Abstract:Big Boss Financial is an unregulated forex/CFD broker with high leverage and no recognized license, posing elevated counterparty and conduct risks.

Overview

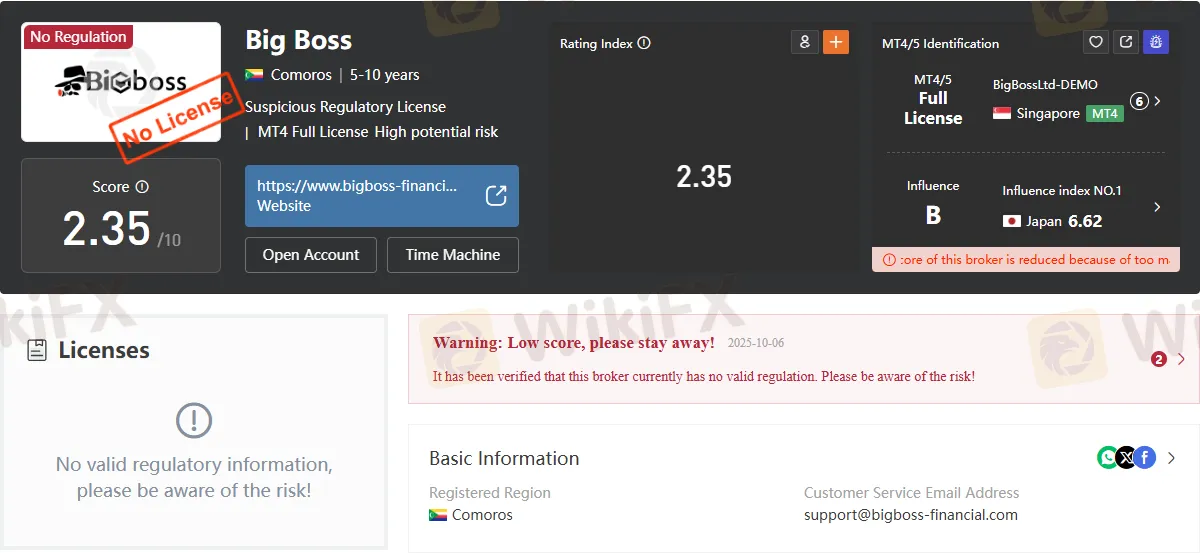

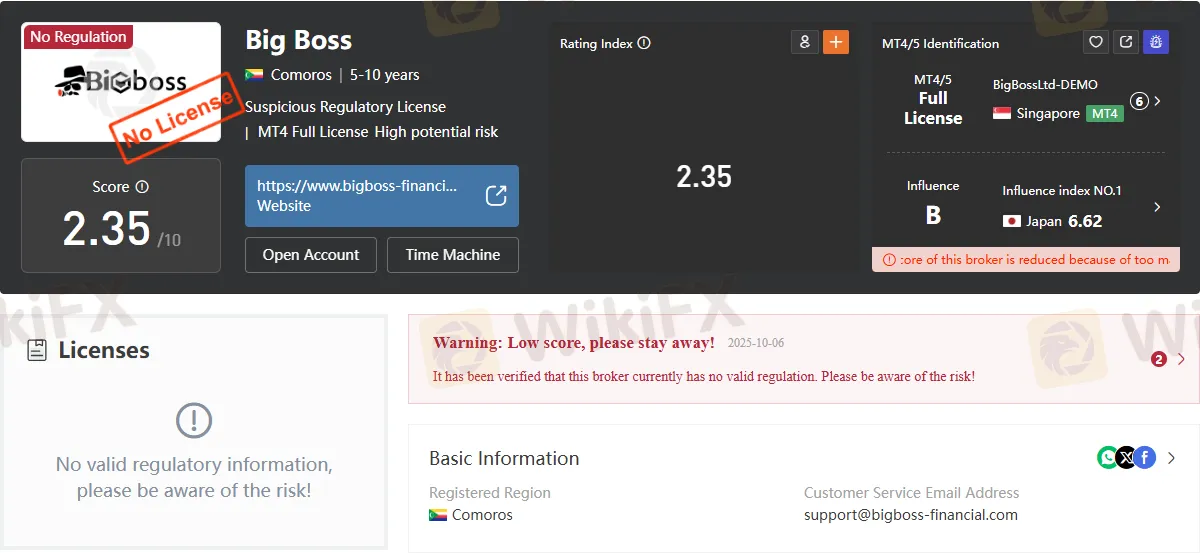

Big Boss Financial Regulation Status refers to the firm‘s lack of recognized regulatory authorization; the broker presently operates without a valid license from a reputable national regulator, which materially increases counterparty and conduct risks for clients compared with regulated peers. The firm’s public profile indicates registration history in Saint Vincent and the Grenadines and a listed address in Comoros, but available compliance checks and ratings services flag the broker as having no valid regulation at this time, urging caution to prospective users. While the brand markets forex, CFDs, and crypto instruments with high advertised leverage and familiar trading platforms, the absence of effective supervision means investor protections such as segregated client money rules, complaints redress, and prudential controls may be limited or unavailable.

