简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Asia Beware: MultiBank Group Faces Warnings Across the Globe

Abstract:MultiBank Group promotes itself as a heavily regulated global broker, but the reality is far more troubling. Behind its glossy image lies a tangled web of revoked licences, offshore registrations, and regulatory warnings that traders, especially those in Asia, cannot afford to ignore!

A Broker Wrapped in Uncertainty

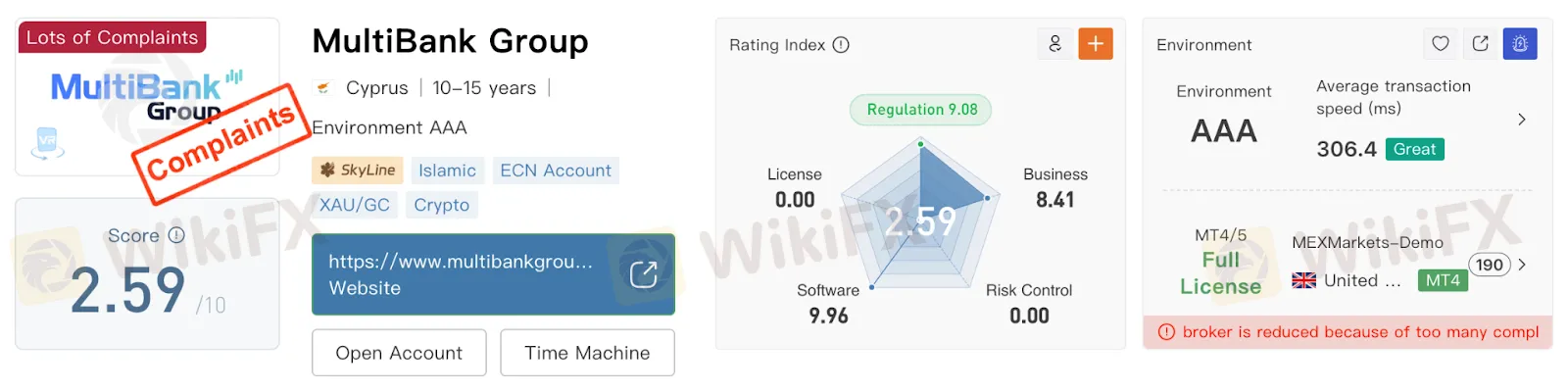

MultiBank Group promotes itself as a heavily regulated global broker, but the reality is far more troubling. Behind its glossy image lies a tangled web of revoked licences, offshore registrations, and regulatory warnings that traders, especially those in Asia, cannot afford to ignore. WikiFX currently assigns MultiBank a score of just 2.59/10, reflecting deep concerns about its regulatory standing, operational risks, and trader complaints from around the world.

Read WikiFXs full review on MultiBank Group here: https://www.wikifx.com/en/dealer/0001326398.html

The Illusion of Strong Regulation

On the surface, MultiBank appears to hold several reputable licences. In Australia, the company is licensed by the Australian Securities and Investments Commission (ASIC) under licence number 416279 as a Market Maker. In Germany, it operates under BaFin licence 10119375, while in Cyprus it holds CySEC licence 430/23 under a Straight Through Processing (STP) model. The broker also has permissions from the Securities and Commodities Authority of the United Arab Emirates and the Monetary Authority of Singapore, two regulators with significant weight in the region. In Poland, MultiBank is further recognised as EEA-authorised under local supervision.

This global spread of licences projects an image of reliability. But beneath this surface, the regulatory picture quickly unravels.

