简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MultiBank Group’s Bold Expansion in the Middle East Raises Compliance Questions

Abstract:MultiBank Group’s expansion in the Middle East comes amid frequent regulatory warnings and user complaints, raising concerns over the safety of client funds.

MultiBank Group has recently made a series of high-profile moves in the Middle East. Yet on WikiFX, a surge of investor complaints has raised red flags. Based on these reports, we conducted further research to explore one pressing question: is MultiBank Group truly establishing roots in the region, or is it leveraging a compliance façade to conceal other intentions?

High-Profile Expansion

Over the past few years, MultiBank Group‘s presence in the Middle East has become increasingly visible. In the summer of 2025, the company announced the opening of a new office in Abu Dhabi, declaring its intent to better serve both retail and institutional clients. Just months earlier, its subsidiary launched CFD products linked to the Abu Dhabi Securities Exchange (ADX) and the Dubai Financial Market (DFM), integrated into its MultiBank Plus App and the MT5 platform, which it promoted as offering “direct access to global markets.” Industry media widely covered these announcements, highlighting the company’s ambition for a stronger regional presence.

However, behind the media coverage, a different narrative emerged. An increasing number of investors reported difficulties with MultiBank platforms, particularly withdrawal failures, website outages, and being encouraged into high-risk accounts that led to significant losses. The sharp contrast between the official marketing and actual user experiences has drawn widespread attention.