What “Unregulated” Means

In retail brokerage, “unregulated” indicates the entity lacks an active license from a credible authority such as the FCA, ASIC, CySEC, MAS, JFSA, or NFA/CFTC, and therefore is not bound to those regimes‘ capital, conduct, safeguarding, reporting, and dispute-resolution standards. The attached dossier explicitly lists “No regulation,” a low risk score, and a warning to stay away, underscoring the gap between the broker’s marketing and its compliance standing in mainstream jurisdictions. For clients, this translates into weaker enforceable protections if operational failures occur (for example, order execution anomalies, withdrawal delays, or platform outages) because oversight, audits, and compensation schemes typical of regulated markets are not present.

Corporate Background and Footprint

According to the provided material, Big Boss began operations in 2013 with an initial registration in Saint Vincent and the Grenadines, later reflecting a registered address in Mohéli, Comoros, a jurisdiction that does not impose EU-, UK-, US-, or AU-style investor protection frameworks for retail derivatives. The firm promotes availability across regions with a marketing footprint in Asia and beyond, but the compliance summary states plainly that it is “not subject to any supervision,” aligning with third-party warnings about the absence of a valid license. Contact points include a support email and a Philippine telephone line, with social presence on major platforms, yet none of these substitute for an enforceable regulatory authorization that would safeguard client positions and funds under a recognized scheme.

Trading Offer and Risk Profile

The broker advertises forex, CFD, and cryptocurrency trading with leverage reportedly up to 1:2222, spreads from 1.1 pips on EUR/USD, and platform access via MT4, MT5, and a proprietary mobile app called QuickOrder, which together create a marketable proposition for high-leverage traders seeking familiar terminals. The materials indicate no demo account, handling fees on withdrawals, and mixed instrument availability, with crypto CFDs marketed as tradable 24/7 with up to 50x leverage, all of which heighten risk when combined with an absence of robust supervision and recourse. A low third‑party score and explicit warnings about the lack of valid regulation emphasize elevated operational and counterparty risks despite the breadth of instruments and the well-known platforms.

User Experiences and Operational Concerns

The attached report includes a user complaint describing failed settlement on an app order and subsequent threatening communications after a chargeback—an anecdote that cannot, on its own, establish systemic misconduct, but illustrates the kinds of disputes that can arise in lightly supervised or unsupervised environments. The same page references a “suspicious regulatory license” flag and reiterates that “no valid regulatory information” is available, reinforcing the pattern of cautionary indicators for prospective account holders. While single-case exposures are not definitive, combined with an unregulated status and high leverage promotion, they point to a risk posture that deserves rigorous due diligence before any funds are committed.

Implications for Client Protection

Without the protections of a recognized regulator, vital safeguards—segregation of client funds, negative balance protections, fair‑dealing codes, compensation schemes, and independent dispute resolution—may be limited or absent, and enforcement pathways are often unclear across offshore jurisdictions. Moreover, high leverage magnifies market risk and can compound losses rapidly, and without mandated risk management controls, retail clients face greater exposure than under regimes that cap leverage and enforce strict margin and disclosure standards. Platform familiarity (MT4/MT5) does not mitigate firm-level counterparty risk; the decisive factor remains whether the entity itself is authorized, supervised, and independently audited to recognized benchmarks.

How to Verify Regulation

A practical verification approach begins by identifying the exact legal entity name and registration number used in client agreements, then checking it against online registers of major regulators—if absent, the firm is not licensed in that jurisdiction. The attached materials already compile a negative finding—“No regulation,” “No valid regulatory information,” and a “Low score, please stay away!” risk banner—so further independent cross‑checks would likely confirm the absence of recognized licensure. Any claimed offshore authorization should be treated critically, as some registries do not supervise retail derivatives conduct or client money rules, and third‑party ratings flag “suspicious license” issues in this case.

Practical Due Diligence Steps

Prospective clients considering any unregulated brokerage should adopt strict precautions: start with zero or de minimis funding to test withdrawals, insist on full legal-entity documentation, and avoid credit‑card deposits that can be complicated by chargeback disputes and potential aggressive collection tactics. Monitoring execution quality, slippage, swap debits/credits, and reconciliation of statements over time is essential, as the attached materials highlight operational complaints around order settlement and post‑dispute interactions. If red flags emerge—withdrawal delays, unexplained fees, pressure to increase deposits—ceasing activity and pursuing formal recovery mechanisms via card issuers or banks is prudent, particularly in the absence of a recognized regulators complaint pathway.

Bottom Line

Big Boss Financial currently operates without a recognized regulatory license and is flagged by third‑party checks as unregulated, carrying a low safety score and explicit warnings, despite offering popular platforms and high-leverage marketing. In practice, this means materially higher counterparty and operational risks relative to regulated alternatives, with thinner avenues for recourse if things go wrong, which warrants a conservative approach or avoidance for those prioritizing investor protections.