Revoked Licences: A Major Red Flag

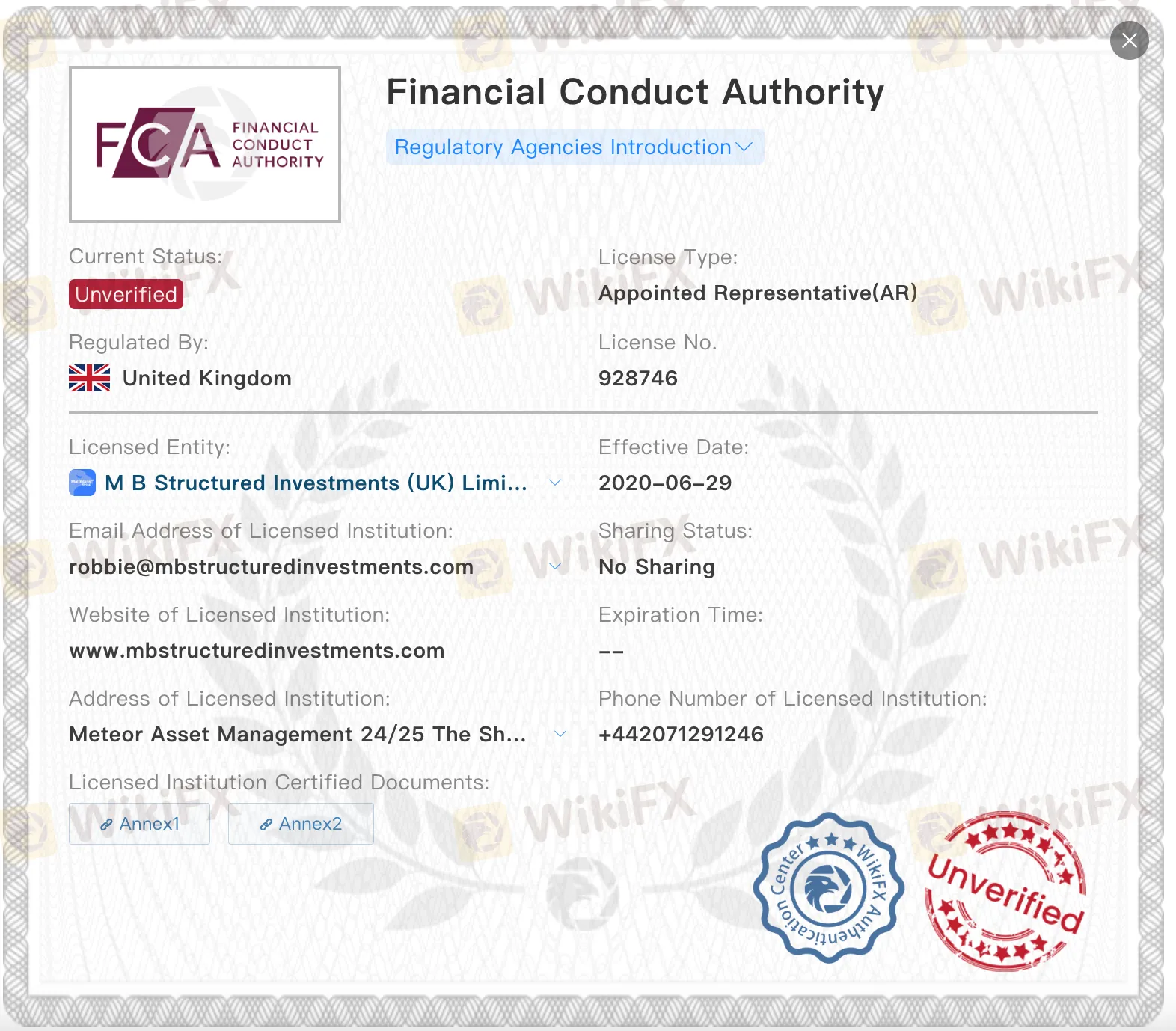

A number of key regulators have already taken decisive action against MultiBank. The Dubai Financial Services Authority withdrew its approval under licence F004403, while the UK‘s Financial Conduct Authority revoked licence 843796, which had been granted under an appointed representative model. Spain’s National Securities Market Commission (CNMV) revoked licence 120, and in the Cayman Islands, licence 1425303 was also revoked.

Additional authorisations, such as another FCA entry and a Seychelles FSA licence, are marked as “unverified,” leaving their legitimacy uncertain. For a company that markets itself as “highly regulated,” these revoked and questionable approvals represent serious warning signs.

Offshore Entities: The Danger Zone

MultiBank also maintains registrations in offshore jurisdictions, including a retail forex licence from the Vanuatu Financial Services Commission (licence 700433, listed both as regulated and unverified in separate records) and another with the British Virgin Islands Financial Services Commission (licence SIBA/L/14/1068).

Offshore regulation is notoriously weak, with minimal oversight and few investor protections. For Asian traders, where these offshore entities frequently target clients, the risks are multiplied. Trading under these licences could mean exposing your capital to a legal grey area where accountability is virtually nonexistent.

