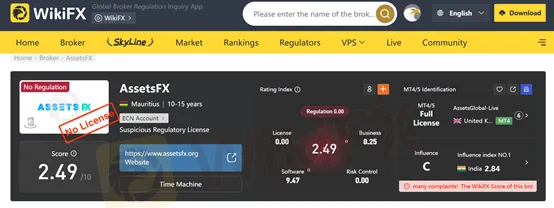

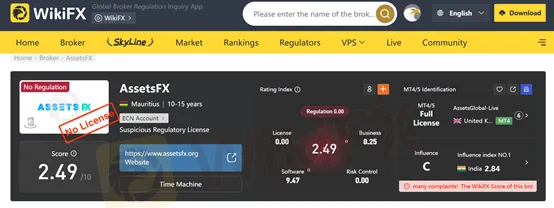

Abstract:Founded in 2013 and headquartered in Mauritius, AssetsFX presents itself as an online broker offering forex and CFD trading services to global clients. The broker provides access to a variety of financial instruments, including forex pairs, commodities, indices, cryptocurrencies, and stocks. While AssetsFX markets itself as a versatile and technology-driven broker, recent complaints and a low WikiFX score of 2.49/10 raise questions about its reliability and trustworthiness.

Founded in 2013 and headquartered in Mauritius, AssetsFX presents itself as an online broker offering forex and CFD trading services to global clients. The broker provides access to a variety of financial instruments, including forex pairs, commodities, indices, cryptocurrencies, and stocks. While AssetsFX markets itself as a versatile and technology-driven broker, recent complaints and a low WikiFX score of 2.49/10 raise questions about its reliability and trustworthiness.

Trading Instruments and Platforms

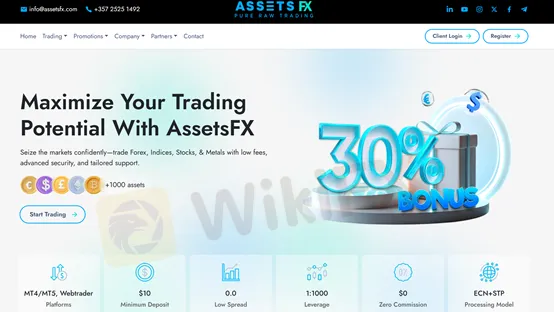

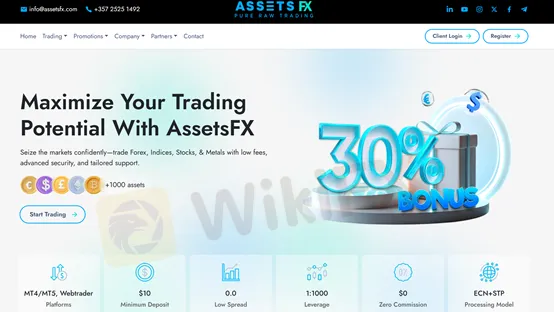

AssetsFX gives traders exposure to multiple global markets through a range of tradable instruments:

- Forex pairs – Major, minor, and exotic currency pairs

- Commodities – Including gold, silver, and oil

- Indices – Global market indices such as the S&P 500 and NASDAQ

- Cryptocurrencies – Bitcoin, Ethereum, and other digital assets

- Stocks – Access to leading shares from global markets

To support trading across these instruments, AssetsFX provides both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are compatible with Windows, macOS, Android, iOS, and web browsers, ensuring that traders can access their accounts and execute trades anytime and anywhere.

Account Types and Trading Conditions

AssetsFX aims to appeal to both beginner and professional traders with a range of account types—each designed to suit different trading styles and budgets:

This tiered structure allows traders to choose an account that best matches their risk appetite and capital availability. The CENT and STANDARD accounts are suitable for newcomers due to their low entry requirements and commission-free trading, while the ECN and ECN PRO accounts are better suited for experienced traders seeking tighter spreads and faster executions.

The ZERO ECN account, although requiring a higher deposit, offers zero commissions and reduced leverage of 1:200, designed for traders prioritizing stability and lower exposure.

Leverage and Costs

AssetsFX offers high leverage up to 1:500 on most account types, enabling traders to amplify their trading positions. However, while this can magnify profits, it also significantly increases risk—especially for inexperienced traders.

Spreads vary depending on the account type, with the lowest spreads (0.0 pips) available on ECN-based accounts. Commissions are competitively priced, ranging from $2 to $3 per lot, depending on the account tier.

Is AssetsFX Legit?

Despite offering competitive trading conditions and advanced platforms, AssetsFXs regulatory transparency remains questionable. The broker is registered in Mauritius, but it is not clearly stated whether it holds a valid license from the Financial Services Commission (FSC) of Mauritius or any other recognized financial authority.

WikiFX, a global forex broker review platform, has given AssetsFX a low score of 2.49/10, citing potential red flags. Recently, WikiFX has also received several user complaints against the broker, mainly related to withdrawal delays and unresponsive customer service. Such feedback suggests possible operational and transparency issues that prospective traders should take seriously.

Customer Feedback and Red Flags

While AssetsFX promotes itself as a client-focused broker, recent reports indicate growing dissatisfaction among traders. Some users have claimed issues with fund withdrawals and limited customer support responsiveness, both of which are serious concerns when evaluating a brokers credibility.

A low rating combined with unresolved complaints highlights the importance of verifying a brokers regulatory status before depositing any funds.

Conclusion

AssetsFX offers a wide range of account types, competitive spreads, and access to MT4/MT5 platforms, appealing to traders with different experience levels. However, the lack of regulatory clarity, recent customer complaints, and a low WikiFX score paint a concerning picture.

Traders are strongly advised to exercise caution and verify all licensing information before opening an account with AssetsFX. Choosing a fully regulated forex broker can provide greater security, transparency, and peace of mind in todays volatile trading environment.