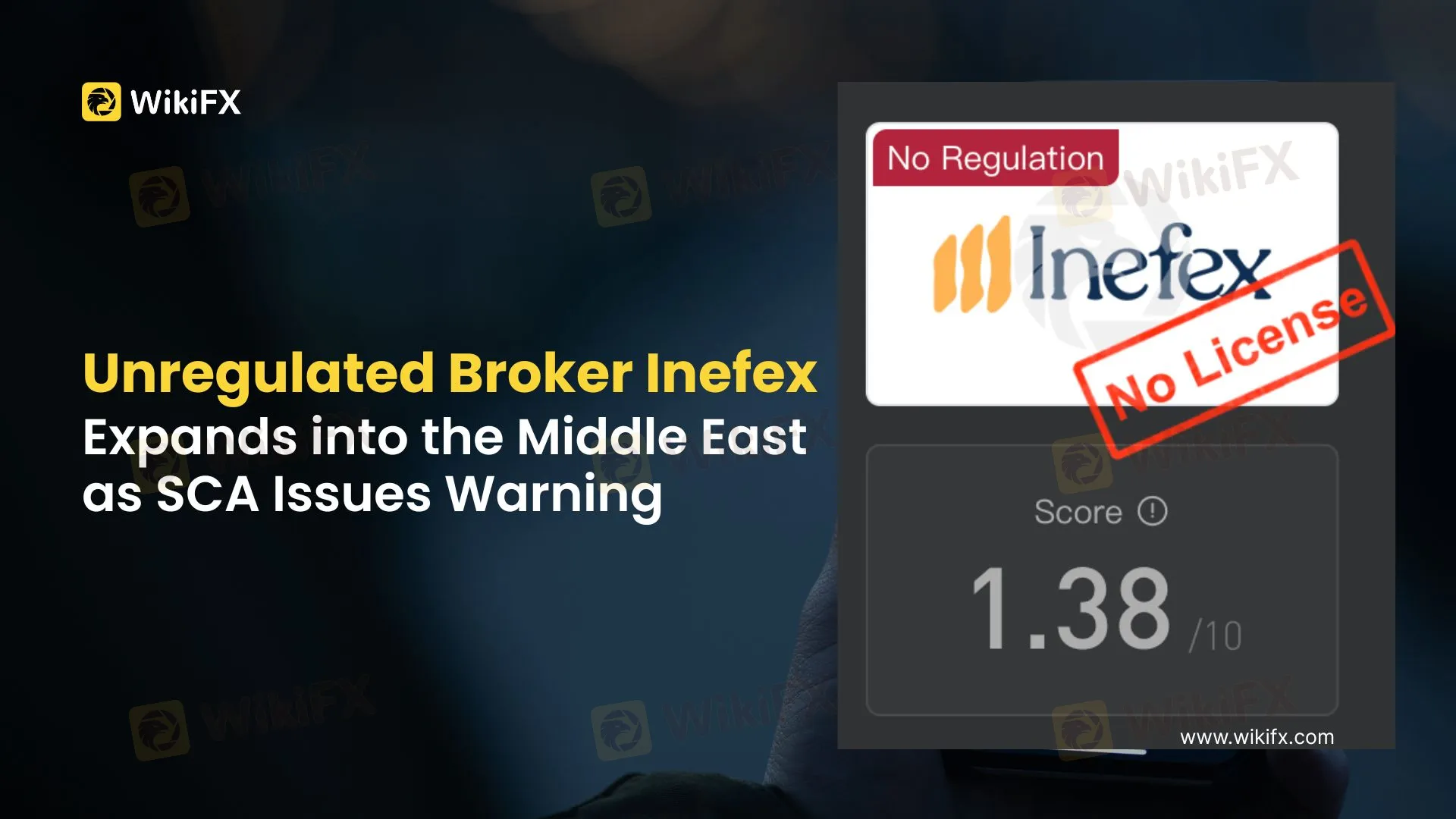

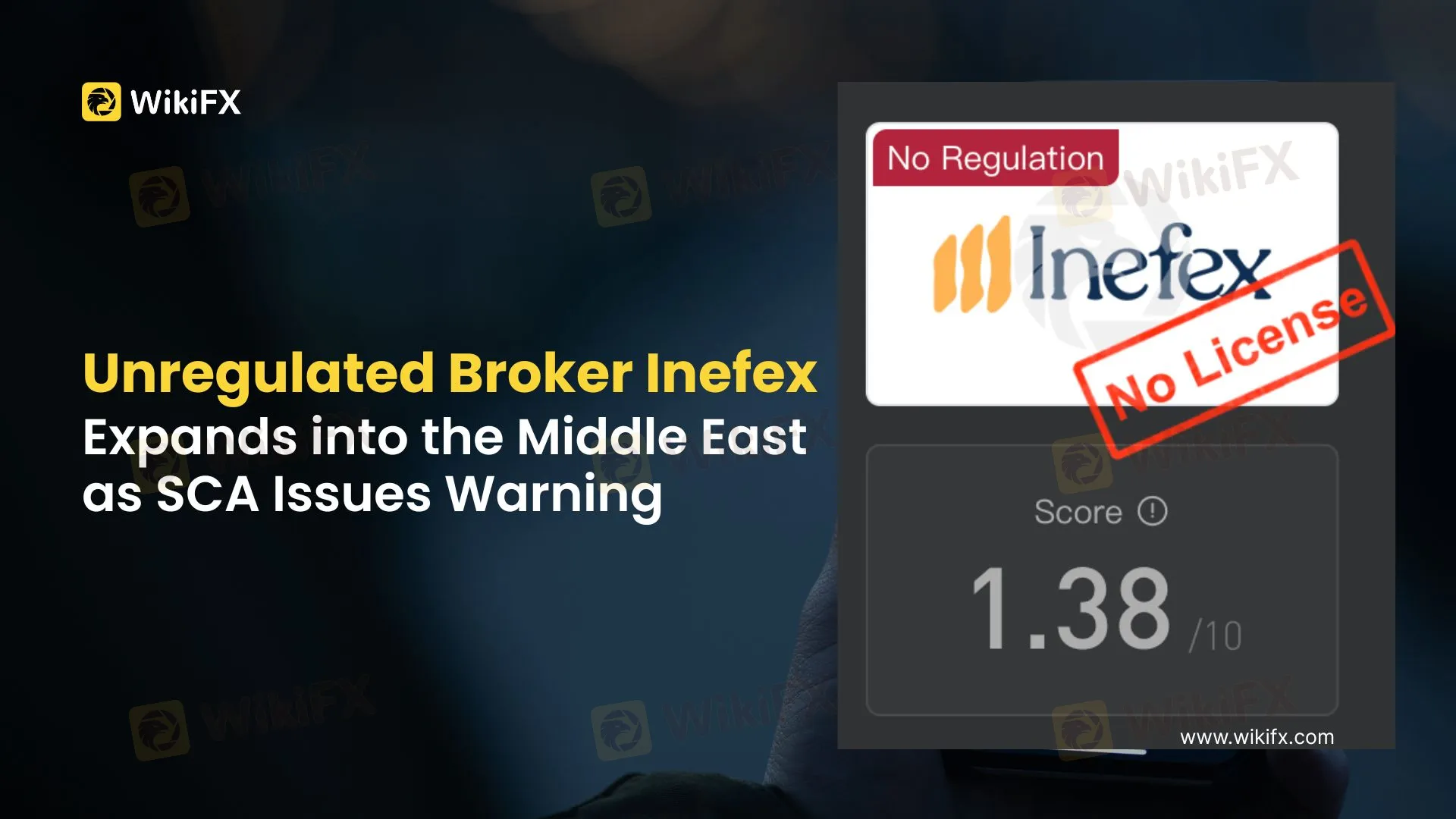

Abstract:The UAE’s Securities and Commodities Authority (SCA) has issued a warning against Inefex, an unregulated CFD broker linked to low ratings and multiple complaints on WikiFX.

The Securities and Commodities Authority (SCA) of the United Arab Emirates has issued a public warning against Inefex. As the national regulator, the SCA stressed that certain companies have been promoting financial services without obtaining the necessary license, authorization, or approval. According to the notice, Inefex is not authorized to conduct regulated financial activities in the UAE, and investors are urged to avoid dealing with the company.

In its statement, the SCA emphasized that it takes no responsibility for any transactions involving the broker. Instead, it advised investors to carefully verify the legitimacy of entities before entering into agreements or transferring funds, in order to avoid potential fraud.