Europe Sounds the Alarm

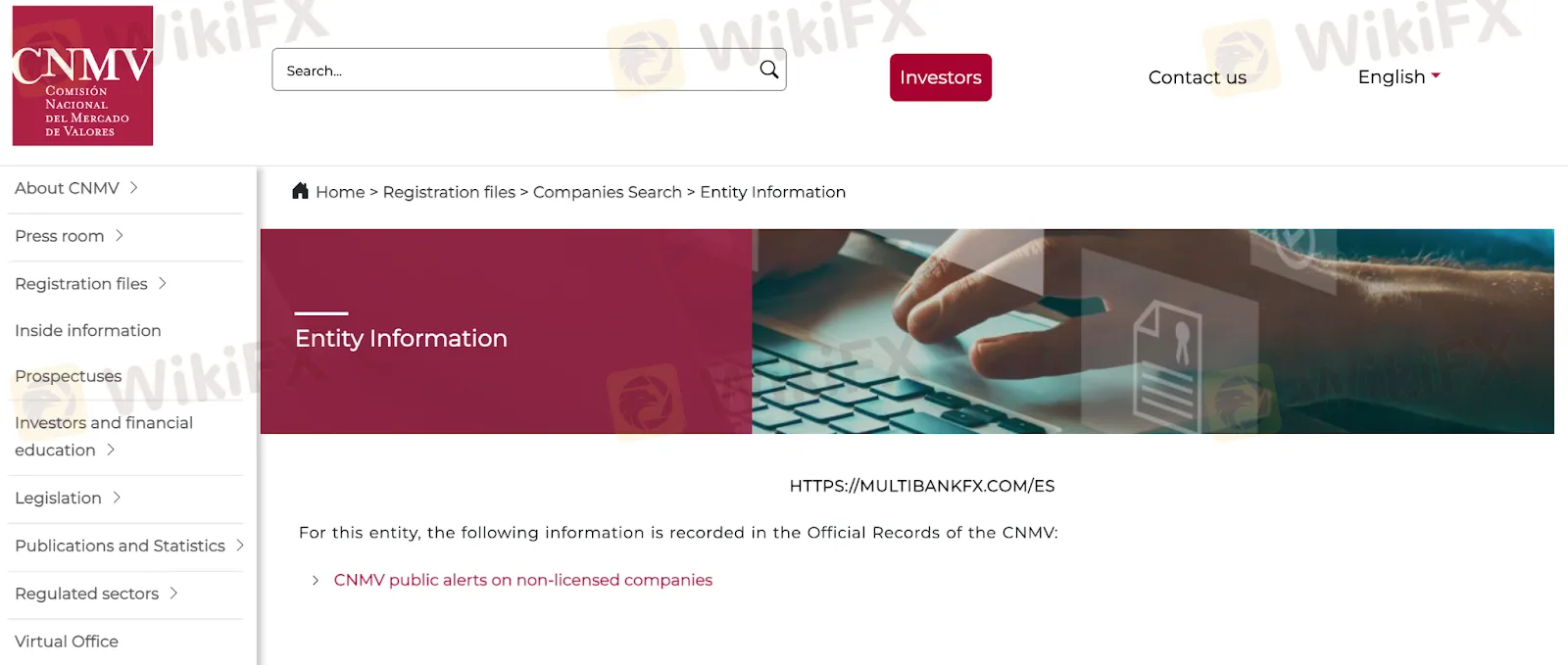

Across Europe, regulators have issued strong and coordinated warnings against MultiBank. Spains CNMV publicly flagged multibankfx.com/es as unauthorised.