Historical Context

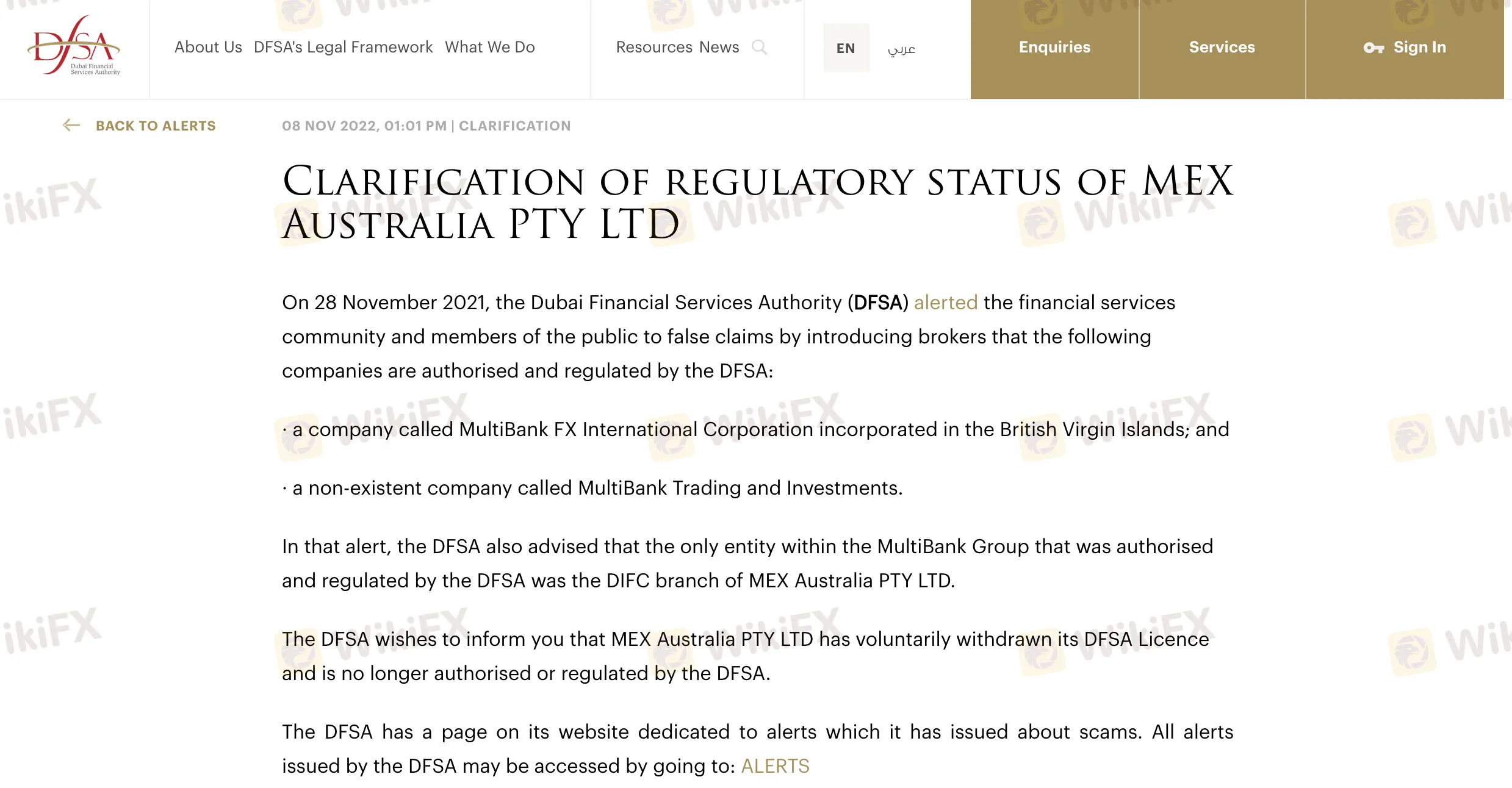

MultiBank Group initially entered the Middle East through MEX Australia Pty Ltds DIFC Branch, which operated under the Dubai Financial Services Authority (DFSA). This represented an important step in its early regional compliance strategy. According to DFSA records, this license was voluntarily withdrawn in 2021, and the branch ceased to be under DFSA oversight. Following this, MultiBank shifted its focus to the UAE mainland by establishing MEX Global Financial Services LLC, which obtained authorization from the Securities and Commodities Authority (SCA). This transition marked a move away from the stricter DFSA framework toward a regulatory structure more accommodating of retail forex and CFD operations.

Regulatory Maze

Understanding MultiBank Group‘s strategy requires a closer look at the UAE’s unique regulatory structure, which consists of three parallel systems:

- SCA (Securities and Commodities Authority): Regulates the UAEs mainland markets, covering securities, commodities, retail forex, and CFDs.

- DFSA (Dubai Financial Services Authority): Oversees only the Dubai International Financial Centre (DIFC), with a framework closer to the UKs FCA and tight restrictions on retail leverage and high-risk products.

- FSRA (Financial Services Regulatory Authority): Governs the Abu Dhabi Global Market (ADGM), with an independent framework similar to DFSA.

Within this system, MultiBanks relationship with DFSA has drawn particular attention. According to a DFSA clarification notice, its DIFC branch, MEX Australia Pty Ltd, had once been licensed but later withdrew the authorization. DFSA explicitly emphasized that other group entities, including the British Virgin Islands-registered MultiBank FX International Corporation, were never under its jurisdiction. To prevent investor confusion, DFSA fined the marketing firm Vedas International Marketing USD 100,000 for promotional materials that wrongly implied DFSA oversight.

This was not an isolated case. In Europe, Italy‘s CONSOB blacklisted multibankfx.com and its login portal my.multibankfx.com, blocking access to local users for offering financial services without authorization. Spain’s CNMV also issued warnings against MultiBanks brand, citing the lack of regulatory approval. Across these jurisdictions, official documents repeatedly noted inconsistencies between promotional claims and the actual licensed entity.

Complaints Resurface

Alongside these regulatory developments, WikiFX has logged a wave of complaints against MultiBank Group from across the globe. The issues most frequently cited include inability to withdraw funds, inaccessible websites, and unresponsive support channels.