Inefex: A CFD Broker Without Regulation

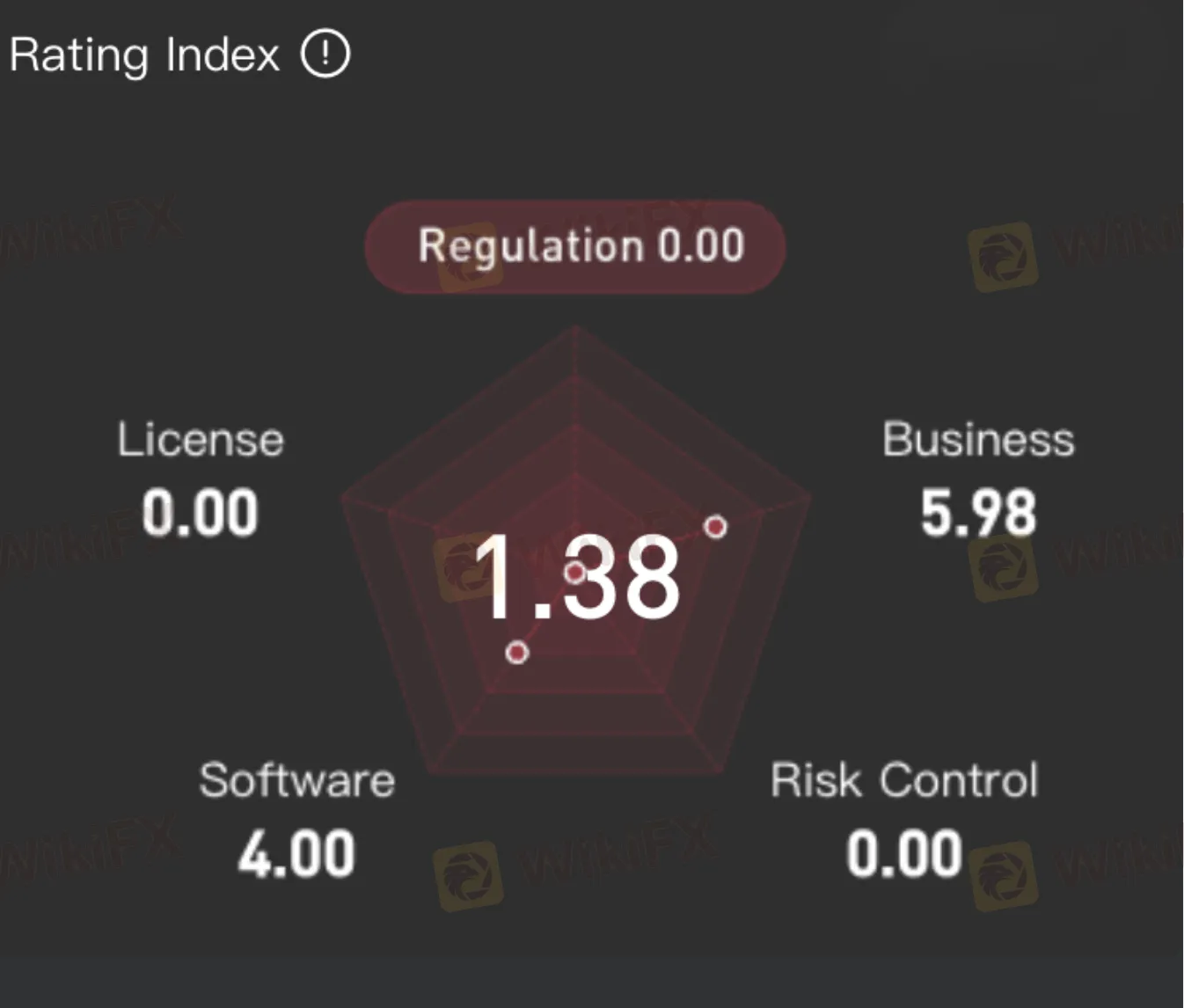

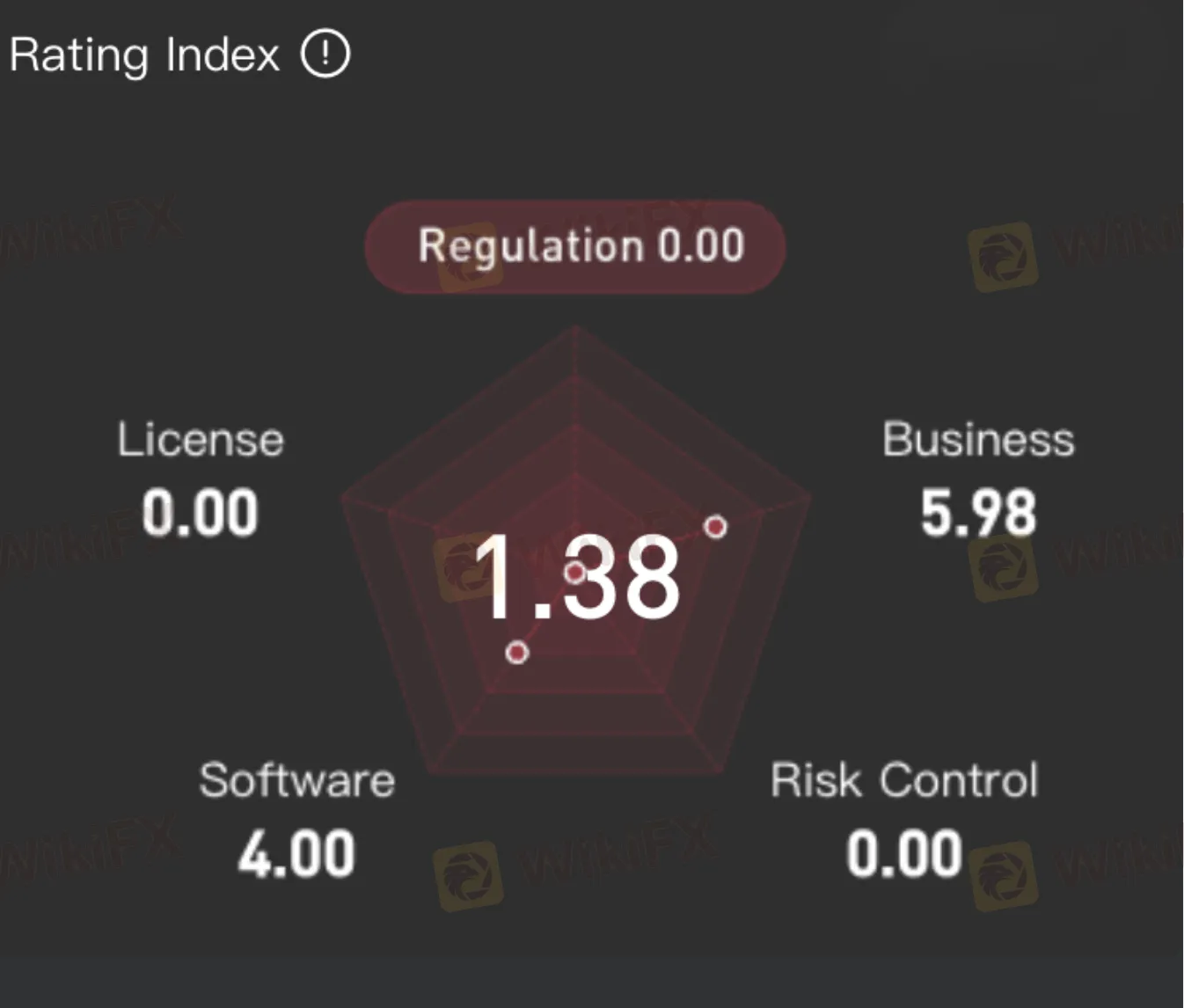

Inefex presents itself as an online broker offering contracts for difference (CFDs) across forex, stocks, cryptocurrencies, commodities, and indices. Despite these claims, WikiFX data shows that Inefex has an extremely low score of just 1.38/10 and holds no valid regulatory license. This absence of oversight leaves traders highly vulnerable, with no assurance of fund security or dispute resolution.

Complaints Mount Across Multiple Regions

Investor complaints about Inefex have been reported from several countries, highlighting a recurring pattern:

- Clients being unable to withdraw funds.

- Aggressive tactics by so-called “advisors” pressuring users to deposit more.

- False promises of guaranteed profits that later resulted in significant losses.

Exposures from Pakistan, Malaysia, Taiwan, Brazil, and Peru all reflect similar experiences, painting a picture of a broker with systemic issues and high risk.

For more details, please visit: https://www.wikifx.com/en/dealer/1891382209.html

WikiFX Early Warnings

WikiFX had already flagged concerns about Inefex well before the latest SCA notice. Past coverage includes:

- Inefex: Mastering the Art of Duping Forex Investors

- Inefex Review: Unregulated Broker with Risky Withdrawal Issues

- Something You Need to Know About Inefex

These records show that Inefex has long been associated with unregulated operations and investor complaints, confirming its status as a high-risk platform.

Conclusion

The SCAs latest intervention is a clear signal to Middle Eastern investors: Inefex is not licensed or regulated, and engaging with the platform carries significant danger. With a poor track record, mounting complaints, and no regulatory protection, traders should exercise extreme caution and prioritize regulated brokers to safeguard their capital.