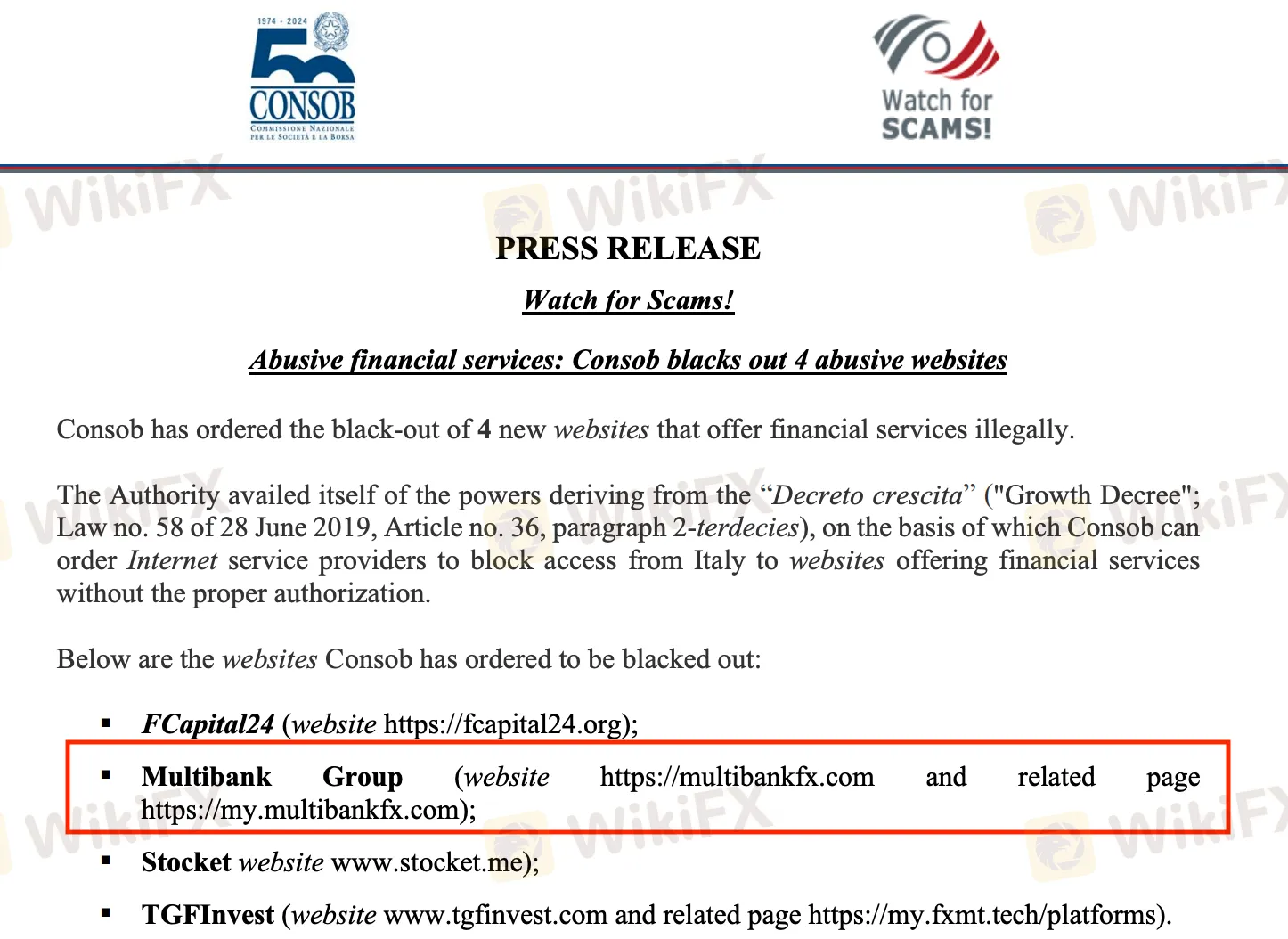

Italy‘s CONSOB went a step further, ordering internet service providers to block access to the broker’s website for soliciting Italian investors without approval.

