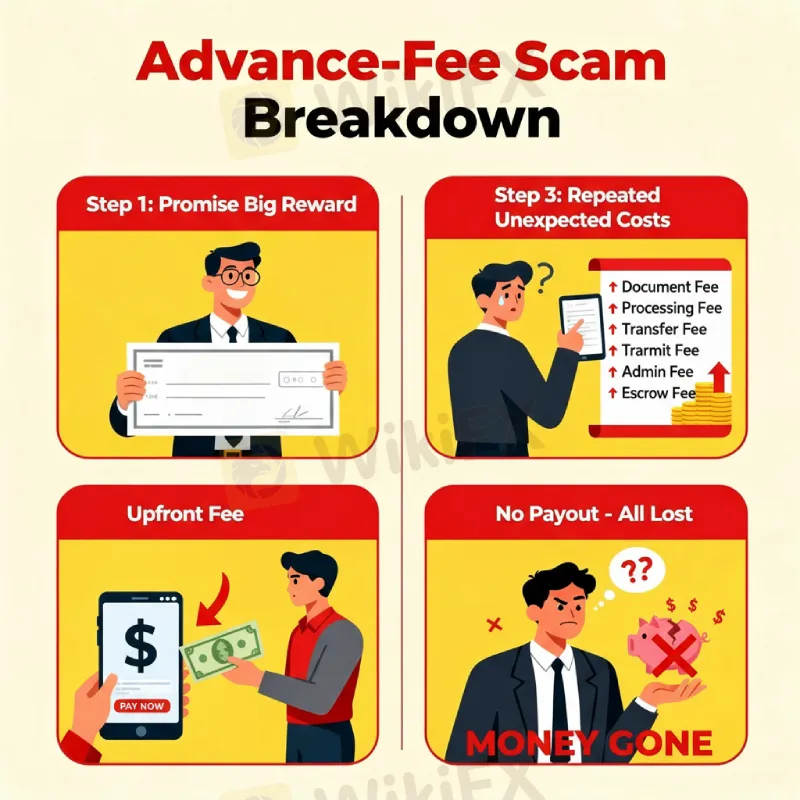

A classic scheme where fraudsters claim the victim is entitled to a substantial reward—an inheritance, contract payment, or lottery win—and must pay preliminary “processing” or “tax” fees first. These promises prey on greed and optimism. Once the fee is paid, further “unexpected costs” appear until the victim realizes the reward was fabricated.

Typical Formats:

Warning Signs: Pressure for confidentiality, poor grammar, vague sender identities, and unrealistic offers requiring prepayment.

Social media has become a fertile hunting ground for scammers posing as successful traders or financial coaches. They display images of luxury cars, screenshots of bank balances, and supposed testimonials to project instant credibility. Victims are persuaded to join private groups or “signal channels” on apps like WhatsApp or Telegram, where the scammer directs collective investments into untraceable accounts.

How They Operate: They use the illusion of community trust—people investing together—to normalize risk and silence skepticism. Many even fabricate conversations showing fake profits or withdrawals.

Warning Signs: Over-the-top lifestyle posts tied to “secret strategies,” membership fees for trading groups, or messages promising earnings without effort.

If you suspect a scam, collect evidence such as emails, chat logs, payment records, and account details. Report it to financial watchdogs, law enforcement, or verified consumer protection agencies. Prompt reporting increases the likelihood of tracing stolen funds and protecting others from similar traps.

Financial scams are not only economic crimes—they are psychological manipulations that exploit human behavior. Every scheme depends on convincing victims to believe. The simplest defense is vigilance: question every claim, verify every source, and trust your own skepticism. True investments withstand research and patience; scams demand secrecy and speed.

When you remain informed, every scam you recognize is one you refuse to fund—and that awareness keeps the financial world safer for everyone.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Access demo accounts from top forex brokers. Practice trading risk‑free and explore platforms before investing.

Top 10 Largest UK Market Makers: J.P. Morgan, Barclays, BNP Paribas, NatWest Markets, HSBC, Nomura, RBC, Lloyds, Winterflood, and UBS lead FCA/LSE rankings by volume and liquidity. Updated 2026 list.

UK forex starts Sun 22:00 GMT, London session 08:00-16:00 GMT. Ultimate guide to 2026 hours, peak liquidity times, GMT/BST shifts for max profits.

Sundramoorthy said investment scams continued to ensnare victims from all walks of life, including highly educated professionals accustomed to analytical and evidence-based thinking