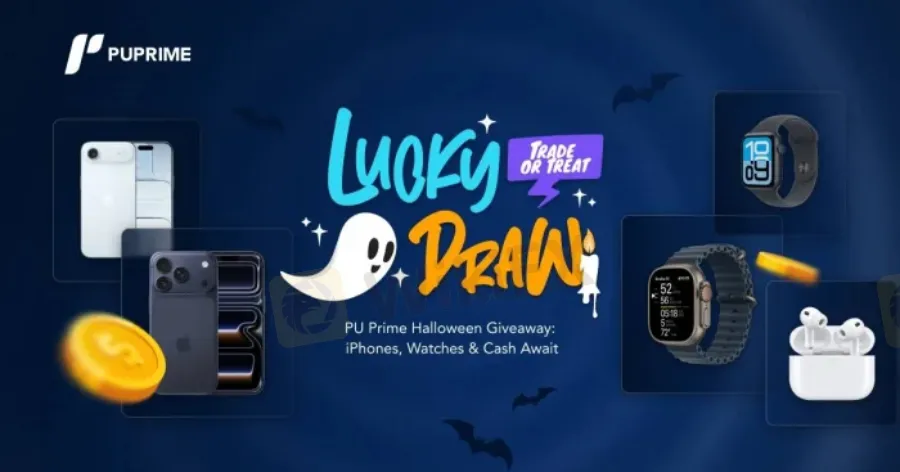

Abstract:PU Prime launches its Halloween Lucky Draw 2025, offering iPhone 17 prizes and weekly cash rewards for traders from 1–31 October.

PU Prime Unveils Halloween Lucky Draw Promotion

PU Prime has announced its Halloween Lucky Draw Promotion, running from 1–31 October 2025, giving traders the chance to win flagship Apple devices and weekly cash rewards. The campaign ties festive excitement to trading activity, with eligibility based on deposits and trading volume.

Grand Prizes: iPhone 17 Series & Apple Watch

At the close of the promotion, PU Prime will award premium Apple products to eight winners:

- 1st Prize: iPhone 17 Pro Max (256GB)

- 2nd Prize: iPhone 17 Pro (256GB)

- 3rd Prize: iPhone 17 Air (256GB)

- 4th Prize: iPhone 17 (256GB)

- 5th–7th Prizes: Apple Watch Ultra 3, Series 11, and SE 3

- 8th Prize: AirPods Pro 3

Winners will be officially announced on 7 November 2025, with notifications sent by 3 November and deliveries completed by 30 November.

Weekly Cash Rewards Throughout October

In addition to the grand prizes, PU Prime will distribute $600 in weekly rewards, with three winners each Friday receiving $50 USD. Draw dates are set for 10, 17, 24, and 31 October.

How to Enter the Lucky Draw

Participation is open to both new and existing clients with Standard or Islamic Standard accounts. The steps are straightforward:

- Deposit & Trade – Fund an account with at least $500 USD.

- Earn Tickets – Every 100,000 notional volume traded equals one lucky draw ticket.

- Win Prizes – Tickets qualify for both weekly cash draws and the grand prize announcement.

Copy Trading accounts are not eligible.

PU Primes Commitment to Traders

A PU Prime spokesperson emphasized the campaigns global reach:

“We are excited to share the Halloween spirit with our community. This promotion not only offers exciting rewards but also reflects our commitment to delivering engaging, international campaigns.”

Founded in 2015, PU Prime has grown into a leading fintech provider, offering regulated trading services across forex, commodities, indices, and shares in more than 190 countries.