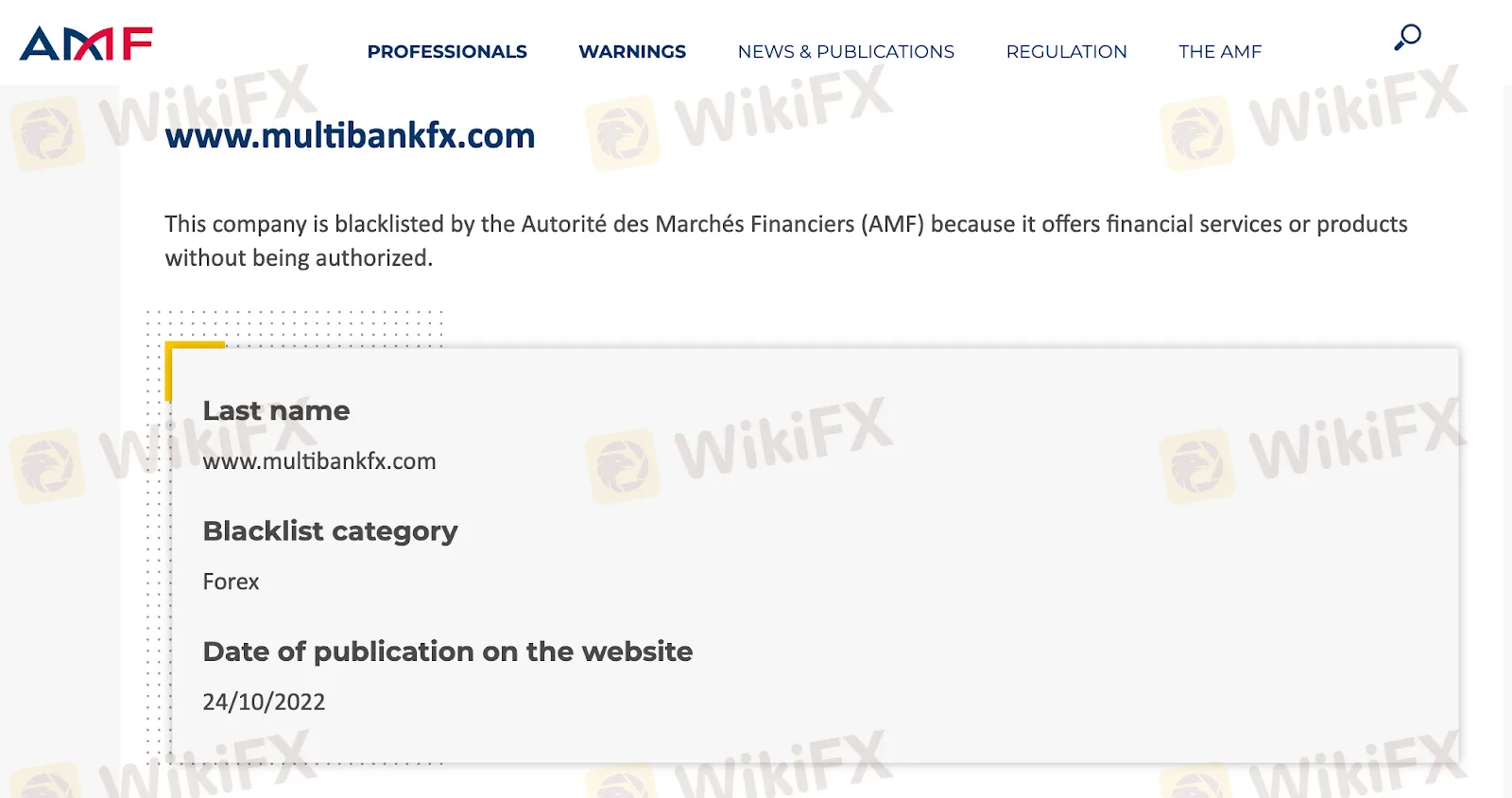

Frances AMF added www.multibankfx.com to its official Forex blacklist, which remains in its consolidated warnings list.

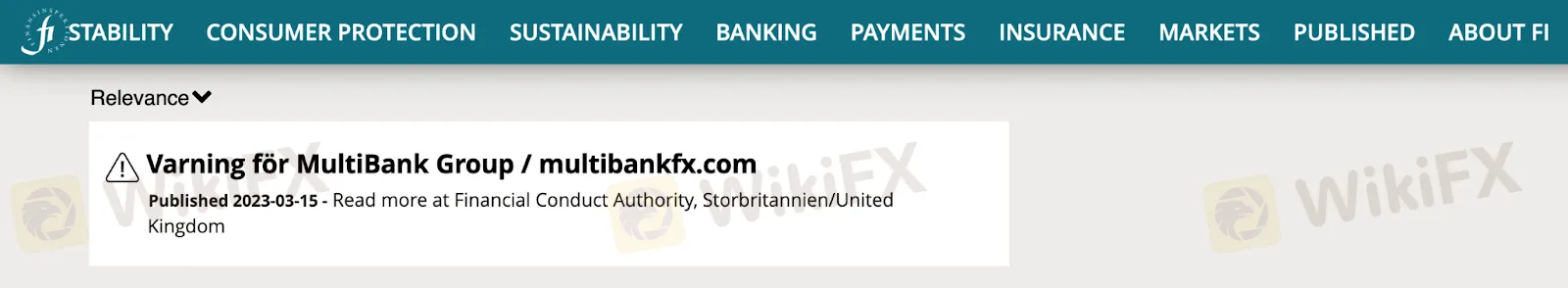

These actions did not go unnoticed: Belgium‘s FSMA, the Netherlands’ AFM, and Swedens Finansinspektionen all republished similar warnings. When multiple European regulators act in unison, it usually suggests that this broker is a danger to retail investors.