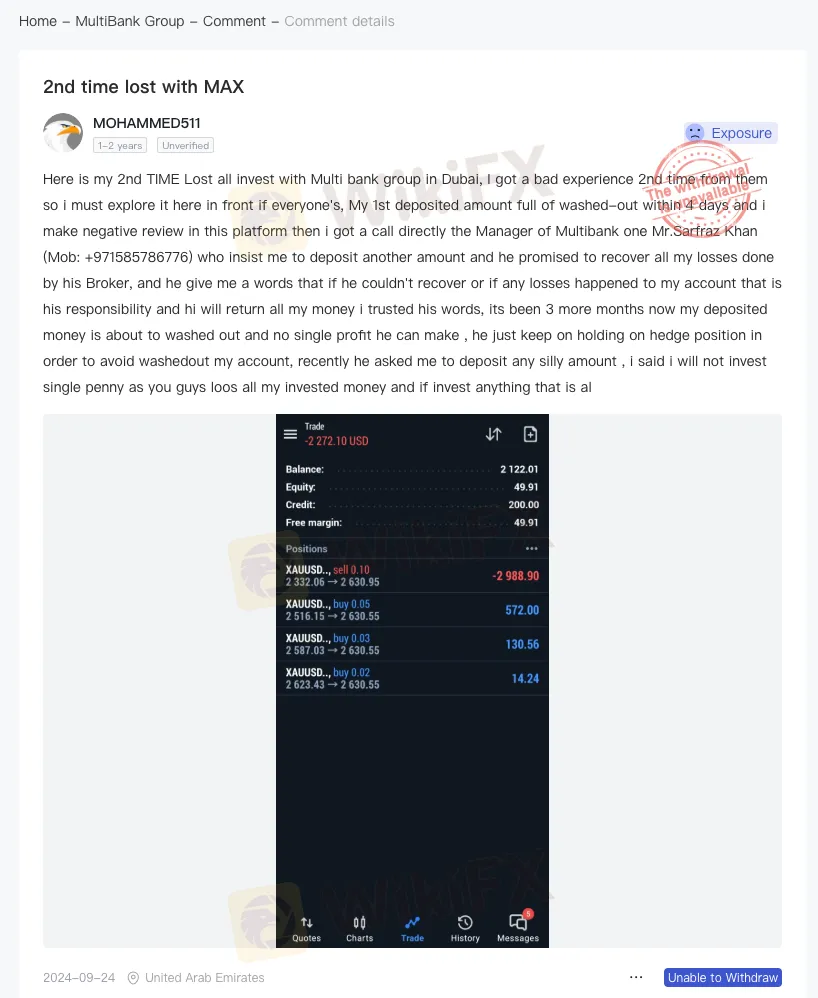

For example, one investor from the UAE reported depositing funds through MultiBank Group, only to face continuous losses and additional pressure to inject more capital. Despite complying, the investor ultimately found withdrawals blocked. Such cases appear repeatedly on WikiFXs complaint section.

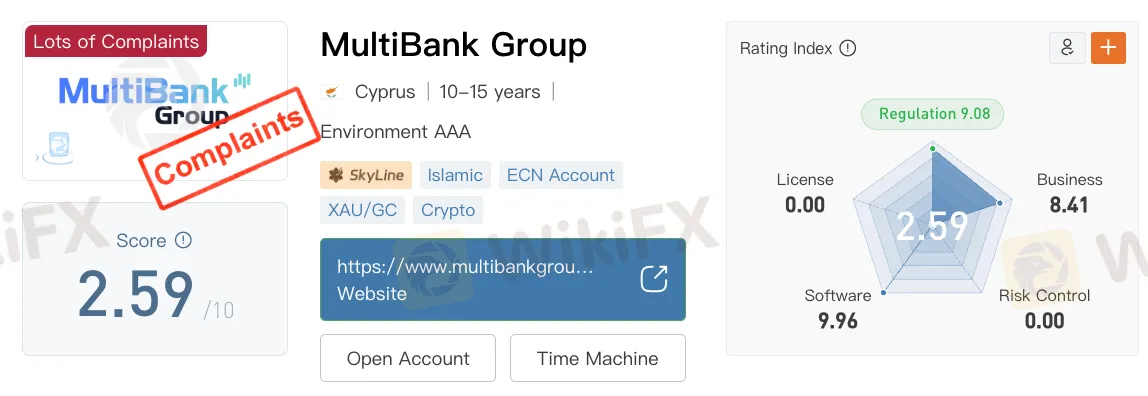

WikiFXs rating system further highlights these risks. MultiBank Group currently holds a score of just 2.59/10, with “Risk Management” and “License Validity” rated near zero, while user feedback is flagged as “Lots of Complaints.” This score is not an isolated number but reflects long-term patterns of complaints, regulatory records, and risk assessments combined.

For the full rating details and complaint records, see: https://www.wikifx.com/en/dealer/0001326398.html

Marketing vs. Reality

In its marketing, MultiBank Group consistently emphasizes its “17+ licenses” and “largest regulatory coverage worldwide.” The message across its website, press releases, and industry conferences is of a global, compliance-first institution deeply rooted in local markets.

In practice, however, the situation appears more fragmented. Core onboarding traffic flows to multibankfx.com (BVI entity), multibank.io (crypto products), or mexatlantic.com (Cayman entity). By contrast, the UAEs genuinely regulated site, mex.ae (SCA authorization), sees relatively limited traffic. This suggests that compliant entities serve more as display windows than primary client channels.

Conclusion

In the Middle East, MultiBank Group is undeniably active—opening offices, launching new products, and boosting its media profile. But beneath the headline announcements lies a gap between compliance branding and operational reality. On one side are licenses and local offices, on the other, unresolved user complaints and offshore structures.

For investors in the region, the critical question is not whether MultiBank is present in the Middle East, but which entity actually holds their funds, and whether those funds are truly safeguarded by the promised regulatory framework.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

BlackBull Markets Regulation: A Complete 2026 Guide to Their Licenses

ATFX Partners with AFA in Strategic Sponsorship

Forex Brokers with Strong Profit Potential in 2026

Gold's Structural Shift: Central Bank Buying Meets 'Peak Production'

CAD Slides as Venezuelan Supply Threat Weighs on Oil Markets\n\nThe Canadian Dollar (

Unitex Review (2025): Is it Safe or a Scam?

Otet Markets Exposed: Withdrawal Denials, Hidden Trading Rules & Scam Allegations

JP Markets Regulation Review: Legit or Fraud?

eFX Markets Review: Check Out Reported Trade Manipulation & Withdrawal Denial Cases

Treasury Secretary Bessent says more Fed rate cuts are 'only ingredient missing' for stronger economy

Currency Calculator