Asia: A Silent but Growing Risk

In Asia, regulators have yet to issue direct warnings against MultiBank. But this silence should not be seen as reassurance. Instead, it highlights a troubling gap in which uneven enforcement practices often delay regulatory responses until after investors have already suffered losses.

This places Asian traders in a particularly precarious position. With MultiBank aggressively marketing to the region, the lack of visible crackdowns creates a false sense of security. In reality, the risks are no less severe than those flagged in Europe, and the absence of action may simply reflect slower enforcement.

The Bottom Line: Traders Beware

MultiBank Groups global footprint may appear impressive at first glance, but the truth is far from reassuring. Revoked licences, offshore loopholes, and blacklists from Europe paint a picture of instability and risk. Traders must take extreme caution, verifying which specific entity they are dealing with, checking licence status directly with the regulator, and recognising the stark differences between reputable supervision and offshore facades.

Why Asian Investors Should Be Especially Cautious

For Asian investors, the danger is even greater. Without heightened vigilance, traders risk falling into one of the most complex and unstable regulatory traps in the global brokerage industry.

One of the first issues for Malaysian investors is that MultiBank does not appear to hold any licenses from local authorities. Market research shows the company is not registered with either the Securities Commission Malaysia or Bank Negara Malaysia. This means that if disputes arise, investors may not have the same level of protection or recourse as they would with a broker that is directly supervised by Malaysian regulators. For this reason, traders need to verify a brokers licensing status independently before depositing funds.

Another risk lies in MultiBanks complex structure. The company operates through multiple entities and domains, and in many cases, accounts are opened through introducing brokers (IBs) or agents. This can create confusion over which entity is actually responsible for providing services. When problems occur, such as blocked withdrawals or unresolved disputes, investors may find it difficult to identify the proper point of accountability. This lack of clarity increases the risk of unresolved complaints.

Finally, the concentration of complaints around withdrawals and customer service cannot be ignored. Many traders across regions have reported serious difficulties in accessing their funds once deposited, and in most cases, recovery across borders is extremely challenging. The combination of blocked withdrawals, unanswered support tickets, and pressure to deposit additional money indicates that investors could face significant risks if similar issues arise in Malaysia.

If you have personally experienced an unpleasant incident with MultiBank Group, get in touch with WikiFX, as we are a renowned global broker regulatory query platform.

In addition to protecting traders through honest reviews, WikiFX has launched a global campaign called the “Real Stories, Real Voices” Broker Review Collection, designed to bring transparency to the trading industry. With a prize pool of 3,330 US dollars, this initiative provides traders with a fair platform to share their experiences and hold brokers accountable. From 20 to 31 August 2025, participants can register, submit reviews via the WikiFX app, and stand a chance to win rewards simply by speaking honestly about their broker.

Every genuine review contributes to building a stronger community and ensures that bad actors are exposed, while reliable brokers receive the recognition they deserve. By taking part, you not only protect yourself and others but also play a role in shaping a safer and more transparent trading environment. Now is the time to make your voice heard.

Read the details of this event and join now:

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Labuan Forex Scam Costs Investors RM104 Million | Authorities Pressed to Act

TopWealth Trading User Reviews: A Complete Look at Real Feedback and Warning Signs

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Fed Holds Firm: January Rate Cut Hopes Fade Despite Cooling CPI

A Complete 2026 Review: Is RockwellHalal Legit or a Scam to Stay Away From?

One Message, RM600K Gone: WhatsApp Investment Scam Exposed

Fed

War Risk Premium Explosions: Gold Hits

TrioMarkets Launches TrioFunded as Brokers Continue to Expand Into Prop Trading

Geopolitical Risk Returns: Iran Threatens 'Unforgettable Lesson' as Tensions Mount

Currency Calculator